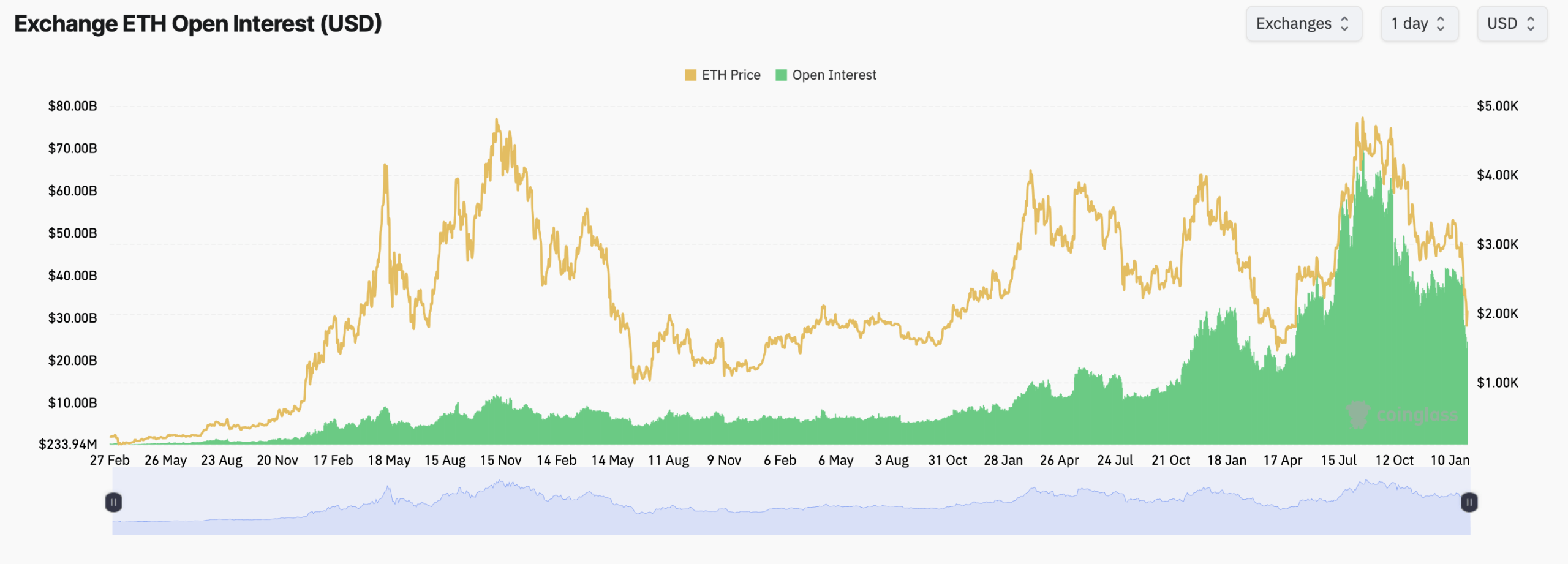

Ethereum had a wild ride yesterday, and on Friday, things are way calmer. According to coinglass.com stats, ethereum futures open interest remains substantial across major venues, with CME leading in dollar terms at roughly $3.45 billion, representing about 14.1% of total tracked exposure.

Binance followed closely with approximately $5.53 billion in open interest, giving it the largest share by notional size, while Gate, Bybit, OKX, and Bitget rounded out a tightly packed second tier.

Ethereum futures open interest on Feb. 6, 2026.

Short-term market action, however, leaned defensive. Most major exchanges recorded one-hour declines in open interest, including Binance, CME, OKX, Bybit, and Bitget, suggesting traders were trimming risk rather than pressing directional bets. The four-hour and 24-hour figures told a more nuanced story, with CME, Binance, and Gate still showing net increases over the day.

Volume-adjusted metrics reinforced that divergence. CME’s open interest-to- volume ratio hovered near 0.93, pointing to deep, institutional-style positioning, while Binance’s lower ratio reflected faster turnover and more active trading. BingX and Bitget posted some of the highest ratios, signaling tighter positioning despite lighter overall flows.

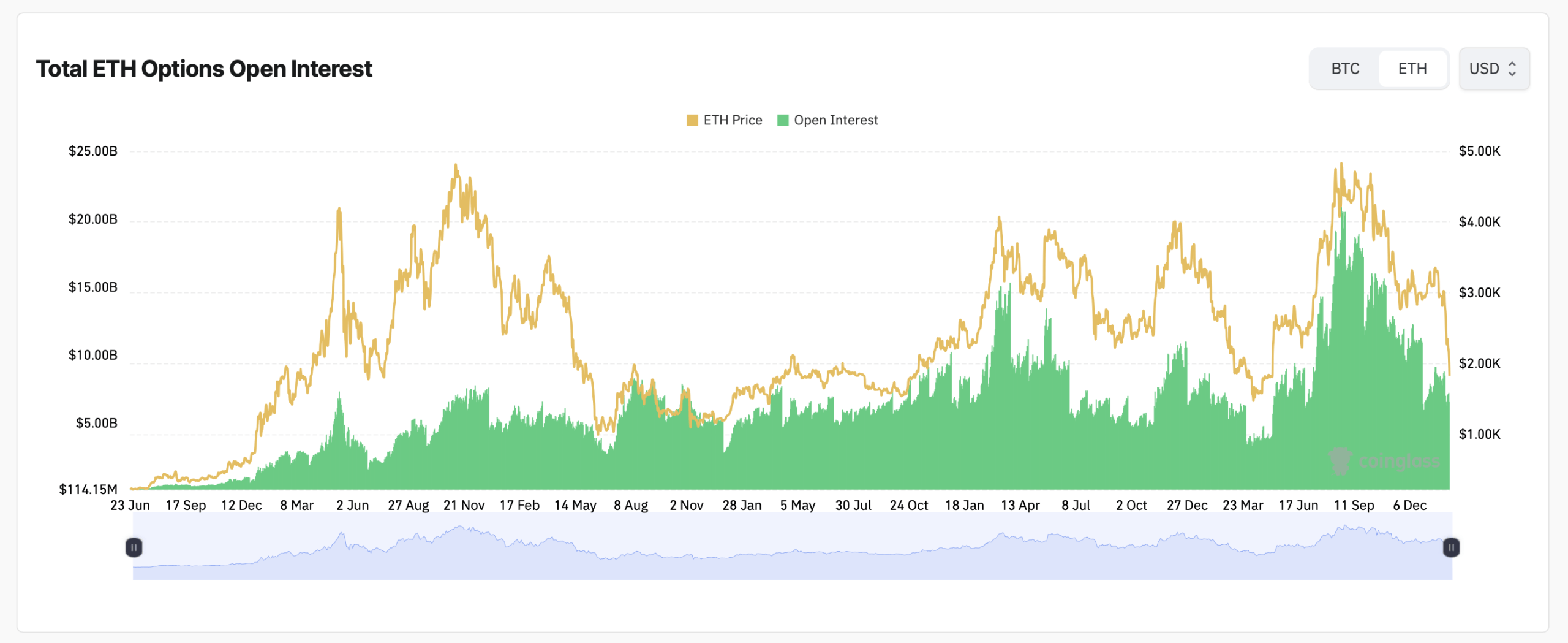

On the options side, ether open interest remained concentrated on Deribit, where long-dated call contracts dominated the leaderboard. The single largest contract by open interest was the Deribit ETH-27MAR26 $6,500 call, followed closely by $5,500 and $6,500 calls expiring later in 2026, underscoring persistent long-term upside positioning.

That optimism, however, came with a hedge. Put contracts at $1,800, $1,500, and $2,200 also ranked among the largest open interest positions, revealing a market that wants upside exposure but refuses to leave the downside unattended. Options traders, in short, are wearing both seatbelts and helmets.

Ethereum options open interest on Feb. 6, 2026.

Aggregate options data showed calls accounting for roughly 58.2% of total ether options open interest, compared with 41.8% for puts. Yet the 24-hour trading split was nearly dead even, with calls and puts each capturing about half of daily volume, a sign that conviction remains fragile.

Max pain levels added another layer of tension. On Deribit, the max pain price clustered near $2,100 to $2,200 per ethereum across upcoming expiries, with notable notional value stacked around late February and late March. Binance’s max pain estimates skewed slightly higher near $2,800 before dropping sharply toward $2,200 for later expiries.

OKX presented a different picture, with max pain gravitating closer to the low-$2,400 range before collapsing near the $2,100 zone on later contracts. Across all three venues, the recurring theme was gravity toward the low-$2,000 region, uncomfortably close to ethereum’s current spot price of $2,041 per coin.

Also read: US Stocks Rally as Inflation Expectations Ease and Tech Stabilizes

Longer-term charts reinforced the message. While total ether futures and options open interest has grown significantly over the past year, recent pullbacks in both price and open interest suggest traders are reducing leverage rather than doubling down. The derivatives market appears to be catching its breath.

Basically, ethereum’s derivatives markets are signaling restraint, not panic. With futures positioning easing, options crowding near max pain, and price hovering just above $2,000, traders appear content to wait, watch, and let the numbers do the talking.

- What is ethereum’s current price?

Ethereum traded at $2,041 per coin as of 1:30 p.m. EST on Feb. 6, 2026. - Which exchange holds the most ethereum futures open interest?

Binance leads by notional size, while CME dominates in institutional-style positioning. - Are ethereum options traders bullish or bearish?

Calls outweigh puts in total open interest, but daily trading is nearly evenly split. - Where is ethereum’s max pain level?

Across Binance, OKX, and Deribit, max pain clusters near the low-$2,000 range.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。