Canaccord Genuity maintains a buy rating on $MSTR but significantly lowers the target price from $474 per share to $185.

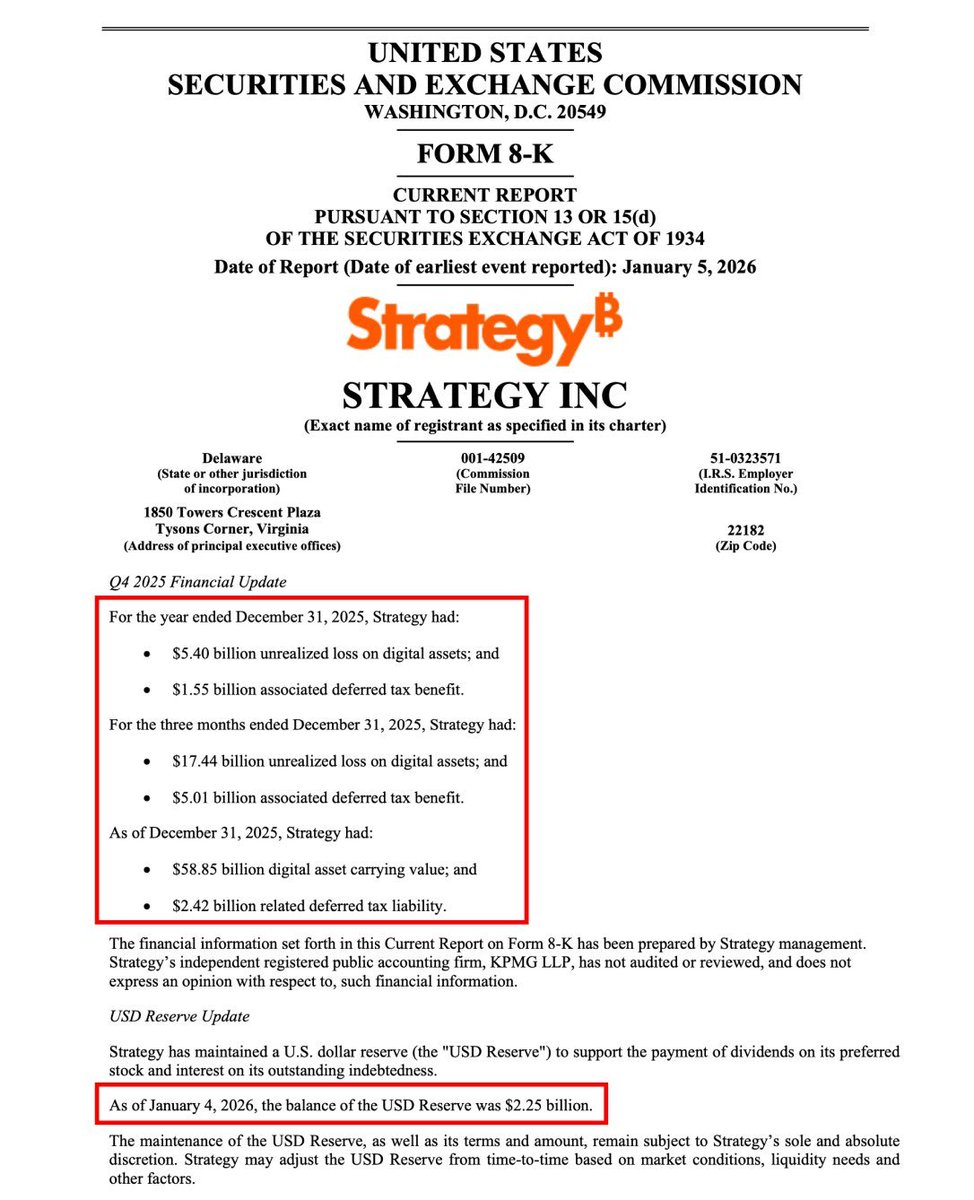

The main reason is that MSTR experienced a very large unrealized loss in the fourth quarter of 2025 (paper loss, with profits at that time also being paper profits). The total paper loss for the year 2025 reached $5.4 billion, with a loss of $17.44 billion generated in just the fourth quarter of 2025, wiping out the earnings from the first three quarters.

As of January 4, 2026, MSTR still has approximately $2.25 billion in cash reserves on the books to cover preferred stock dividends, interest, and debt-related expenses.

The rating remains a buy, indicating that analysts are still betting on the upward trend of BTC in the future and believe that MSTR is a leveraged BTC, thus having certain appeal. However, the target price has been cut to $185 due to an increase in the discount rate in the valuation model, a decrease in tolerance for future financing capabilities and volatility, and the market's willingness to maintain the premium (mNAV) at past high levels under such volatility is difficult.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。