Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.24 trillion, with BTC accounting for 58.4%, or $1.3 trillion. The market capitalization of stablecoins is $30.51 billion, decreasing by 0.48% in the last 7 days, with USDT making up 60.64%.

Among the top 200 projects on CoinMarketCap, almost all have declined, with BTC down 20.22% over the past 7 days, ETH down 30.04%, SOL down 30.27%, while HYPE rose against the trend with a 7-day increase of 12.71%, and SKR up 49.47%.

This week, the net outflow from U.S. Bitcoin spot ETFs was $358 million; the net outflow from U.S. Ethereum spot ETFs was $170.4 million.

Market Forecast (February 9 - February 15):

BTC: $67,000 - $82,000

ETH: $1,900 - $2,200

SOL: $86 - $120

The current RSI index is 33.03 (weak zone), and the fear and greed index is 10 (extreme fear), while the altcoin season index is 41 (neutral, consistent with last week).

The sharp decline in the market this week is not due to a single factor but rather a "perfect storm" driven by macro policy shocks combined with internal market vulnerabilities. The main reasons are:

The nomination of former board member Kevin Warsh as the next Federal Reserve Chairman is the key trigger for market panic. Warsh is known for his extreme hawkish stance. The market generally interprets that if he takes office, global liquidity will continue to tighten, posing a fatal blow to risk assets (such as cryptocurrencies and tech stocks) that rely on loose liquidity.

Before the crash, the market had accumulated a large number of high-leverage long positions. When prices fell below key support levels (such as Bitcoin at $65,000), it triggered large-scale, chain-reaction liquidations. The cycle of "decline → liquidation → exacerbated decline" is the technical main reason for the sharp increase in the drop.

On February 6 (the day of the significant drop), the People's Bank of China issued a notice explicitly prohibiting the issuance of stablecoins pegged to the yuan without permission. Although this move primarily targets the domestic market, it exacerbated investors' concerns about "global regulatory tightening" during a period of weak global market sentiment.

It is expected that the market will continue to digest macro pressures next week, remaining in a wide-ranging fluctuation phase while searching for bottom support. The current market has entered the "extreme fear" zone, which is usually an important contrarian indicator that the market is approaching a phase bottom, but it requires net inflows into ETFs and continued growth in stablecoins to confirm.

If the market breaks below support levels, it may enter a deeper decline:

The new Federal Reserve Chairman makes hawkish statements that exceed expectations, or key inflation/employment data unexpectedly strong, leading to market expectations of higher and longer-lasting interest rates.

Continued capital outflows: Bitcoin ETF funds are accelerating outflows, indicating that institutions are still decisively retreating.

Black swan events: such as major exchanges/projects collapsing, geopolitical crises, etc.

Overall, it is acknowledged that the market is in a downtrend, but it is believed that after consecutive sharp declines, there is a demand and space for a technical rebound, rather than a straight drop.

Understanding Now

Review of Major Events of the Week

On February 2, the dollar strengthened against the yen in the early trading session, Asian stock index futures generally fell, and U.S. stock index futures dropped by 1%, highlighting the fragility of market sentiment after a turbulent week on Wall Street. At the beginning of trading, spot gold's decline expanded to 3.5%, silver fell nearly 9%, and WTI crude oil dropped 4%. Previously, due to the sharp drop in precious metals and Trump's nomination of Kevin Warsh as the next Federal Reserve Chairman, the dollar recorded its largest single-day increase since last May on the previous Friday;

On February 1, renowned trader and chart analyst Peter Brandt, who successfully predicted the 2018 Bitcoin crash, hinted in a post this morning that Bitcoin would drop to $58,000, with a chart showing BTC near the lower bound of a logarithmic channel, suggesting a continuation of the bear market. The day before, Peter Brandt had predicted that "Bitcoin will bottom out and rebound between August and October, then soar";

On February 4, U.S. President Trump signed a government funding bill in the Oval Office, ending part of the government "shutdown." Earlier that day, the U.S. House of Representatives voted to pass a funding bill for several federal government departments for the remainder of the fiscal year, resolving the "shutdown" stalemate that began on January 31. The bill will provide funding for several federal government departments until September 30, the end of the fiscal year, and provide two weeks of funding for the Department of Homeland Security, which has faced controversy and protests due to immigration enforcement actions, allowing all parties to continue negotiating improvements to the department's operations;

On February 5, Trump stated, "If Warsh raises interest rates, he would have been out long ago," and Bessent claimed the president could intervene in the Federal Reserve;

On February 5, Bitcoin briefly fell below $74,000 in early U.S. stock trading, with the previous day's low quickly rebounding fading, and tech stocks again sold off, dragging down cryptocurrency market sentiment. The Nasdaq 100 index continued to weaken, with the software sector experiencing significant declines, exacerbating concerns about the impact on the AI industry;

On February 5, Multicoin co-founder Kyle Samani announced his departure to explore new directions in the tech field, while still serving as chairman of the largest SOL treasury company;

On February 6, global risk markets fell again this morning, with Bitcoin dropping to the $60,000 mark and Ethereum falling below $1,800; in U.S. stocks, the three major stock index futures expanded their declines, with S&P 500 index futures down 1%, Nasdaq futures down 1.6%, and Dow futures down nearly 0.6%; in precious metals, spot gold touched down to $4,660 per ounce, down 2.51% for the day. Spot silver plummeted 9.00% during the day, currently reported at $64.38 per ounce. Spot palladium fell by 4.00% during the day, currently reported at $1,574.96 per ounce; the Nikkei 225 index fell below 53,000 points, down 1.57% for the day. The South Korean KOSPI 200 index futures fell by 5%, with program trading paused for 5 minutes;

On February 5, according to Antpool data, based on the current Bitcoin mining difficulty and a power cost of $0.08 per kilowatt-hour, mining machines including Antminer S19 XP+ Hyd, Bitmain M60S, Avalon A1466I, and some models of Antminer S21 series have reached shutdown price levels. Additionally, models like S21Pro and S21+ Hyd in the Antminer S21 series are close to shutdown price levels in the range of $65,000 to $69,000. Furthermore, high-performance mining machines like Antminer U3S23H and Antminer S23 Hyd have shutdown price levels above $44,000;

Macroeconomics

On February 4, U.S. companies added fewer jobs than expected in January, indicating a continued slowdown in the labor market at the beginning of the year. ADP research data released on Wednesday showed that private sector employment increased by only 22,000 jobs in January, below market expectations, with the previous month's data revised down;

On February 5, the Bank of England kept the benchmark interest rate unchanged at 3.75%, in line with market expectations. Five members voted to maintain the rate, while four voted for a rate cut. The Bank of England indicated that rates may be further reduced.

On February 5, the number of initial jobless claims in the U.S. for the week ending January 31 was 231,000, expected to be 212,000, with the previous value at 209,000.

On February 7, according to CME "FedWatch" data, the probability of the Federal Reserve cutting rates by 25 basis points in March is 12%, while the probability of maintaining rates is 82.3%. The probability of the Federal Reserve maintaining rates until April is 66.4%, with a cumulative probability of a 25 basis point cut at 30.2% and a cumulative probability of a 50 basis point cut at 3.4%.

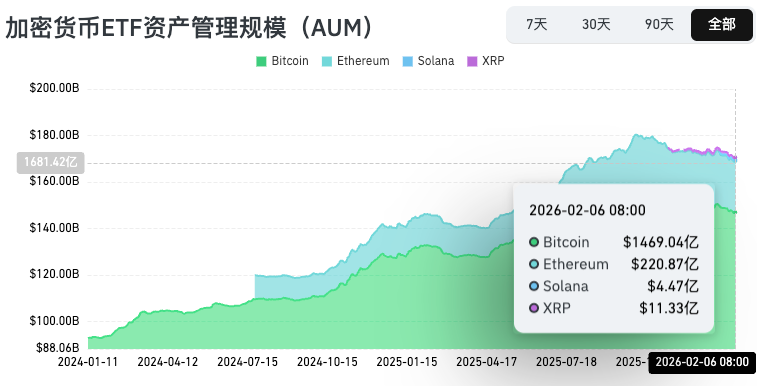

ETF

According to statistics, from February 3 to February 9, the net outflow from U.S. Bitcoin spot ETFs was $358 million; as of February 6, GBTC (Grayscale) had a total outflow of $25.832 billion, currently holding $11.17 billion, while IBIT (BlackRock) currently holds $53.511 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $92.399 billion.

The net outflow from U.S. Ethereum spot ETFs was $17.04 million.

Envisioning the Future

Industry Conferences

Consensus Hong Kong 2026 will be held from February 11 to 12 in Hong Kong, China;

ETHDenver 2026 will be held from February 17 to 21 in Denver, USA;

EthCC 9 will be held from March 30 to April 2, 2026, in Cannes, France. The Ethereum Community Conference (EthCC) is one of the largest and longest-running annual Ethereum events in Europe, focusing on technology and community development.

Project Progress

The stablecoin protocol Cap will conduct its initial token issuance through Uniswap on February 9, with 10% of the total supply allocated for sale, and an initial FDV of $150 million;

The application for compensation related to the Trust Wallet security incident will close on February 14. Trust Wallet reminds users that wallets affected by this security incident should not continue to be used, and users need to update to the latest version and migrate their funds immediately.

Important Events

On February 10 at 21:30, the U.S. will announce the monthly retail sales for December;

On February 11 at 21:30, the U.S. will announce the unemployment rate for January;

On February 12 at 21:30, the U.S. will announce the number of initial jobless claims for the week ending February 7 (in ten thousand);

On February 13 at 21:30, the U.S. will announce the year-on-year CPI for January (not seasonally adjusted).

Token Unlocking

Linea (LINEA) will unlock 138 million tokens on February 10, valued at approximately $4.58 million, accounting for 5.96% of the circulating supply;

Aptos (APT) will unlock 11.28 million tokens on February 10, valued at approximately $12.07 million, accounting for 0.69% of the circulating supply;

Avalanche (AVAX) will unlock 1.67 million tokens on February 11, valued at approximately $14.33 million, accounting for 0.32% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. We analyze market trends through our "Weekly Insights" and "In-Depth Reports"; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。