Prime Vaults may provide a new participation window for multiple benefits at this stage.

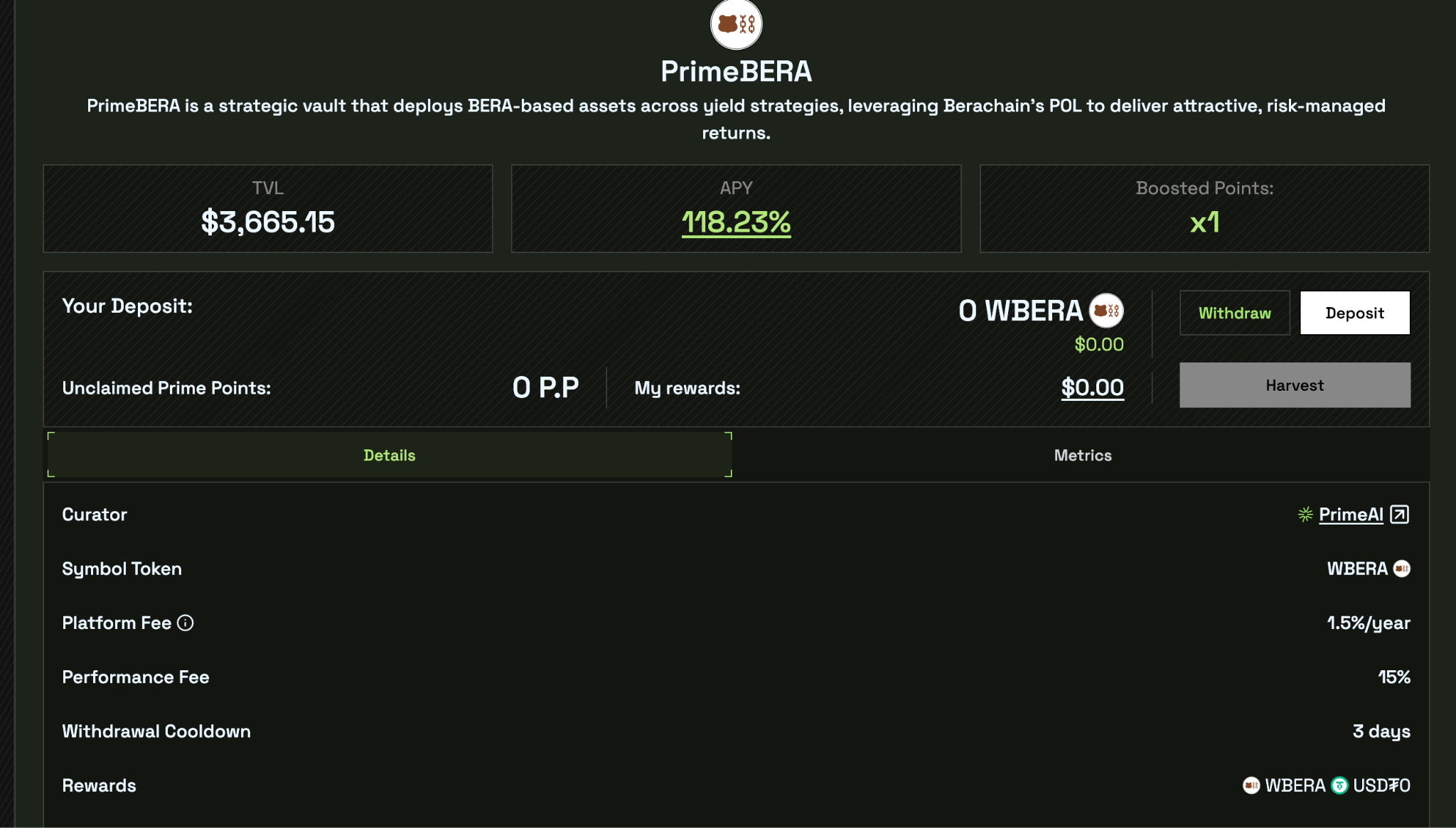

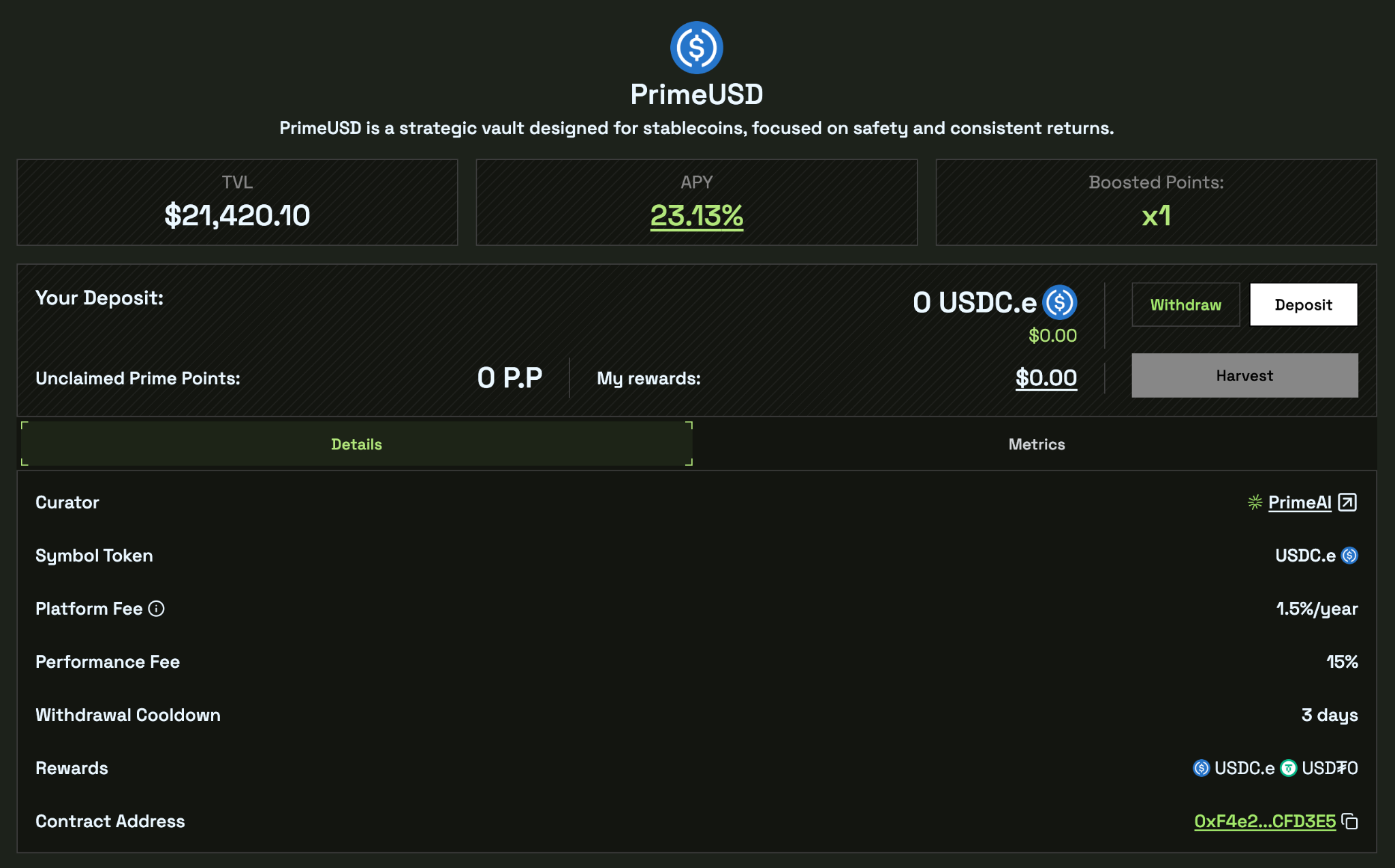

Since the beginning of 2026, several funding pools with considerable yield capabilities have emerged within the Berachain ecosystem. Among them, the recent Pre-deposit activity launched by Prime Vaults stands out, making it one of the most attractive yield protocols currently available. Despite the overall yield declining as TVL continues to rise, the APY of its PrimeUSD pool remains around 23% (supporting multiple stablecoin staking), while the APR of the PrimeBERA pool reaches as high as 118%, keeping it at the forefront of yield tiers in the current DeFi market.

In addition to the aforementioned pools, Prime Vaults also supports staking of BTC and ETH, with the corresponding PrimeBTC and PrimeETH pools currently having APRs of 5.87% and 9.22%, respectively, placing them at an upper-middle level in the industry, balancing stability and yield performance.

Focusing on the Prime Vaults protocol itself, it is primarily positioned as a smart strategy gun pool protocol, aiming to address the pain points of traditional DeFi vaults, such as high risk, reliance on short-term incentives, and asset isolation, providing a more stable and sustainable yield solution, and offering users a foolproof one-click yield method to simplify the complexity of participating in DeFi.

Unified Yield Structure Centered on "On-chain Savings Account"

Focusing on the product itself, Prime Vaults is based on the core concept of "on-chain savings accounts," aiming to provide users with sustainable passive returns while ensuring the safety of the principal and a minimum yield level. Unlike the asset isolation structure commonly seen in traditional DeFi vaults, Prime Vaults adopts a unified architecture for centralized management and scheduling of funds, significantly enhancing capital allocation efficiency and overall risk control capability.

Its core innovation lies in the unified yield model.

Under this model, the various assets deposited by users (such as USDC, WETH, WBTC, WBERA, etc.) are not bound to a single strategy or asset pool but are instead aggregated into a shared liquidity pool. The system dynamically allocates these funds to multiple risk-adjusted strategy combinations based on real-time yield and risk conditions. This design allows funds to "intelligently flow" between different assets and strategies, capturing better yield opportunities without sacrificing safety.

The unified yield model also supports cross-chain and multi-strategy parallel operation. Prime Vaults can allocate liquidity between different chains and protocols, deploying liquidity to the scenarios with the highest yield efficiency while simultaneously executing various strategies such as lending and liquidity provision. This approach not only reduces the friction costs associated with frequent internal swaps but also mitigates liquidity fragmentation issues, resulting in a smoother and more stable overall yield distribution.

Its yield sources do not rely on a single incentive mechanism but are composed of multiple factors, including base interest rates, strategy yields, and cross-chain opportunities, ultimately settling and distributing to users, structurally reducing the risk of yield volatility.

Taking the yield path of Prime Vaults on Berachain for WBERA and stablecoins as an example:

High Yield Generation Logic for WBERA Deposits (PrimeBERA)

In the Berachain ecosystem, the high yield capability of Prime Vaults is most typically reflected in the PrimeBERA native asset pool.

For example, when a user deposits 1,000 WBERA into the PrimeBERA Vault, this portion of funds is not simply used for single BERA staking or liquidity mining but first enters the unified liquidity pool of Prime Vaults, participating in cross-strategy scheduling alongside assets like ETH and BTC. Based on this, the system prioritizes deploying funds to whitelisted Reward Vaults and high-efficiency strategies within the Berachain ecosystem.

The core source of yield in this path comes from Berachain's PoL mechanism. It is well-known that PoL does not directly reward trading or staking actions but incentivizes liquidity contributions to network security and ecosystem activity through the governance token BGT.

As a protocol-level participant, Prime Vaults can deploy the liquidity from the unified pool to designated Reward Vaults (such as BERA staking or BERA-related LP) and receive approximately 33% of the incentive redirection from the validators' BGT emissions. This portion of BGT is not directly exposed to users but is converted into WBERA through an auction mechanism and automatically reinvested into the user's share, forming a continuous compounding effect.

Additionally, the system routes part of the WBERA liquidity to LP pairs on Berachain with higher APYs (such as the BERA/USDC pool), obtaining dual yields from trading fees and PoL subsidies. If local opportunities on Berachain decrease, funds may temporarily flow to other chains like Arbitrum for lending or yield strategies, provided the risks are controllable, but overall management still anchors on the Berachain ecosystem for yield.

In the current early stage of pre-deposit, due to the relatively small TVL scale and fixed PoL incentive pool, the APR of PrimeBERA has once surged to about 118%, with approximately 80-100% of the yield directly coming from BGT emissions, while the remaining portion is contributed by base interest rates, trading fees, and cross-chain strategies. All yields are uniformly settled after periodic harvesting by the system, automatically counted into the user's net asset value without the need for manual claims. It is important to note that this high APR is essentially a result of early incentive amplification, and as TVL grows, the yield level will gradually return to a more sustainable range, but its long-term support logic still derives from the systematic incentive mechanism of PoL.

Stable Yield Generation Logic for USDC Deposits (PrimeUSD)

Compared to the high-volatility yield path of native assets, PrimeUSD better reflects the structural advantages of Prime Vaults in the stablecoin scenario. For example, when a user deposits 1,000 USDC into the PrimeUSD Vault, this portion of funds also first enters the unified liquidity pool, rather than being restricted to a single USDC strategy. The system will prioritize deploying USDC to the lending market within the Berachain ecosystem to obtain stable base interest rate yields, with the benchmark returns typically aligning with the supply rate range of mainstream lending protocols (approximately 5-10%).

On this basis, Prime Vaults further leverages Berachain's PoL mechanism to "add a layer of leverage" to stablecoin yields. By directing USDC liquidity to stablecoin pools or related Reward Vaults that meet PoL incentive conditions, the protocol can additionally obtain BGT subsidies. This means that USDC is no longer just passively earning lending interest but is indirectly participating in Berachain's liquidity security and governance incentive system. As the RWA-related ecosystem of Berachain matures, this path may also potentially layer additional yield sources from off-chain cash flow mapped onto the chain.

Moreover, the unified yield model allows the system, under controllable risks, to combine part of USDC with ETH or BTC to participate in multi-asset-driven strategies (such as stablecoin + volatile asset LP structures), thereby obtaining trading fees and incentive yields. Unlike traditional stablecoin vaults that can only "do USDC strategies with USDC," Prime Vaults enhances the overall efficiency of unit capital through cross-asset collaboration.

At the current stage, the APY of PrimeUSD is approximately 23%, with about 10% coming from the base lending rate, while the remaining portion is contributed by PoL incentives, cross-asset strategies, and cross-chain optimizations. The yield and principal are clearly separated within the system, with the principal being prioritized for protection, while the yield is settled periodically and can be flexibly withdrawn. Compared to traditional vaults (which rely solely on single assets or single derivative yield models), Prime Vaults, through a multi-source, low-correlation yield structure, makes stablecoin returns more resilient in a volatile environment.

Risk Management System

While building a robust yield system, Prime Vaults clearly establishes "safety first" as the underlying principle of product design.

The system buffers and constrains common risks in DeFi through multi-layer mechanisms, rather than simply pursuing high APY.

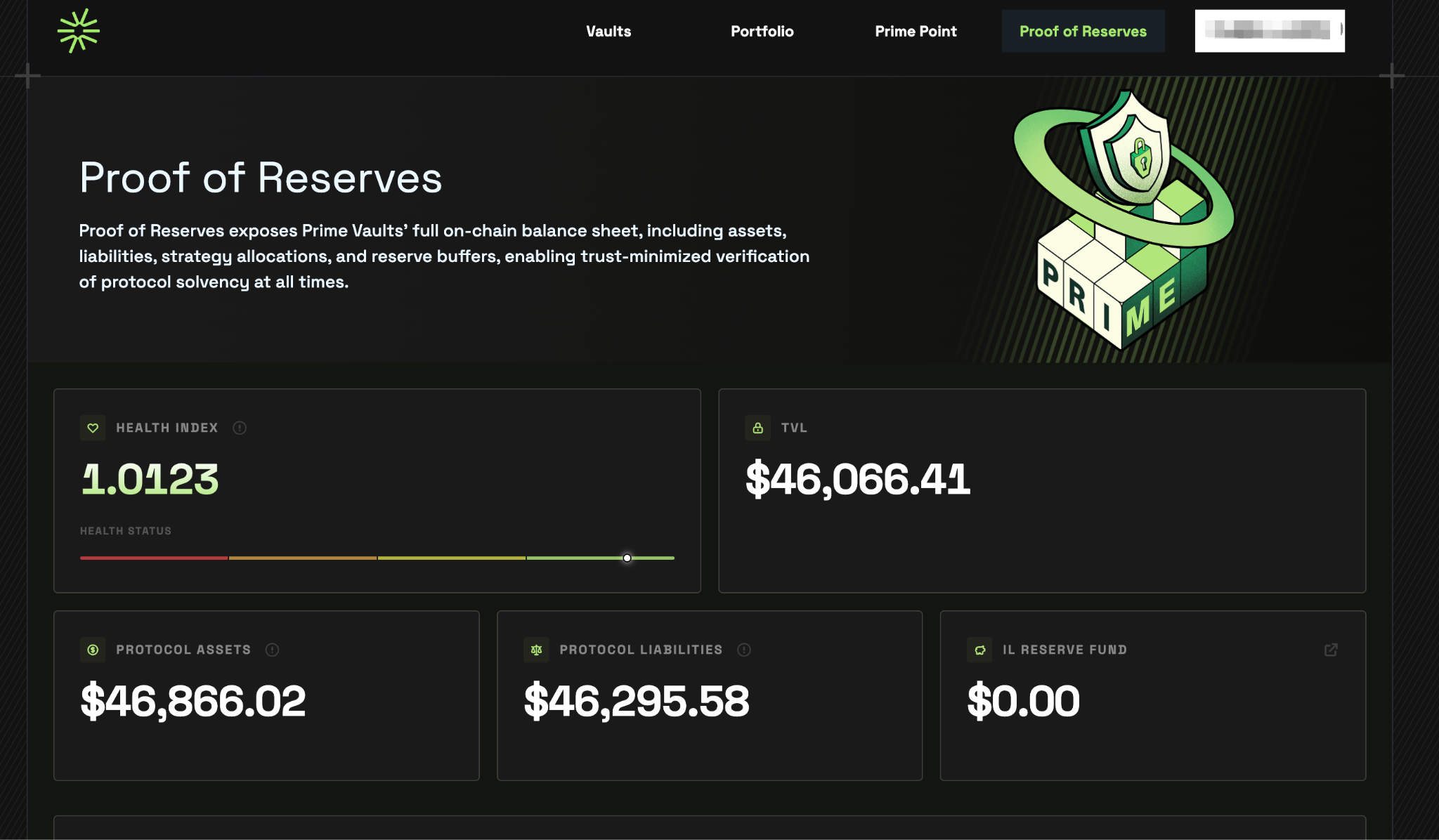

To protect asset safety, the protocol distinctly separates user assets into principal and yield components. The principal will only be deployed to strategies that have undergone strict screening and will absorb the impacts of strategy volatility, impermanent loss, or adverse events through the IL Reserve Fund (impermanent loss reserve fund), aiming to safeguard the principal's integrity as much as possible under normal market conditions.

At the same time, Prime Vaults sets minimum yield protection mechanisms for different assets, with benchmarks referencing the deposit interest rate levels of mainstream lending protocols (such as Aave V3). Even in cases of incentive decay or market downturns, users' returns will not fall below industry benchmarks, thus avoiding the typical vault risk of "high yield—high drop." The scale and use of the reserve fund are dynamically managed by the system to ensure that the protocol maintains overall solvency while taking on risks.

On this basis, Prime Vaults further introduces several system-level protective measures, including an automatic trigger mechanism for circuit breakers under extreme market conditions and a protocol health index for real-time monitoring of fund exposure and solvency. All key data can be verified through On-chain Proof of Reserves (https://app.primevaults.finance/proof-of-reserves), ensuring transparency in fund deployment paths, asset locations, and protocol endorsements.

Based on this system, Prime Vaults is positioned more as a verifiable and composable on-chain savings account, rather than a traditional high-risk yield vault. This mechanism, based on structured risk control and a unified yield model, makes it more suitable for users who seek stable returns but do not wish to frequently monitor and adjust strategies, constituting its core differentiation in the current DeFi market.

Potential Points Incentives

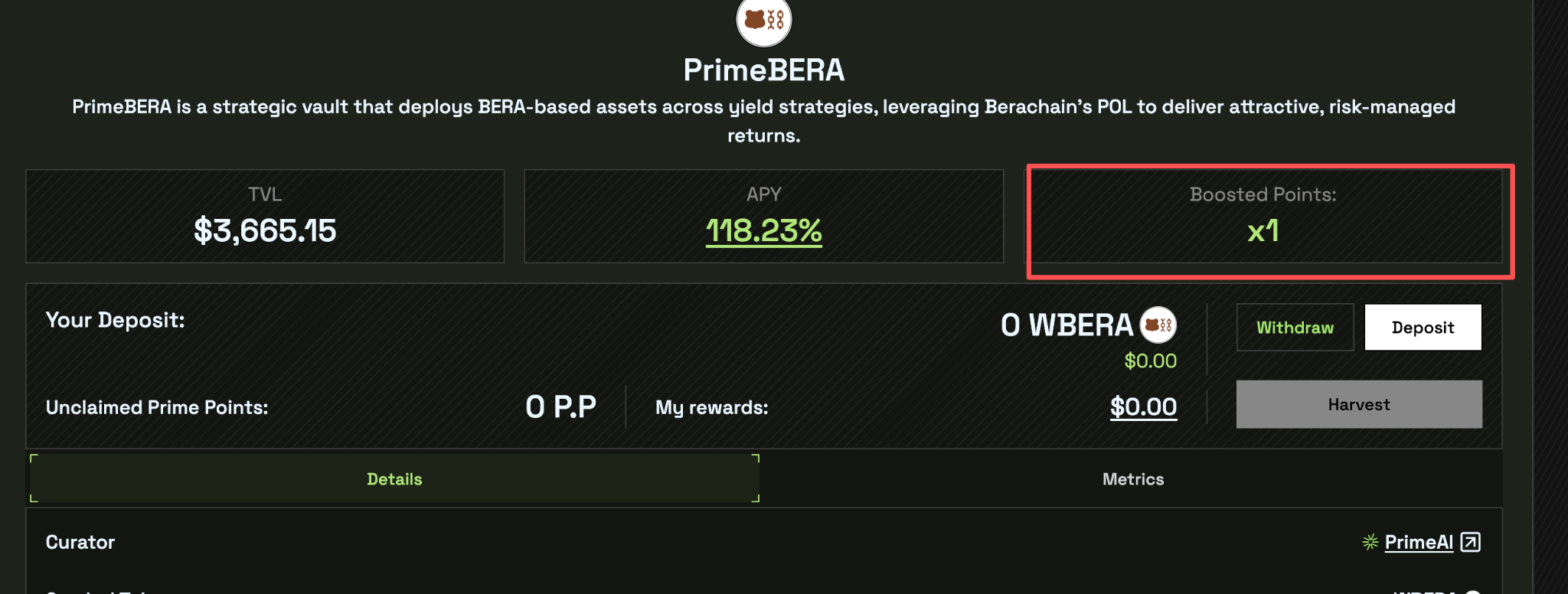

Currently, when we participate in its Pre-deposit deposit activity, we see a Boosted Points section, which means that participating in deposits will earn points rewards, and we can view our specific points details in the Prime Point section.

For users familiar with the Berachain ecosystem, this is a familiar formula. Considering that Prime Vaults is a newly launched project with a currently healthy growth momentum, the points system is likely to serve as an important reference dimension for user incentives and rights distribution at key points in 2026 (such as TGE), creating potential expectations for airdrops. Therefore, for Berachain users who previously missed early opportunities like Infrared Finance or Kodiak, Prime Vaults may provide a new participation window for multiple benefits at this stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。