This article systematically reviews the current status and prospects of stock tokens from multiple dimensions, including the advantages and issuance mechanisms of stock tokens, the current state and data performance of the stock token market, a roundup of representative issuers of stock tokens, the risks and opportunities of stock tokens, and future trend outlooks.

Author: Hotcoin Research

Introduction

Since 2025, U.S. stock tokens have shown exponential growth, with major trading platforms establishing dedicated sections to launch U.S. stock tokens issued by Ondo, xStocks, and others. In particular, the recent on-chain trading volume of U.S. stocks and precious metal tokens has continuously set new highs, with stock tokens gradually transitioning from a crypto fringe innovation to a mainstream investment entry point. On-chain tokenized assets from tech giants like Tesla, Nvidia, Apple, and Circle are sparking a cross-border investment frenzy among global users.

This article systematically reviews the current status and prospects of stock tokens from multiple dimensions, including the advantages and issuance mechanisms of stock tokens, the current state and data performance of the stock token market, a roundup of representative issuers of stock tokens, the risks and opportunities of stock tokens, and future trend outlooks. By analyzing the specific models and differences of major issuers (such as Ondo, xStocks, Securitize, Robinhood, etc.), it reveals how stock tokens are reshaping the participation logic and infrastructure of the securities market. As funds continue to flow into on-chain securitized assets, stock tokens are gradually evolving into a bridge market between traditional finance and Web3, potentially serving as a key starting point for the next bull market.

1. Advantages and Mechanisms of Stock Tokens

The core design of stock tokens is to map real or expected equity assets onto the blockchain and achieve free circulation in the form of standardized tokens.

Advantages of Stock Tokens

As a product of the integration of traditional financial assets and blockchain, stock tokens have multiple potential advantages:

- Global Accessibility: Through crypto wallets and open networks, global users can access tokenized U.S. stocks, ETFs, etc., without needing a securities account, significantly lowering the barriers to cross-border investment.

- Fragmented Investment: Users can purchase in any small amount, allowing for more flexible asset allocation, suitable for young retail investors and emerging market investors.

- 24/7 Trading: Unlike traditional stock market trading time restrictions, tokenized stocks can be traded around the clock, enhancing market efficiency and risk management capabilities.

- Faster Settlement Mechanism: On-chain transactions have real-time settlement characteristics (T+0), which can reduce clearing risks and intermediary costs.

- Programmability: Smart contracts can enable automated dividend distribution, governance weight, trading restrictions, and other functions, providing new possibilities for financial product design.

- Integration with DeFi Ecosystem: Tokenized stocks can be used as collateral in DeFi, participate in portfolio strategies, and promote the expansion of on-chain financial system functions.

These advantages are attracting more and more traditional financial institutions and crypto-native users into the market, accelerating the evolution of stock tokens from "alternative tools" to "infrastructure."

Issuance Mechanisms of Stock Tokens

The core design of stock tokens is to map real or expected equity assets onto the blockchain and achieve free circulation in the form of standardized tokens. The current mainstream token mechanisms in the market can be categorized into the following three types:

(1) Real Stock Mapping

Real stocks or ETFs are held by regulated entities, issuing an equal amount of tokens, commonly seen in xStocks, Ondo, and WisdomTree. These tokens often have off-chain custody structures and complete compliance paths, with a 1:1 correspondence between tokens and stocks, and some support USDC net value redemption or on-chain stock account reversals.

- Shareholder Rights: In most cases, holders enjoy economic rights, including price fluctuations and dividend distributions, but do not have voting rights or corporate governance rights unless a chain-based registration system like Superstate is adopted, directly making them legal shareholders.

- Custody Structure: Stocks are held by independent third-party brokers or trusts (such as Backed Assets Jersey, Prime Trust) to ensure asset isolation and redemption capability.

- Compliance: Adheres to securities issuance regulations (such as Reg D, Reg A+, MiCA) and is supervised by the U.S. SEC, EU ESMA, or financial regulatory agencies in various countries, making it the most compliant model currently.

(2) SPV Mapping

For example, PreStocks holds private company equity (such as OpenAI, SpaceX) through an SPV, issuing tokens that represent expected economic exposure, with investors lacking real stock voting rights and legal shareholder status, and no redemption support. The compliance path for such products is vague, typically limited to non-U.S. investors, posing higher potential legal risks.

- Shareholder Rights: Token holders have no direct rights to the underlying company and may only receive economic returns after the SPV realizes an equity exit (such as an IPO or acquisition).

- Custody Structure: Assets are managed by the project's self-established SPV, lacking independent custodians and having limited structural transparency.

- Compliance: Often classified as gray contract-type assets, not registered as securities or funds, and lacking legal enforceability in most jurisdictions.

(3) Synthetic Type

No real asset support, only tracking the underlying stock price through oracle prices, typically seen in the now-defunct Mirror Protocol. These tokens only reflect price fluctuations, have no voting rights or dividend rights, and are generally regarded as unregistered derivatives, facing significant regulatory pressure, with mainstream institutions having largely abandoned them.

- Shareholder Rights: There are no equity or cash flow rights, and investors bear the risk of price speculation.

- Custody Structure: No off-chain assets, no need for custody, and completely reliant on on-chain mechanisms.

- Compliance: Legally positioned close to CFDs or synthetic futures, considered illegal securities or prohibited products in most jurisdictions.

In summary, real stock mapping tokens have the strongest regulatory adaptability and market sustainability, making them the fastest-growing mainstream form currently. Their issuance typically requires supporting off-chain custody institutions, restricted investor access, and net value redemption mechanisms, increasingly becoming the standard paradigm for "on-chain mapping" of traditional equity assets.

2. Current Status and Performance of Stock Tokens

Since 2025, with the maturation of the macro environment and technology, the stock token market has entered an explosive period. Many large institutions and trading platforms have joined the competition: Kraken Exchange partnered with the Swiss compliance agency Backed Finance to launch xStocks stock token business in May 2025, offering dozens of U.S. stocks and ETF tokens, including S&P 500 components. The Robinhood brokerage platform launched 24/7 stock token trading services in June 2025, using the Ethereum-based Arbitrum Layer 2 network to provide European users with around-the-clock trading of U.S. stocks, ETFs, and even private company equity tokens. Robinhood also announced it is developing its own blockchain to achieve native custody and settlement of stock tokens. Ondo issued a series of large tech stock tokens through Ondo Global Markets, covering Solana, Ethereum, and BNB chains. JPMorgan, BlackRock, and others are experimenting with putting some fund products and ETF shares on-chain, such as JPM's MONY fund and BlackRock's BUIDL fund. With various players entering the market, the stock token market saw exponential growth in 2025, pushing stock tokens from fringe experiments to the mainstream stage.

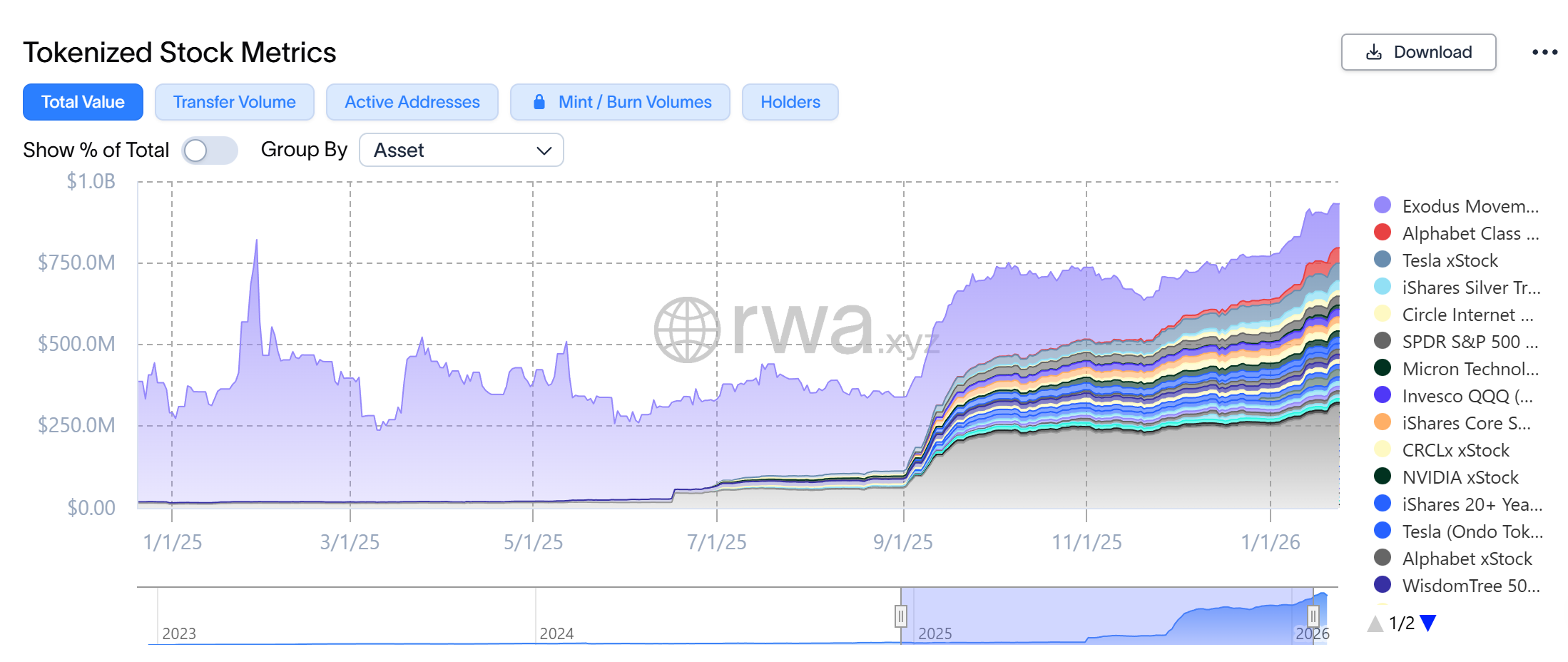

As of early February 2026, the total market capitalization of on-chain stock tokens is approximately $930 million. This scale has grown several times compared to a year ago: according to TokenTerminal and RWA data, the market capitalization of stock tokens was only about $32 million at the beginning of 2025, and within just one year, the market capitalization increased nearly 25 times, demonstrating strong explosive power.

Source: https://app.rwa.xyz/stocks

In addition to total market capitalization, on-chain trading activity has also surged significantly. The monthly on-chain stock token transfer transaction volume is approximately $2.4 billion. Currently, the total number of addresses holding stock tokens on-chain is about 298,000. In terms of exchange distribution, these tokens are widely present on platforms such as Binance, Kraken, Bybit, Hotcoin, Bitget, Gate, and Jupiter DEX, forming a hybrid trading ecosystem of centralized and decentralized exchanges.

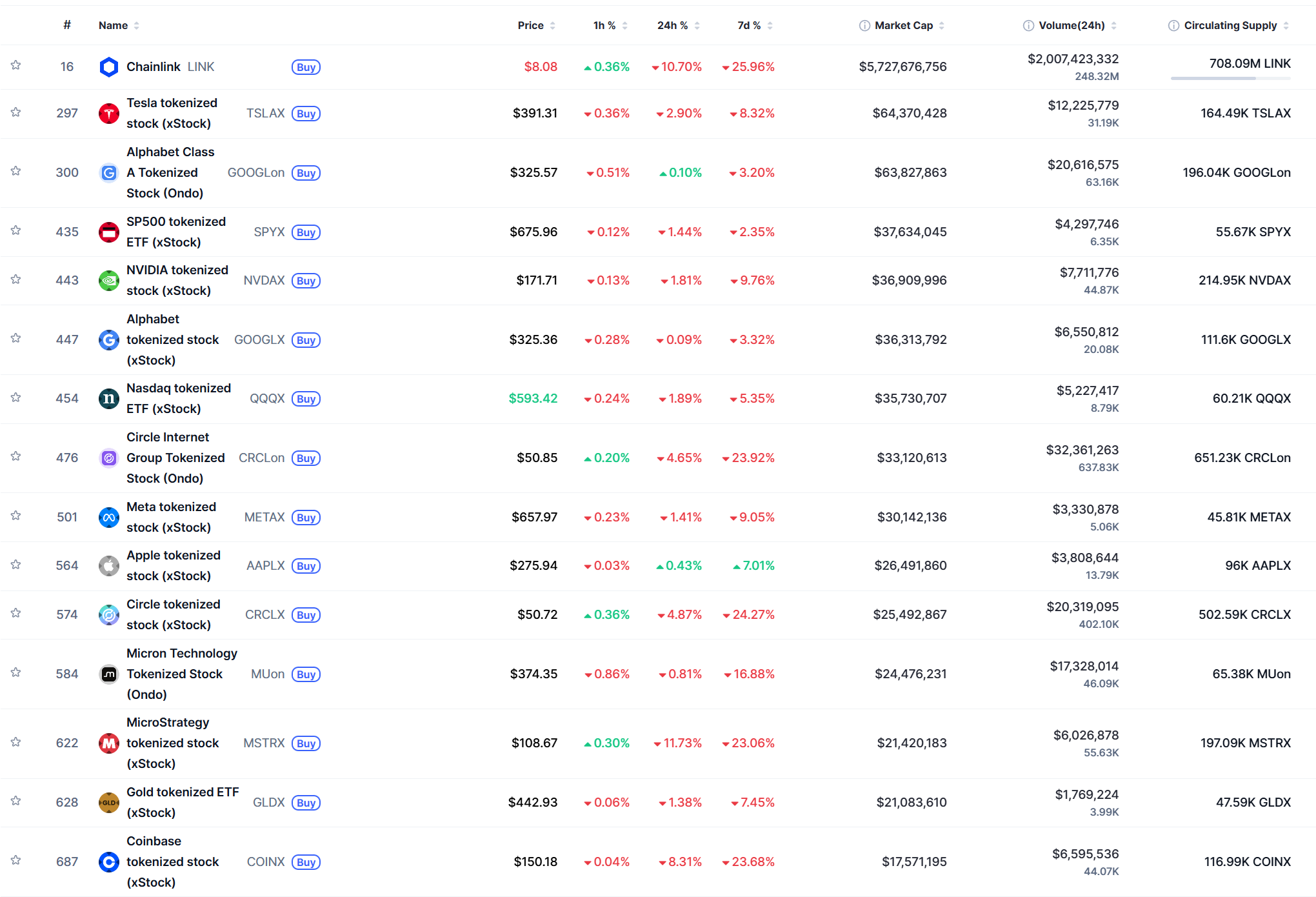

According to CoinMarketCap Tokenized Stock sector data, stock tokens overall show strong capital attention and trading activity. Tokens from tech giants like Apple, Tesla, Nvidia, and Meta dominate, with TVL and trading volume steadily increasing. The average trading volume over the past 30 days has been in the million-dollar range. There are phenomena of discounts and premiums in the market, for example, some token prices deviate from actual stocks by +1% to -2%.

Source: https://coinmarketcap.com/view/tokenized-stock/

3. Representative Issuers of Stock Tokens

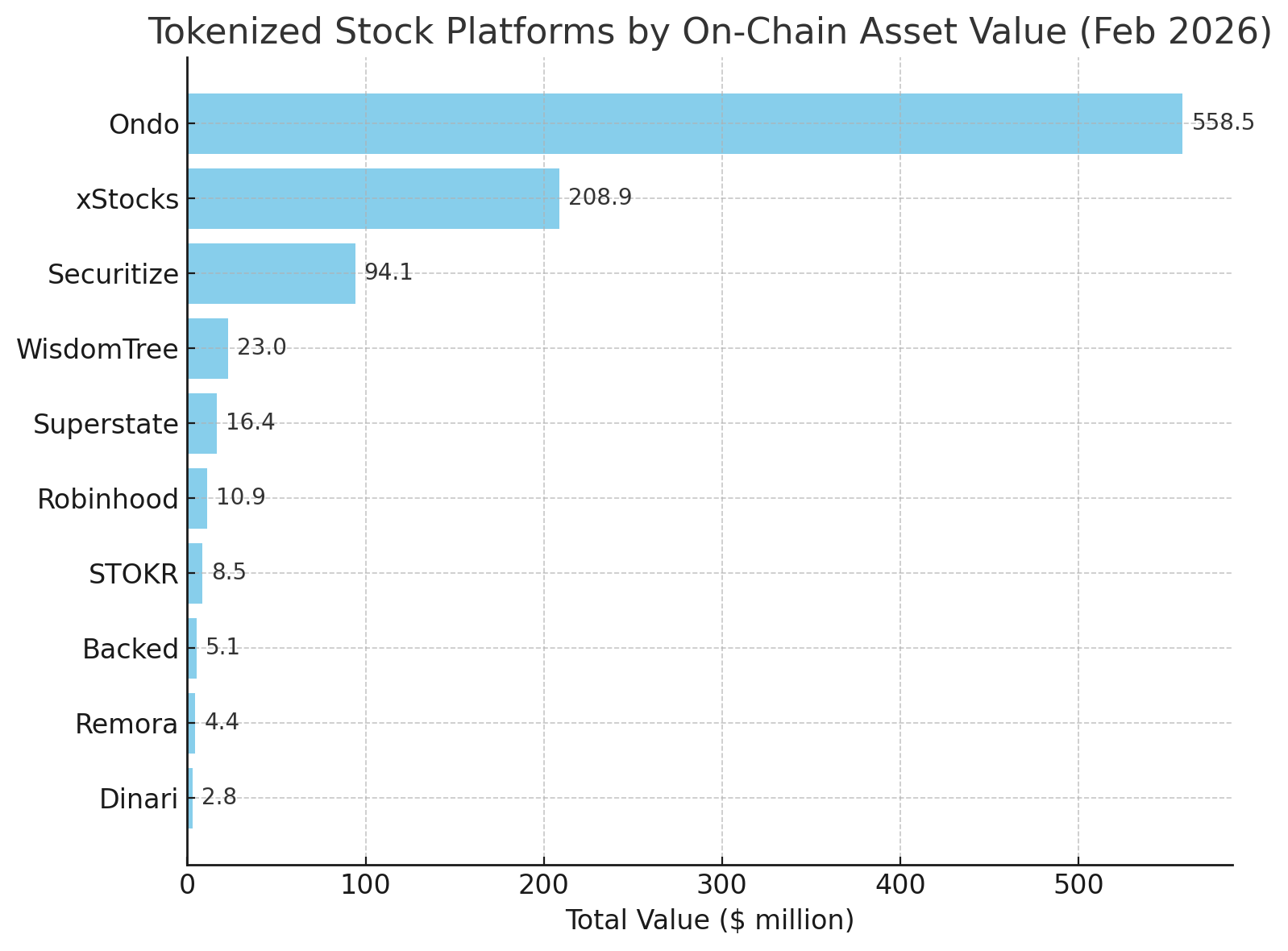

From the perspective of market share, as of early February 2026, the ranking of the stock token stock value on various platforms is as follows: Ondo Finance leads by a wide margin, with a market share of 59.5%, accounting for nearly 60% of the market, with on-chain asset value of approximately $559 million. The second is the xStocks platform, with a market value of about $209 million, accounting for 22.4% of the share. xStocks covers about 74 types of U.S. stock and ETF tokens, making it one of the channels with the highest retail participation. The third is Securitize, accounting for about 10% of the share, valued at $94.1 million, mainly from a few large equity token projects like Exodus. Following are WisdomTree (2.5%), Superstate Opening Bell (1.8%), and Robinhood-related tokens (about 1.2%). It can be seen that the market is highly concentrated in a few leading platforms: the top two combined account for over 80% of the share, reflecting that trusted licensed institutions are more favored by funds in the stock token market, while new platforms are still striving to expand their scale.

Source: https://app.rwa.xyz/stocks

Ondo Finance: A decentralized finance (DeFi) startup founded in 2021, dedicated to bringing traditional fixed-income assets on-chain. In 2023, Ondo launched three tokenized fund products: OUSG (short-term U.S. Treasury fund), OSTB (investment-grade corporate bond fund), and OHYG (high-yield bond fund), corresponding to investments in ETFs managed by BlackRock and PIMCO. These tokens are aimed at qualified investors through KYC, issued on chains like Ethereum, and can be subscribed and redeemed daily using USDC. Ondo relies on cooperative custodians (such as Prime Trust) to hold the underlying ETF shares. In 2025, Ondo expanded into the stock token space, issuing a series of large tech stock tokens (such as tokenized Alphabet, Microsoft, Apple, Tesla, etc.) through its subsidiary "Ondo Global Markets," covering Solana, Ethereum, and BNB chains. As of early 2026, the total value of stock/securities tokens managed by the Ondo platform is approximately $559 million, leading the industry. The Ondo model is characterized by high compliance and on-chain funds: each token is backed by a complete legal structure and real assets, with a high investment threshold but large capital volume. In terms of regulation, Ondo follows the Reg D private placement path, open only to Qualified Purchasers. Currently, Ondo's tokens are primarily traded on its own portal and in secondary market DeFi protocols, showing high activity.

xStocks: xStocks is a stock and ETF token trading service launched by the globally renowned crypto exchange Kraken in 2025. This service is supported by technology from Backed Finance, a Swiss company acquired by Kraken. The feature of xStocks is that it holds the underlying stocks/ETFs 1:1, with shares held by a regulated custodian and issuing an equal amount of SPL tokens on the Solana chain. On the Kraken platform, these tokens are denoted by adding an "x" to the stock ticker, such as AAPLx, TSLAx, etc., covering over 70 assets including Amazon, Apple, and the S&P 500 ETF. xStocks allows non-U.S. users to purchase with amounts as low as $1 and supports 24/5 trading. For dividend processing, xStocks adopts an automatic reinvestment approach: when the underlying stock pays dividends, the token holding balance increases accordingly, rather than distributing cash. Legally, xStocks token holders are not considered company shareholders; the tokens are more akin to exchange notes. Kraken ensures compliance by establishing a Jersey registered entity, limiting services to regions outside the U.S., Canada, and the UK. Since its launch, xStocks has seen rapid growth in trading volume and asset scale. As of early 2026, the on-chain asset market value of xStocks is approximately $209 million, ranking second in the industry with a 22% share. Kraken also announced in the second half of 2025 that xStocks would expand to the Ethereum chain to enhance composability. The xStocks model indicates that large exchanges are actively embracing the tokenization trend, addressing user trust issues in acquiring stock tokens through their own credibility and operational capabilities.

Securitize: Founded in 2017, Securitize is a leading U.S. digital securities issuance platform focused on providing blockchain-based securities registration and trading solutions for enterprises. Securitize holds licenses from the U.S. SEC and FINRA (including transfer agent and broker qualifications) and has consistently followed a compliant issuance route. One of its representative cases is assisting Exodus wallet company in completing a Reg A+ equity token issuance in 2021: Exodus issued approximately $75 million in company stock tokens through Securitize, registered on the Algorand blockchain. Investors subscribe through the Securitize investment portal, with Securitize acting as the official transfer agent managing the shareholder register. Currently, the Exodus token EXOD is traded on ATS platforms, with on-chain records showing a total market value of approximately $94 million. In addition to Exodus, Securitize has also issued tokens for several private companies and funds, including KKR medical fund shares and global equity portfolio funds. The Securitize model is fully compliant and operates in the private market: it helps non-public companies raise funds through tokenization or provide liquidity for employee equity, with investors primarily being qualified/institutional.

WisdomTree: A well-known U.S. asset management company famous for issuing ETFs. In recent years, WisdomTree has expanded its business into the on-chain fund space, launching the WisdomTree Prime and WisdomTree Connect platforms that offer a series of tokenized funds covering money market funds, equity portfolio funds, bond portfolios, and more. Currently, WisdomTree has issued 13 SEC-registered tokenized funds. Investors can purchase these fund tokens through WisdomTree's mobile app, with the actual process similar to purchasing ETFs, except that the share records are on the blockchain. WisdomTree's tokens are currently issued on multiple chains, including Ethereum and Solana. WisdomTree holds asset management and brokerage business licenses in Europe and the U.S., representing a traditional asset management giant testing the waters of tokenization, providing seamless products that connect traditional funds with blockchain, and offering users a 24/7 fund trading and holding experience.

Superstate Opening Bell: Launched by Superstate, a company founded by Compound protocol creator Robert Leshner in 2023, aims to bring publicly traded company stocks directly on-chain. Its "Opening Bell" platform went live in May 2025 and is a regulated on-chain securities issuance platform that allows publicly traded companies to convert SEC-registered public offering stocks into on-chain forms. The uniqueness of the Opening Bell model lies in its collaboration with issuing companies, making on-chain tokens part of the company's legal capital rather than third-party issued certificates. Superstate itself is a registered transfer agent and FINRA member, able to register and update stockholder registers on the blockchain with company authorization. As of now, the Opening Bell platform has launched three stock tokens, including Forward and Galaxy, with a total market value of approximately $16.4 million. Although the scale is small, its model is highly compliant: Superstate, as a registered transfer agent, ensures that on-chain shareholders are no different from company shareholders, achieving that tokens are equivalent to stocks. This also means that holders enjoy complete shareholder rights and can participate in company actions on-chain.

Robinhood: Robinhood is a well-known U.S. commission-free stock trading platform that launched stock token trading services for the European market in 2025 through its Robinhood Wallet and Robinhood Crypto entities. Its stock tokens are issued on the Arbitrum Nova blockchain, supporting 24/5 trading and covering over 2,000 assets, including U.S. listed stocks, ETFs, and some company equity mapping assets. Robinhood does not directly issue stock tokens but integrates multiple token issuers to provide asset access, relying on its self-developed chain for trade matching and custody. This service is primarily open to European users, and U.S. investors cannot access it directly. In terms of regulatory attributes, Robinhood's stock token trading has not yet received approval from the U.S. SEC, and its business is managed by Robinhood Europe and Robinhood Crypto, claiming compliance with applicable EU crypto asset regulations. On-chain data shows that the total TVL of Robinhood's related tokens (tracked through its Arbitrum Nova address) is currently approximately $10.9 million, with rapid user growth, making it one of the most active retail entry points. Its token products do not grant holders voting rights or direct shareholder rights but are price-anchored to the corresponding stocks, providing a convenient market access channel.

PreStocks: PreStocks is a platform focused on the tokenization of equity in private companies (Pre-IPO stage). It holds a small number of secondary market shares of well-known unlisted companies such as OpenAI, SpaceX, Anthropic, and Neuralink through a special purpose vehicle (SPV) structure and issues corresponding tokens that circulate on the Solana blockchain. PreStocks explicitly states that it has no official partnership with the involved companies, and the tokens are merely economic rights certificates, lacking voting rights, shareholder rights, or dividend income. Users who purchase tokens gain rights to potential future profit distributions from the corresponding SPV (such as monetization upon IPO, equity sales, etc.). PreStocks does not hold a U.S. securities broker license and has not registered with the SEC, with its services open to non-U.S. users.

- Additionally, Coinbase has stated that it is seeking U.S. SEC approval to launch tokenized stock trading services, potentially introducing stock token trading features through its Broker-Dealer subsidiary, directly competing with Kraken and Robinhood. Dinari has obtained the first tokenized stock brokerage license, launching dShares token products and planning to create a dedicated L1 chain. These unique participants collectively enrich the stock token ecosystem.

4. Risks and Opportunities of Stock Tokens

Currently, stock tokens face a situation of both risks and opportunities. Only by effectively managing risks can their potential opportunities be fully realized, driving this innovation towards maturity.

Major Risks

Compliance and Policy Risks: Due to the intersection of stock tokens with traditional securities and the crypto space, regulatory uncertainty is the primary risk. Different jurisdictions may classify stock tokens differently, potentially viewing them as securities, derivatives, or even illegal issuances. If regulatory policies tighten, related services may be forced to cease, as seen in the cases of Binance and FTX stock tokens. Even compliant tokens must adapt to the differences in securities laws across countries, creating barriers to cross-border promotion. For example, the U.S. has not formally approved public trading of stock tokens for retail investors, and the EU's MiCA regulations are still under observation. Policy changes may lead to users being unable to access certain platforms or tokens being delisted.

Legal Rights and Investor Protection: Many stock tokens do not grant holders true shareholder status (especially synthetic or gray market tokens), resulting in a lack of investor rights. In the event of disputes or defaults by the issuer, token holders may have no direct legal recourse. This is particularly pronounced in bankruptcy situations: if the institution holding the shares goes bankrupt, can token holders recover their assets? Currently, there is a lack of case law on this issue. Additionally, the absence of voting rights means that token investors cannot participate in corporate governance, which could harm their interests in extreme cases (such as company mergers or privatization decisions).

Liquidity and Premium/Discount Risks: Although the total market value is rising, the overall liquidity of stock tokens remains lower than that of traditional stock markets. Some tokens have very low daily trading volumes and wide bid-ask spreads, making them susceptible to trading at a discount or premium. This is especially true when redemption mechanisms are not smooth, causing token prices to deviate from the value of the underlying assets. For instance, a private company token may trade at a price significantly lower than the company's latest financing valuation, resulting in paper losses for holders. Additionally, large holders selling in a thin market can trigger price crashes, posing a risk of liquidity exhaustion.

Technical and Security Risks: Stock token contracts operate on blockchains, necessitating attention to technical risks such as smart contract vulnerabilities and hacking attacks. If a token contract is attacked, resulting in a large number of tokens being stolen or transferred, the relationship with the underlying assets could be jeopardized. Furthermore, oracle prices are crucial for synthetic tokens; if an oracle fails or is manipulated, it could lead to significant price deviations for synthetic tokens, triggering liquidation cascades. On the other hand, the stability of the blockchain network itself also affects the trading experience; for example, past outages on Solana interrupted token trading, potentially causing losses for users. Although most stock tokens choose mature chains and audited contracts, technical risks cannot be ignored, and the industry needs to continuously invest in security measures.

Credit and Counterparty Risks: When users purchase stock tokens, they effectively assume the credit risk of the issuer or custodian. Compliant tokens are relatively better, usually held by independent trusts, but in gray market models, users are merely creditors of the trading counterpart. If the issuer absconds with funds or misappropriates assets, users will incur losses. Moreover, even with custodians, the legal structures can sometimes be complex: for example, the holding SPV may lack transparency, making it difficult to monitor the actions of the SPV manager. These potential counterparty risks need to be mitigated through audits, notarizations, and other means; otherwise, if a trust event occurs, it will severely undermine market confidence.

Potential Opportunities

Cross-Border Investment and Inclusive Finance: Stock tokens are expected to reconstruct cross-border investment channels. Traditionally, investors from different countries face challenges such as account opening, foreign exchange controls, and market access, making it difficult to invest in foreign stocks conveniently. Stock tokens break geographical limitations; as long as there is internet access and a crypto wallet, anyone can purchase overseas stock tokens at any time. This is particularly beneficial for investors in emerging markets, providing a new pathway to participate in global capital markets. For example, an individual in a country without a developed securities market can invest in companies like Apple and Tesla through stock tokens. This contributes to inclusive finance and global wealth allocation. In the long run, stock tokens may become a shared market for global investors, significantly lowering the barriers and costs of cross-border securities investment.

Enhancing Market Efficiency and Liquidity: The 24/7 trading and real-time settlement brought by tokenization have the potential to enhance market efficiency. Investors are no longer limited by exchange operating hours and can respond more flexibly to news and events (such as earnings reports and macro data). At the same time, instant settlement reduces the counterparty default risk associated with T+2 settlements, freeing up capital efficiency. The pressure on broker clearing is reduced, allowing investors to adjust their positions without waiting. This high efficiency may attract some traditional stock trading to shift on-chain. Additionally, fractional investments (small purchases) allow more capital to enter the market, enhancing overall liquidity. This is especially true for stocks that are illiquid or have high prices, as tokenization can introduce a new group of investors. On the institutional side, some banks and funds have already begun to accept tokenized securities as collateral, increasing the speed of asset circulation. Overall, stock tokens are expected to make the securities market more efficient, interconnected, and continuous.

Innovative Financial Products and Services: Stock tokens can be combined with DeFi to create innovative financial services. Current use cases include: holding stock tokens can be used as collateral in lending protocols to obtain stablecoin loans, providing liquidity on decentralized exchanges to earn fees, or even combining with options contracts to form new derivative strategies. In the future, developers can create index tokens or actively managed token portfolios, achieving ETF and portfolio management functions on-chain. Additionally, stock tokens can be used in payment and settlement scenarios, such as representing receivable equity in supply chain finance or directly exchanging another stock token in company mergers, thereby reducing intermediary costs. These are difficult to achieve or time-consuming in traditional systems but become feasible in a blockchain environment. Stock tokens provide a rich soil for financial innovation, expanding the boundaries of securities.

Opportunities for Traditional Financial Institutions: For traditional players such as brokers and exchanges, stock tokens present both challenges and opportunities. Leading institutions are actively investing: large investment banks like JPMorgan and Morgan Stanley have established tokenized asset departments, and exchanges like Nasdaq have announced plans to offer digital asset custody or trading services. If they can align with this trend, traditional institutions can leverage their brand and customer resources to carve out a share in the new market. For example, Fidelity Investments launched a trading platform supporting digital assets, allowing qualified clients to purchase tokenized securities. Some traditional brokers are considering becoming partners with token issuers like Dinari to provide custody and market-making services. It is foreseeable that as regulations gradually clarify, traditional institutions will enter the market in large numbers, which is expected to accelerate the maturity of the stock token market while bringing new growth points for the institutions themselves. This is especially a new avenue for multinational financial groups to extend their business boundaries and connect with global markets.

Promoting Capital Market Reform: The rise of stock tokens compels traditional capital markets to consider reform. Currently, there are many pain points in stock trading: long settlement cycles, limited trading hours, and high cross-border costs. Tokenization provides a viable alternative. This will prompt existing exchanges and intermediaries to lower costs and extend trading hours to enhance competitiveness. For example, some exchanges are studying T+0 settlement and all-day trading mechanisms. Additionally, tokenization is driving updates to legal frameworks, including the recognition of electronic equity registration and the rights to execute smart contracts. These changes will benefit the entire capital market, making it more aligned with the demands of today's digital age. From a macro perspective, if securities are fully digitized, regulators can monitor transactions in real-time and transparently, contributing to market stability and risk prevention.

### Future Trends of Stock Tokens

Based on the current development trends and industry perspectives, we make the following forecasts for the future of stock tokens:

Huge Potential for Tokenized Securities Market: According to the World Economic Forum, it is predicted that within the next 10 years, approximately 10% of global securities will be tokenized. As the largest category of securities assets, stocks hold a trillion-dollar tokenization potential, with the stock token market expected to reach several trillion dollars by 2030. Especially in cross-border stock investment and private equity markets, tokenization can significantly expand the participant base and release previously inaccessible liquidity. This will create a prototype of a globally unified, around-the-clock capital market, making capital allocation more efficient.

Traditional Brokers and Exchanges Accelerating Transformation: As mentioned earlier, stock tokens are impacting the business models of traditional brokers and exchanges. This may force traditional players to transform: on one hand, actively launching digital asset segments to provide tokenized securities trading; on the other hand, optimizing existing processes to lower fees and enhance services to retain customers. We have already seen emerging brokers like Robinhood leverage tokenization to offer 24-hour trading, while Nasdaq and the London Stock Exchange are also exploring blockchain settlement solutions. In the future, it is possible that major securities exchanges will directly launch stock token trading boards, provided regulations allow, or even move parts of the listing process for small and medium-sized enterprises onto the blockchain to reduce IPO costs. Brokers may transform into digital asset brokers, selling both traditional stocks and tokenized stocks, providing one-stop services for clients. It can be said that stock tokens are a "forced reform" for traditional intermediaries, and their ability to successfully transform will determine the rise and fall of these institutions in the new competitive landscape.

Gradual Improvement of Regulatory Framework: Currently, regulators in various countries are closely monitoring tokenized securities. It is expected that a clear regulatory framework will be established in the coming years, providing guidelines for market participants. For example, the U.S. may introduce a digital securities bill that incorporates tokenized stocks into existing securities law regulation while providing some flexibility; the EU may refine STO rules based on MiCA; and Asian financial centers like Hong Kong and Singapore are already releasing guiding principles. The SEC may gradually open more licenses and establish investor protection guidelines after observing pilot effects. The improvement of regulations will eliminate many uncertainties, attract conservative institutional funds, and further grow the market.

Strengthening Mapping of Real Shareholder Rights: Currently, many stock tokens cannot provide voting rights, but this situation is expected to improve in the future. As the Superstate model proves feasible, more companies or intermediaries will adopt direct mapping of shareholder rights, utilizing blockchain for shareholder register management and online voting. This not only grants token holders their rightful rights but also improves corporate governance efficiency. For example, voting at shareholder meetings can be automatically counted and transparently disclosed through on-chain tokens, reducing the possibility of human error and tampering. Dividend distribution can also be programmed for more timely and direct issuance to token holders. These improvements will narrow the gap between tokens and real stocks, ultimately achieving "same rights and benefits for the same shares."

Collaborative Development with Real-World Assets: In addition to stocks, the tokenization of bonds, funds, real estate, and other assets is also accelerating. In the future, tokenized securities will form a comprehensive ecosystem: investment portfolios will include stock tokens, bond tokens, commodity tokens, and more. Tokens of different asset categories can be combined, staked, and traded within a unified wallet and DeFi protocols, creating synergistic effects. For example, investors can use their held government bond tokens as collateral to borrow stablecoins to purchase stock tokens, achieving leveraged investment in traditional assets; or automatically rebalance between stock and bond tokens through smart contracts, forming dynamic tokenized investment portfolios. This will connect previously fragmented markets, allowing global capital to flow freely on-chain and improving resource allocation efficiency.

Conclusion

In summary, stock tokens, as a frontier of financial innovation, are at the threshold of taking off from their initial stages. They have the potential to change the way we participate in the stock market, making investment more open, efficient, and globalized. Currently, the stock token market still exhibits some characteristics of "wild growth," such as volatile valuations and varying project quality. In the future, as large institutions enter and regulations improve, the market will move towards maturity and standardization. This includes unified information disclosure standards, the establishment of industry self-regulatory organizations, and the emergence of third-party rating agencies. Market infrastructure will also be strengthened, such as professional market makers providing liquidity for tokens and insurance products covering token asset loss risks. Investors will be able to receive services and protections similar to those of traditional securities investments. This will further attract traditional funds into the market, creating a virtuous cycle and unlocking a trillion-dollar on-chain stock trading market. It is conceivable that the stock token market in 2030 may be as commonplace as the electronic trading market in 2010.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Every week, our researchers also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。