Written by: Glendon, Techub News

In the early hours of today, Ethereum fell again, dropping below $2100 and starting to test the critical support level of $2000. As the cryptocurrency market continues to decline, the investment institution Trend Research is also experiencing a "desperate survival."

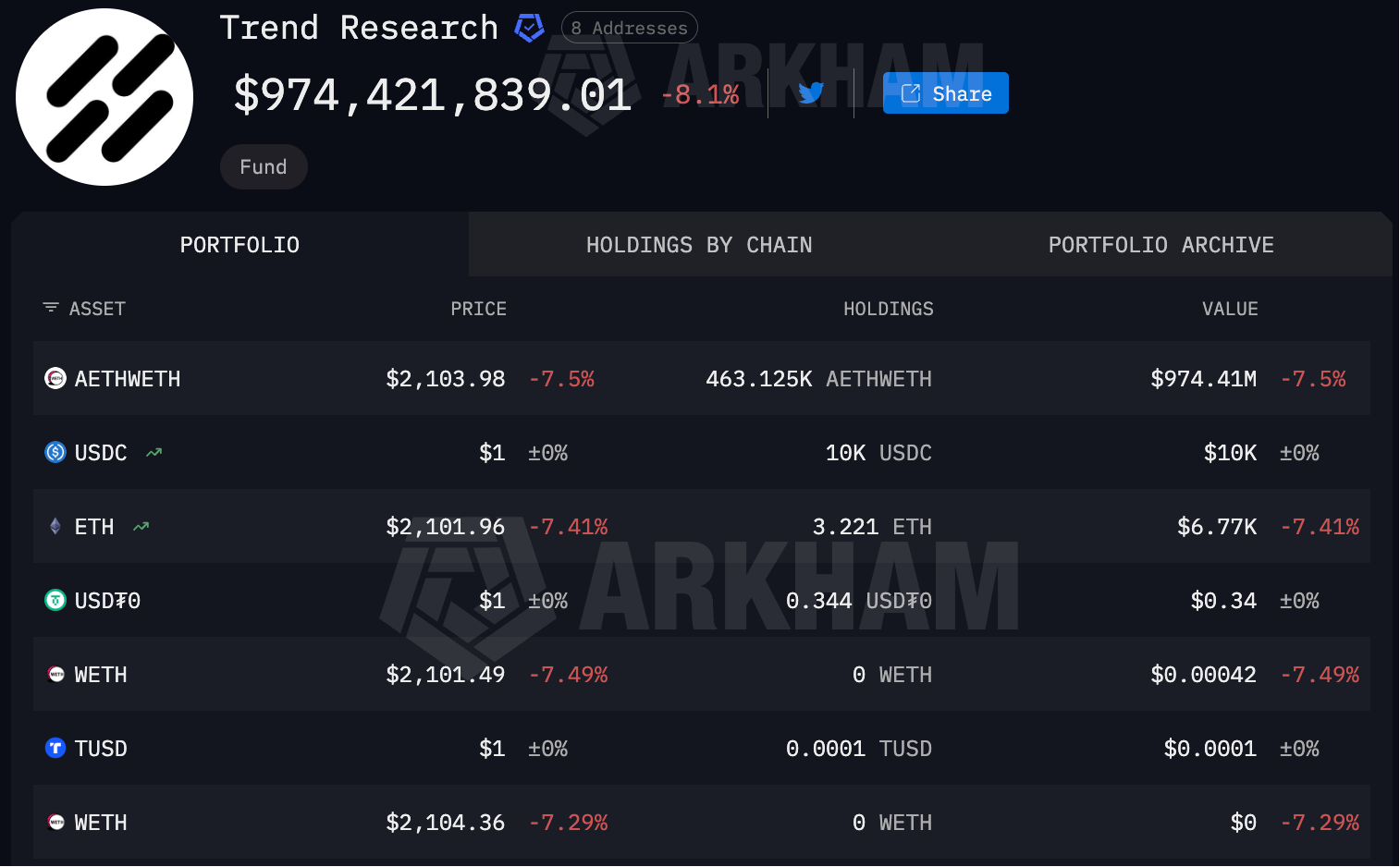

According to on-chain analyst Ai Yi's monitoring, in the past 8 hours, Trend Research transferred 35,000 ETH back to Binance for sale and to repay loans. Currently, Trend Research has lowered its liquidation price to a range of $1575.13 to $1681.94, temporarily alleviating liquidation risks.

Trend Research's "desperate survival" journey began on January 29. At that time, the market faced another sharp decline, and Ethereum plummeted significantly, dropping to $2800 in a short period. Meanwhile, Trend Research immediately withdrew 36.39 million USDT from Binance, depositing it in batches into Aave as collateral to reduce liquidation risks. At that time, the institution's Ethereum holdings exceeded 661,200 ETH, with an average cost price of about $3104.36, but the unrealized loss had approached $180 million.

According to Yu Jin's monitoring, since February 1, Trend Research has cumulatively reduced its position by 188,500 ETH at an average stop-loss price of $2263 (worth about $426 million), while repaying 385 million USDT to lower its leverage level. Currently, the prices of multiple ETH lending positions held by the institution are mainly concentrated around $1640.

As of the time of writing, Trend Research still holds about 463,100 ETH on-chain, with an average cost price of $3180. Based on current prices, the total value of these ETH is approximately $977 million. However, the institution's total loss has reached as high as $647 million, with realized losses of about $173 million and unrealized losses of about $474 million. It is worth mentioning that the institution's leveraged borrowing amount is approximately $625 million.

Coincidentally, BitMine, another significant holder of Ethereum, is also facing substantial unrealized losses. Currently, BitMine holds about 4.2851 million Ethereum, accounting for approximately 3.55% of the total Ethereum token supply. As Ethereum's price fell below $2100, BitMine's paper losses have exceeded $7 billion. However, due to essential differences in holding strategies, capital structure, and risk exposure, BitMine has not engaged in selling Ethereum and has no liquidation risk.

In contrast, Trend Research's actual losses and risks are closely related to its institutional positioning and holding strategy.

Trend Research is a secondary market investment institution under Jack Yi, the founder of the cryptocurrency fund Liquid Capital. It operates publicly through on-chain addresses and is widely regarded as one of the largest unilateral long positions in Ethereum.

Liquid Capital, formerly known as LD Capital, is an influential early venture capital institution in the crypto space, focusing on primary market investments in Web3, DeFi, NFT, and Layer1/Layer2 infrastructure projects. It was once one of the active "capital drivers" in the crypto ecosystem. As the market shifted from primary to secondary and the Ethereum ecosystem gradually recovered, Jack Yi shifted the investment focus from primary investments to secondary market trend trading.

In April 2025, Trend Research released an Ethereum investment research report, predicting that Ethereum would break through $5000 and began accumulating Ethereum. By June 20, Trend Research had cumulatively purchased over 184,000 ETH, with unrealized gains reaching as high as $191 million. In August, Jack Yi officially announced a strategic transformation, renaming LD Capital to Liquid Capital, with a strategic focus on the Ethereum ecosystem, viewing it as the cornerstone of on-chain finance, and publicly sharing its investment logic and holding movements through Trend Research, completing its transformation from a "behind-the-scenes investor" to a "transparent trader."

Although Trend Research had also purchased a significant amount of Ethereum at this time, its true systematic accumulation began in November and was regarded by the market as a representative of "faith-based long positions." By the end of December, Trend Research held about 645,000 ETH, and even though the unrealized loss was close to $150 million at that time, Jack Yi still tweeted that Trend Research would prepare $1 billion to continue increasing its Ethereum holdings.

During this process, Trend Research's positioning belongs to a "whale-type" investment entity driven by personal capital and systematic trading logic. Its funding sources for increasing Ethereum holdings differ from those of Ethereum treasury companies. Trend Research employs a relatively common "stake ETH - borrow USDT - buy ETH again" circular leverage strategy, primarily implemented through the decentralized lending protocol Aave V3. However, it is noteworthy that the institution's leverage ratio has long been maintained in the range of 2.0–2.4 times, which is typical of high-leverage longs.

Because of this, when the price of Ethereum plummeted from $3200 to below $2300, Trend Research's high leverage put it at risk of forced liquidation. Now, the institution has reduced its leverage by selling Ethereum and repaying loans. The market generally estimates its leverage ratio to be between 1.6 and 1.8 times, which is in a relatively controllable range, and the liquidation risk has significantly eased in the short term.

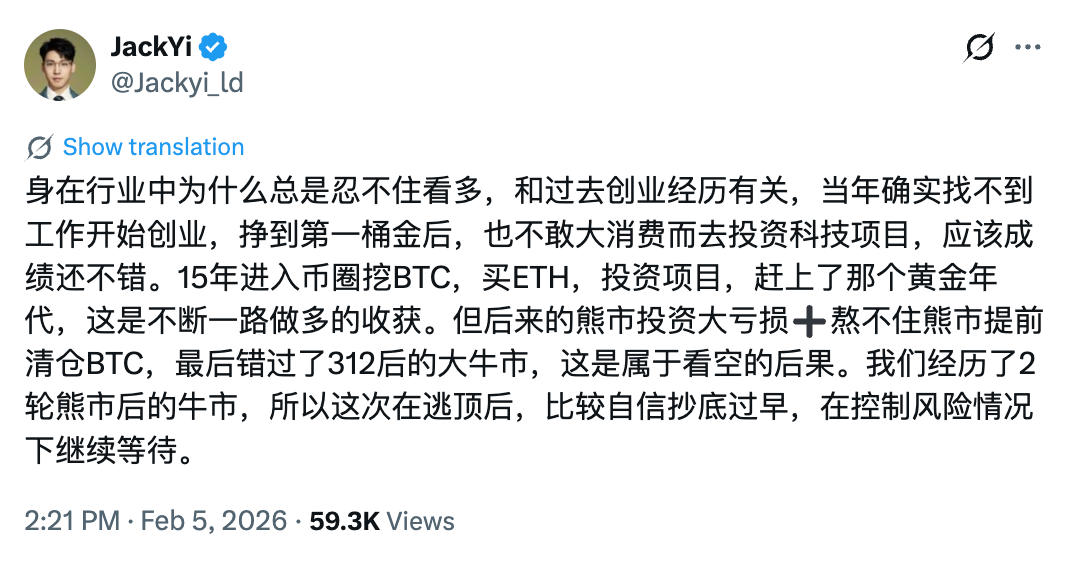

However, as a firm "faith-based long," its founder Jack Yi still holds a long-term bullish view on Ethereum, and his faith has not collapsed due to significant losses. He admitted that since the "10.11" peak liquidation, being overly bullish on ETH too early was indeed a mistake, but he remains optimistic about the performance of the next bull market: "ETH will reach over $10,000, and BTC will exceed $200,000." He stated that the recent sale of a large amount of ETH was merely to control risk and make partial adjustments, and his expectations for a future bull market have not changed. Today, he tweeted again emphasizing, "Being overly confident in bottom fishing after a peak will continue to wait under controlled risk."

Regarding Trend Research's recent "desperate survival" move, many believe that the institution's unrealized loss of $474 million still poses significant risks, and some even think it has fallen into a "death spiral" mechanism of "cutting losses - price decline - liquidation line lowered - further cutting losses."

So, is this statement valid?

In fact, the industry generally does not consider Trend Research to have failed. Compared to a true "death spiral" (like the LUNA collapse), Trend Research's actions are seen as timely loss-cutting, which is a rational self-rescue for high-leverage longs in a bear market. It actively reduces its position to lower risk exposure rather than falling into a self-reinforcing collapse cycle. Although the current unrealized loss amount is large, the risk has been systematically reduced, and there is no immediate threat of liquidation.

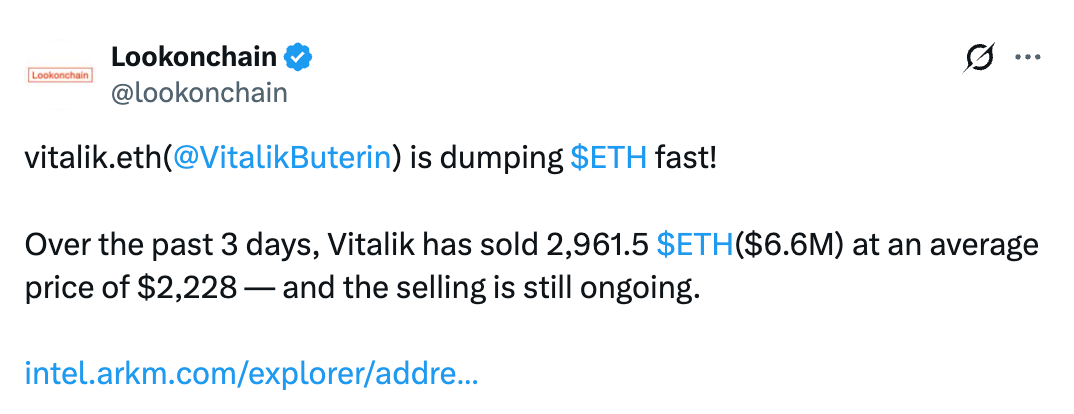

Moreover, there are other whales in the market selling ETH, with Ethereum co-founder Vitalik Buterin also selling ETH (Vitalik sold 2961.5 ETH worth about $6.6 million in the past three days) being mentioned multiple times by monitoring platforms. This indicates that the current selling pressure is a systemic market behavior and not solely triggered by Trend Research. As of now, platforms like Arkham have not issued a "high-risk" warning regarding Trend Research but continue to track its holdings and operations. This suggests that its actions are viewed in on-chain analysis as "controllable deleveraging" rather than a "systemic risk source."

Of course, from the worst-case scenario, if the price of Ethereum falls below $1500, Trend Research may trigger a second liquidation risk, but since its leverage has been reduced, only a portion of its positions may be affected, which will not trigger a chain reaction in the market. From an optimistic perspective, if the price of Ethereum can rebound above $2600, Trend Research's unrealized losses will narrow to below $270 million, potentially making it one of the bottom support forces in the market. Given the current situation, the likelihood of ETH remaining in the $2000 - $2300 range for the long term is also high, and the entire market needs to patiently wait for new catalysts to emerge.

Trend Research's "self-rescue" behavior also reveals a key fact: in the high-leverage game of the crypto market, "survival" is more important than "faith." When price fluctuations exceed expectations, actively cutting losses, reducing leverage, and retaining core holdings is the underlying logic for navigating bull and bear markets. Trend Research's "soft landing" may be a reflection of the market's shift from "frenzied speculation" to "rational investment." It also reminds the industry that true risk control lies not in predicting the bottom but in timely adjusting strategies to avoid being eliminated by the market. After all, in the crypto world, those who survive have the opportunity to see the next spring.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。