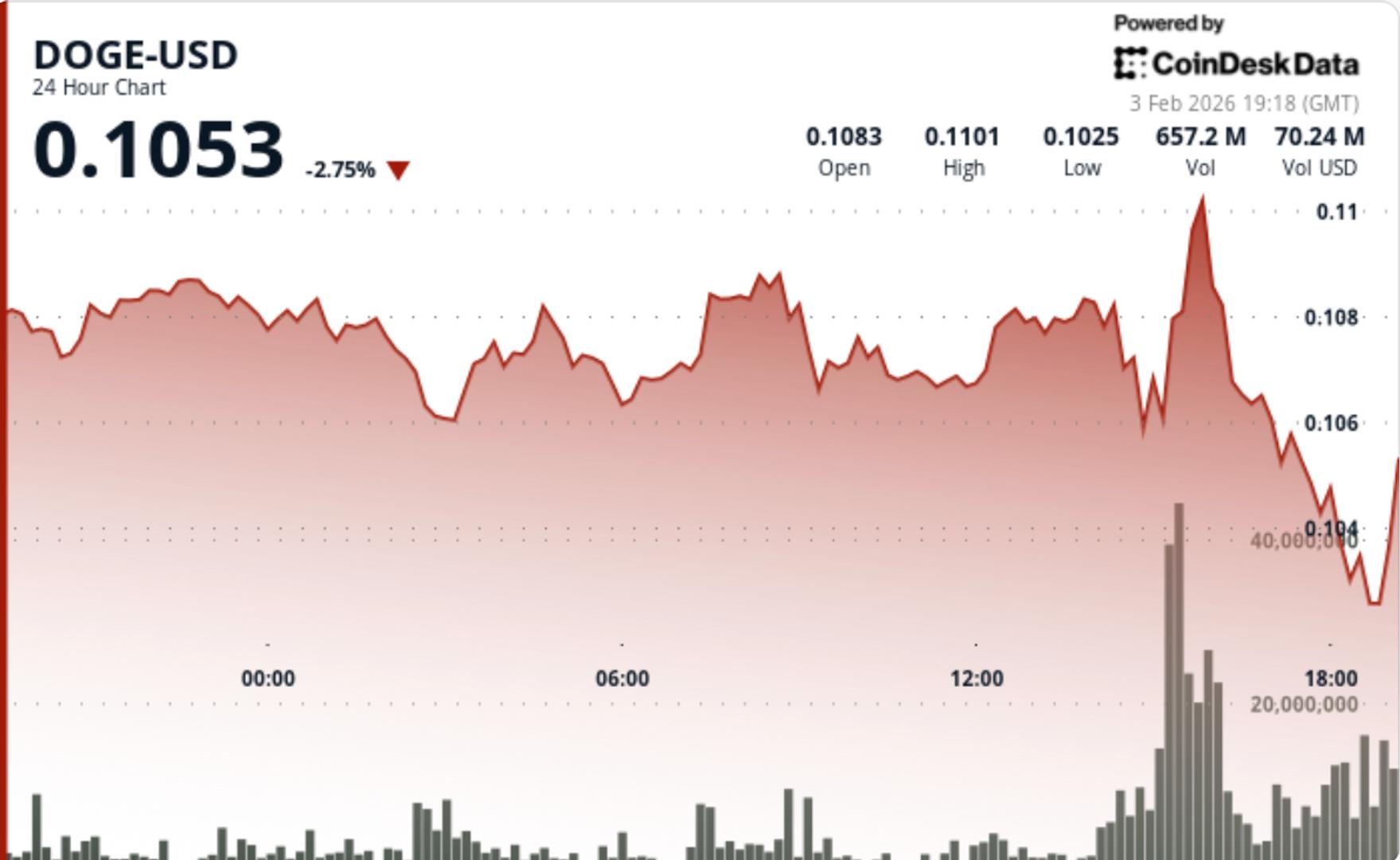

What to know : Dogecoin dropped about 6.9 percent, sliding from roughly $0.1085 to $0.1030 as broader crypto markets weakened. The sell-off was driven by risk-off positioning and heavy derivatives speculation, with futures volume surging even as spot trading declined. Traders view $0.10 as a key support level, with a break lower potentially opening downside toward $0.08, while a sustained move back above $0.106–$0.110 would be needed to signal recovery.

DOGE slid sharply as sellers pushed price through multiple support levels, with a spike in derivatives activity signaling speculation rather than conviction buying.

News Background

- Dogecoin fell alongside broader crypto weakness, acting as a high-beta proxy as ether slid roughly 7% over the same period.

- The move wasn’t driven by DOGE-specific news, but by risk-off positioning that weighed on speculative assets.

- Macro sentiment remained mixed even as U.S. lawmakers narrowly passed a funding bill to end the government’s partial shutdown, removing one near-term uncertainty but doing little to improve appetite for risk across crypto markets.

Price Action Summary

- DOGE fell about 6.9%, sliding from $0.1085 to $0.1030

- Multiple support levels failed during the decline

- A sharp volume spike near $0.110 marked a failed breakout and reversal

- Price stabilized late in the session near $0.103–$0.104

Technical Analysis

- DOGE rejected sharply near $0.110, where a high-volume spike gave way to a fast reversal, flipping that zone into resistance. Selling accelerated once price broke below $0.106, confirming a distribution-led breakdown rather than a brief liquidity sweep.

- The final hour saw capitulation-style selling into the $0.103 area, where bids finally emerged to slow the decline. While that suggests short-term stabilization, structure remains bearish unless DOGE can reclaim lost support.

- A notable feature of the session was the disconnect between futures and spot: derivatives volume surged while spot trading declined, pointing to speculative positioning rather than fresh demand.

What traders say is next?

- Traders see $0.10 as the immediate line in the sand.

- If $0.10 holds, DOGE may consolidate as liquidation pressure fades — but bulls would need a reclaim of $0.106, and eventually $0.110, to argue the selloff has run its course.

- If $0.10 breaks, downside risk opens toward $0.08, with momentum likely to accelerate given the recent failure of multiple support levels.

- For now, DOGE remains a high-beta trade, with futures activity amplifying moves but spot demand needed to confirm any meaningful recovery.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。