The lights of Wall Street flicker in the winter night, as global markets hold their breath waiting for the first signal from the new head of the Federal Reserve. This candidate for Fed Chair, praised by Trump as "possibly the greatest ever," arrives on stage with a rare combination of monetary policies.

Kevin Warsh was once seen as a typical "hawk"—his criticisms of quantitative easing after the financial crisis and his uncompromising anti-inflation stance are well-known. However, before his nomination as Fed Chair, his position seemed to shift, beginning to support Trump's demands for lower interest rates.

On January 30, 2026, President Trump officially nominated Kevin Warsh as the next Chair of the Federal Reserve, succeeding Jerome Powell, whose term ends on May 15, 2026.

When the news broke, the market reacted violently and swiftly, with gold prices plummeting 8.35% in a single day, marking the largest single-day drop in nearly 40 years. Meanwhile, the dollar index surged 1.5% within two trading days.

1. Sudden Nomination

● Warsh's nomination is seen as an "unexpected" decision. Prior to this, the market widely expected Trump to choose a more "dovish" candidate, one whose policy proposals focused more on aggressive rate cuts to align with Trump's political demands.

● Although Warsh also supports rate cuts, he is a staunch "critic of excessive quantitative easing (QE)", having long advocated for the reduction of the Fed's massive balance sheet. The contradiction in this stance makes his nomination particularly noteworthy.

● Despite publicly expressing support for the Trump administration, some senators are attempting to shield the Fed from political pressure. Republican Senator Thom Tillis explicitly stated that due to the Justice Department's criminal investigation into Powell, "he would oppose the confirmation of any Fed-related nominations, including the Fed Chair position."

2. Contradictory Policy Core

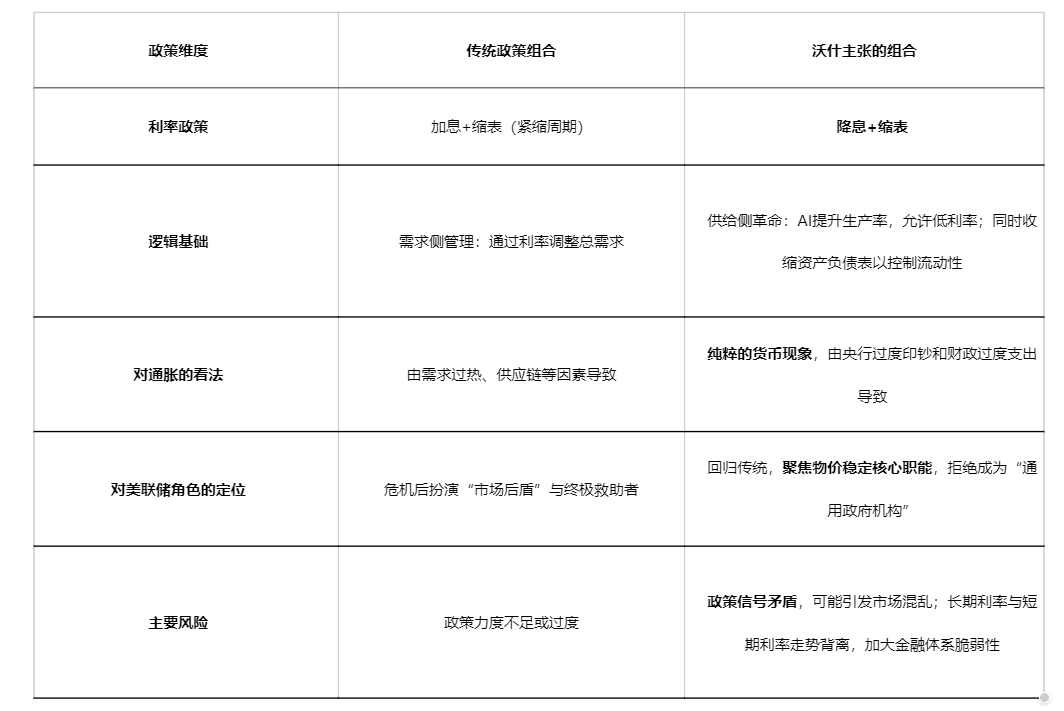

● Warsh's monetary policy proposals can be summarized as "rate cuts + balance sheet reduction," a combination that is contradictory within traditional monetary policy frameworks.

Warsh believes that technologies like AI will drive productivity levels up, alleviating inflationary pressures. He firmly believes that AI can achieve growth without inflation. This "rate cuts for the supply side" logic cleverly aligns with Trump's desire to lower rates to stimulate economic growth.

At the same time, Warsh strongly criticizes the Fed's excessively expanded balance sheet. He argues that the Fed's expansion blurs the lines between the central bank and the Treasury, and while quantitative easing is a "necessary evil" in times of crisis, once the crisis is over, the central bank should reduce its balance sheet and return to its original boundaries.

3. Crisis Trigger

● Martin Wolf, chief economic commentator for the Financial Times, issued a clear warning: under Warsh's policy framework, "the result could be another financial crisis." This concern primarily stems from the inherent contradictions in Warsh's policy combination. On one hand, he plans to lower short-term interest rates; on the other hand, he hopes to raise long-term rates by reducing the Fed's balance sheet.

● Wolf warned that under this policy combination, the U.S. yield curve would steepen further, leading to increased short-term dollar financing demand while reducing long-term demand. More importantly, "given the decline in bank reserves and financial deregulation, the financial sector's balance sheets will become more fragile."

● The U.S. Treasury market may face direct liquidity pressures. If the Fed continues to reduce its balance sheet, it means that this "largest buyer" holding a massive amount of U.S. Treasuries will exit the market, throwing a large volume of bonds into the market. However, market data shows that the capacity to absorb U.S. Treasuries has already become quite weak.

4. Potential Balancing Path

● Despite the obvious risks in Warsh's policy combination, there exists a potential balancing path. An analysis by Caixin pointed out that Warsh and Treasury Secretary Yellen share consistent positions on several key issues, creating the possibility for an informal agreement between the two institutions.

● If the Treasury's issuance and the Fed's balance sheet reduction paths remain stable and credible in the long term, it could avoid unexpected tightening of financial conditions, and any non-coercive shocks in the interest rate market would be limited.

● Warsh's inclination towards financial deregulation may also support his policy combination. Easing regulations, lowering liquidity thresholds, and addressing structural demand for reserves would suppress volatility in repurchase transactions and free up dealers' balance sheets, allowing them to intermediate more Treasury supply.

5. Global Market Turmoil and Domestic Impact

● Warsh's nomination has already caused severe shocks across various global assets. The gold market experienced a "roller coaster" ride, breaking through the historical high of $5,500 per ounce on January 29, followed by a drop of about $1,200 in the subsequent two days.

● Meanwhile, cryptocurrencies like Bitcoin also saw a significant plunge. In the early hours of February 5, Bitcoin fell below the $72,000 mark, the lowest level since April 2025.

● Analysts believe that Warsh's nomination alleviated market concerns about the Fed potentially succumbing to political pressure and implementing aggressive easing monetary policies. Previously, gold had surged to historical highs due to "currency devaluation" and safe-haven logic, but Warsh's nomination weakened this core upward logic.

● For the Chinese market, if Warsh's policies lead to a temporary strengthening of the dollar due to tightening expectations, it could create short-term pressure on the RMB exchange rate. However, Wang Qing, chief macro analyst at Dongfang Jincheng, pointed out that regardless of what adjustments Warsh brings to Fed monetary policy after taking office, the impact on domestic monetary policy is relatively limited.

6. Challenges Ahead

● For Warsh to successfully implement his policy proposals, he will face threefold challenges. He must garner sufficient support within the Federal Open Market Committee (FOMC). Given the composition of the four regional Fed presidents who will gain voting rights in 2026, there is significant resistance to pushing for additional large rate cuts.

● Warsh will challenge the clear and consistent collective consensus that has already formed within the FOMC. The FOMC has decided to officially end the quantitative tightening (QT) that began in 2022 on December 1, 2025, and to initiate a "Reserve Management Purchase (RMP) plan" primarily focused on purchasing short-term Treasuries.

● He must also confront challenges to the Fed's own theoretical framework. A significant research paper released by the Fed in January 2026, titled "The Triple Dilemma of Central Bank Balance Sheets," pointed out that when setting the size of the balance sheet, central banks face an "impossible triangle," necessitating trade-offs in practice.

The dollar index surged after the nomination was announced, while gold recorded its largest single-day drop in nearly 40 years. The market's violent reaction suggests that investors are struggling to recalibrate their expectations.

Trump called Warsh "undoubtedly one of the greatest Chairs in Fed history," while critics cautiously observe how this candidate attempts to reconcile the contradictions between "rate cuts" and "balance sheet reduction," as one analyst noted: "His policy combination has very little room for error."

All eyes are focused on the Senate confirmation hearing, and if approved, Warsh will usher in a new era for the Fed in May. The suspense remains: will this former Fed governor, once seen as a believer in "hard currency," ultimately become a bastion of central bank independence or evolve into a conduit for political pressure?

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。