What to know : Bitcoin accumulation has broadened across cohorts for the first time since late November. Wallets holding 10 to 100 BTC have been the most aggressive dip buyers during the drawdown, stepping in as prices fell toward $60,000.

As February began, bitcoin was trading around $80,000, with whales dipping their toes in while retail investors were running for the exits. Just one week later, bitcoin plunged to $60,000 on Feb. 5, and the market is now showing a broad shift toward accumulation across nearly all cohorts as investors start to see value.

This change follows one of the most severe capitulation events in bitcoin’s history. Which now appears to be evolving into a more synchronized accumulation phase.

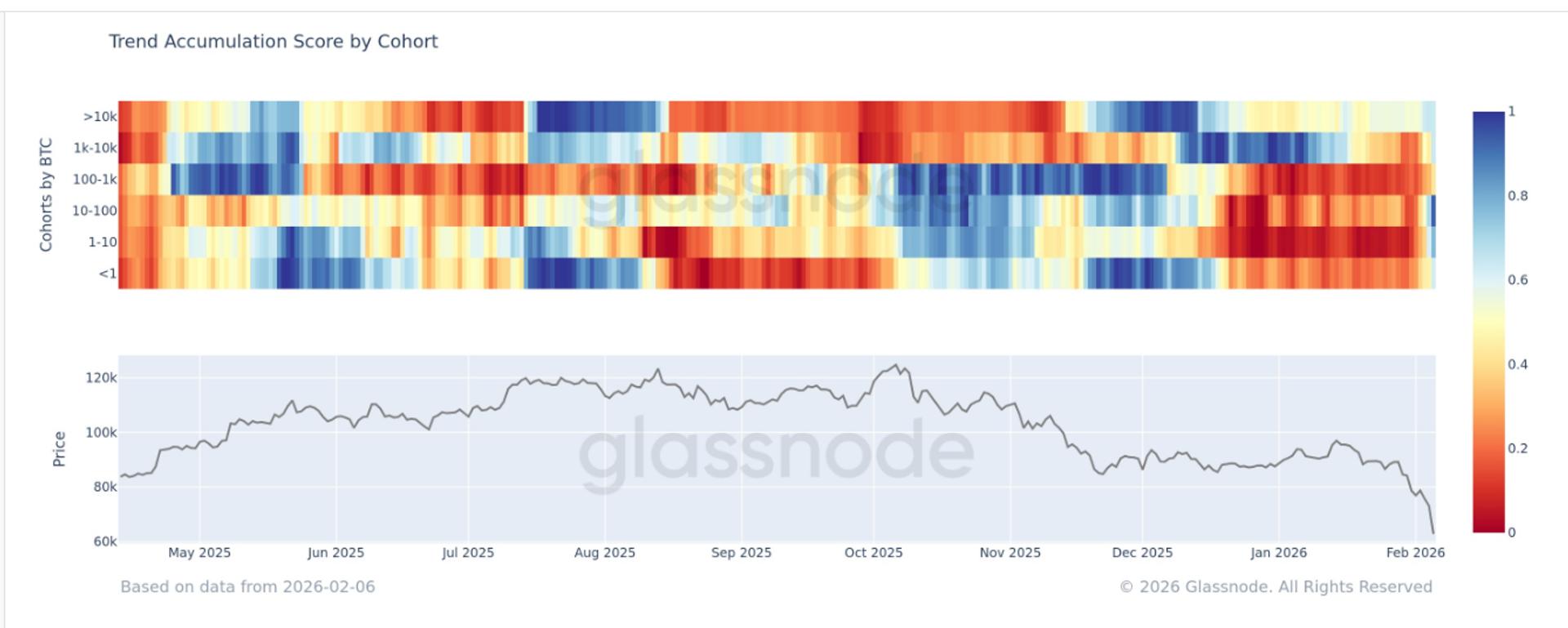

Glassnode’s Accumulation Trend Score by cohort highlights this shift in behavior. The metric measures the relative strength of accumulation across different wallet sizes by factoring in both entity size and the amount of BTC accumulated over the past 15 days. A score closer to 1 signals accumulation, while a score closer to 0 indicates distribution.

On an aggregate basis, the Accumulation Trend Score by cohort has now climbed above 0.5, reaching 0.68. This marks the first time since late November that broad-based accumulation has been observed, a period that previously coincided with bitcoin forming a local bottom near $80,000.

The cohort showing the most aggressive dip buying has been wallets holding between 10 and 100 BTC, particularly as prices fell toward $60,000

While it remains uncertain whether the ultimate bottom is in, it is evident that investors are once again finding value in bitcoin after a drawdown of more than 50% from its October all-time high.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。