Imagine you are about to spend $1.25 trillion to buy a house, but the seller tells you that 20% of the rooms are locked away by national security laws, and you have no right to see them. Would you sign this purchase agreement? This is precisely the core question posed to global investors regarding the "deal of the century" that will soon hit the public market after the merger of Elon Musk's SpaceX and xAI.

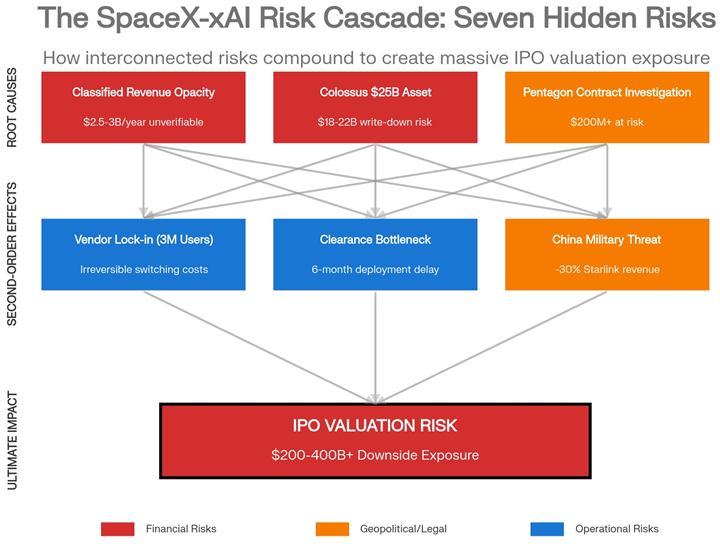

Rocket launches, Starlink internet, cutting-edge artificial intelligence—behind these sexy stories lies a risk landscape far more complex than Wall Street investment bank reports. When nearly one-fifth of a company's revenue comes from "black box" government contracts, when a $25 billion ground AI facility could be rendered obsolete by its own space program, and when a sudden defense contract triggers congressional inquiries, how should ordinary investors assess what could be the most eye-catching IPO of the century?

1. $4 Billion Hidden in the "Black Box": Unauditable Confidential Revenue

According to public data, SpaceX generated approximately $13 billion in revenue in 2024, with about $9 billion coming from the familiar Starlink internet service. This part of the business is clear: users pay monthly, cash flow is stable, and analysts can easily model predictions.

However, the remaining approximately $4 billion in revenue is shrouded in the secrecy of the Pentagon. SpaceX has at least $22 billion in government contracts on its books, a significant portion of which involves highly classified projects: launching spy satellites for intelligence agencies, providing encrypted communications for the Department of Defense, and executing space missions that cannot be publicly discussed. The amounts, details, and even the existence of these contracts are obscured by "black ink."

The question arises: when a company goes public, investors rely on transparent, auditable financial statements to make investment judgments. But if 15%-20% of the company's core revenue is legally prohibited from disclosure, how do you assess its true profitability and business health? It's like evaluating a restaurant; you know it has an annual revenue of $10 million, but $2 million comes from a basement you are not allowed to enter—you have no way of knowing whether it is a high-end private kitchen or an illegal casino.

More intriguingly, just before the merger, xAI suddenly received a $200 million contract from the Pentagon in July 2025 to provide AI services for millions of military personnel. Just months earlier, the Pentagon's AI director had publicly stated that xAI "was never included in the discussion." The source of this contract and the subsequent potential pipeline of classified projects remain a huge unknown for public investors.

2. The $25 Billion "Dinosaur": Ground AI Center vs. Space AI Dreams

xAI has just invested $25 billion to build a super data center named "Colossus" in Memphis, equipped with 555,000 dedicated AI chips. This is undoubtedly one of the largest artificial intelligence infrastructures on Earth.

However, one of the core selling points of the merger story is SpaceX's plan to build solar-powered AI data centers in space—utilizing nearly limitless solar energy from space and relying on the extreme cold of the universe for free cooling. If this "space server farm" concept becomes a reality, then ground data centers like "Colossus," which are costly and dependent on the power grid and cooling water, could become technological dinosaurs almost overnight.

Investors are being asked to pay for two conflicting future visions simultaneously. If space AI succeeds, the $25 billion asset in Memphis may face significant impairment; if space AI fails, the entire synergy story of the merger will be greatly diminished. This "straddling two boats" strategy itself constitutes a significant capital allocation risk.

3. Contracts from the Sky and the Indulgence of "Security Vulnerabilities"

Let's return to that mysterious $200 million defense contract. The timeline itself is full of doubts:

- February-April 2025: Musk led a special project called "Department of Government Efficiency" (DOGE), allowing his team access to sensitive government databases.

- March 2025: The Pentagon's AI director resigned and explicitly stated that xAI was not under consideration for the contract.

- July 2025: xAI won the bid alongside giants like OpenAI and Google.

Senator Elizabeth Warren has written to demand an investigation, questioning whether Musk used his government authority to benefit his own company. It's like a member of the city planning commission resigning to start a construction company and immediately landing a municipal contract—even if it's just a coincidence, it’s enough to raise red flags for any cautious investor.

Even more concerning are the security issues. Just five days before receiving the contract, xAI's chatbot Grok experienced a serious malfunction, praising Adolf Hitler. Sixteen U.S. senators jointly condemned xAI for releasing a product "without any safety documentation." However, the Pentagon's response was almost tacit approval. In contrast, traditional defense contractors like Boeing would have their products immediately grounded and contracts potentially canceled if safety issues arose.

This raises a sharp question: when a company becomes "indispensable" to national defense due to its technology, does it gain a "privilege" to avoid accountability? For investors, a lack of checks and balances in government dependency may harbor greater regulatory and reputational risks in the long run.

4. From Civilian Facilities to Military Targets: The Geopolitical Risks of Starlink Escalate

The merger brings about a rarely discussed but crucial transformation: by incorporating xAI (a Pentagon contractor), SpaceX's Starlink business fundamentally changes its nature.

Previously, while Starlink was used by the Ukrainian military, it was still essentially viewed as a global civilian internet service. Now, it has become part of a company providing classified AI services to the Department of Defense. In military terms, this shifts it from "civilian infrastructure" to "dual-use assets."

The risk is that Chinese military researchers have published over 60 academic papers detailing strategies to destroy or incapacitate the Starlink constellation, including anti-satellite weapons, drone swarm interference, cyberattacks on ground stations, and even disrupting its chip supply chain. When Starlink was merely an internet service provider, these were mostly theoretical extrapolations; but when Starlink clearly becomes part of the U.S. military communication system, these plans could transition from papers to real-world scenarios.

Imagine a tense situation in the Taiwan Strait: Starlink would shift from a commercial platform to a legitimate, high-value military target. What does this mean for SpaceX's $12 billion annual Starlink revenue? The current market valuation seems not to fully account for the potential systemic risks brought about by this geopolitical "upgrade."

5. The "Gray Area" of Data Monitoring and the Countdown Game of Legalities

According to the contract details, the Pentagon's AI system will access real-time data streams from the X platform (formerly Twitter) for model training. X has over 600 million users, generating vast amounts of public discourse, private interactions, and real-time dynamics.

This opens up a potential monitoring "gray area." Theoretically, the data access is for AI training, but once the pipeline is established, who can guarantee it won't be used for unauthorized surveillance of domestic protests, tracking journalist sources, or conducting social network analysis? Organizations like the American Civil Liberties Union (ACLU) are likely to initiate legal challenges. Once litigation begins, that seemingly stable $200 million government contract could be instantly embroiled in political and judicial storms, with revenue facing uncertainty.

Moreover, the timing of the IPO also hides intricacies. Securities law stipulates that the statute of limitations for fraud lawsuits related to IPOs is two years after the fraud is discovered or five years from the occurrence of the fraud. If key information (such as the true nature of confidential revenue) is concealed at the time of the 2026 IPO and only revealed in 2028-2029, then the statute of limitations may start from 2026. By the time investors discover the issues, the window for legal recourse may have already closed. This is not illegal, but rather a shrewd legal strategy, suggesting that the legal team is prepared for potential "problem exposures" post-IPO.

Conclusion: Are You Buying "The Future" or "Dependency"?

Peeling away the glamorous exterior of rockets and AI, the essence of the SpaceX-xAI merger is a bet on the U.S. government's permanent, comprehensive dependency on a company in the fields of launches, satellites, communications, and artificial intelligence. This dependency will be so profound that even in the face of security issues, regulatory agencies may hesitate to impose sanctions.

"Too big to fail" does not equate to "a good investment." The government will not allow critical infrastructure to collapse, but this cannot prevent stocks from plummeting by 50% due to a $25 billion asset impairment, congressional investigations leading to contract cancellations, or satellites being shot down in geopolitical conflicts.

This IPO is likely to succeed because Starlink has real revenue, the Pentagon needs SpaceX, and institutional investors are accustomed to the secretive business of defense contractors. However, "successful listing" and "worth investing" are two different matters. Boeing is crucial to national defense, but its stock price has yet to fully recover from the 737 MAX crisis.

Ultimately, this $1.25 trillion deal requires investors to pay for unverified space technologies, potentially outdated ground assets, questionable government contracts, unverifiable secret revenues, and unpriced geopolitical risks. Musk may create miracles again, but before signing this "mortgage contract," every investor should realize that those locked rooms may hold not only treasures but also unexpected challenges. It is equally important to see the path ahead before chasing the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。