Midweek trading offered little relief for crypto ETF investors. Selling pressure broadened across major products, dragging total assets lower once again, while only XRP managed to stay afloat in an otherwise red session.

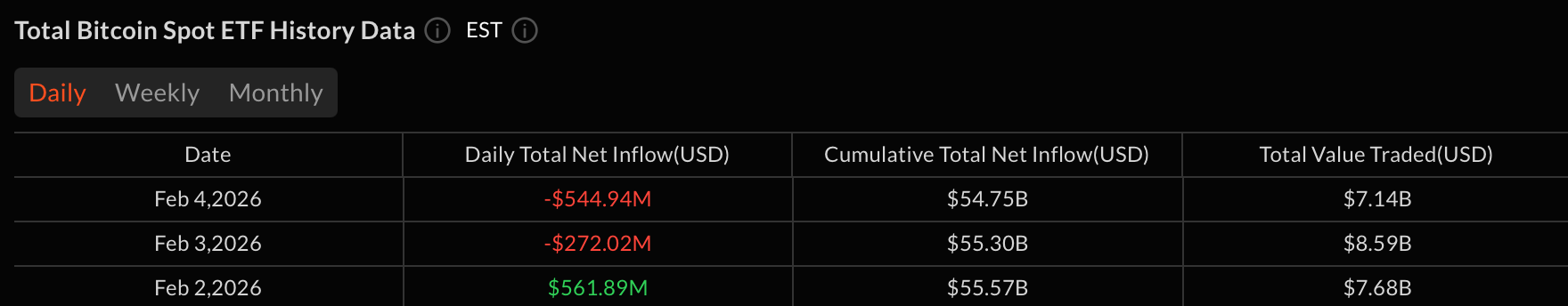

Bitcoin spot ETFs led the downturn with a $544.94 million net outflow, spread across six funds. Blackrock’s IBIT absorbed the heaviest blow, shedding $373.44 million. Fidelity’s FBTC followed with $86.44 million in exits, while Grayscale’s GBTC lost $41.77 million.

Additional redemptions came from Ark & 21shares’ ARKB ($31.72 million), Franklin’s EZBC ($6.38 million), and Vaneck’s HODL ($5.20 million). Despite elevated trading activity of $7.15 billion, total net assets slid further to $93.51 billion, underscoring the intensity of the drawdown.

Ether spot ETFs also remained under pressure, posting a $79.48 million net outflow. Blackrock’s ETHA accounted for the majority of the exits with $58.95 million, while Fidelity’s FETH saw $20.53 million leave the fund. Trading volumes reached $2.27 billion, but net assets continued to erode, closing the day at $12.71 billion.

XRP spot ETFs once again bucked the broader trend, attracting $4.83 million in net inflows. Franklin’s XRPZ led with $2.51 million, followed by Bitwise’s XRP at $1.72 million and 21Shares’ TOXR with $600.36K. Total value traded came in at $42.65 million, while net assets held steady at $1.07 billion, reinforcing XRP’s relative resilience during the recent selloff.

Solana spot ETFs were not spared, recording a $6.71 million net outflow. Grayscale’s GSOL accounted for the bulk of the exits with $5.22 million, while Bitwise’s BSOL saw $1.49 million leave the fund. Trading activity remained healthy at $61.67 million, but net assets slipped sharply to $789.47 million, pushing SOL ETFs further away from the $1 billion mark.

Read more: XRP and Ether ETFs Lead Inflows as Bitcoin Sees $272 Million Exit

Overall, Wednesday’s session reflected deepening risk aversion across crypto ETFs. Bitcoin and ether continued to bleed capital, solana joined the slide, and XRP stood alone in the green, highlighting a market that remains cautious, selective, and firmly defensive as February unfolds.

- Why are Bitcoin ETFs seeing heavy redemptions?

Persistent risk-off sentiment and February volatility are driving investors to cut BTC exposure. - How did Ether and Solana ETFs perform this session?

Both ETH and SOL ETFs posted notable outflows, confirming broad selling across major crypto assets. - Why did XRP ETFs attract inflows while others fell?

XRP benefited from selective positioning as investors rotated into perceived relative strength. - What does this mean for overall crypto market sentiment?

The divergence signals defensive capital rotation, not renewed risk appetite, as caution dominates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。