Written by: Xiao Za Legal Team

As of February 2026, the global cryptocurrency market has experienced a continuous "crash-like" decline for several days. Even BTC, which is hailed as "virtual gold," has fallen below the $70,000 mark after a series of sharp declines. From the time this article is written, BTC's price has plummeted by more than half since reaching its peak last October. However, regardless of the short-term chill, it will eventually pass, and the trend of the cryptocurrency market continuing to exist and expand will not change.

Today, the Xiao Za team will share insights based on the latest frontline case-handling experiences regarding the policy direction for individuals mining, holding, and trading cryptocurrencies in mainland China in 2026, for partners to exchange and reference.

I. What is the overall judicial policy direction in 2025?

In an article by the Xiao Za team in 2025, we shared that there has been a positive policy shift in how judicial authorities in our country handle disputes related to cryptocurrency assets:

Contracts are no longer deemed invalid in a one-size-fits-all manner but are reviewed based on fixed time nodes.

Even if a contract is deemed invalid, parties are not automatically held responsible for their own risks; instead, it will be assessed whether legal tender was used as the transaction price—if legal tender (mainly RMB) was used, there is a possibility of requiring the receiving party to return a certain proportion of the contract amount (refer to the recent case of Tong vs. Qian regarding a mining machine custody contract published by the Shenzhen Intermediate People's Court).

However, it is important to note that if contracts are directly executed using cryptocurrencies, judicial authorities in our country are likely to still deem the contracts invalid, with losses borne by the parties (refer to the Supreme People's Court case database entry: (2021) Jing 0101 Min Chu 6309, entry number: 2023-11-2-119-001).

In summary, regarding "mining" disputes, by the end of 2025, judicial authorities in our country have clarified several key points in practice.

First, regarding the validity of "mining" contracts. Distinguish based on the time node of September 3, 2021: Contracts signed after this date should be deemed invalid; relevant contracts before this date should not be simply denied their validity but should be recognized based on the Civil Code's provisions on contract validity, combined with the facts of the case.

Second, regarding the handling of contracts deemed invalid. Distinguish based on whether legal tender was used for transactions: If legal tender was used, the court will judge the proportion of return based on the faults of both parties; if transactions were conducted using cryptocurrencies like BTC, ETH, USDT, the court will likely rule that losses are borne by the parties.

Finally, regarding the effectiveness of re-signing contracts after both parties agree when the contract cannot be performed. Distinguish based on whether both parties signed the contract on an equal negotiation basis, reaching a clear amount for cryptocurrency depreciation compensation: In principle, if one party claims compensation in legal tender value based on virtual currencies like Bitcoin without mutual agreement, the people's court will not support it; if both parties agree and sign a settlement agreement specifying the depreciation compensation amount, if one party defaults, the people's court can provide judicial relief based on the subsequently signed settlement agreement.

II. Has the judicial policy changed in 2026?

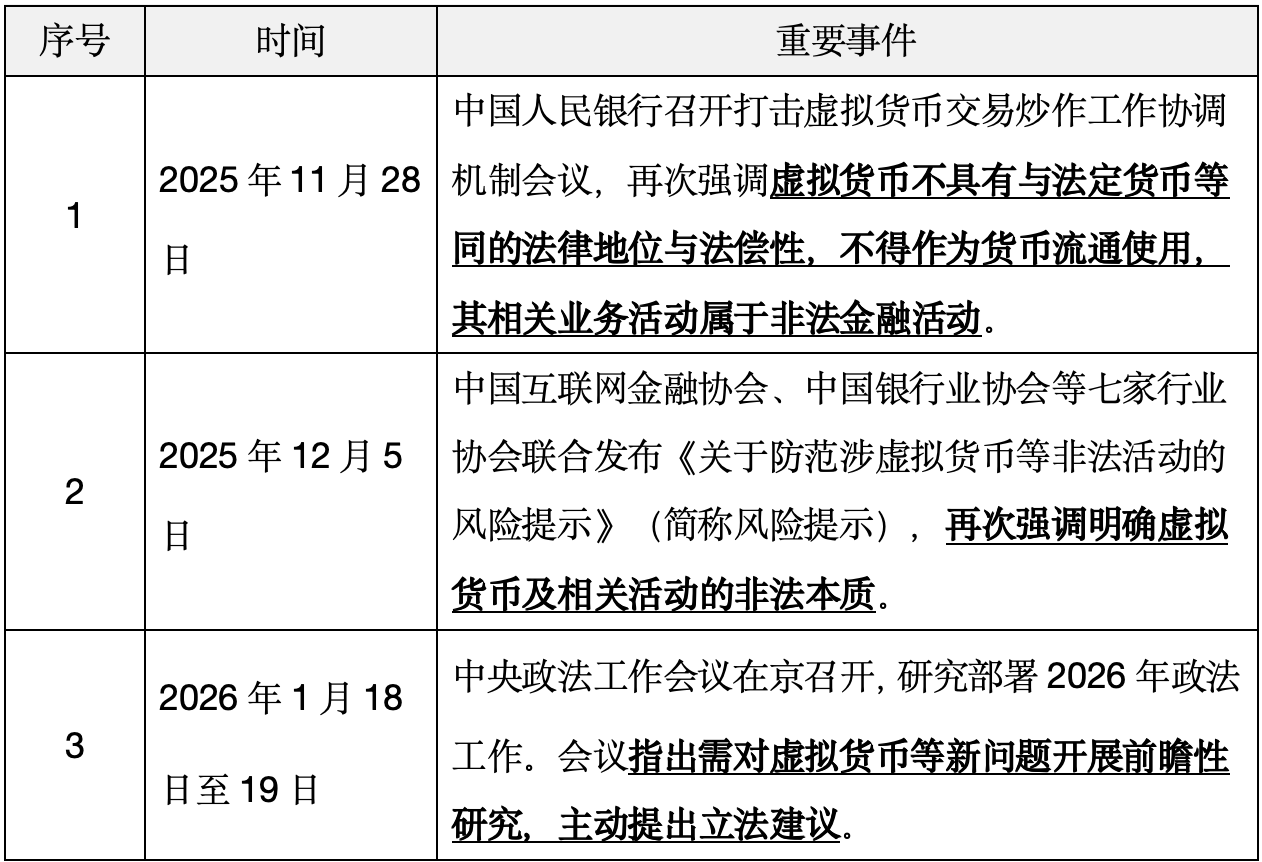

From the end of 2025 to the beginning of 2026, our legislative and judicial authorities have continuously released a series of signals regarding cryptocurrency assets, which we summarize as follows:

The Xiao Za team believes that the above information indicates that our country is still in a cautious observation phase regarding cryptocurrency assets: while delineating several red lines, it has not restricted individuals from holding and using cryptocurrencies for non-business purposes, but at the same time, scrutiny of organizations using cryptocurrencies for criminal activities, such as underground banks, is becoming increasingly stringent. Details are as follows:

(1) Regarding "mining" activities

Judicial and administrative enforcement agencies in our country have actually conducted several rounds of crackdowns on "mining" activities since 2021, and many "mining farms" have relocated out of mainland China after 2021. Based on the practical experience of the Xiao Za team serving clients, the current major mining farms are primarily distributed in the Middle East, North America, and Africa, with "mining farms" in mainland China decreasing significantly.

From the recent actions of our judicial and enforcement agencies, there has not been a significant policy change regarding "mining" activities. If verified by enforcement agencies, "mining" companies and related responsible persons will face legal consequences of administrative penalties, which may result in significant financial losses, but the criminal risk is relatively low (excluding those operating OTC businesses and other non-"pure mining" entities).

In judicial practice, courts across the country still follow the key review points established since 2025 to make judgments, with little change.

(2) Regarding individuals holding cryptocurrencies

The Xiao Za team emphasizes again: our country's laws and regulations do not prohibit individuals from holding cryptocurrencies.

Although various normative documents and notices issued by multiple departments in our country often emphasize the risks and scams associated with cryptocurrency trading, this does not mean that the mere act of "holding" cryptocurrency assets constitutes an administrative violation or crime.

The Xiao Za team has found that many people still have unclear understandings of relevant legal provisions, with absurd cases emerging where a husband falsely claims to have been punished administratively for holding/trading cryptocurrencies after being detained for other administrative violations.

As of now, our country has not enacted relevant laws or regulations to change this situation. Partners should make judgments based on the information released through official channels and assess the authenticity of the information before making decisions.

(3) Regarding individual trading behaviors

Due to the diverse nature of "trading" behaviors, the legal risks associated with such activities in mainland China are the most complex and difficult to assess. From the current judicial direction, trading contracts carry significant red line risks in our country. Based on our case-handling experience, trading contracts should be viewed in two parts.

For service providers (individuals or companies, teams) offering contract trading, some local judicial authorities have classified them under "operating a gambling house," "illegally absorbing public deposits," or "fundraising fraud." A small number of cases have been investigated under "illegal business operations," with publicly available cases being relatively rare.

For individuals merely participating in trading contracts, the probability of constituting a crime is low, but in practice, we have indeed seen a few cases where individuals were investigated by local public security for "illegally obtaining data from computer information systems" or "illegally controlling computer information systems."

Conclusion

In summary, in 2026, there has been no significant change in the judicial policies of our judicial and enforcement agencies regarding individuals mining, holding, and trading cryptocurrencies in mainland China. Civil judicial cases even show positive signs of change.

However, it is crucial to note that behaviors involving the use of stablecoins like USDT for disguised capital outflows, money laundering, concealing criminal proceeds, and currency exchange are clearly defined red lines, and crossing them will inevitably lead to criminal risks.

Additionally, the Xiao Za team has also noticed an increasing number of behaviors using stablecoins like USDT to assist in smuggling ordinary goods and evading taxes. Given the current trend of strict investigations into tax-related crimes in our country, such behaviors also clearly touch upon red lines, and partners should avoid them.

That concludes today's sharing. Thank you to our readers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。