Written by: Jin Shi Data

Gold experienced one of its most severe price declines in years last Friday and Monday. The market attributed this to the potential appointment of Kevin Warsh, nominated by President Trump as the Federal Reserve Chairman, who may implement orthodox policies, thereby diminishing the appeal of precious metals as a hedge against currency devaluation. This wave of selling has spread to other metals.

However, analysts suggest that a more plausible explanation may be that the unpredictable nature of the options market is disrupting gold's role as a barometer for geopolitical conflict.

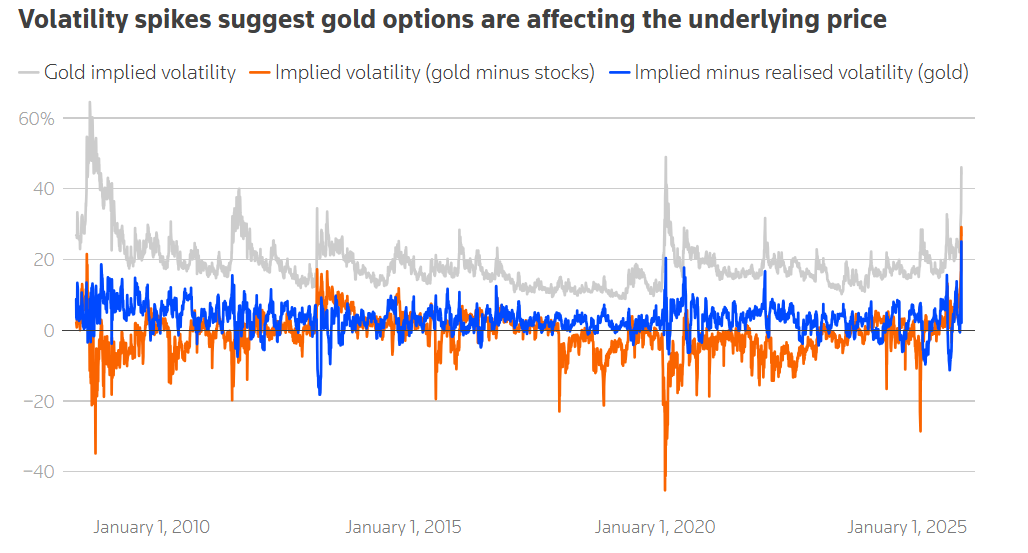

One clue lies in the Chicago Board Options Exchange (Cboe) Gold Volatility Index, which uses options from the SPDR Gold Trust (GLD) exchange-traded fund (ETF) to measure expected gold price volatility over the next 30 days. This index recently closed above 44, a level only seen during the 2008 global financial crisis and the 2020 COVID-19 pandemic crash.

In theory, gold options should track rather than influence gold prices. However, over the past year, investors have purchased a massive amount of GLD "call" options, indicating they are betting on price increases. They have also bet on a surge in silver through the iShares Silver Trust (SLV) fund. Their counterparties, namely banks, thus face the risk of price declines.

Financial institutions hedge by purchasing metal futures or ETF shares. Once this occurs, even a relatively minor shock can snowball into a massive sell-off, as options traders rush to adjust their positions, and banks become sellers.

Analysts point out that this feedback loop is similar to the infamous "gamma squeeze" triggered by retail investors on Reddit buying GameStop stock in 2021. It also echoes the "Volmageddon" of 2018, which led to a sharp decline in the S&P 500 index.

The U.S. stock market has long been accustomed to these capital flows. According to Cboe data, the daily notional trading volume of U.S. blue-chip stock options surged from about $0.5 trillion in 2020 to nearly $3.5 trillion in 2025.

Strong evidence suggests that a similar situation is occurring in precious metals, where options trading volume has also increased. The Cboe Gold Volatility Index reaching the 44 level last week set new records compared to both the actual volatility of gold and the implied volatility of the S&P 500 index. Moreover, the implied volatility had already been rising before the actual gold price plummeted, without the typical accompanying losses in the underlying asset. All of this points to a frenzy of "call" option buying fueling the situation.

The main lesson for gold buyers from the stock market influenced by options is that sell-offs driven by such market distortions often do not last long.

In fact, analysis shows that when gold's implied volatility rises above 40%, the price of gold tends to increase by an average of 10% three months later. Of course, given that gold prices have already risen so much, this time may not be as smooth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。