Written by: Lucas Gui

As BTC continues to plummet near the $60,000 mark, MSTR's stock price also plummeted over 17% on Thursday, down about 80% from its peak in 2024.

In such a gloomy market sentiment, the atmosphere during MSTR's recent conference call was inevitably tense. The core speakers from MSTR's management included: founder Michael Saylor, CEO Phong Le, and Andrew Kang.

(BTC price once approached $60,000)

The questions from sell-side analysts and investors were quite sharp, focusing on MSTR's valuation multiples, financing sustainability, and cash flow and dividend pressures in a downturn scenario.

To this end, we have summarized the core content and logical thread of this conference call, helping readers clarify the management's core narrative, key data disclosed, and the final analyst Q&A.

1 Management's Main Narrative

First, the management clarified MSTR's company positioning, transitioning from a software company to a Bitcoin balance sheet and digital credit issuance platform. The core viewpoint of the management is to create a digital fortress, hold Bitcoin indefinitely, and use digital credit products to transform Bitcoin volatility into distributable income and financing capabilities.

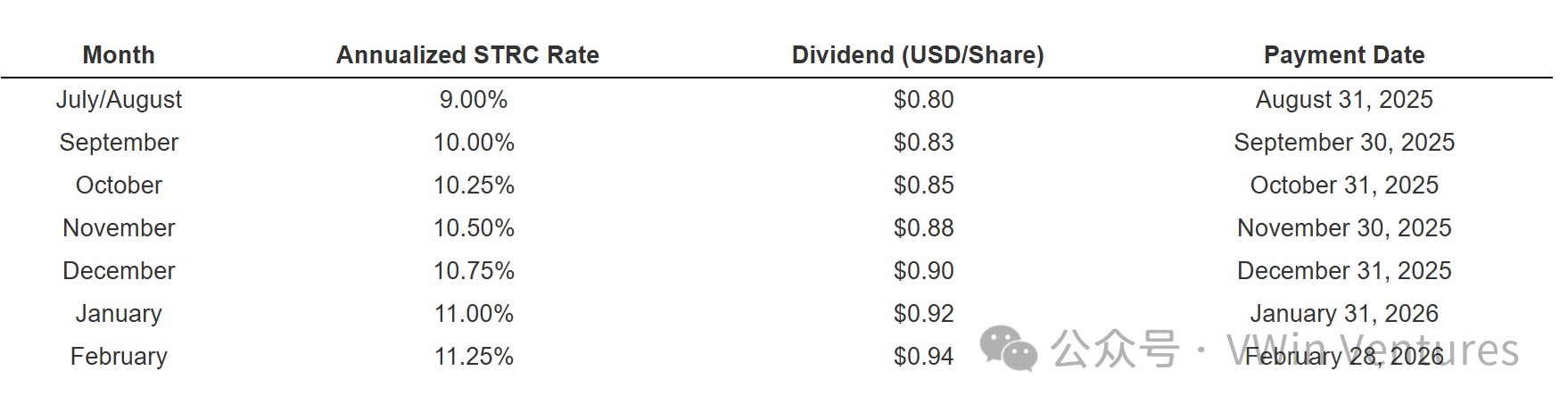

In terms of capital structure narrative, the management emphasized that MSTR's common stock will complement digital credit tools like STRC, with credit tools aimed at income-oriented investors, while common stock bears more volatility and provides more comprehensive asset coverage, thus continuing to maintain a complete set of financing for buying Bitcoin and credit expansion growth flywheel.

(The above image shows STRC's dividend-related data)

Currently, in the face of the market's sharp decline, the management is trying to shift the discussion focus from accounting losses to the following three aspects:

Bitcoin holdings and unit cost, the durability of the company's cash and dollar reserves, and the expansion path of digital credit products, in order to stabilize investors' mindset and maintain confidence.

Finally, regarding whether to sell Bitcoin, MSTR's management seems less resolute than before. For example, Michael Saylor publicly acknowledged during the earnings call that "selling Bitcoin is an option."

2 Key Data Overview

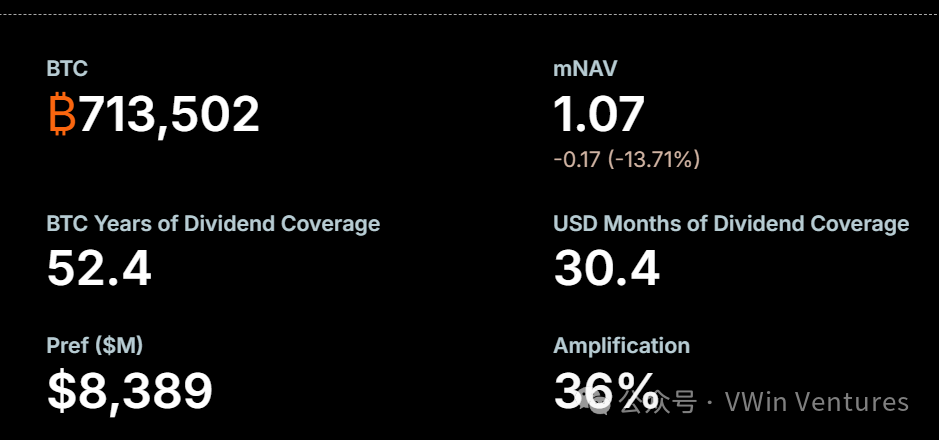

As of February 1, MSTR's total Bitcoin holdings amounted to 713,502 coins, with a total cost of $54.26 billion, and an average cost of about $76,052.

(The above image shows MSTR's BTC reserve quantity and mNAV)

For the entire year of 2025, Bitcoin-related metrics include — BTC Yield 22.8%, BTC Gain 101,873, BTC dollar gain of $8.9 billion.

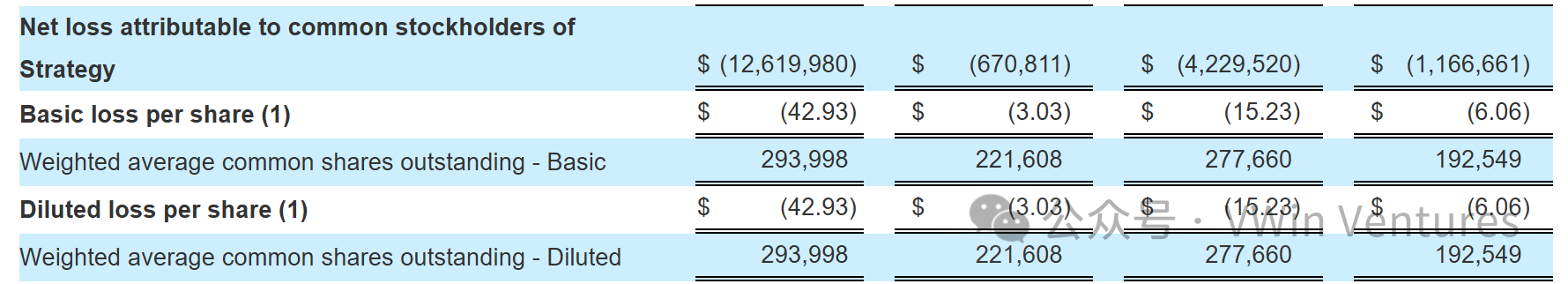

The Q4 operational and accounting results can be described as "bleak," with revenue of $123 million, including subscription service revenue of $51.8 million, a significant year-on-year increase, but Q4 still recorded an overall operational loss of $17.4 billion, a net loss of $12.4 billion, and a diluted loss per share of $42.93. Clearly, the main reason for the loss is the unrealized digital asset losses measured at fair value.

(The above image shows MSTR's earnings situation)

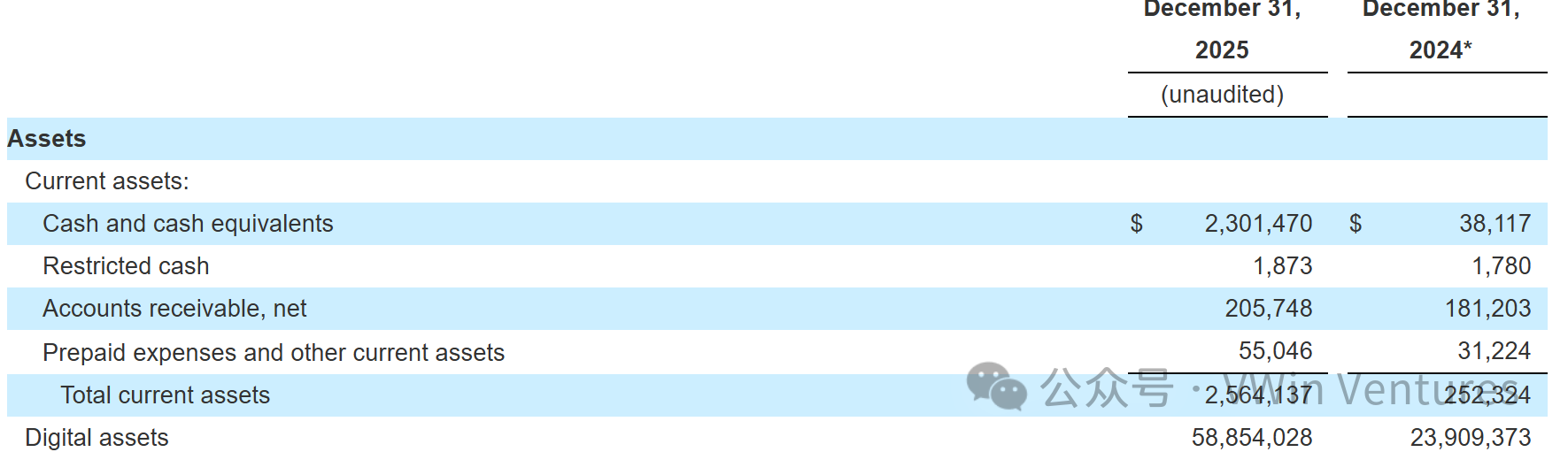

Considering the cash flow pressure brought by BTC depreciation and declining financing capabilities, MSTR's cash flow data is also a highly watched indicator in the market. Currently, MSTR's cash and cash equivalents at the end of the period are about $2.3 billion, and the management emphasized during the conference call that dollar reserves of about $2.25 billion can still cover about 30 months of dividend obligations.

(The above image shows MSTR's cash flow-related data)

Finally, regarding MSTR's financing and expansion, executives emphasized raising $25.3 billion in 2025, while still considering digital credit as a key channel for leveraging capital.

3 The Real Points of Divergence in Q&A

1. Will they be forced to sell Bitcoin?

The market's core concern centers on the decline in valuation multiples mNAV after the stock price drop, whether approaching or falling below 1 would trigger a chain reaction of selling Bitcoin or financing failure, leading to a death spiral.

The management's response leaned more towards a buy low, sell high trading logic. When market sentiment is good and mNAV rises, they will accelerate the issuance of equity or credit tools to expand the pool, and when sentiment is low, they will slow down, rather than treating selling Bitcoin as a routine solution. However, as mentioned earlier, Michael Saylor's stance on not selling Bitcoin has also begun to loosen.

2. Leverage and Convertible Bond Expiration Pressure

The core divergence between management and analysts does not lie in numerical terms, but in extreme tail scenarios. Analysts questioned whether, in the event of extreme market conditions causing Bitcoin to continue to decline, they could still rely on convertible bonds and dividends to withstand the pressure, and whether this would raise refinancing costs.

In response, the management provided a framework indicating net liabilities of about $6 billion, which is still within a controllable range compared to MSTR's BTC reserve size. At the same time, the management emphasized that the maturity of convertible bonds is distributed from 2027 to 2032, and they will gradually be converted to equity, considering restructuring or refinancing only in extreme scenarios.

3. Are digital credit products a moat or a new risk?

The divergence on this topic centers on whether high dividends and expansion speed of products like Stretch would amplify burdens during a downturn in risk assets.

In this regard, the management maintained a positive attitude, stating that Stretch is the core growth engine for the next phase, and provided an effective yield of around 11%, explaining that they will enhance credit quality through increased collateral and risk management, while promoting distribution through brokerage and retail accounts.

At the same time, the management adjusted the reference price rules for Stretch actions, changing from the average price of the last five days of the month to the average price for the entire month, indicating that they are actively addressing trading disturbances caused by ex-dividend and dividend distribution points.

4. How to respond to the narrative of Bitcoin's quantum threat?

The key point of contention is not whether the quantum threat exists, but whether the company should provide a specific roadmap in public discussions.

Analysts hope to hear more executable technical or wallet migration paths. The management, however, avoided the topic, refusing to provide a specific response timeline or single route, emphasizing that the quantum threat should be addressed through industry consensus and collaborative efforts akin to a security committee, positioning quantum concerns as another round of cyclical panic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。