Introduction

Recently, the market has almost simultaneously collapsed from multiple directions.

On a macro level, after the news of Kevin Warsh's nomination came out, the uncertainty regarding the Federal Reserve's policy direction was brought back to the forefront; the situation in Iran remains tense, with the risk of conflict repeatedly escalating. Theoretically, the "safe-haven assets" that should benefit from this environment have not provided the expected feedback. Bitcoin not only failed to strengthen in such an environment but also fell alongside U.S. stocks and commodities—rendering the logic of "macro turmoil → BTC hedge" exceptionally fragile in reality.

Within the crypto circle, it is equally turbulent. The FUD surrounding major exchanges continues to spread, and more shockingly, after the news of the arrests of Qian Zhimin, Chen Zhi, and others, many people realized for the first time: the so-called narratives of "anti-censorship" and "decentralization" are far less robust in the face of strong regulation in the real world than imagined.

The result is what we see:

U.S. stocks fell, commodities corrected, and crypto assets weakened simultaneously, with several risk curves that were not entirely overlapping choosing to move downward at the same time.

In such an environment, I lost faith in the market but did not know what to replace it with.

It was at this moment that I revisited the article "Hoarding Bitcoin" written by Jiu Shen.

This article does not concern itself with macro games nor respond to any current FUD; it discusses only one question: how ordinary people can continue to accumulate during cycles when uncertainty becomes the norm, rather than being repeatedly washed out by emotions.

The AHR999 indicator, which has been repeatedly cited and validated, is derived from this line of thought. It does not promise to judge tops and bottoms but attempts to help you retain a path that can still be executed during the most chaotic times in the market.

When I re-examined it at my lowest point of confidence, I realized: perhaps in such market conditions, the most important thing is not to make the smartest decisions, but whether one can still believe in a system that does not rely on emotions.

1. The Principle and Usage of the AHR999 Indicator

We need an indicator that can quantify the market's temperature, allowing ordinary investors to have a sense of direction when facing volatility; this is the significance of the AHR999 indicator. It was proposed by Jiu Shen, a representative figure of the hoarding Bitcoin faction, to measure the relative long-term valuation of Bitcoin, and can be understood as an "emotional thermometer" or "value anchor."

AHR999 Index = (Bitcoin Price / 200-Day Dollar-Cost Averaging) * (Bitcoin Price / Index Growth Valuation)

AHR999 actually combines two key variables: one is the ratio of Bitcoin's current price to the 200-day dollar-cost averaging, reflecting the market's short-term temperature; the other is the degree of deviation between Bitcoin's current price and the long-term growth curve, representing how far the market is from its long-term reasonable value.

Multiplying these two together gives us AHR999. Jiu Shen's logic is that prices always fluctuate around the long-term growth trend; when prices are far below the trend line, it is an opportunity for long-term positioning, increasing dollar-cost averaging; when prices deviate too far from the trend line, it often means that market sentiment is overheated, and the risks outweigh the rewards, leading to a halt in dollar-cost averaging or even selling.

On the AiCoin platform, ordinary investors can intuitively view the real-time dynamics and historical trends of the AHR999 index. The path is as follows: Open AiCoin - Search for AHR999 Index - Click to view.

Additionally, if you want to integrate this index into your external strategy, AiCoin also provides a convenient API data interface:

https://www.aicoin.com/zh-Hans/opendata

How to Understand AHR999?

Based on historical data, AHR999 has the following reference ranges:

AHR999 Dollar-Cost Averaging Strategy Example

If you are an ordinary investor with no time to monitor the market daily, you can follow the execution of the following ideas:

When AHR999 < 0.45: Double your purchase, for example, if you usually dollar-cost average 100 USD, you can buy 300 USD at this time;

When AHR999 is between 0.45–1.2: Maintain the original dollar-cost averaging rhythm;

When AHR999 > 1.2: Pause or halve the dollar-cost averaging, gradually accumulate cash;

When AHR999 > 2.0: Take profits in batches or exit at highs.

The benefit of this approach is that you will neither heavily invest at high levels nor hesitate and miss out at low levels. By executing at fixed intervals (for example, once daily or weekly), you hand over "timing anxiety" to data rather than emotions.

2. Historical Win Rate and Returns of the AHR999 Indicator

If we detach our perspective from the current chaos and look back at the past three complete bull and bear cycles, we will find that the signals given by the AHR999 indicator during extremely low phases almost always corresponded to subsequent significant upward trends.

During the deep bear market in 2015, Bitcoin was largely ignored, and the AHR999 indicator fell into an ultra-low range, lingering in the bottom area for nearly 9 months. It was during this time that market sentiment was extremely pessimistic, and narratives completely failed, but subsequently, the price rose from a low of 152 USD to 19,666 USD, with a maximum increase of 128 times.

The situation in 2018 was similarly typical. Against the backdrop of the Federal Reserve's interest rate hike cycle and U.S.-China trade frictions, Bitcoin's price was under long-term pressure, and the market entered a prolonged downward phase. When AHR999 once again entered the bottom-buying range, the BTC price started from 3,122 USD and eventually rose to 69,000 USD in the next cycle, completing a full bull-bear transition.

By 2022, the aftermath of the COVID-19 pandemic combined with a sharp tightening of global liquidity, and the Federal Reserve's aggressive interest rate hikes became the key factors weighing on the market. The AHR999 indicator lingered in the bottom-buying range for 216 days during this bear market, corresponding to an extremely low price range. However, subsequently, Bitcoin's price still started from around 15,000 USD and reached a maximum of 126,000 USD in the new cycle.

Comparing these three cycles reveals a highly consistent pattern:

Each time AHR999 falls into the bottom-buying range, the market is at a dual low of sentiment and narrative; and after the indicator gives an extreme undervaluation signal, the price ultimately experiences a cross-cycle level of upward movement.

From the results, in the past three complete bull and bear cycles, if one strictly followed the AHR999 indicator for dollar-cost averaging execution, the win rate in determining "whether it is in a long-term undervaluation range" reached 100%. It does not tell you where the lowest point is, but it provides a highly certain reference for deciding "whether it is worth continuing to buy." And the current market has entered the bottom-buying range, making it the best time to execute the dollar-cost averaging strategy.

3. The Power of Dollar-Cost Averaging: Time is the Greatest Leverage for Ordinary People

Recently, a simple post was repeatedly shared on Twitter:

Buy 30 USD of Bitcoin every day, persist for 8 years,

and now the account value is approximately 1 million USD.

No complex strategies, no timing techniques, and no so-called insider information.

Just an extremely simple action: buy a little every day, and then persist.

Many people's first reaction upon seeing this number is shock, followed closely by the phrase:

"This is just hindsight."

But if you remove the emotions and return to the calculations themselves, you will find that this is not a myth, but an inevitable result of the dollar-cost averaging mechanism in high-volatility assets.

This is also why mainstream exchanges have successively launched automated dollar-cost averaging products:

Transforming the judgment of "whether to buy" into a process of "executing as planned."

Next, let's take a closer look at the dollar-cost averaging tools currently offered by OKX, Binance, and Bitget. As long as AHR999 reaches the dollar-cost averaging or bottom-buying range, we can directly use these tools.

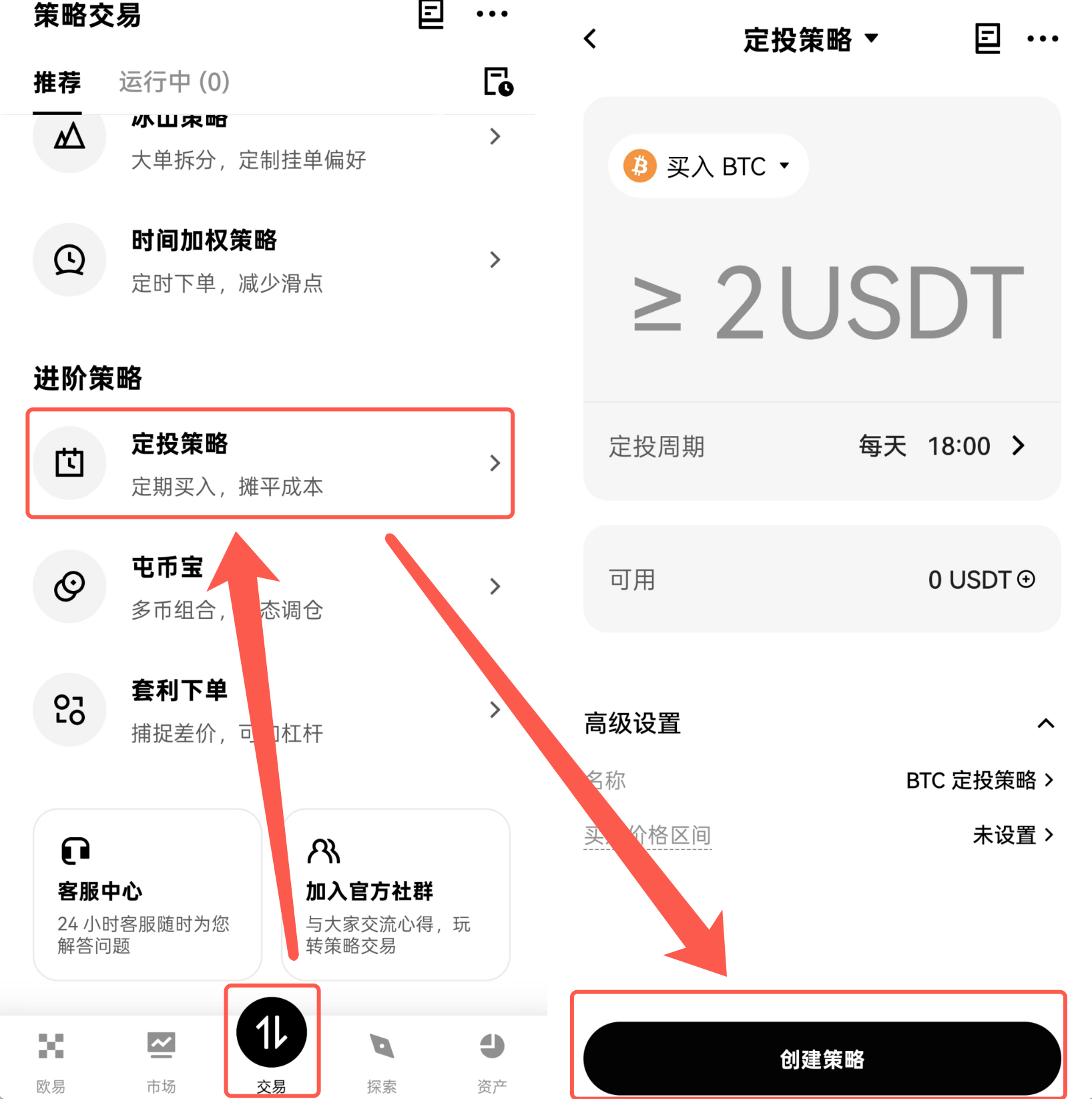

OKX

Entry Path: Click "Trade" at the bottom of the main interface → Switch to "Strategy Trading" → Find the "Dollar-Cost Averaging" function entry.

Register for OKX using the invitation code [aicoin20] to enjoy a 20% permanent rebate on fees.

Registration link:

https://www.okx.com/zh-hans/join/aicoin20

Binance

Entry Path: Click "Trade" at the bottom of the main interface → Enter "Swap" → Select "Dollar-Cost Averaging" to set up a dollar-cost averaging plan.

Register for Binance and use the invitation code [h9qr216i] to receive a 10% rebate on spot trading fees.

Registration link:

https://accounts.binance.com/zh-CN/register?ref=aicoin668

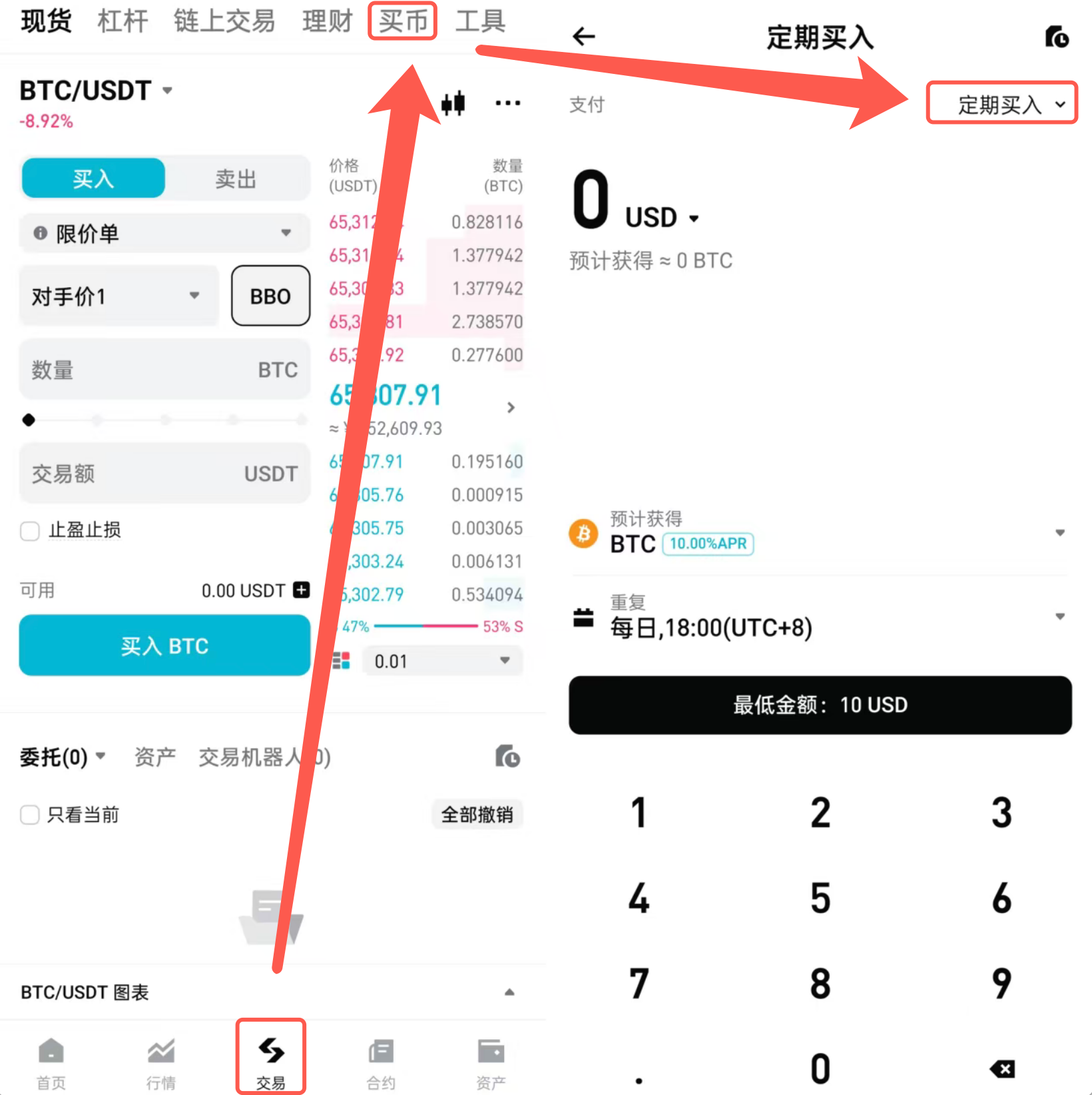

Bitget

Entry Path: Click "Trade" at the bottom of the main interface → Enter "Buy Crypto" → Select "Regular Purchase" to set up dollar-cost averaging.

Register for Bitget to receive a 10% rebate on fees.

Registration link:

https://www.bitget.com/zh-CN/expressly?channelCode=fxbu&vipCode=hktb3191&languageType=1

Conclusion

Market uncertainty always exists, and emotional fluctuations are unavoidable. The AHR999 indicator does not promise to predict the lowest point, nor can it eliminate the risks of each fluctuation, but it provides ordinary investors with an executable, data-driven path. With the guidance of the indicator, we can remain calm amidst the chaos, making dollar-cost averaging a powerful tool against emotional interference.

With the automated dollar-cost averaging tools from mainstream exchanges like OKX, Binance, and Bitget, ordinary people can grasp market cycles and achieve long-term asset accumulation without constantly monitoring the market. True victory does not lie in every precise judgment, but in the persistence of execution and continuous positioning, allowing time to become the most powerful leverage.

In the market's trough, when AHR999 signals, action is the best response. Time and discipline will accompany you through the fluctuations, welcoming the next upward cycle.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Chat Group - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。