IBIT triggered a massive liquidation of Bitcoin? Wrong!!

Many friends forwarded Parker's article to me, asking if the liquidation of $IBIT caused the chain reaction in the price of $BTC. Let me explain a bit: what Parker refers to as liquidation is actually the liquidation of the IBIT spot ETF, not the liquidation of Bitcoin itself. Although IBIT is a spot ETF for BTC, it does not equate to BTC, and the liquidation of IBIT did not trigger the liquidation of BTC.

An ETF essentially operates in two layers of the market. The primary market mainly involves the buying and redeeming of Bitcoin, which is mostly facilitated by APs (understood as market makers) providing liquidity. This is fundamentally similar to generating USDC with USD, and APs rarely circulate BTC through exchanges. Therefore, the main utility of buying a spot ETF is that it locks in the liquidity of Bitcoin.

During the large-scale liquidation on Thursday, the outflow of BTC from BlackRock's investors, which means the redeemed BTC, was less than 3,000 coins. The total BTC redeemed by all spot ETF institutions in the United States was less than 6,000 coins (according to all official data). This means that the maximum amount of Bitcoin sold to the market by ETF institutions was only 6,000 coins. Moreover, not all of these 6,000 coins were necessarily transferred to exchanges.

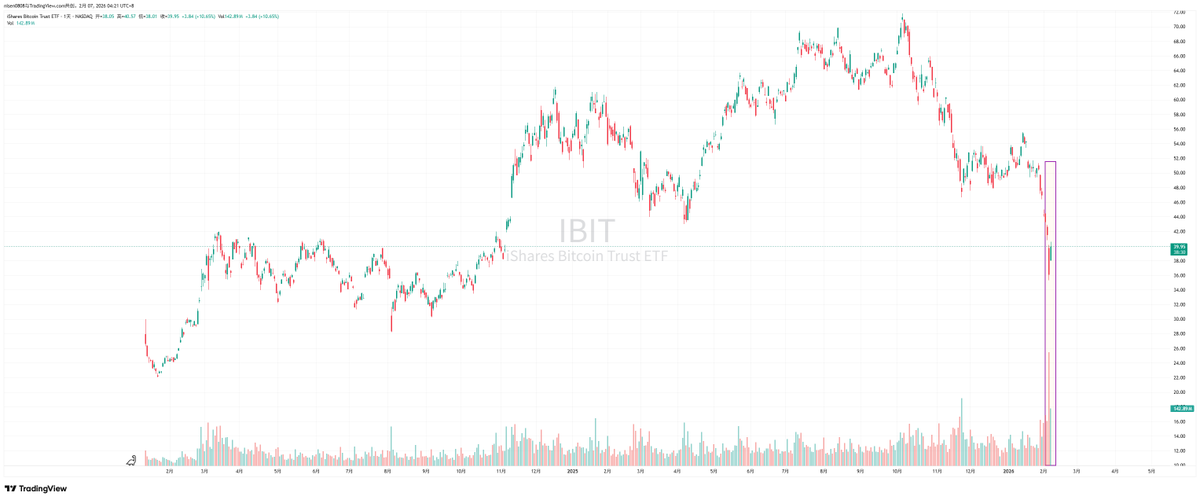

What Parker refers to as the liquidation of IBIT actually occurred in the secondary market, with a total trading volume of $10.7 billion, marking the largest trading volume in IBIT's history. It indeed triggered some institutional liquidations, but it is important to note that this liquidation was solely of IBIT and not of $BTC. At least this part of the liquidation did not transmit to the primary market of IBIT.

Therefore, the significant drop in Bitcoin on Thursday only triggered the liquidation of IBIT, but did not result in BTC liquidation caused by IBIT. The trading targets in the secondary market of the ETF are essentially still the ETF, while BTC merely serves as the price anchor for the ETF. The only potential market impact comes from the liquidation triggered by the primary market's sale of BTC, not from IBIT.

In fact, although BTC's price dropped over 14% on Thursday, the net outflow of BTC in the ETF only accounted for 0.46%. On that day, the BTC spot ETF held a total of 1,273,280 BTC, with a total outflow of 5,952 BTC.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。