On January 30, 2026, a bombshell was dropped in American politics: President Trump announced the nomination of Kevin Warsh as the new chairman of the Federal Reserve. This decision instantly ignited global financial markets, with gold plummeting over 8% in a single day, the dollar index surging, and stock and bond markets experiencing severe volatility.

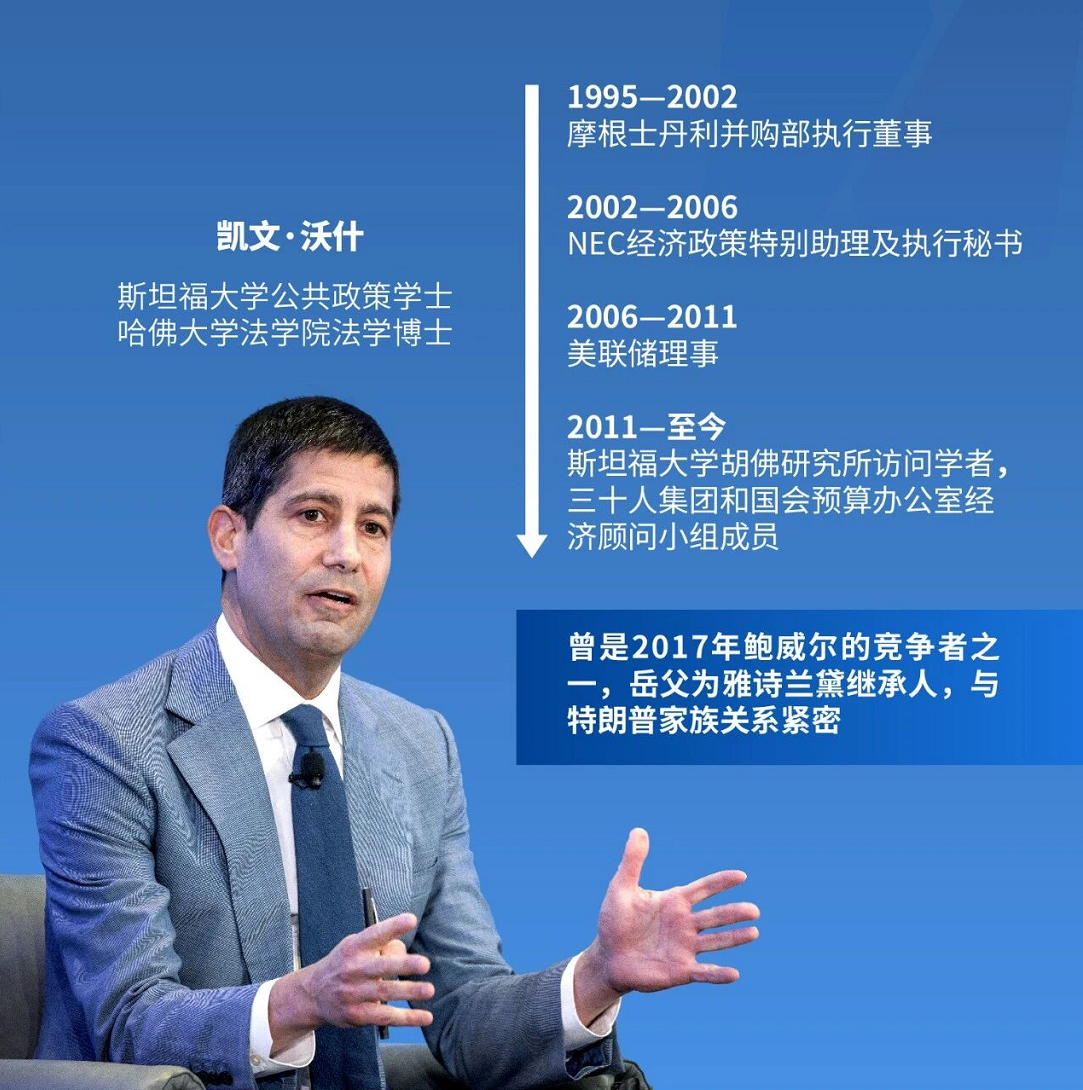

Who is Warsh? This elite figure, who spans the realms of politics, business, and academia, is known for his criticism of quantitative easing but advocates for the contradictory policy of “rate cuts + balance sheet reduction,” vowing to tame inflation with AI and refusing to let the Federal Reserve continue acting as a "big buyer" of U.S. Treasuries. His ascension signals that a transformative storm, unprecedented in the Federal Reserve's century-long history, is about to hit, reshaping the global liquidity landscape.

1. Trump's "Surprising Nomination": Why Choose Warsh?

● Kevin Warsh's nomination was seen by the market as "beyond expectations," as previous popular candidates were mostly dovish figures advocating for aggressive rate cuts to align with Trump's political demand for low interest rates. Warsh, however, is known for his hawkish stance, having long criticized the expansion of the Federal Reserve's balance sheet and advocated for monetary tightening. Why did Trump praise him as the "perfect candidate"?

● Colin Anderson, a political science professor at the University at Buffalo, pointed out that Warsh's nomination indicates that someone successfully persuaded Trump that the Federal Reserve, as a key institution, should not be completely politicized. While Warsh supports rate cuts, he emphasizes policy independence, which creates a subtle balance with Trump's surface demands.

● After the nomination was announced, the market quickly repriced: COMEX gold plummeted 8.35%, marking the largest drop in 40 years, while the dollar index jumped 1.5%, reflecting panic over the marginal tightening of liquidity.

● Looking deeper, Warsh's background makes him a compromise candidate:

○ He served as a Federal Reserve governor (2006-2011), experiencing the financial crisis firsthand and familiar with central bank operations;

○ He later entered the business world, serving as an executive at Morgan Stanley, deeply understanding market dynamics;

○ He is also a researcher at Stanford University, with a solid academic foundation.

○ This "trifecta" experience gives him practical insights when facing complex economic situations. What Trump may value is that Warsh can both push for rate cuts to stimulate the economy and maintain the credibility of the dollar with his hawkish reputation, avoiding a market crash.

2. Decoding the Contradictory Policy: How Does "Rate Cuts + Balance Sheet Reduction" Make Sense?

Warsh's core proposition is perplexing: on one hand, he advocates for rate cuts and liquidity expansion, while on the other, he supports balance sheet reduction. From a traditional monetary policy perspective, this seems like "fighting oneself," but he has a self-contained logic based on "pragmatic monetarism" and the AI productivity revolution.

● First, Warsh is a staunch monetarist, attributing inflation to the Federal Reserve's excessive money printing and fiscal deficits. He rejects the "transitory inflation" narrative of the Powell era, believing that inflation is a policy choice rather than a result of external shocks. Therefore, balance sheet reduction is a necessary means to cure inflation by withdrawing liquidity.

● Second, part of the rate cuts stems from his optimism about the AI revolution. In a November 2025 article, Warsh pointed out that AI technology will enhance productivity, achieving growth without inflation and becoming a "deflationary force." Thus, rate cuts are not aimed at stimulating demand but rather adapting to supply-side expansion, providing businesses with cheap capital.

● However, this combination challenges historical norms. In the history of the Federal Reserve, "rate cuts + ongoing balance sheet reduction" has almost never occurred simultaneously for an extended period. The balance sheet reduction cycle from 2017 to 2019 was accompanied by rate hikes, and by the time rate cuts occurred in 2019, the balance sheet reduction was nearing its end; during the 2022-2025 balance sheet reduction cycle, rate cuts only appeared in the final stages of the reduction.

● Warsh must confront a paradox: balance sheet reduction means the Federal Reserve is selling U.S. Treasuries, while the current market for U.S. Treasuries has shown signs of weakness. In 2025, multiple auctions faced cold receptions, with declining demand from overseas investors. If the largest buyer withdraws, it could trigger a liquidity crisis.

3. Challenging Norms: The Lifeblood of the U.S. Treasury Market and the "Impossible Trinity"

● Warsh's balance sheet reduction proposal directly targets the lifeblood of the U.S. Treasury market. The Federal Reserve holds about $7 trillion in U.S. Treasuries, accounting for over 20% of the market's stock. If it continues to reduce its holdings, it will flood the market with a massive amount of bonds. Data shows that in 2025, U.S. Treasury auctions frequently faced crises: the overseas subscription ratio for seven-year bonds in April hit a four-year low, and the primary dealer support ratio for thirty-year bonds in August soared to 17.46%, reflecting a cooling interest from global central banks and other investors.

● A deeper challenge comes from the theoretical framework within the Federal Reserve. In January 2026, a Federal Reserve research paper proposed the "impossible trinity" of central bank balance sheets: it is difficult to balance scale, interest rate control, and operational frequency. Currently, the Federal Reserve has chosen to maintain a large balance sheet (18% of GDP) to ensure interest rate stability.

● Warsh advocates a return to a small-scale "scarce reserve mechanism," directly challenging this consensus. Additionally, the Federal Open Market Committee (FOMC) has already decided to end balance sheet reduction in December 2025 and initiate a short-term Treasury purchase program. Warsh will need to overturn this collective decision, facing significant resistance.

4. Internal Resistance: FOMC Games and Policy Independence

● Warsh's reforms face internal checks and balances within the Federal Reserve. The FOMC consists of 12 voting members, and decisions require a majority. In the 2026 voting year, 3 regional Federal Reserve presidents are hawkish, and 1 is dovish, so Warsh needs to garner support to push for rate cuts.

● More critically, on the balance sheet policy, the FOMC has a clear consensus to end balance sheet reduction. If Warsh forcibly reinitiates it, it could trigger internal backlash.

● Historical experience shows that while the Federal Reserve chairman has the authority to set the agenda, they must respect the collective will of the committee. Warsh has previously emphasized the independence of monetary policy in a speech titled "Ode to Independence," which may earn him respect but could also exacerbate conflicts with Trump.

● Investment banks reflect this uncertainty: Nomura Securities believes Warsh will take a dovish stance in the short term, prioritizing rate cuts to soothe the market; Barclays sees him as fundamentally hawkish, supporting slow rate cuts due to the AI deflation narrative. Tian Kun, a researcher at Xinhui Securities, points out that Warsh is more likely to make concessions on the balance sheet side, using technical adjustments to ease funding pressures and avoid being interpreted as a policy shift.

5. Market Direction: What Lies Ahead for U.S. Stocks, Treasuries, the Dollar, and Gold?

● Warsh's appointment will reshape the global asset landscape. Galaxy Securities analyzes that rate cut expectations will be beneficial for U.S. stocks in the short term, and with Warsh's inclination to relax regulations, it may boost liquidity and confidence. However, the AI narrative and corporate earnings remain key; if balance sheet reduction triggers volatility, stock market returns may be suppressed.

● The U.S. Treasury market is the most sensitive. Song Xuetao, chief economist at Guojin Securities, states that balance sheet reduction will widen the supply-demand gap for U.S. Treasuries, pushing up long-term yields and mortgage rates, while short-term yields are supported by rate cuts. The dollar may strengthen in the short term due to balance sheet reduction expectations, seen as a signal to defend credit, but its medium- to long-term weakness is hard to change—high fiscal deficits and the ongoing trend of de-dollarization globally remain unchanged. Industrial Securities points out that Trump's policies have damaged the dollar's credibility, and the value of gold as an asset remains certain.

● The recent sharp drop in gold prices has shown signs. Colin Anderson states that assets reliant on liquidity, such as precious metals and cryptocurrencies, will see a slowdown in price growth. However, if the pace of rate cuts exceeds that of balance sheet reduction, gold may rebound. Overall, market volatility is expected to rise significantly, and investors need to be alert to policy turning points.

6. Warsh and Trump: Honeymoon Period and Potential Conflicts

● The relationship between Trump and Warsh began with a short-term alignment of interests. Trump needs rate cuts to stabilize the economy and assist in elections, while Warsh, after taking office, may prioritize rate cuts to solidify his position, and their personal connections (Warsh has ties with the Trump family) reduce initial friction. Song Xuetao believes a honeymoon period is highly likely, but core contradictions are lurking.

● The conflict point lies in: Trump pursues aggressive rate cuts, while Warsh emphasizes independence and advocates for balance sheet reduction to control inflation. If inflation rebounds or the dollar depreciates, Warsh's slowdown in rate cuts may provoke dissatisfaction from the White House; conversely, if rate cuts prove ineffective, Trump may pressure for expanded easing, and Warsh's steadfastness could lead to a repeat of the Powell-era standoff. Mark Dowding points out that risks may emerge after the midterm elections at the end of this year; if the economy disappoints, Trump may attack Warsh as he did with Powell.

● Warsh's ultimate test is how to balance political pressure with central bank credibility. If his policies succeed, they may usher in a new era of growth without inflation; if they fail, they could exacerbate market turmoil and even shake the century-old foundation of the Federal Reserve.

Kevin Warsh's rise marks a crossroads for the Federal Reserve. His "rate cuts + balance sheet reduction" experiment attempts to tame the inflation beast with the wings of the AI revolution, yet he treads carefully. The fragility of the U.S. Treasury market, internal resistance, and Trump's unpredictability present triple challenges. Global liquidity faces reconstruction: the credibility of the dollar may further erode, while the appeal of alternative assets like gold and cryptocurrencies rises, and emerging markets must guard against capital flow shocks.

History will test whether Warsh can navigate a new path amid contradictions. The only certainty is that this storm of new Federal Reserve policies has left the world holding its breath. Investors should pay attention to the June 2026 FOMC meeting; Warsh's debut may set the tone for the monetary landscape in the coming years. In this era of uncertainty, the only constant is change itself—and Warsh is the catalyst for that change.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。