According to the announcement, the program will run for up to 12 months and allows Galaxy to repurchase shares through open-market transactions, privately negotiated purchases, or other methods permitted under securities laws, including Rule 10b5-1 trading plans. The company disclosed that the program may be suspended or discontinued at any time and does not obligate Galaxy to repurchase the full amount.

Galaxy further said the authorization represents up to 5% of its outstanding common shares at the start of the program. Repurchases on the Toronto Stock Exchange are subject to normal course issuer bid approval, while Nasdaq purchases will follow applicable regulatory limits. All transactions will be made at prevailing market prices unless otherwise permitted.

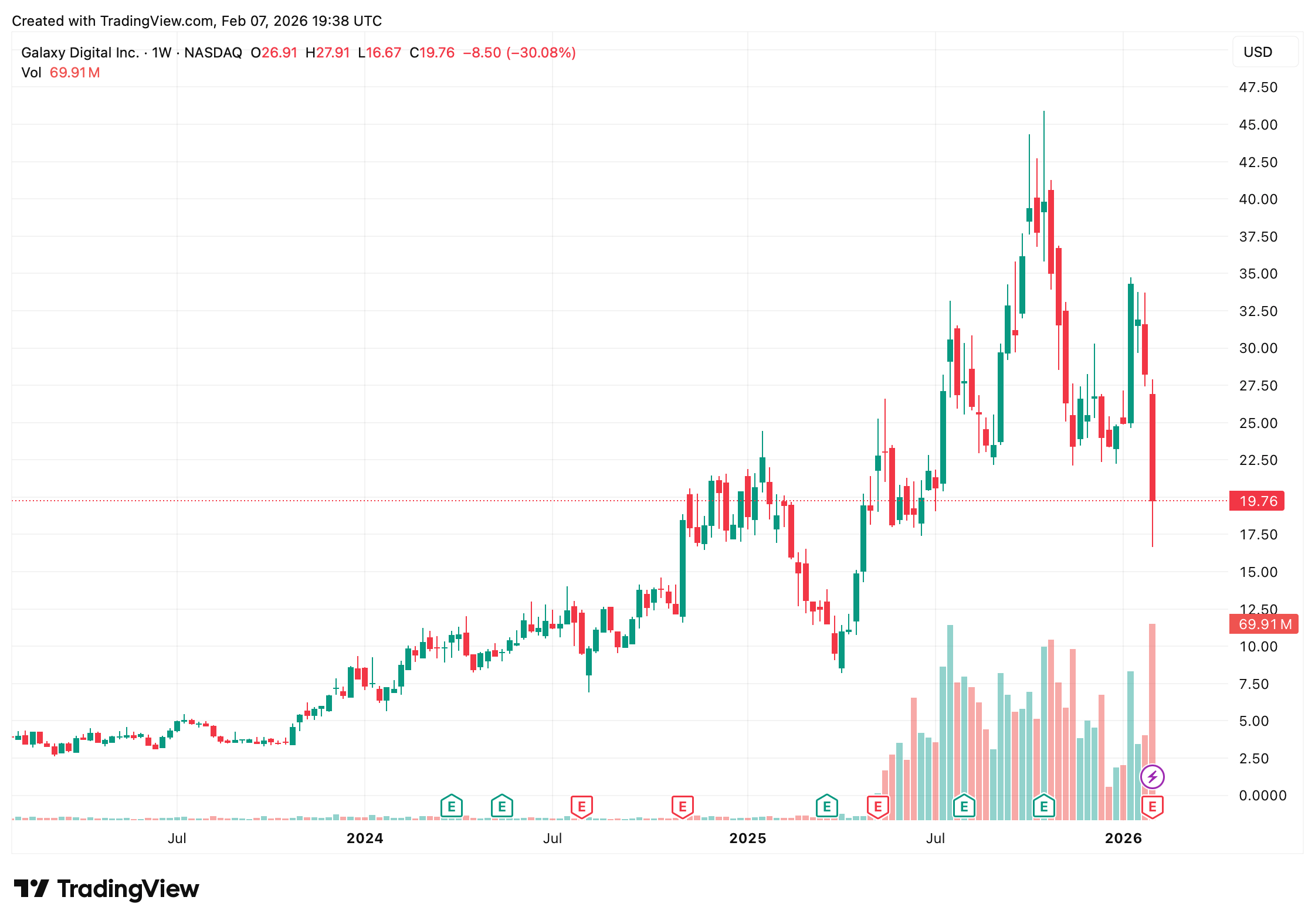

Following the announcement, shares of Galaxy rose about 17.34% on Feb. 6 to close at $19.76, reversing some of the pressure seen earlier in the week. GLXY is still down 32% over the five-day stretch. The stock had fallen sharply in prior sessions and remained well below analyst price targets, according to the company’s summary data.

While Galaxy lost 32% over the last five trading sessions last week, it managed to climb 17.34% on Friday.

The buyback followed Galaxy’s fourth-quarter earnings release earlier in the week, which reported a net loss of $482 million for Q4 2025. Despite the loss, the company reported full-year adjusted gross profit of $426 million and said it entered 2026 with a strong liquidity position, including $2.6 billion in cash and stablecoins.

Also read: Sen. Cynthia Lummis Tells Banks to Stop Fighting Stablecoins and Start Using Them

Chief Executive Officer Mike Novogratz said the company believes its shares do not fully reflect the underlying value of the business, citing Galaxy’s balance sheet and ongoing investments in growth initiatives. Galaxy emphasized that capital returns will be evaluated alongside operational needs and market conditions.

Beyond the repurchase program, Galaxy continues to expand its business beyond digital asset services, including its Helios data center campus in Texas, which supports high-performance computing and artificial intelligence workloads. The company said this diversification strategy is intended to reduce reliance on crypto-related revenue while positioning Galaxy for longer-term growth.

- What did Galaxy Digital announce?

The company authorized a $200 million share repurchase program for its Class A common stock. - How long will the buyback last?

The program is approved to run for up to 12 months starting Feb. 6, 2026. - Is Galaxy required to buy back all $200 million?

No, the program is discretionary and may be paused or ended at any time. - Why did Galaxy approve the buyback?

Management said it believes the stock is undervalued relative to the company’s financial position and long-term outlook.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。