Original Title: What Happens When The Bet Against America Fails?

Original Author: @themarketradar

Translated by: Peggy, BlockBeats

Editor's Note: In the current context where "de-Americanization" and "de-dollarization" have almost become market consensus, this article attempts to remind readers that the real risk often lies not in whether the judgment is correct, but in whether everyone has already taken the same side. From the crowded positioning in emerging markets, the speculative rise of precious metals, to the highly consistent narrative of a weakening dollar, the market is replaying a script that is not unfamiliar.

The article does not deny the possibility of long-term structural changes in the world, but it still brings the perspective back to a more realistic cyclical level: once the dollar no longer continues to weaken, when monetary discipline re-enters pricing, and the U.S. economy does not slow down as expected, those trades that are entirely based on a "single tailwind" may collapse at a speed far exceeding expectations. As we experienced from 2017 to 2018, when consensus is too uniform, reversals often come quickly and violently.

In this framework, the article presents a contrarian but serious judgment: what may be overlooked is the U.S. assets themselves. Not because the narrative is overly optimistic, but because when crowded trades recede, capital often returns to the places with the deepest liquidity and the most stable structure.

The following is the original text:

Currently, there is a narrative in the market that is almost irresistible: the dollar is being diluted; emerging markets have finally welcomed their own moment in the spotlight; central banks are selling U.S. Treasuries and increasing their gold holdings; capital is rotating from U.S. assets to "other parts of the world." You can call it "de-Americanization," "de-dollarization," or "the end of American exceptionalism." Regardless of the label used, this judgment has formed a high level of consensus.

And precisely because of this, it is particularly dangerous.

Last Friday's market performance demonstrated what happens when highly crowded trades encounter unexpected catalysts. Gold plummeted over 12% in a single day; silver experienced its worst day since 1980, with a drop of over 30%. The entire precious metals sector saw market value fluctuations of up to $10 trillion in one trading day. Meanwhile, the dollar surged sharply, and emerging markets showed a clear retreat.

On the surface, all of this was triggered by Kevin Warsh's nomination as Fed Chair; but the real key lies not in a single personnel appointment, but in a position structure that has reached extremes, waiting for any excuse to "close positions and pull back."

We do not believe the world is abandoning the U.S. Our judgment is that the "de-Americanization" trade has become one of the most crowded macro bets for 2026, and it is on the verge of reversal.

In this analysis, we will systematically break down the deep macro mechanisms supporting this view, not only explaining what we expect to happen but, more importantly, why.

Consensus Positioning

First, let's take a look at how one-sided this trade has become.

In 2025, emerging market asset returns reached 34%, marking the best annual performance since 2017. More notably, during a sustained "emerging market leadership period" that has not been seen in over a decade, the performance of EEM outperformed the S&P 500 by more than 20%.

Fund managers and strategists are almost in unanimous agreement. JPMorgan stated that emerging markets "have never been this attractive in 15 years"; Goldman Sachs predicts a further 16% upside for emerging markets in 2026; Bank of America even claimed that "those who are bearish on emerging markets have gone extinct."

In 2025, emerging market securities experienced the largest capital inflow since 2009.

At the same time, the dollar recorded its most severe annual decline in eight years. Gold prices doubled within 12 months, and silver's increase approached fourfold. A bet known as "devaluation trade" quickly became dominant, with its core logic being: the U.S. is marginalizing itself by continuously printing money. This narrative has become widely popular among hedge funds, family offices, and even retail investors.

U.S. Treasuries are also under pressure. China's holdings of U.S. Treasuries fell to $689 billion in October, the lowest level since 2008, down 47% from the peak of $1.32 trillion in 2013. Central banks around the world have been increasing their gold holdings for three consecutive years at a rate of over 1,000 tons per year, clearly expressing the need to diversify away from dollar reserves. The narrative of "selling America" has thus fully taken shape.

But all of this is heading towards change. The only question is what will trigger the reversal.

Reasons for Dollar Stability

The core premise of "de-Americanization" is the continued weakening of the dollar. However, the dollar's decline in 2025 is not due to structural collapse but is driven by a series of specific policy shocks, the effects of which have largely been digested by the market.

The main catalyst was the so-called "Liberation Day." When the Trump administration announced large-scale reciprocal tariffs in April, the market quickly fell into panic, and the "sell America" trade was indeed reasonable at that time: if the world cannot trade smoothly with the U.S., then why would it need so many dollars and U.S. Treasuries?

However, the tariff shock has gradually been absorbed. A series of trade agreements have provided stable anchor points for the market; the Xi-Trump meeting in October released clear signals of easing; and the agreement with India reduced Trump's previous 25% tariff to 18%. The lower the tariffs, the stronger the fundamental support for the dollar. The market is recalibrating expectations, and the focus is returning to fundamentals—where the dollar still holds key advantages.

Interest rate differentials still favor the dollar.

Despite the Federal Reserve having cut rates by a total of 175 basis points since September 2024, U.S. interest rates remain structurally higher than all other developed economies. The current federal funds rate range is 3.50%–3.75%; the European Central Bank's rate is 2% and has signaled the end of its rate-cutting cycle; the Bank of Japan has just raised its rate to 0.75%, which may only reach 1.25% by the end of 2026; and the Swiss National Bank remains at 0%.

This means that U.S. Treasuries still offer a significant yield premium compared to German, Japanese, British, and almost all other sovereign bond markets. This yield differential continues to create demand for the dollar through carry trades and international asset allocation.

It is expected that by March 2026, the Federal Reserve will complete all rate cuts in this round of easing; while most other G10 central banks will also be nearing the end of their respective rate-cutting cycles. When the interest rate differential no longer continues to narrow, the core force driving the dollar's weakness will also disappear.

For the dollar to continue to decline, capital must have somewhere to go. The problem is that all alternative options themselves have unavoidable structural flaws.

Europe is mired in a structural dilemma: Germany is trying to support growth through fiscal stimulus, while France is straying further into unsustainable fiscal deficits; once the economic environment deteriorates again, the European Central Bank will have very limited policy space.

Japan's policy mix is also struggling to support a stronger yen. The Bank of Japan is normalizing its policy at an extremely slow pace, while the government is simultaneously pursuing re-inflationary policies. The yield on 10-year Japanese government bonds has just risen to 2.27%, the highest since 1999. According to Capital Economics, about 2 percentage points of this comes from inflation compensation, reflecting price pressures in the Japanese economy during the re-inflation process. Japan's inflation rate has been above the Bank of Japan's 2% target for 44 consecutive months. This is not a signal for a stronger yen, but rather a market demand for higher yields to compensate for the persistent inflation risk.

Now, looking at gold. In this macro environment, it is undoubtedly one of the best-performing assets. But last Friday's movements exposed its fragility. When gold plummeted over 15% in a single day following a personnel nomination news, and silver dropped 30%, this was no longer normal behavior for a safe-haven asset, but rather a highly crowded trade packaged as a safe-haven product.

The dollar may not be perfect, but as the old saying goes: in the land of the blind, the one-eyed man is king. The capital fleeing the dollar does not have truly attractive alternatives on a large scale. Gold and other metals once acted as a "pressure relief valve," and we believe this phase is coming to an end.

Kevin Warsh's nomination as Fed Chair signals a potential shift in monetary policy stance. He is widely regarded as the most hawkish among the candidates, having publicly criticized quantitative easing, advocated for balance sheet discipline, and prioritized inflation control. Whether Warsh ultimately implements a tough policy is not the key issue. What is truly important is that the market's unilateral bet on "the dollar will weaken for a long time" has been challenged for the first time. Warsh's emergence has made "monetary discipline" a real threat again, while the market had already priced in "permanent easing." This is precisely the change that the highly crowded "devaluation trade" is most unwilling to see.

But there is a crucial detail. No Fed Chair, not even Warsh, would sacrifice tens of trillions of dollars in stock market value just to bring inflation down from 2.3% or 2.5% to 1.8%. If inflation is only slightly above target, no policymaker would want to be the one who "brings the S&P 500 down by 30%." They are more likely to choose to wait for inflation to naturally decline rather than take forceful action. Just the hawkish "threat" is enough to disrupt the devaluation trade; real policy does not need to be brutal.

The dollar does not need to surge; it just needs to stop falling. And once the core tailwinds supporting emerging markets' outperformance and the surge in metal assets disappear, these trades will reverse.

Why U.S. Economic Growth Remains Resilient

Another premise of the "de-Americanization" narrative is that U.S. economic growth is weakening. However, the structural foundation of the U.S. economy is far more solid than this narrative suggests.

Our growth index illustrates this well. Indeed, growth momentum slowed in the fourth quarter of 2025. The index fell below the momentum line in mid-October, and the trend briefly turned bearish, which fueled the "de-Americanization" narrative. However, growth did not accelerate downward towards collapse but stabilized. By early January, the index had risen above the momentum line again, briefly turning bullish before falling back to the current neutral range.

The U.S. economy has digested the tariff shock from "Liberation Day" and has endured higher interest rates, yet it continues to move forward. The growth in the fourth quarter did slow down and was fully capable of "collapsing"—but it did not. The failure to accelerate into a bearish trend is itself a signal. We believe that after months of sideways movement in the stock market, the market's "reverse slap" phase is approaching.

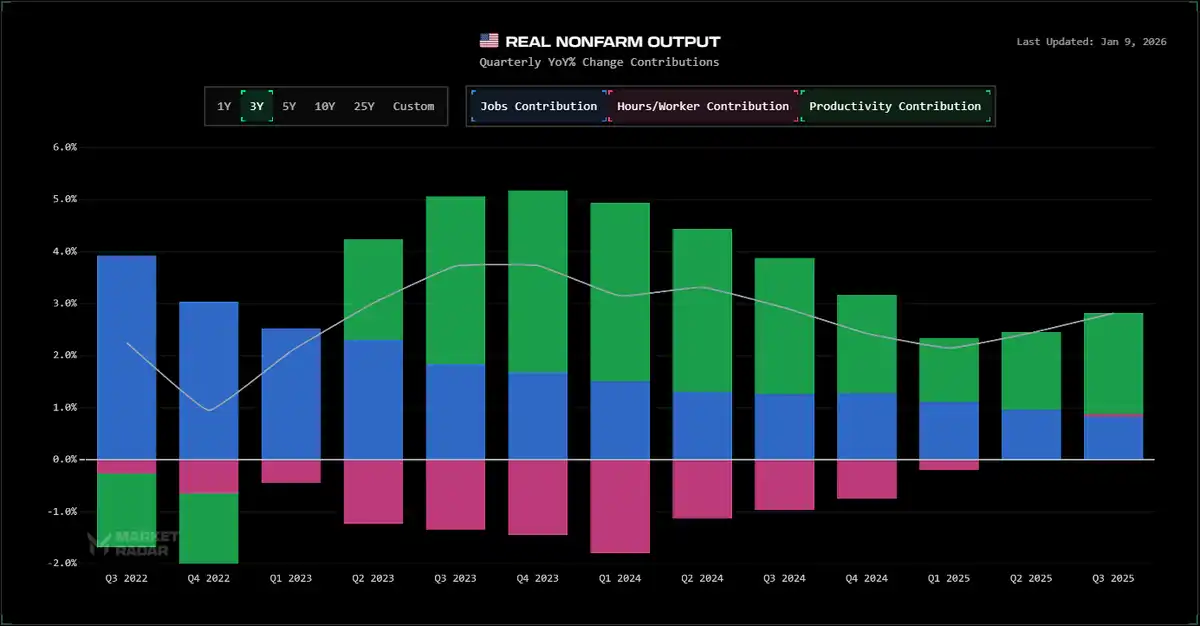

Real GDP remains significantly above target growth levels; the number of unemployment claims has not risen significantly; actual non-farm output continues to rise, and productivity, after contracting throughout 2024, is once again expanding; just residential consumption alone contributed 2.3 percentage points to growth. This is not an economy on the verge of losing its competitive edge.

Moreover, the fiscal dimension, which most analyses overlook, firmly stands on the side of the U.S. The U.S. fiscal deficit accounts for over 6% of GDP, and the "One Big Beautiful Bill Act" is expected to release an additional $350 billion in fiscal stimulus before the second half of 2026. In contrast, Europe’s fiscal rules limit stimulus space even during downturns, and Japan's fiscal leeway has long been exhausted. Only the U.S. has both the willingness and the ability to continue increasing spending during economic weakness.

Why Positions Are Forced to Liquidate So Drastically

The extreme crowding of the "de-Americanization" trade creates a vulnerability that transcends fundamentals. When everyone stands on one side of the boat, even the slightest directional change can trigger a chain reaction of liquidations. Last Friday's performance of gold and silver was a textbook demonstration of this mechanism.

When the news of Warsh's nomination broke, it directly impacted the market consensus—that the Fed would maintain a loose policy for a long time and that the dollar would continue to weaken. However, the subsequent price movements were not a calm reassessment of fundamentals by investors, but rather a brutal mechanical reaction as the position structure began to collapse.

This situation has been playing out across the entire metals sector. Looking back over the past few months, you will notice a key divergence: copper prices have been falling, while gold and silver have been rising. This is very important. Copper has significantly more industrial uses. If this round of metal price increases were truly driven by fundamentals—such as demand from AI data centers or renewable energy construction—then copper should have led the charge. But the reality is the opposite: copper has lagged, while "monetary metals" have soared. This indicates that the market is not being driven by fundamentals, but by speculative capital. And once speculative trades reverse, they often fall the hardest.

The "de-Americanization" trade is essentially reflexive. It self-reinforces: a weaker dollar makes dollar-denominated emerging market assets more attractive; capital flows into emerging markets, boosting their currencies; and as emerging market currencies strengthen, they further depress the dollar. This virtuous cycle appears to be "validating" the narrative based on fundamentals, but in reality, it is merely positions continuously generating more positions. However, reflexivity is always two-way. Once the dollar stabilizes for any reason, the cycle will reverse: the attractiveness of emerging market assets will decline, triggering capital outflows, suppressing emerging market currencies, and in turn strengthening the dollar. At that point, the so-called "virtuous cycle" will quickly evolve into a vicious spiral.

The "Trump 1.0" Script

We have seen this movie before, and we know how it ends.

Let's turn the clock back to 2017. At that time, the dollar fell sharply, recording its worst annual performance in 14 years, with a decline of about 10%. Emerging markets became the biggest beneficiaries of this round of dollar weakness, rising 38% for the year, marking their best performance since 2013. Emerging market currencies generally appreciated against the dollar. Analysts spoke of a "Goldilocks" environment—everything was perfectly positioned for overseas assets. Jeffrey Gundlach publicly called for emerging markets to continue outperforming. By January 2018, market consensus had become highly uniform, even to the point of raising alarms: emerging markets were a once-in-a-decade trading opportunity.

Then, the dollar bottomed out.

What followed was a dramatic reversal. The Fed tightened policy, and the shock quickly transmitted to vulnerable emerging market economies. The Turkish lira collapsed, and the Argentine peso experienced its largest single-day drop in three years. By August 2018, EEM had fallen to $41.13, nearly giving back all of its gains from 2017 in just a few months. The so-called "generational opportunity" ultimately turned into a generational trap for those who came later.

Now, looking at the present. In 2025, when did the dollar record its largest annual decline? It was in 2017. What was the decline? Again, about 10%. Emerging markets rose 34%, almost equivalent to their performance in 2017. Analysts declared that "the bears on emerging markets have gone extinct"; Bank of America proclaimed that "the next bull market has begun." This level of consensus now seems familiar.

The dynamics are the same, the positioning structure is the same, the narrative is the same.

Even the ruling government is the same one that watched all of this collapse back then.

This is a template that has been repeatedly played out under the same political backdrop: the same volatility triggered by tariffs, the same consensus euphoria, and this is precisely what we are witnessing today. The end of the 2017–2018 cycle was not due to a collapse in the fundamentals of emerging markets, nor was it because of an impending recession; it ended for one reason only: the dollar stopped falling, and that was enough. When the core tailwinds disappear, the positions built on those tailwinds collapse at an astonishing speed.

We do not predict a mechanical replication. Markets never repeat exactly. But when conditions are so highly aligned, history provides a valuable prior: the same trades, the same consensus, the same government. The burden of proof has shifted. Those who continue to bet on the long-term superiority of emerging markets need to explain why this time will be different. Because last time, under almost identical circumstances, the reversal was swift, and the losses were real.

The Undervalued Trade

One point that the "de-Americanization" camp continues to overlook is that the S&P 500 is essentially a representative of global growth.

The world economy largely operates on the foundation of U.S.-listed companies. For overseas pension fund managers or hedge fund managers, making a clear decision—systematically not allocating to the U.S. stock market—almost equates to declaring that they do not want to hold a significant portion of the world economy. To continue winning on such a bet means that the global economic structure must undergo a drastic and profound transformation, which, for now, is unrealistic.

There is no large-scale "foreign version of Google," no "foreign version of Meta," and no overseas competitor that can rival Apple. The dominance of American technology is a fact that advocates of "de-Americanization" are more willing to avoid.

Now, looking at the current market structure: Oracle has fallen about 50% from its peak; Microsoft is underperforming; and Amazon is almost stagnant. These giants have been almost absent from this round of rebound, yet the Nasdaq has continued to raise its lows. What does this mean? It means that the index has maintained a high level for quite some time without the participation of these mega-cap companies. Now imagine: if Oracle finds a bottom, if Microsoft starts to gain buying interest, even if these companies rebound by 20%–50%, they may still be in a bearish trend; but once they start moving, where do you think the index will go?

The real contrarian trade is actually U.S. stocks. Everyone is focused on the dollar's decline, worried that the era of U.S. assets is coming to an end; but the Nasdaq is quietly preparing for a round of "catch-up." The AI theme that pushed the index to a historical high last year had briefly cooled: concerns about capital expenditures emerged, expectations were pulled too high, and AI growth was momentarily difficult to realize. The market did not crash; instead, it completed a correction through several months of sideways movement.

Now, expectations have returned to a more realistic position. As long as growth can break upward and AI expectations truly convert into cash flow, the market is likely to rise again. The metal theme may be retreating; once this wind stops, a new theme will emerge—U.S. stocks are that undervalued theme.

What Form Will the Reversal Take?

If the "de-Americanization" trade begins to unwind, its effects will transmit predictably across various assets:

Emerging market stocks will underperform: a stronger dollar will mechanically suppress dollar-denominated returns; the reflexive cycle will reverse, and capital flows will shift; the narrative of "generational opportunity" will fade, and investors will remember why they long underweighted emerging markets.

Metals will further correct: last Friday was not an isolated day but the beginning of a larger-scale repricing. What drove the previous rise was not fundamentals, but speculation; and once speculative trades reverse, they often fall the hardest. Gold and silver are the purest expressions of the "devaluation thesis"; if this thesis is losing strength, metals still have considerable downside potential.

The U.S. stock market will re-establish its leadership: regardless of how "rotation" is discussed, the U.S. market still gathers the highest quality companies, the deepest liquidity, and the most transparent governance. If the dollar stabilizes and growth holds, capital will return to where it has always felt most comfortable.

Timing and Catalysts

We are not calling for an immediate collapse of emerging markets or a straight-line surge in the dollar. Our judgment is more nuanced: "de-Americanization" has become a crowded trade, and its downside risks are asymmetric; last Friday, the narrative showed clear cracks for the first time.

Timing depends on several key factors:

Dollar price behavior is the most important: DXY needs to first rise above the mid VAMP of 97.50, then break through the momentum level of 99 to confirm the start of a reversal. Until then, regardless of the fundamentals, the dollar remains in a technical downtrend.

Fed communication shapes expectations: if Warsh's confirmation process strengthens hawkish expectations, dollar buying will increase.

Growth data changes sentiment: any upward surprise in U.S. GDP, productivity, or employment will directly challenge the narrative of "American decline."

Our system currently shows: a Risk-On dynamic in an inflationary environment, but growth intensity is neutral. We are at the boundary between "slowing" and "Risk-On": inflation momentum is relatively strong, while growth has not yet firmly turned bullish. The structure is sufficiently fragile, and returning to "slowing" or even "Risk-Off" is not far off. We will let institutional signals guide positioning; but the macro backdrop is increasingly favorable for U.S. assets, rather than those already highly crowded alternatives.

Why This Matters

The danger of consensus trades is not that they are necessarily wrong, but that they are too crowded. When the narrative breaks, crowded trades often unwind in the most violent manner.

From a decades-long perspective, "de-Americanization" may ultimately prove to be correct; the long arc of history may indeed deviate from U.S. dominance. But in the next 6–12 months, we believe the risk-reward has reversed.

Everyone is positioned for a weaker dollar, emerging markets to outperform, and abandoning U.S. Treasuries. Last Friday demonstrated what happens when such positions encounter unexpected shocks. We do not believe that was a coincidence; we see it as a warning.

The world has not turned away from the U.S. It is preparing to remember why it was there in the first place.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。