Why Kevin Warsh’s Fed Nomination Has Markets Nervous—and Divided

The answer matters, because investors are already trading the nomination as if Volcker himself just walked back into the Federal Reserve building.

Trump announced the nomination on Jan. 30, 2026, framing Warsh as a steady hand capable of restoring credibility and discipline at the Fed as Chair Jerome Powell’s term winds down in May. The timing is not subtle: Trump has repeatedly criticized the Fed’s rate posture and its independence, making Warsh’s policy instincts the central question.

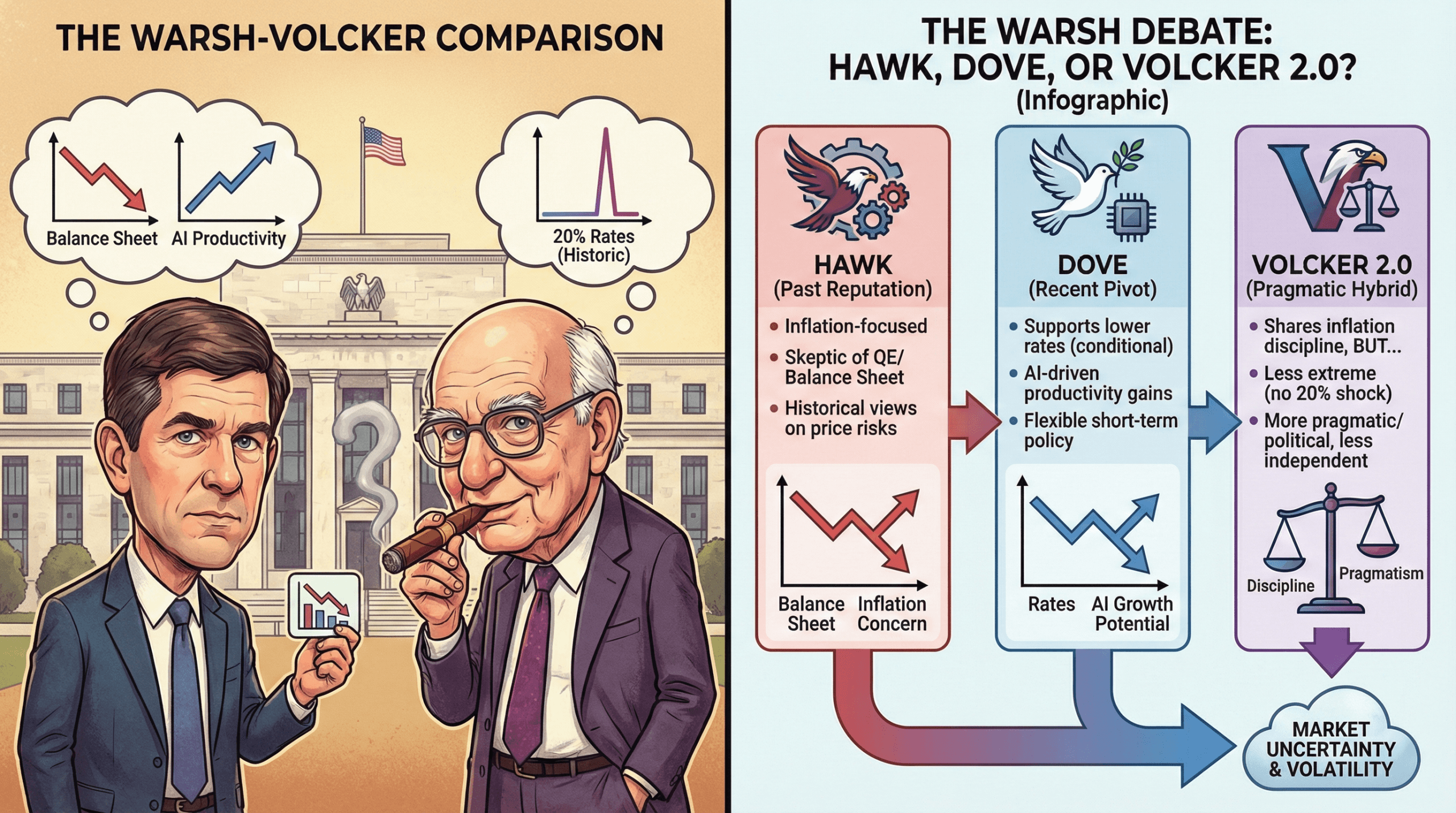

Warsh arrives with baggage—and receipts. As a Fed governor from 2006 to 2011, he earned a reputation as one of the most inflation-focused voices on the board, repeatedly flagging price risks even as the global financial crisis pushed unemployment higher and deflation fears spread. While others embraced aggressive easing, Warsh kept warning that inflation expectations could become unanchored.

At the time, Warsh said:

“ Inflation risks, in my view, continue to predominate as the greater risk to the economy.”

Those views hardened into a public philosophy after he left the Fed. Warsh became a sharp critic of quantitative easing (QE), calling the central bank’s swollen balance sheet a distortion that blurred the line between monetary and fiscal policy. He has repeatedly argued that inflation is not a mystery or a fluke, but the predictable outcome of excess spending and money creation.

“My overriding concern about continued QE, then and now, involves the misallocations of capital in the economy and the misallocation of responsibility in our government,” the Fed Chair nominee stated in 2018.

That history explains why markets initially treated his nomination as a hawkish shock. Gold and silver sold off hard, the dollar firmed, and traders dusted off old Volcker comparisons. In short: the hard-money crowd smelled blood.

But here’s where things get complicated. In recent years, Warsh has openly criticized Powell’s rate stance from the opposite direction—arguing that policy has become too restrictive and is holding back growth. He has said both interest rates and the Fed’s balance sheet should be lower, suggesting a willingness to cut rates if structural reforms do the heavy lifting.

That dual position—hawkish on balance-sheet discipline, flexible on short-term rates—has split analysts into camps. Some see intellectual consistency: shrink the Fed’s footprint and you earn room to ease. Others see political adaptation, particularly given Trump’s long-standing frustration with higher rates.

Volcker 2.0

This tension fuels the Paul Volcker comparison, but the resemblance has limits. Volcker, the 12th Chairman of the Federal Reserve, confronted runaway inflation in the late 1970s and responded by pushing the federal funds rate above 20%, willingly triggering a recession to restore credibility. Warsh has never faced that kind of inflationary inferno as chair, nor has he signaled a readiness to impose similar economic pain.

Volcker’s defining trait was independence. He resisted political pressure across administrations and let the consequences fall where they may. Warsh, by contrast, is widely viewed as more pragmatic—keenly aware of political realities and less inclined to wage war on the White House that appointed him.

That does not make him dovish. It makes him conditional. Warsh has consistently argued that inflation control is non-negotiable, but he also believes productivity gains—particularly from artificial intelligence—could allow for lower rates without reigniting price pressures. If that productivity story holds, he may look accommodative. If it cracks, the hawk likely reappears.

Markets seem undecided. Fed funds futures are pricing in additional rate cuts for 2026, even as traders brace for faster balance-sheet runoff. That combination hints at a hybrid Fed: tighter in structure, looser in signaling, and harder to pigeonhole.

Also read: Gold and Silver Keep Falling as Markets Deal With the Warsh Effect

If confirmed, Warsh may also revive an old-school Fed style—less forward guidance, fewer verbal crutches, and more emphasis on actions over promises. That alone could increase volatility, as markets adjust to a central bank that speaks less and surprises more.

So is Kevin Warsh a Volcker successor? Not quite. He shares Volcker’s skepticism of easy money and institutional sprawl, but not his appetite for economic shock therapy. Hawk or dove depends less on ideology than on conditions—and Warsh has made clear he intends to respond to data, not dogma.

For investors, the message is simple: ignore the labels. Warsh is neither a soft touch nor a crusader. He is a Fed chair nominee who believes inflation credibility matters—and who may prove more flexible than his reputation suggests.

FAQ 🏦

- Is Kevin Warsh considered hawkish?

Yes, based on his long-standing emphasis on inflation control and opposition to prolonged quantitative easing. - Has Kevin Warsh supported lower interest rates?

Recently, yes—particularly if balance-sheet reductions and productivity gains offset inflation risks. - Is Kevin Warsh comparable to Paul Volcker?

Only partially; he shares Volcker’s inflation discipline but lacks his record of extreme rate hikes and political independence. - How could Warsh change Fed policy if confirmed?

He may combine faster balance-sheet runoff with selective rate cuts and reduced forward guidance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。