In the Eastern Eight Time Zone this week, TRM Labs announced the completion of a $70 million Series C funding round, with a post-investment valuation of approximately $1 billion, making it part of the new batch of "unicorns" in the crypto space. Compared to the previous funding cycle where capital was fervently focused on public chains, trading platforms, and speculative narratives, this time, traditional financial institutions like Goldman Sachs and Citigroup, alongside crypto-native capital such as Blockchain Capital, are betting on what several media outlets classify as compliance, investigation, and on-chain intelligence infrastructure companies. A sector that was rarely sought after during the bull market is now being spotlighted by capital. With tightening regulations and an escalation in cross-border crime crackdowns, the crypto ecosystem is being re-evaluated: as every on-chain transaction could potentially be "seen" and modeled, will the industry be reshaped into a safer financial network or a higher-threshold "compliance club"?

$70 Million Boost: A Capital Turning Point for Compliance Narratives

● Financing and Valuation Structure: According to information from a single source, TRM Labs secured $70 million in its latest Series C funding round, with a post-investment valuation of approximately $1 billion, officially entering the unicorn ranks. This round was led by Blockchain Capital, with participation from Goldman Sachs, Bessemer, Brevan Howard, Thoma Bravo, and Citigroup, also reported by a single source. This "crypto-native + traditional Wall Street" mixed shareholder structure means that TRM's valuation no longer solely reflects technological expectations but is endowed with a strategic premium for compliance infrastructure in the next cycle.

● Multiple Role Positioning: In both Chinese and overseas reports, TRM Labs is uniformly described as a compliance, investigation, and blockchain intelligence company aimed at the crypto asset ecosystem. Its positioning is not merely as a risk control tool but more like an "intelligence hub" connecting regulators, law enforcement, financial institutions, and trading platforms. This multiple role allows for future development to extend into anti-money laundering solutions, risk monitoring, and regulatory technology, telling a long-term story that far exceeds a single SaaS product.

● Why Compliance is Gaining Traction Against the Trend: In the context of overall macro and crypto market uncertainties, funds are more cautiously avoiding short-cycle narratives and betting on those "essential infrastructure" that are indispensable in any market condition. Compliance and on-chain intelligence precisely meet this characteristic: whether prices rise or fall, regulatory requirements for anti-money laundering and sanctions compliance will only strengthen. Because the business is less correlated with short-term market conditions, companies like TRM are viewed as "defensive core holdings" during periods of volatility, becoming preferred targets for capital in the risk repricing phase.

From Dark Web to Courtroom: Regulatory Signals of 30-Year Sentences

● Dark Web Founder Sentenced to 30 Years: According to a single source report, the founder of the dark web market Incognito Market was sentenced to 30 years in prison for involvement in on-chain related crimes. Although the details of the judicial materials have not been made public, and the briefing deliberately avoids discussing the amounts involved and the technical operations, the sentence itself is enough to send a clear signal: regulatory and judicial institutions will no longer tolerate the use of crypto assets as a "cloak" for evading tracking, engaging in illegal transactions, and money laundering; on-chain behavior is being fully incorporated into criminal justice considerations.

● Deterrence and Demand from Heavy Sentences: A 30-year sentence is not only a ruling on a specific case but also a strong deterrent to potential criminal participants globally. It indicates that once on-chain fund flows are successfully restored and a chain of evidence is established, "decentralization" cannot provide immunity from criminal responsibility. Accompanying this is the urgent demand from law enforcement and financial intermediaries for more refined on-chain tracking tools: from cross-platform address profiling to money laundering path identification, and to evidence presentation that can be accepted in court, all require compliance and intelligence companies to provide verifiable data and analytical frameworks.

● The "Weaponization" Trend of Compliance Tools: In such a judicial and regulatory environment, the role of companies like TRM Labs is undergoing a subtle transformation—from traditional "compliance assistants" to on-chain intelligence arsenals in the hands of law enforcement agencies and large financial institutions. These tools not only help track cross-border fund flows and identify high-risk counterparties but also participate in case investigations and courtroom evidence presentation, promoting a deep coupling between the crypto world and traditional criminal justice systems, with compliance gradually acquiring a "hard power" deterrent attribute.

Behind Binance's Trillion-Dollar Reserves: The Game of Exchanges and Transparency

● Reserve Size and Structure: According to data from a single source, Binance currently ranks first among mainstream trading platforms with a total reserve size of approximately $155.64 billion, of which about 30.5% consists of accounting assets like USDT and USDC. This figure not only highlights its pivotal position in global crypto asset liquidity but also means that any discussions about asset security, reserve sufficiency, and on-chain transparency cannot bypass this platform. Such a large asset pool, if a trust crisis occurs, will have systemic impacts on the entire ecosystem.

● Reserve Disclosure and External Audit Interaction: Recently, trading platforms have generally shifted from "minimal information disclosure" to "actively publishing proof of reserves (PoR)" and on-chain address lists, attempting to alleviate user panic through frequently updated asset snapshots. However, the persuasive power of self-certification remains limited, and more institutions and individual users are seeking to use third-party tools to cross-verify address ownership, fund flows, and liability structures. This demand naturally fosters a reliance on external compliance audits and on-chain data analysis services.

● Why Leading Platforms Need Third-Party Compliance: Faced with regulatory pressure, risk assessments from banking partners, and higher user security demands, leading platforms can no longer meet expectations solely with internal risk control teams. Introducing external service providers like TRM Labs can provide independent perspectives in KYC/KYB, anti-money laundering monitoring, and suspicious transaction reporting, as well as offer "endorsement" for cooperation with traditional financial institutions. In this process, third-party compliance tools are no longer just auxiliary means but have become key infrastructure for exchanges to maintain their brand, expand licenses, and stabilize institutional clients.

Wall Street and Crypto-Native Capital: At the Same Compliance Betting Table

● Subtle Changes in Capital Composition: The shareholder list surrounding TRM Labs' current funding round presents a noteworthy combination: on one side are crypto-native capitals like Blockchain Capital that have been deeply involved in the industry for years, and on the other side are traditional financial and private equity forces such as Goldman Sachs, Citigroup, Bessemer, Brevan Howard, Thoma Bravo (all according to a single source). This is not merely a financial allocation but allows regulators, investment banks, hedge funds, and tech entrepreneurs to form a community of interests for the first time in the niche track of "compliance tools."

● The Real Demands of Traditional Finance: For institutions like Goldman Sachs and Citigroup, investing in TRM Labs is not about betting on the next bull market's token prices but about laying out the infrastructure for risk profiling and compliance intelligence. Whether serving institutional clients, participating in crypto-related transactions, or meeting their own compliance requirements, these institutions' primary concern is how to identify high-risk addresses, block money laundering channels, and meet multinational regulatory scrutiny, rather than achieving multiple returns on token valuations. This positions companies like TRM closer to "infrastructure stocks" in their asset portfolios rather than "high-volatility speculative targets."

● Reordering of Industry Power Structures: When the equity and discourse power of "compliance tools" are simultaneously held by traditional finance and crypto-native capital, the industry narrative also shifts—transitioning from an early emphasis on "de-regulation" and "confronting the system" to gradually embracing regulation and expanding the compliance pie. Compliance and on-chain intelligence are no longer just passive responses under regulatory pressure but proactive weapons for platforms to secure licenses, expand institutional clients, and reshape ecological order. Whoever controls the standards for compliance tools and data has a greater claim to be a rule-maker in the next phase of industry competition, rather than just a rule-taker.

Fraud Accounts and Public Opinion Defense: Compliance Becomes a Brand Moat

● CZ Calls Out Fraud Accounts: According to a briefing, former Binance CEO CZ publicly named a certain account on social media, alleging it was operated by a competitor and involved in fraudulent activities. Regardless of the true ownership behind the account, this incident brings the topic back to what ordinary users care about most: how to identify scams, protect asset security, and how platforms should respond to public opinion and trust crises amidst the noise of social media and misinformation.

● Synergy in Identifying Fraud and Intelligence Sharing: In the context of increasingly sophisticated fraud techniques and frequent multi-platform interactions, individual trading platforms or project parties find it difficult to rely solely on their own data for risk identification. If compliance and intelligence companies can integrate information across multiple chains, platforms, and judicial jurisdictions to build a shareable threat intelligence network, they can detect suspicious funds and related addresses earlier and push alerts to partners. From the user's perspective, this directly enhances asset security; from the platform's perspective, it provides more verifiable evidence materials in the event of disputes or attacks.

● Market-Driven "Compliance Competition": Notably, even in regions where regulatory standards have not yet formed, platforms have begun to use "compliance," "risk control," and "security team strength" as competitive weapons to vie for discourse power. Those who can delist high-risk tokens faster, freeze suspected illicit assets earlier, or cooperate more proactively with law enforcement are more likely to win favor from institutional clients and cautious users. Compliance and risk control have been spontaneously elevated by the market as brand moats, and in this process, service providers like TRM Labs that offer on-chain intelligence and risk scoring have become important behind-the-scenes forces in shaping platform credibility.

The Next Act Under Regulatory Iron Fist and Capital Frenzy

Behind the three clues of TRM Labs entering the unicorn ranks, the founder of Incognito Market being sentenced to 30 years, and Binance disclosing $155.64 billion in reserves, of which 30.5% are accounting assets, points in the same direction: compliance and on-chain intelligence are transitioning from "optional components" to the underlying infrastructure of the entire crypto financial system. Whether it is the tightening of regulatory and judicial practices or the transparency attempts by trading platforms to maintain trust, both are pushing the industry from "concealment" to a new stage of "auditable" and "accountable."

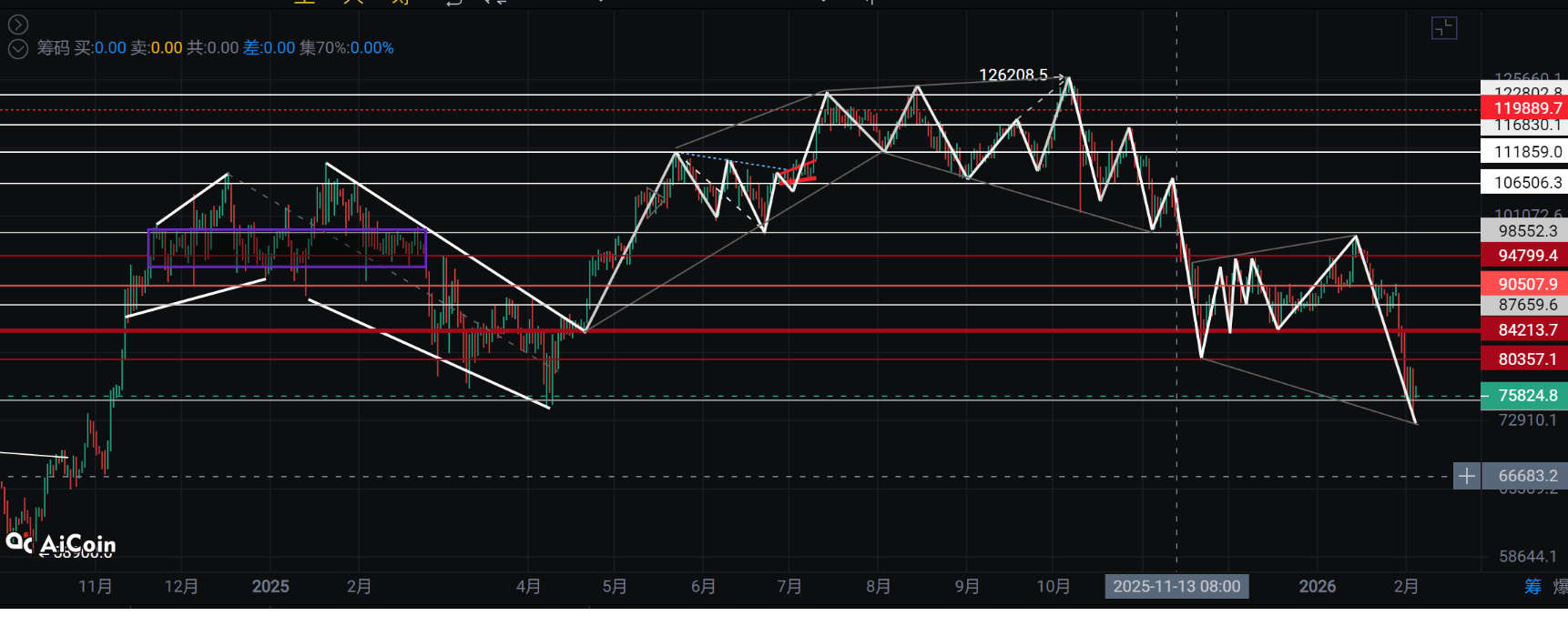

Currently, some key market data still has information gaps, such as Bitcoin's price fluctuations during specific periods and the fund flows of the U.S. spot Bitcoin ETF, which are categorized as pending verification or prohibited from citation and cannot be used as evidence in this article. However, these short-term market conditions and fund flow noises are not enough to shake a clearer medium- to long-term judgment: as regulatory paths gradually clarify and institutional participation deepens, the compliance track surrounding anti-money laundering, risk profiling, and on-chain tracking is evolving along a structurally upward trajectory.

Moving forward, what truly deserves attention will be the tripartite game among regulatory authorities, traditional financial institutions, and crypto-native companies over the dominance of compliance tools and data: regulators hope to control the interpretation and review standards, traditional finance seeks to share growth dividends under controllable risks, while crypto-native institutions aim to avoid marginalization through technological and discourse advantages. In this process, those who possess high-quality on-chain data, have cross-platform integration capabilities, and can be widely accepted within judicial and regulatory frameworks are likely to become key hubs in the next round of power restructuring.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。