Written by: KarenZ, Foresight News

The current cryptocurrency market is deeply caught in a vortex of severe correction. As Bitcoin's price retreated to $60,000, market sentiment quickly turned to extreme panic.

At this tumultuous moment, the release of the Q4 2025 financial report by Strategy (formerly MicroStrategy), the world's largest Bitcoin corporate holder, undoubtedly added insult to injury, dousing the already sluggish market with a bucket of icy cold water: a net loss of up to $12.4 billion in a single quarter.

On the day the report was released, Strategy's stock price plummeted by about 17%, and as of now, its stock price has cumulatively dropped nearly 80% from the historical high set in November 2024.

From once being a star company that soared with its "Bitcoin treasury strategy" to now being mired in massive losses and a stock price that has been halved repeatedly, Strategy's situation is a true reflection of the current turmoil in the cryptocurrency market—on one side, there are enormous losses on paper, and on the other, an almost obsessive accumulation of coins. This company is staging a gamble on its future with a series of split data.

Core Data: Crazy Accumulation Amidst Huge Losses

The core contradiction in Strategy's Q4 2025 financial report lies in the stark contrast between record high paper losses and historical highs in Bitcoin holdings.

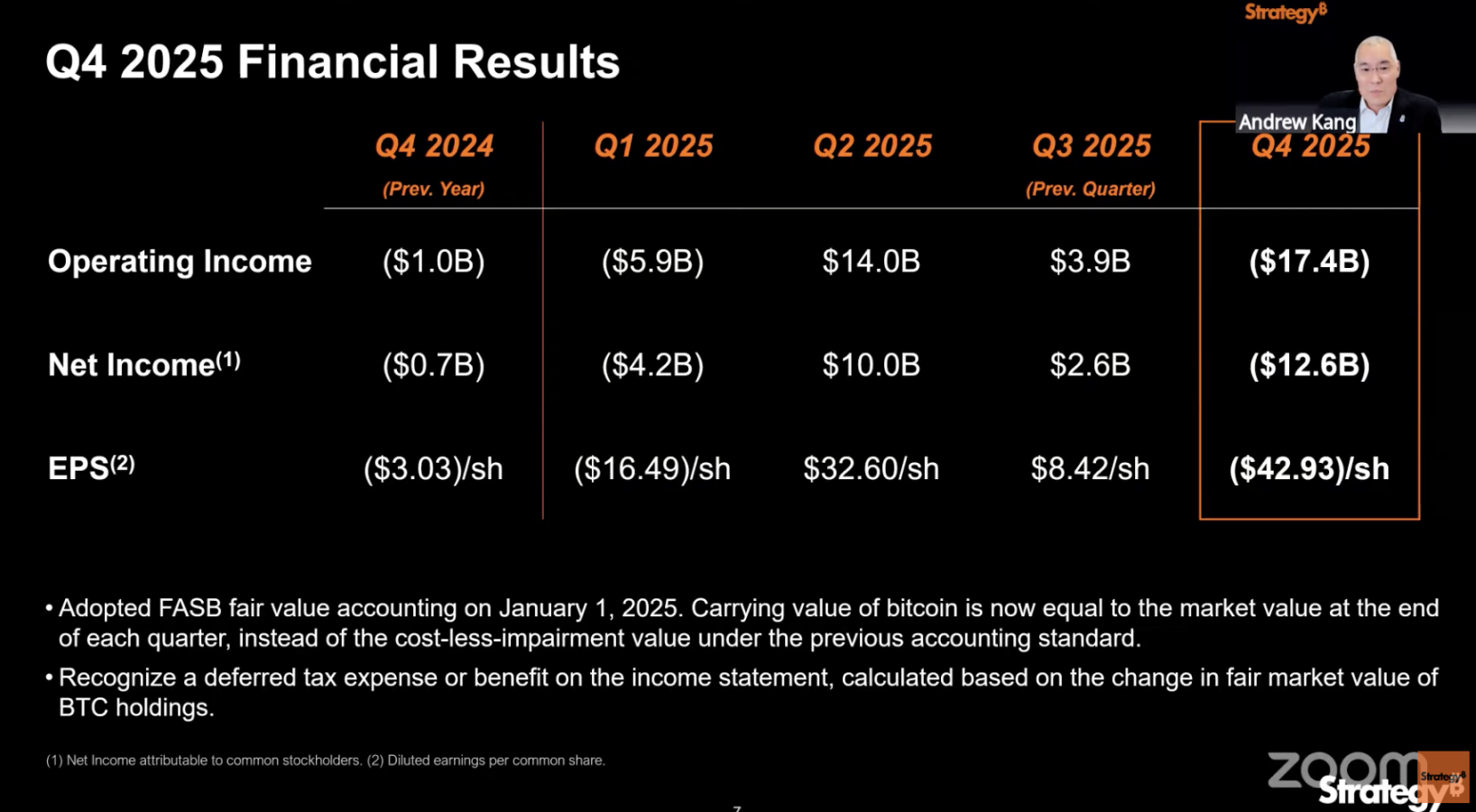

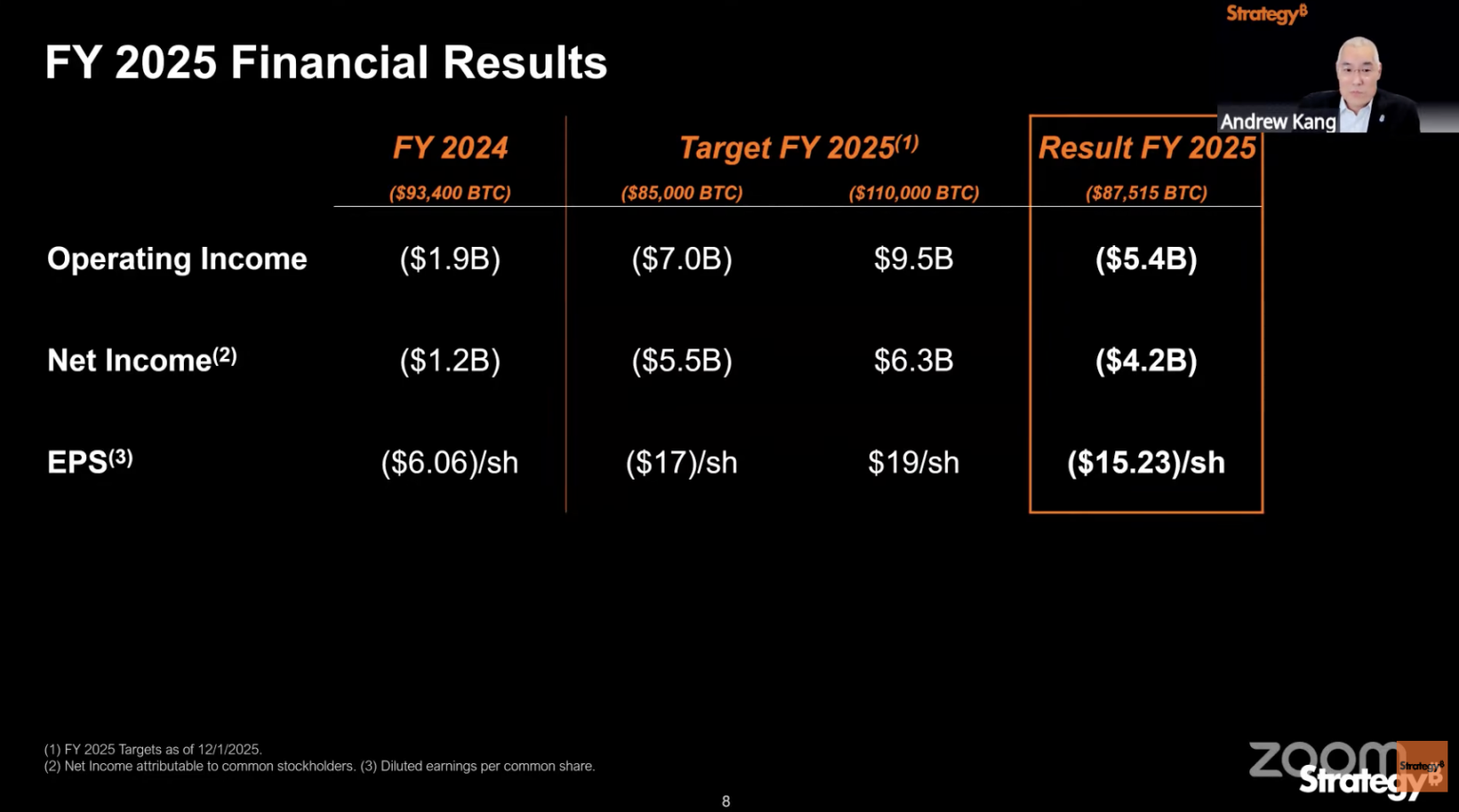

Massive Paper Losses Under Fair Value Accounting: In Q4 2025, Strategy's operating loss reached an astonishing $17.4 billion, with a net loss of $12.4 billion. This is primarily due to the new fair value accounting standards adopted by the company starting January 1, 2025. According to these standards, the company must reassess all Bitcoin holdings at market prices at the end of each quarter, and price fluctuations will directly impact the profit and loss statement. The ongoing correction in Bitcoin prices has directly transformed the shrinkage of holding market value into paper losses, becoming the most intuitive "negative news" in the financial report.

Obsessive Accumulation of Bitcoin Against the Trend: Despite market volatility, Strategy continued to buy aggressively, purchasing 41,002 Bitcoins in January 2026. As of February 1, 2026, Strategy held 713,502 Bitcoins, accounting for approximately 3.4% of the total Bitcoin supply, firmly securing its position as the world's leading corporate Bitcoin holder.

Super Financing Machine: In the fiscal year 2025, Strategy raised over $25.3 billion in total capital, which accounted for about 8% of the total equity financing in the United States that year.

Risk Buffer from Special Reserves: As of February 1, 2026, Strategy had $2.25 billion in cash reserves specifically set aside to cover preferred stock dividends and debt interest payments for the next 2.5 years, attempting to alleviate market concerns about its cash flow pressure.

From the perspective of holding costs, Strategy's original total cost for holding Bitcoin reached $54.26 billion, with an average cost per coin of $76,052, while the current Bitcoin price is approximately $65,000. Based on this calculation, the company's unrealized losses on its Bitcoin holdings have exceeded $7.8 billion.

Marginalized "Main Business" and Amplified "Leverage"

Ironically, Strategy's traditional main business—enterprise analytics software—has become an almost forgotten footnote in the financial report, with its business scale and contribution forming a stark contrast to the magnitude of its Bitcoin strategy.

In Q4 2025, while the company's software business maintained positive growth, the data performance was relatively lackluster: total revenue was $123 million, a year-on-year increase of only 1.9%; subscription service revenue was $51.8 million, a year-on-year increase of 62.1%; the overall gross profit for the quarter was $81.3 million, with a gross margin maintained at a high level of 66.1%.

From the data, it is clear that while the software business has stable profitability and a high gross margin, its revenue scale is only in the hundreds of millions, which is negligible compared to the company's hundreds of billions in fundraising scale, hundreds of billions in Bitcoin holding costs, and tens of billions in quarterly losses.

For today's Strategy, the company's core resources and strategic focus have completely tilted towards Bitcoin. Strategy provides investors with a leveraged Bitcoin exposure through complex financial instruments such as stocks, bonds, and preferred shares. It has also completely devolved into a "shadow of Bitcoin," with the company's development deeply tied to Bitcoin prices—prospering together and suffering together.

What Happens When Convertible Debt Matures?

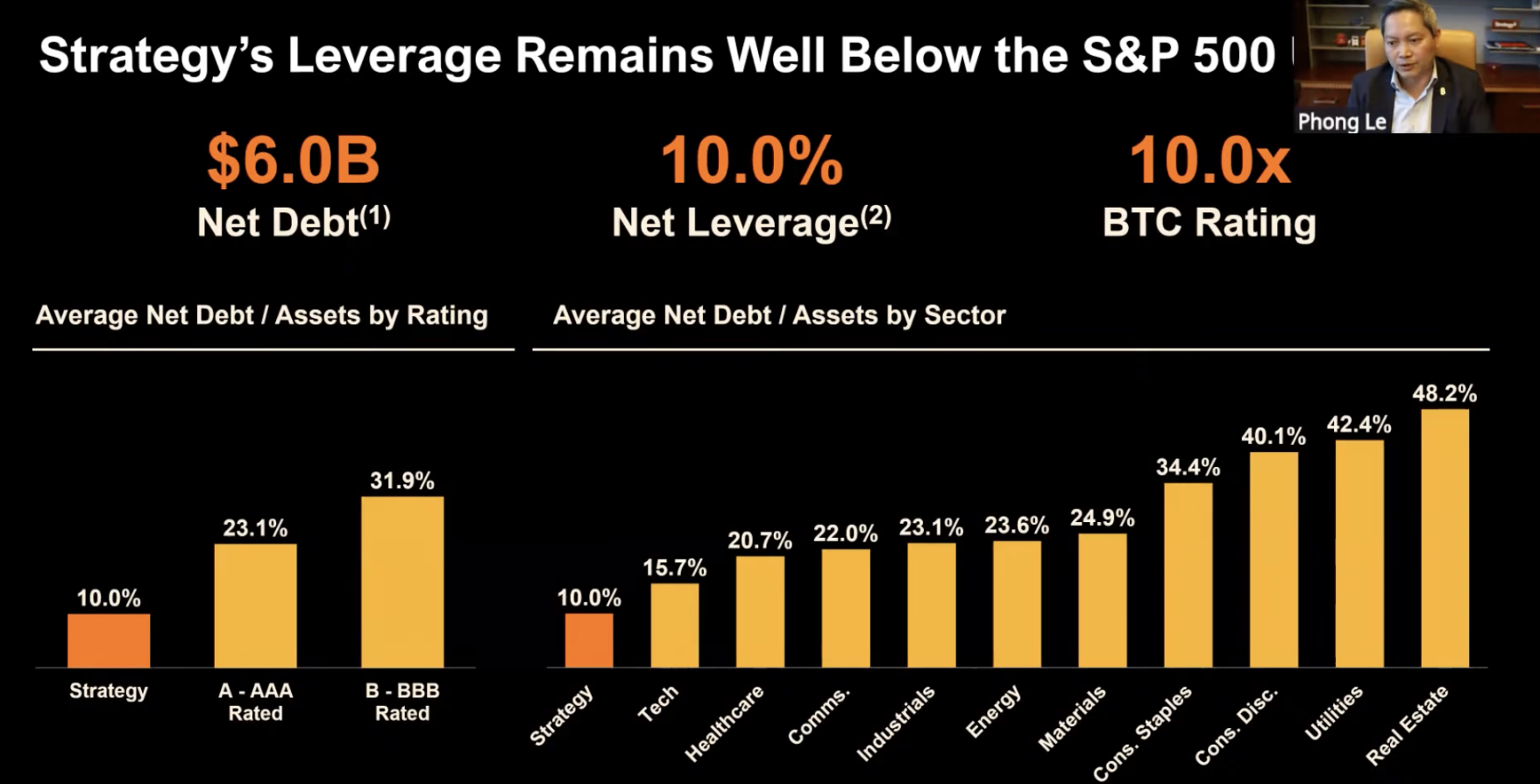

In the latest earnings call, Phong Le stated, "Strategy currently has $6 billion in net debt, with a current leverage ratio of around 13%, which is only half that of investment-grade companies and one-third of high-yield companies. In an extreme scenario, if Bitcoin's price drops by 90% to $8,000, our Bitcoin reserves will equal our net debt, and we will be unable to repay the convertible bonds with our Bitcoin reserves, at which point we will consider restructuring, issuing new shares, or incurring additional debt."

Additionally, Phong Le hopes the company will gradually achieve equity conversion. If equity conversion cannot be realized at that time, alternative methods for restructuring debt will be sought, aiming to sustainably reduce leverage, avoid selling coins, and continue the Bitcoin accumulation strategy.

When the "Flywheel" Loosens

Strategy's "Bitcoin flywheel" model is built on an extremely fragile assumption: that Bitcoin prices will spiral upward in the long term, and that capital markets will always be willing to provide premium financing for the company, creating a positive cycle that drives the company's stock price and holding scale to grow in sync.

However, when Bitcoin's price falls below its average holding cost ($76,000), the risks and paradoxes faced by Strategy are also exposed.

STRC High Dividend: High Yield Corresponds to High Risk

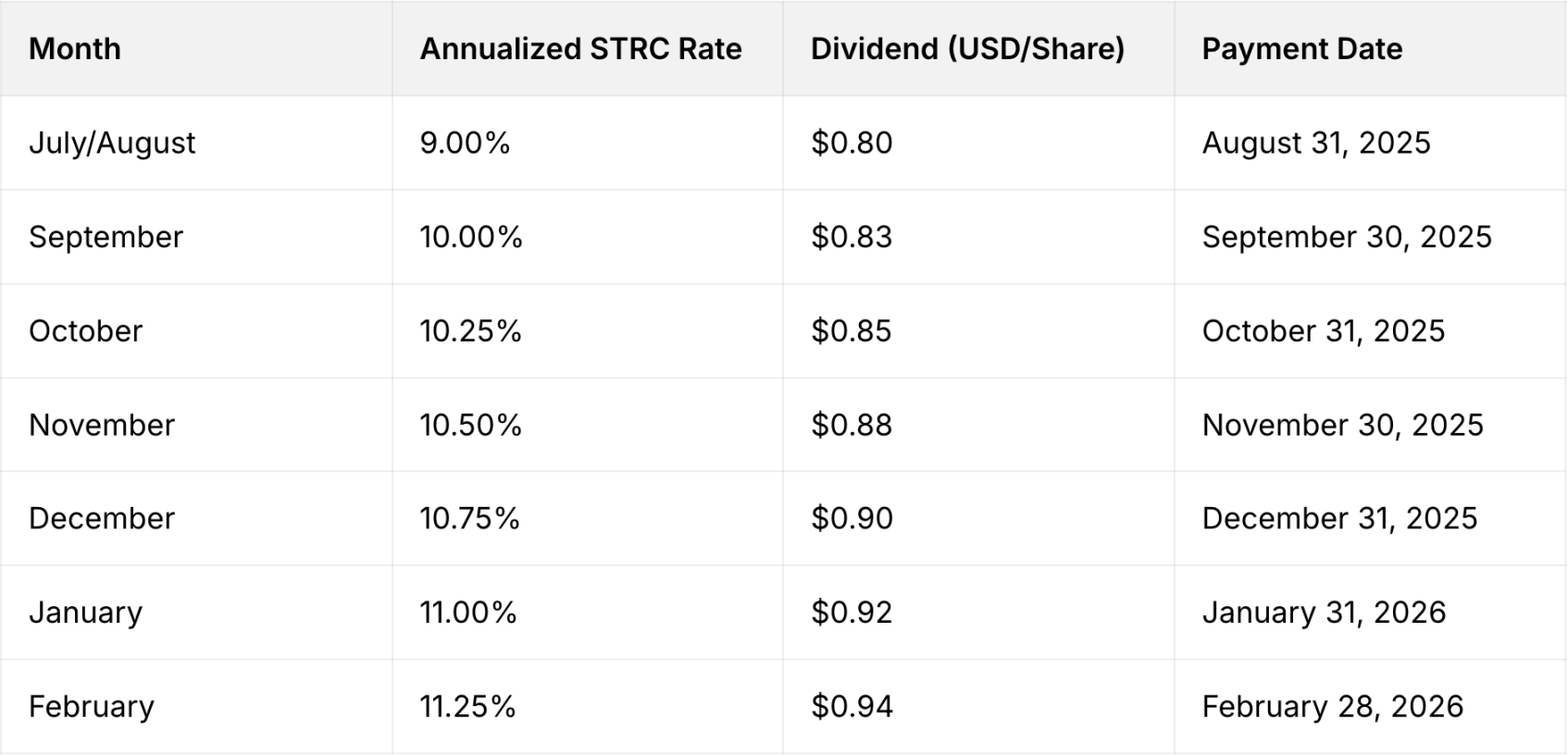

The perpetual preferred stock STRC launched by Strategy currently has a dividend yield of 11.25%, and this yield has been continuously raised since July 2025.

Strategy designed this variable mechanism to keep the STRC price as stable as possible around the $100 par value, reducing volatility, and positioning it as a "short-term high-yield credit" or "high-yield savings account" alternative.

In the current low-interest-rate environment, an 11.25% nominal yield is indeed very attractive, especially for investors seeking high fixed income. However, the fundamental logic of capital markets has never changed: high yields inevitably come with high risks, and the high dividend of STRC is backed by the enormous uncertainty deeply tied to Strategy's Bitcoin strategy.

Strategy's core strategy is "Bitcoin leverage + financing expansion," and its solvency is highly dependent on: long-term increases in Bitcoin prices, and continuously financing to buy more BTC through the issuance of MSTR common stock, other preferred shares, or debt.

If a prolonged Bitcoin bear market occurs, mNAV remains depressed or even discounted, and the difficulty of equity financing increases, reserves may be quickly depleted. Although the company has established a $2.25 billion cash reserve as a buffer, this merely buys a 2.5-year insurance for this gamble.

The current market has already reflected some concerns: the STRC price is below the $100 par value, currently at $93.67.

mNAV Compressed to 1.07, Will Financing Channels Remain Smooth?

The core motivation for Strategy to infinitely issue stock to buy Bitcoin lies in its mNAV metric, which measures the valuation of its stock relative to its Bitcoin reserves. When mNAV > 1, it indicates that the market values Strategy higher than the value of its Bitcoin holdings (i.e., trading at a premium), and investors are willing to pay an additional premium for its "Bitcoin leverage strategy."

Currently, Strategy's mNAV has compressed to 1.07. Once it falls below 1, financing channels may be forced to close. At that point, Strategy may lose the ability to support and replenish its holdings, becoming a prisoner of Bitcoin price fluctuations.

Unlike the content emphasized in the latest meeting, Strategy CEO Phong Le stated in an interview with "What Bitcoin Done" in November 2025 that if the company's mNAV falls below 1 and financing options are exhausted, selling Bitcoin is "mathematically" reasonable. However, he clarified that this would be a last resort, not a policy adjustment.

Negative Feedback Loop?

For Strategy, the most terrifying aspect is not the current massive losses, but the potential triggering of a negative feedback loop, which is the scenario that all players in the cryptocurrency market dread:

Bitcoin price drops → company net assets shrink → mNAV falls below 1, premium disappears → unable to obtain new funds through financing → unable to pay high interest and dividends → forced to sell Bitcoin to raise funds → increased selling pressure on Bitcoin, further price drops → net assets shrink further…

Policy Benefits and Technical Commitments, Can They Restore Confidence?

Michael Saylor did not limit his focus to the short-term negative impact of the company's quarterly losses during the earnings call, but instead outlined a long-term positive blueprint for Bitcoin development centered on the comprehensive shift in U.S. policy and the accelerated adoption by the financial industry, while also addressing the market's greatest concerns regarding quantum technology risks and implementation plans, aiming to restore market confidence in the company's Bitcoin strategy.

Michael Saylor emphasized that Bitcoin's current development is entering an unprecedented dual bonus period of policy and finance. On the policy front, the U.S. government's attitude towards digital assets has undergone a fundamental shift from skepticism to recognition, with the president and 12 cabinet members clearly expressing support for Bitcoin. Bipartisan consensus on digital asset regulation and adoption has positioned the U.S. among the leading ranks of global digital asset development.

On the financial front, Bitcoin's industry adoption is experiencing explosive growth: major banks are launching full-chain services for Bitcoin trading, credit, and custody, while fintech companies continue to ramp up their Bitcoin layouts. The dual entry of public markets and traditional financial institutions is continuously strengthening Bitcoin's financial attributes, enhancing liquidity and recognition.

In response to the various FUD sentiments permeating the market, Michael Saylor also provided direct responses, particularly focusing on the core technological concern of quantum computing: the commercial-level threat of quantum computing to Bitcoin will not manifest for at least another 10 years, and the Bitcoin community possesses the ability to upgrade global consensus to adequately address future technological challenges.

Michael Saylor further stated that Strategy will actively take on industry responsibility by launching a global Bitcoin security initiative, collaborating with global resources in cybersecurity and cryptocurrency security to research and propose consensus solutions to address quantum computing and emerging security threats, promoting the healthy and stable development of the entire cryptocurrency industry.

Conclusion

If the market continues to decline, the $17.4 billion quarterly operating loss and $12.4 billion net loss may just be the beginning of Strategy's predicament.

The real test lies in whether faith can overcome gravity when market panic spreads, when "premiums" disappear, and when new funds dry up. For investors, today's Strategy may represent a high-risk, high-reward options contract: if the bet is right, Bitcoin prices rebound, the flywheel turns again, and investors gain returns; if the bet is wrong, the negative feedback loop starts, the company falls into crisis, and investors will face heavy losses.

This gamble on the company's future remains uncertain, but Strategy has already sounded the alarm for the entire cryptocurrency industry—amidst the fervent market sentiment, excessive obsessive faith and unrestrained leverage may face a backlash from reality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。