The Bitcoin market sentiment has slipped into a deeply bearish zone, mirroring the state during the sell-off wave in November last year, despite a significant price correction in late January, where the market is attempting to stabilize.

Data shows that the number of negative comments related to Bitcoin has surpassed positive comments for the first time in the past two months, a trend that intuitively reflects the growing pessimism among retail traders following the sharp decline in coin prices.

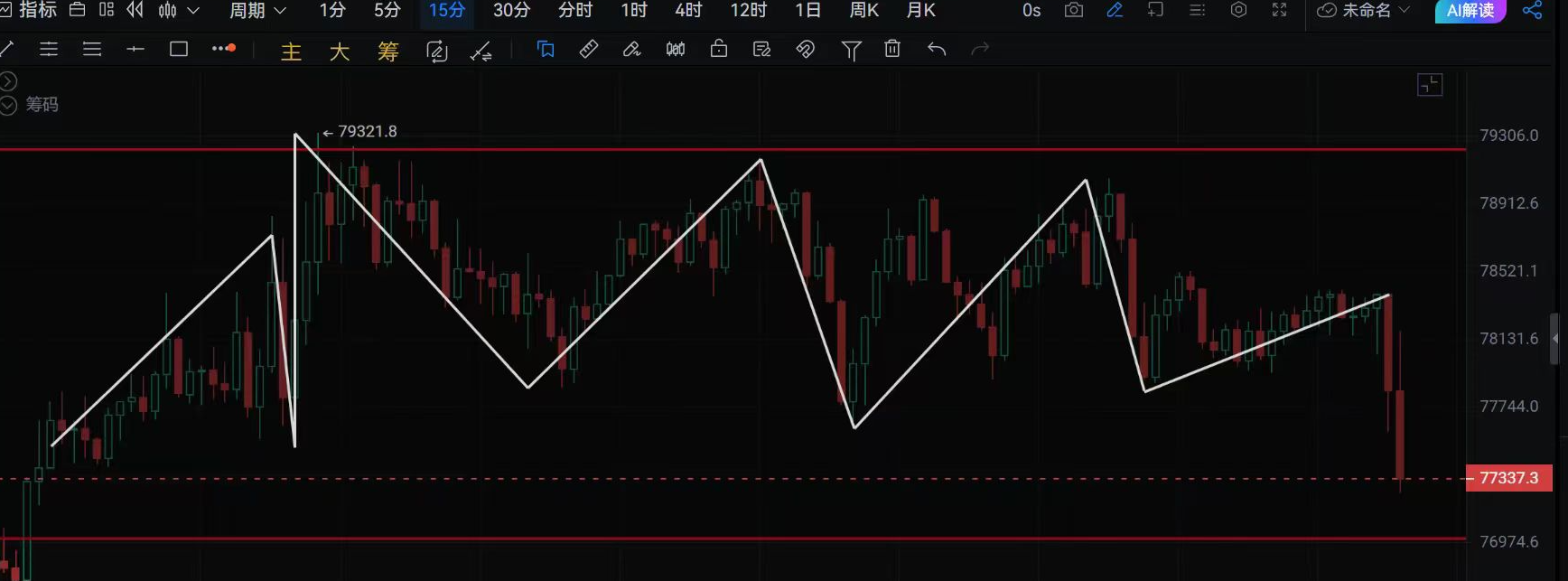

Previously, Bitcoin had cumulatively dropped about 16% since January 28, with prices once dipping to around $74,500, followed by a phase of rebound. In the past 48 hours, the coin price has shown initial signs of stabilization, currently rebounding to around $78,700, with a daily increase of just over 2%, but the price still remains well below the previous short-term psychological support level of $80,000.

The daily chart of Bitcoin shows signs of being oversold.

Technical indicators further highlight the intensity of the recent sell-off, with Bitcoin's 14-day Relative Strength Index (RSI) dropping to around 29, firmly in the oversold region and close to levels that historically accompany short-term rebounds.

During the price dip to $74,500, market trading volume increased, indicating a capitulation-style sell-off rather than a gradual decline. However, subsequent buying pressure remains limited, making it difficult for the price to recover the lost support range of $80,000-$85,000.

From the current market perspective, the price has started to rebound with reduced volume, and a slight pullback near $78,200 could be a buying opportunity, targeting around $80,000. A stable breakthrough could lead to a focus on the $82,000 level.

Follow the public account, "What Can Relieve Worries, Only Jiang Wei," a treasure analysis blogger with high emotional value, sharing trading education for free, bringing stability and clear guidance in the restless trading market, traversing three rounds of bull and bear markets and years of practical trading experience, specializing in naked K, trends, Dow Theory, Gann, harmonics, Chan Theory, wave theory, and other technical analyses, culminating in a unique personal perspective.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。