Bitcoin has clawed its way back above the $70,000 range, trading between roughly $70,500 and $71,500 over the past few hours. The rebound follows a sharp dip on Feb. 5, when BTC slipped into the $60,000 range and briefly touched $59,900 on a few exchanges.

During this stretch, sentiment has leaned heavily bearish, with some arguing that bitcoin is already deep into a bear cycle rather than merely catching its breath. Metrics from the Fear and Greed indexes tracked by alternative.me and coinmarketcap.com also indicate that the market’s mood has slid firmly into the “extreme fear” zone.

The alternative.me Crypto Fear and Greed Index (CFGI) debuted in 2018 and keeps its focus squarely on bitcoin. It pulls together five weighted inputs— volatility (25%), market momentum and volume (25%), social media activity (15%), bitcoin dominance (10%), and Google Trends data (10%)—to serve as a shorthand barometer for overall market sentiment.

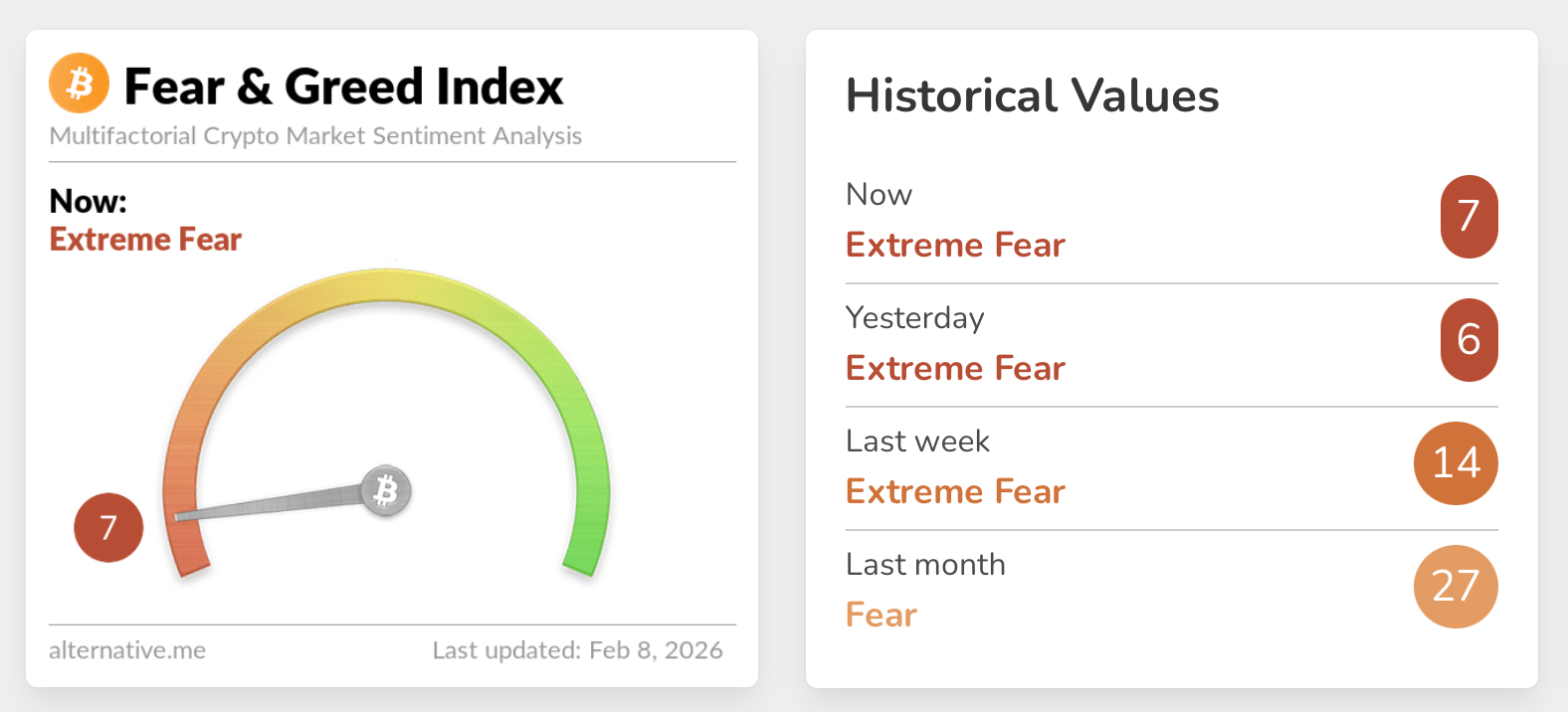

The alternative.me CFGI on Feb. 8, 2026.

As of Feb. 8, 2026, the alternative.me CFGI sits at 7 out of 100, placing sentiment firmly in the “extreme fear” category. That reading typically reflects investors who are deeply uneasy about market conditions. Because the alternative.me CFGI extends back to 2018, the index has dipped into similar territory on a handful of occasions.

One such moment came in June 2022, when the score hit 9, or “extreme fear,” amid the Terra project’s collapse and the de-pegging of its stablecoin. While the chart shows other notable lows, the chaos of 2022 lines up closely with the volatility and crypto downturn seen in February 2026. The CMC CFGI is also in “extreme fear” with a score of 8 on Sunday.

The index offered by CMC is a proprietary gauge that casts a wider net, analyzing the top 10 cryptocurrencies—excluding stablecoins—instead of zeroing in solely on bitcoin. CMC’s framework blends five inputs: volatility measured through Volmex indices for bitcoin and ethereum, price momentum, social sentiment drawn from proprietary sources, derivatives market data such as Deribit’s put-call ratio, and overall market composition based on the stablecoin supply ratio, all weighted through an undisclosed formula.

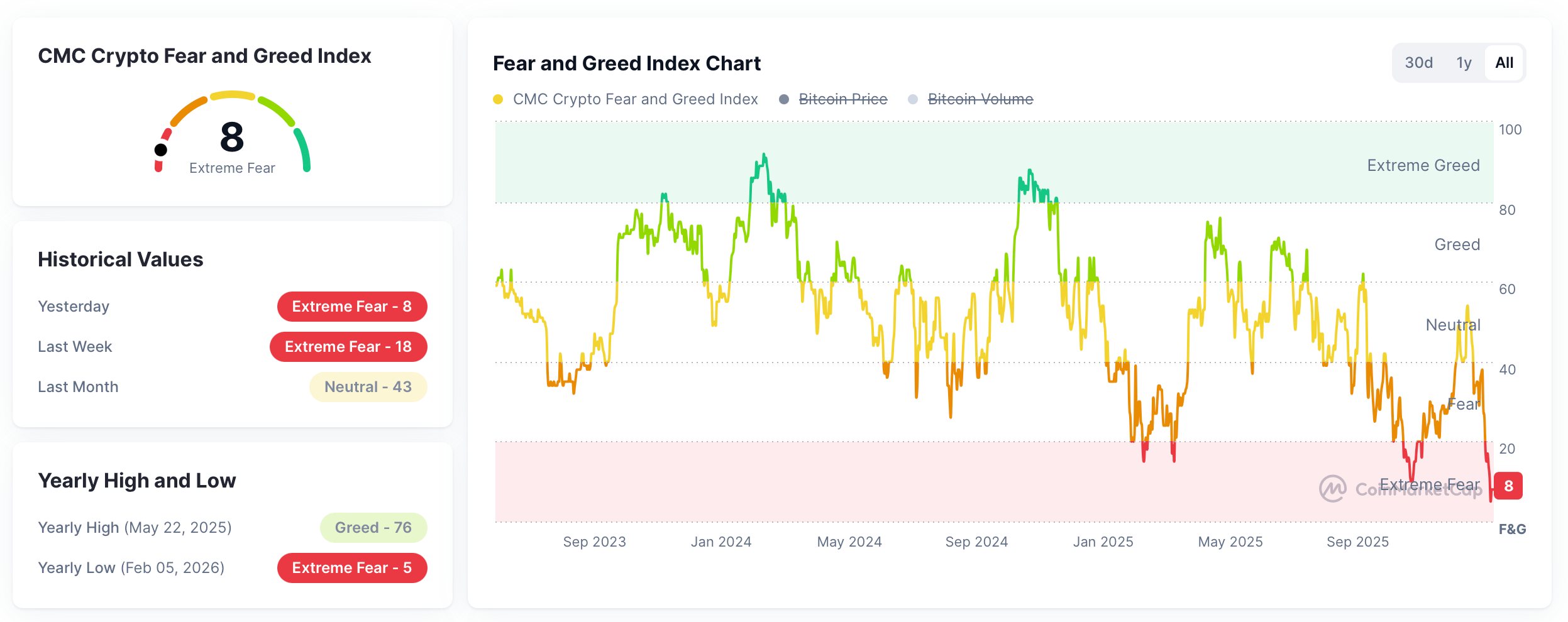

The CMC CFGI on Feb. 8, 2026.

Extending CMC’s CFGI back to June 2023, or as far as the data allows, shows the current reading sitting near the bottom of the chart’s historical range. The widely discussed Feb. 5 crypto crash dragged CMC’s index even lower than today’s score of 8, briefly dropping it to 5. Read together, the CMC and alternative.me indexes suggest that last month hovered in the “neutral” to “fear” zone, while last week tipped decisively into “extreme fear.”

Also read: ‘Clueless and Venal’: Economist Nouriel Roubini Blasts Trump’s Crypto Push as a Recipe for Financial Ruin

The data from both platforms paint a market caught between exhaustion and hesitation. Historically, readings buried this deep in “extreme fear” have tended to surface when anxiety is widespread, conviction is thin, and participants are reacting defensively rather than positioning with confidence. That does not guarantee an immediate reversal, but it does suggest that much of the panic may already be priced in, leaving the market hypersensitive to even the most modest shifts.

- What does “extreme fear” mean in crypto markets?

It signals widespread investor anxiety, often reflecting heightened uncertainty and defensive positioning. - Why are crypto fear indexes at unusually low levels now?

Recent price swings and the Feb. 5 sell-off pushed sentiment gauges to levels rarely seen outside major stress events. - Which indexes are showing extreme fear?

Both the alternative.me Crypto Fear and Greed Index and Coinmarketcap’s proprietary index are currently in the “extreme fear” zone. - Does extreme fear predict what bitcoin will do next?

Not directly, but historically, it has coincided with periods of heightened risk and potential turning points.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。