Fidelity Investments’ director of global macro, Jurrien Timmer, shared on social media platform X on Feb. 6, 2026, commentary identifying $65,000 as an attractive bitcoin entry point, linking the level to recent macro-driven volatility and using Fidelity charts to frame the asset’s technical support and relative flows compared with gold.

He said:

“The markets spoke loudly last week to the next Fed Chair being announced. For bitcoin though, I continue to view $65K as an attractive entry point.”

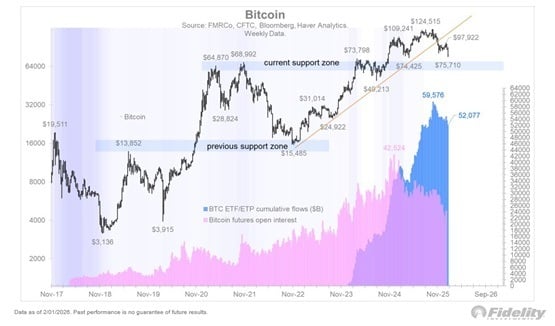

The accompanying bitcoin chart highlighted what Timmer labeled a “current support zone” clustered around the mid-$60,000 range, a level that aligns with prior resistance from earlier cycles. That setup followed sharp market volatility after President Donald Trump’s Jan. 30 nomination of Kevin Warsh as the next Fed chair, which reshaped expectations across currencies, bonds, and risk assets.

The visual also showed bitcoin consolidating above its long-term upward trend line after peaking above $120,000 in late 2025, reinforcing his view that the asset is in a reset phase rather than a breakdown. Beneath the price action, cumulative BTC ETF and ETP flows approached roughly $59.6 billion, while bitcoin futures open interest remained elevated, signaling sustained institutional involvement despite cyclical cooling.

Later in the post, the Fidelity executive explained:

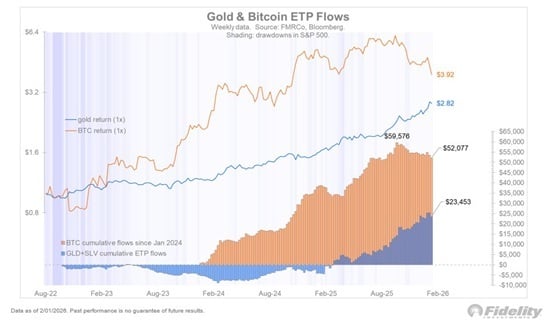

“Given the distance between gold and bitcoin vis-à-vis their support levels, I suspect that gold will continue to outpace bitcoin until the flows converge further.”

A second chart comparing gold and bitcoin exchange-traded product (ETP) flows highlighted the imbalance Timmer referenced. Gold-linked vehicles, including GLD and SLV, two of the largest exchange-traded funds (ETFs) backed by physical gold and silver, showed cumulative inflows of about $52.1 billion, while bitcoin ETPs recorded roughly $23.5 billion in net inflows since January 2024. Although bitcoin continued to outperform gold on a normalized return basis over the broader period, gold attracted steadier capital during recent equity drawdowns, reflecting a defensive shift as investors priced in a more conventional, potentially hawkish Federal Reserve.

Markets interpreted Warsh’s nomination as signaling tighter policy discipline and faster balance sheet reduction, strengthening the dollar, pressuring anti-debasement trades, and pushing long-term yields higher. Within that macro backdrop, Timmer framed bitcoin’s weakness as cyclical rather than structural, characterizing 2026 as a consolidation year after a potential cycle peak in October 2025 and positioning the $65,000 level as a strategic accumulation zone for long-term investors rather than a signal for short-term trading.

Read more: Strategist Sees Bitcoin and Cryptos Turning More Violent Than 1929 Stock Collapse

- Why does Fidelity see $65,000 as an attractive bitcoin level?

Jurrien Timmer says $65,000 aligns with prior highs, psychology, and adoption-based valuation models. - How did the Kevin Warsh Fed nomination affect bitcoin and gold?

Markets priced in a more hawkish Fed, pressuring bitcoin while gold benefited from near-term flows. - Is Fidelity calling for a new bitcoin bull run in 2026?

No, the view frames 2026 as a consolidation phase after a prior cycle peak. - Why is gold outperforming bitcoin right now, according to Timmer?

He attributes gold’s strength to timing and policy-transition flows rather than long-term fundamentals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。