The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to cryptocurrency enthusiasts. I welcome all friends to follow and like, and reject any market smoke screens!

A wave of market activity has directly crashed to the 60K mark, and the continued sluggishness of the market has left many users, including Lao Cui, very puzzled. Especially with small cryptocurrencies, the overall depth of the drop has even exceeded 200% for some coins, which is extremely disorienting. Even in the face of such a drop, Lao Cui will still give the same answer: there will still be new highs this year. Many friends will explain this drop's depth using cycle theory; from a timing perspective, it indeed aligns with the so-called four-year cycle theory and the downturn in the gold market. Lao Cui does not define it as a cyclical conclusion, and thus it cannot be compared to gold, as they are completely different forms. The unified stance domestically and internationally is more about condemning Binance, which also includes recent rumors about Binance being insolvent. This series of signals reveals something strange, and Lao Cui tends to agree with this viewpoint, but we cannot discuss it further. The current situation is such that all giants are showing signs of outflow, without exception.

The fact that major giants have a unified stance can only indicate that the returns are sufficiently enticing. What everyone needs to do at this stage is to stabilize their mindset and focus solely on the results. The process is not important for all of us; Lao Cui has mentioned the solution that he is also implementing. For us investors, the only thing we can do is hold; all other actions are futile. This kind of market will only yield profits for contract users; those who only do spot trading will have to endure it to the end. Some friends have complained to Lao Cui, asking why he doesn't provide a range for the bottom space. To be frank, there is no definitive conclusion on the bottom space. Not just Lao Cui, but analysts in the market, or even the entire team of analysts, do not have a unified stance, especially Lao Cui, who is a staunch supporter of the bulls. It can be said that since breaking below the 75 mark, the subsequent trend has completely exceeded expectations.

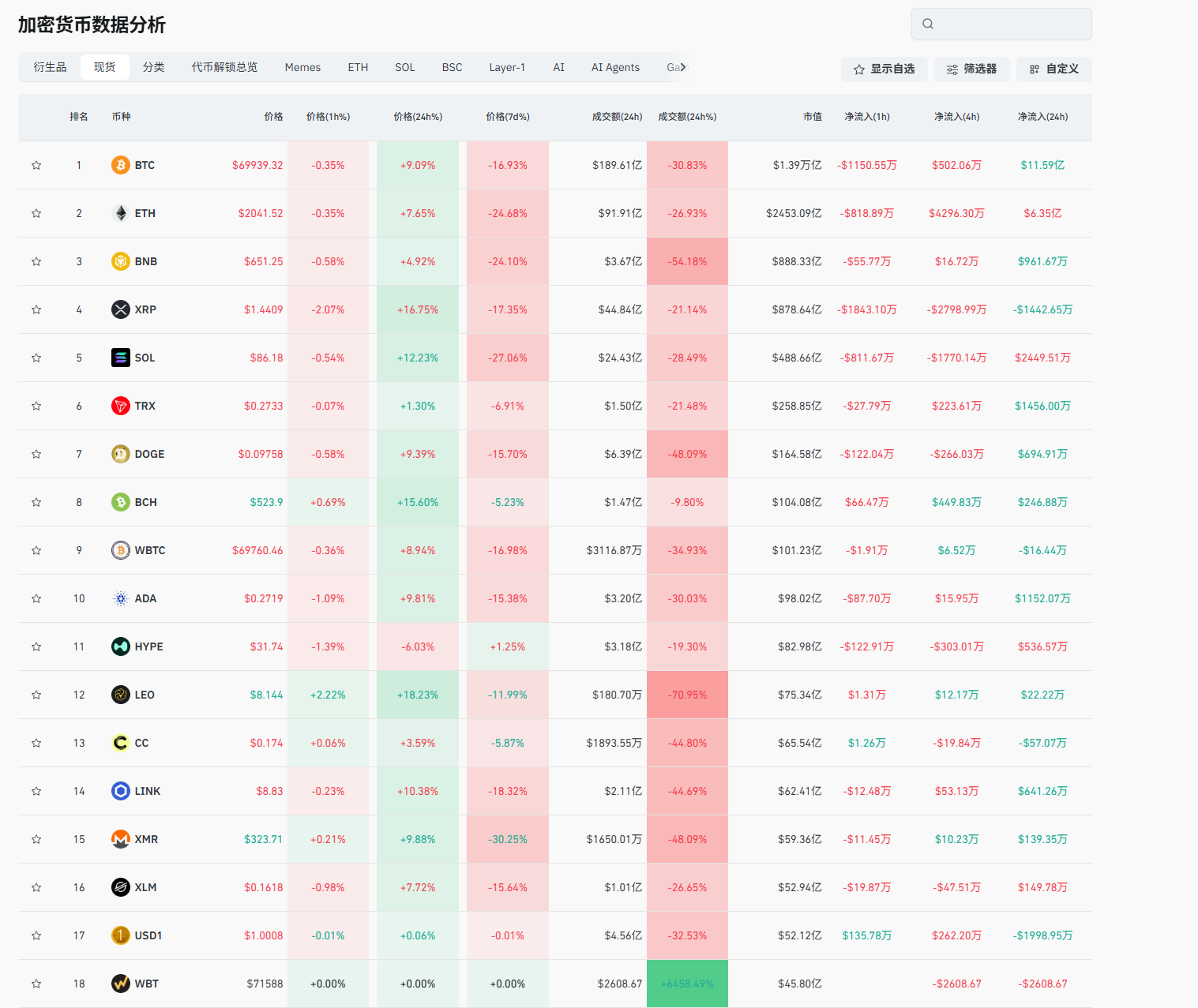

Therefore, regarding the depth below, many friends have asked Lao Cui, and some friends have not received a direct response. If even the depth of Bitcoin cannot be predicted, how can we talk about other cryptocurrencies? However, in terms of trends, there is almost a unified ideal target; this year will definitely be a year of growth. A conservative estimate is that Bitcoin will at least stabilize at the 100K mark, while Lao Cui's more aggressive target is to break through the previous high. No analyst in the team believes that from this point onward, the entire cryptocurrency market will enter a year-long downward cycle. Especially after reviewing the data, everyone should be clear that the current cryptocurrency market is in a state of extreme panic; the long positions that should have been liquidated, especially those that made significant profits last year, have almost all been completely cleared. Further downward movement offers almost no profit for the giants, so in today's article, Lao Cui will not seek the main reasons for the decline with everyone, as the decline has already become a fact; pursuing reasons is living in the past.

Today's trend shows that the drop can be called the largest in recent times, while the recovery strength is also the strongest in recent times; especially as Lao Cui was writing this article, the sudden announcement of domestic sanctions being upgraded is also extremely strange. Almost all negative news has been released; when this news came out, there was still some concern, but the market trend indicated a clear attitude. If there is still downward space in the near future, then only this incident can become the source. Comparing the number of Bitcoins in the market, nearly 9.5 million Bitcoins are in a state of loss, while the remaining 10.4 million Bitcoins are in profit, including confiscated and original coins like those of Satoshi Nakamoto, which have no cost. This data is almost the same as at the end of the bear market in 2022. Why did we encounter this round of sharp decline? Lao Cui has overall sorted out the trend and has a vague feeling that in the past two years, to have such a large downward space, it seems that only this round of window is available.

Lao Cui defines this round of time as a transitional phase. This is the window period for everything to go on-chain. This announcement today made Lao Cui suddenly realize, in conjunction with the U.S. employment data: Overview of January employment data, according to data released by the ADP Research Institute, the U.S. private sector added only 22,000 jobs in January 2026, far below the market expectation of 45,000. This data reflects a weakening momentum in the labor market at the beginning of the year, especially with employment shrinkage occurring in several key industries. The new jobs were almost entirely driven by the education and healthcare sectors, which saw a monthly surge of 74,000 jobs. In contrast, professional and business services lost 57,000 positions, and manufacturing cut 8,000 jobs, showing clear signs of structural weakness. The summary of the domestic announcement is to strengthen the previous vision, directly eliminating the link between the domestic and cryptocurrency markets, and even starting to crack down on illegal mining, which is good news. The U.S. data will not affect the short-term interest rate cut strategy but will definitely impact the long-term interest rate cut baseline issue.

In straightforward terms, there is definitely no need for an interest rate cut in March; the recent interest rate cut will likely be postponed until around June. This is also a concern for everyone; the recent good news has already been delayed until June, so many friends do not have strong confidence in the trend before June. The most significant news yesterday was that Trump is scheduled to hold a meeting with banks next Tuesday regarding the structure of the cryptocurrency market. Everyone needs to note that this meeting is only for discussion and will not yield any results. News from external sources suggests that Wall Street may have already begun to connect with the cryptocurrency market, and it is very likely that a direct link between U.S. stocks and the cryptocurrency market will be achieved within the year. Lao Cui has not paid much attention to this news, but the domestic announcement seems to be sending some signals, which has led Lao Cui to some speculation. Everyone needs to be aware that once a connection between U.S. stocks and the cryptocurrency market is realized, new highs will definitely be unstoppable. If anyone still wants to get involved, Bitcoin and Ethereum are currently better choices.

Lao Cui summarizes: Frankly speaking, the depth of this round of decline is beyond Lao Cui's control. The new low of 60K, in Lao Cui's eyes, has already formed a bottom, especially as more positive news will follow. Coupled with the judgment of linearity and capital volume, the recovery strength at the 60K mark is the most intense since the opening of this downward range, which all indicates that the market is about to start reversing. Of course, this reversal signal still requires a period of observation, especially since no more positive real information has emerged. The new low of 60K has seen a concentration of positive news. This also seems to be a signal that the market makers want to save the market, with over a billion in funds flowing in within less than 24 hours, which is quite beyond normal expectations. At the same time, the heavy metal sector, the rebound of gold and silver, and the Dow Jones reaching a new record of 50,000 points last night, have not yet ended the siphoning effect on the cryptocurrency market. Therefore, although there will be signs of a stop in the decline recently, it will not show the bullish signals that everyone is looking forward to. More of Lao Cui's speculation will be a fluctuating upward trend, which can also be described as a recovery; the possibility of a slow rise may be greater. Of course, Lao Cui will not look for lower new lows unless a major event occurs. Due to the excessive decline of various cryptocurrencies, Lao Cui has a new plan for users looking to bottom out in the spot market. Based on the current price of Bitcoin and the subsequent trend, there is an opportunity for it to double this year, and the same goes for Ethereum. Therefore, these two cryptocurrencies will become everyone's top choices, while SOL and XRP will be secondary choices. Friends who have already purchased cryptocurrencies do not need to re-plan their entry; long-term holding is sufficient. This year, these cryptocurrencies still have the potential for new highs. The Bitcoin and Ethereum that Lao Cui mentioned are for friends who have not yet purchased. As the year-end approaches, Lao Cui's updates will become slower, and he wishes everyone a better return in the Year of the Horse!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。