Thursday was one of the most painful days in cryptocurrency history, with investor confidence nearly collapsing across the board. Not only was the cryptocurrency sector in distress, but even traditional media reported on the significant liquidation in cryptocurrencies. If nothing unexpected happens, $60,000 should be the bottom this time. From both a data perspective and an ETF perspective, the panic among investors has mostly been released, and the sentiment for bottom-fishing at the $60,000 price level has significantly increased.

The most important aspect of this decline is that there were no actual negative data, including in the U.S. stock market. From my personal perspective, the repeated historical lows in cash held by institutions and fund managers should be the main reason. With the release of passive positions and the drop in prices, bottom-fishing should begin again. Currently, the main contradiction in the market remains the monetary policies of Trump and the Federal Reserve.

Looking back at Bitcoin's data, the price changes made the market feel like a roller coaster. Friday's rebound made this weekend a bit simpler; otherwise, I was worried that the low liquidity over the weekend would lead to further price fluctuations. Currently, after $BTC rebounded back to $70,000, market sentiment has eased somewhat.

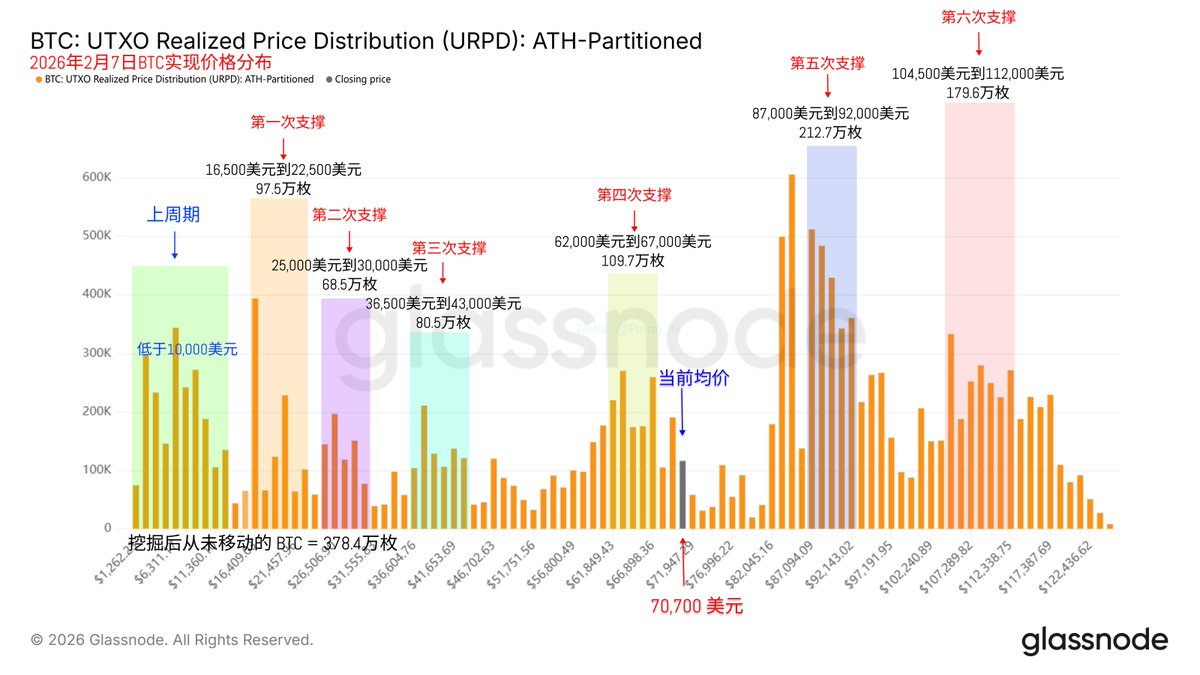

The biggest difference this time is that the distribution of chips has not experienced a cliff-like change. Even early investors who suffered losses did not react significantly to this decline. More BTC holders are not very interested in short-term price fluctuations, even when it nearly dropped below $60,000.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。