1. What is a Prediction Market?

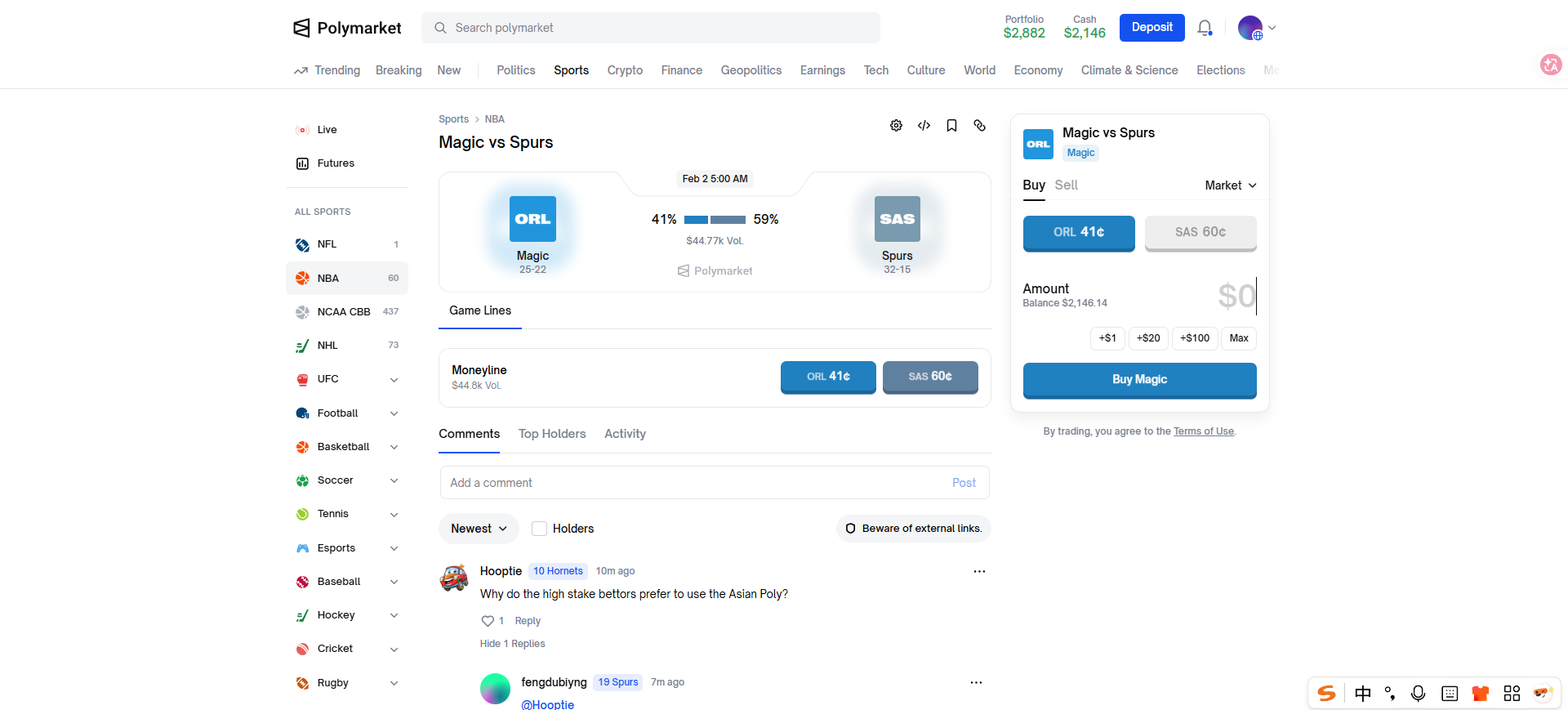

First, let's clarify a concept: a prediction market is not gambling, but rather a probability forecast of upcoming events. It is a market mechanism based on trading the outcomes of future events. Essentially, it is a tool that uses collective intelligence to predict the probability of uncertain events occurring. Participants express their views on the outcomes of events by buying and selling "contracts," the value of which ultimately depends on whether the event occurs or the outcome. The focus is on information aggregation and prediction accuracy.

In short, a prediction market is similar to trading "the outcomes of future events." Participants do not buy stocks but trade judgments on whether an event will happen or not. For example, for the event "Will Biden be elected in the 2024 U.S. election?", the market will issue "Yes" and "No" contracts. The contract price directly reflects the market's consensus probability of the event occurring: if the "Yes" contract price is $0.60, it means the market believes there is a 60% chance that Biden will be elected.

Prediction markets typically focus on binary contracts (Yes/No contracts) but can also be extended to multi-outcome events. Their advantage lies in the market incentive mechanism, which encourages participants to reveal true information, thereby enhancing prediction accuracy.

2. Order Book Trading in Prediction Markets

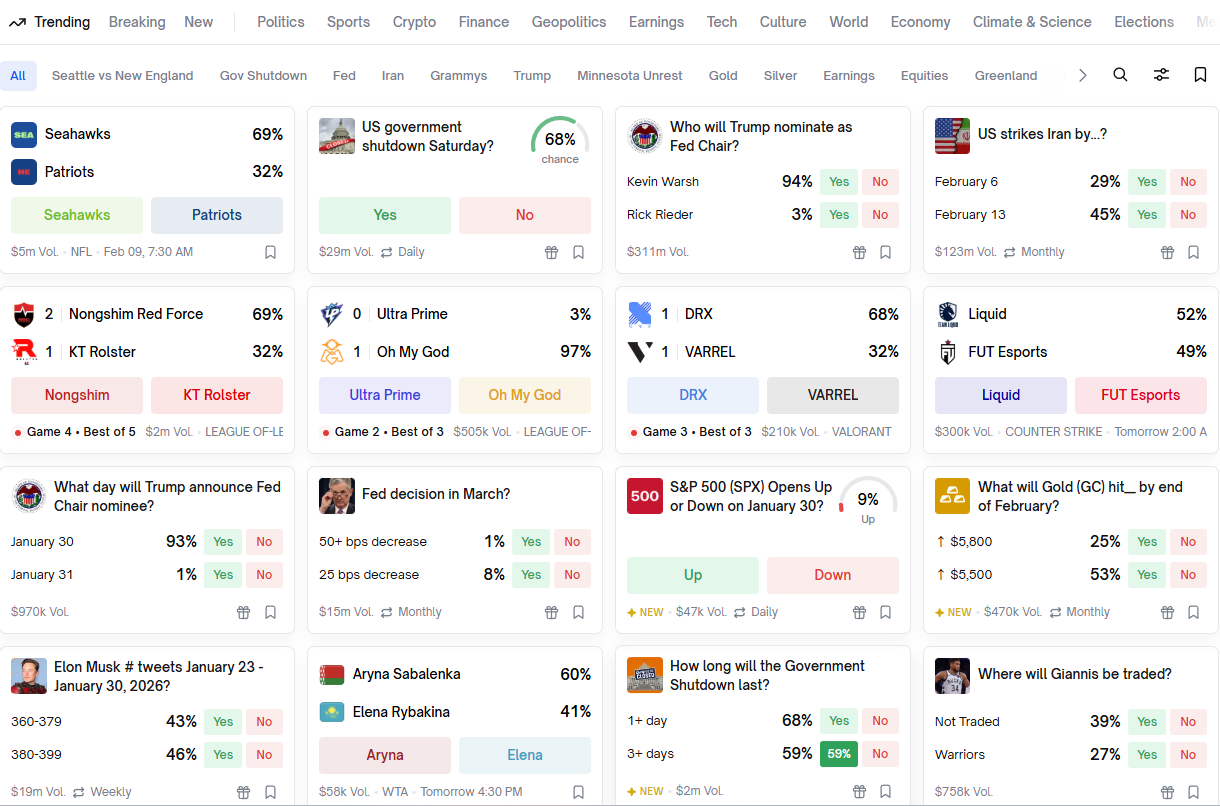

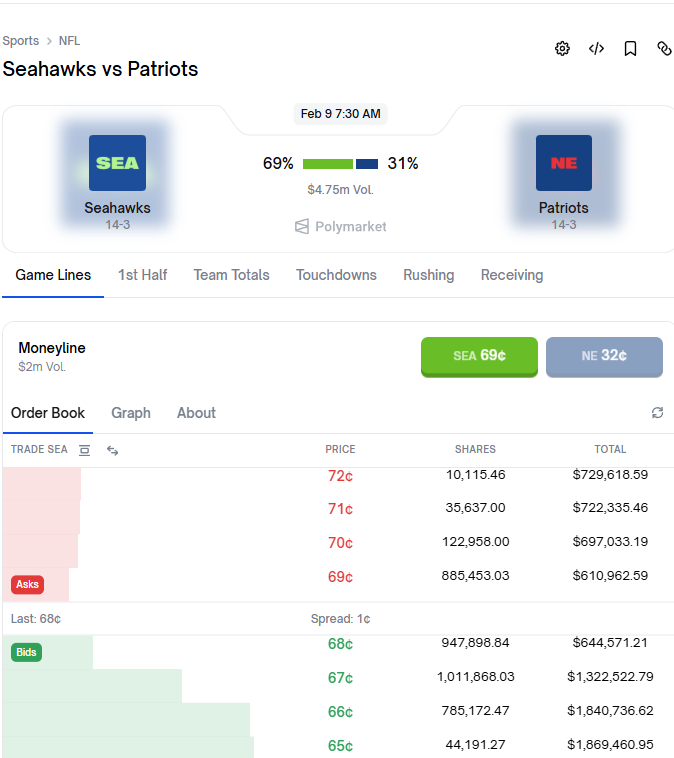

Platforms like Polymarket use a Central Limit Order Book (CLOB) model, similar to traditional centralized exchanges (like stock markets). In this model, prices are no longer preset by algorithms but are driven in real-time by buyers and sellers submitting limit orders. Market prices are determined by supply and demand, reflected in the matching of the best bid (Buy) and ask (Sell) prices.

As we mentioned earlier: contract prices reflect the market's probability of an event occurring. Yes, the order book model perfectly aligns with the concept of prediction markets. It allows the market to dynamically adjust probability valuations. However, it is important to note that the market price (market probability) does not always perfectly reflect the true probability of the event. Influenced by FOMO sentiment, independent information channels, or market maker behavior, prices may deviate. This creates opportunities for arbitrage: identifying value mismatches and buying the undervalued side.

3. How to Arbitrage

There are many arbitrage opportunities in prediction markets, and participants typically play two roles:

- Role A: Market makers/liquidity providers buy the undervalued side and sell the overvalued side at extreme odds, closing positions for profit when prices return to rationality.

- Role B: Direction-neutral arbitrageurs bet on one side of the prediction market while using perpetual contracts to hedge directional risk. The focus is not on betting on price movements but on locking in profits by exploiting odds discrepancies.

The following sections introduce specific arbitrage methods. Please note that all arbitrage is not risk-free and is affected by market sentiment, fees, and liquidity constraints.

3.1 Finding Value Mismatch Opportunities

Polymarket does not have fixed odds like traditional betting, but rather prices are determined in real-time by user supply and demand. The market is easily influenced by sentiment, leading to price distortions, with prices determined by supply and demand forming "probabilities." By scanning a large number of events and using human judgment, one can look for opportunities where market prices do not match true values and buy the undervalued side.

Note: The market may not correct (sentiment persists), or your probability estimate may be wrong. It is not risk-free.

3.2 Intra-platform Arbitrage

Basic idea: For the same event, the combined prices of Yes + No contracts should equal 1 (or for multi-outcome events, the total should equal 1). If a deviation occurs, arbitrage can be executed.

- If the total > 1 (market overall overestimation): short the overvalued side to lock in profits.

- If the total < 1 (market overall undervaluation): buy all outcomes, and you will inevitably profit when settled (total value ≥ 1).

Basic idea: YES + NO does not equal 1 or multiple outcomes do not add up to 1.

Cautions: This strategy is susceptible to the following factors:

- Transaction fees

- Slippage (large orders causing price changes)

- Transaction limits and platform position restrictions

3.3 Cross-platform Arbitrage

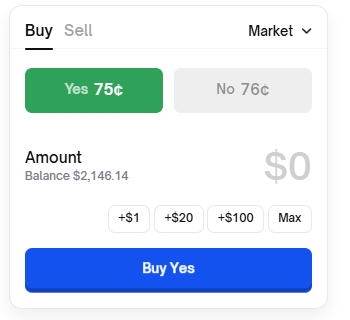

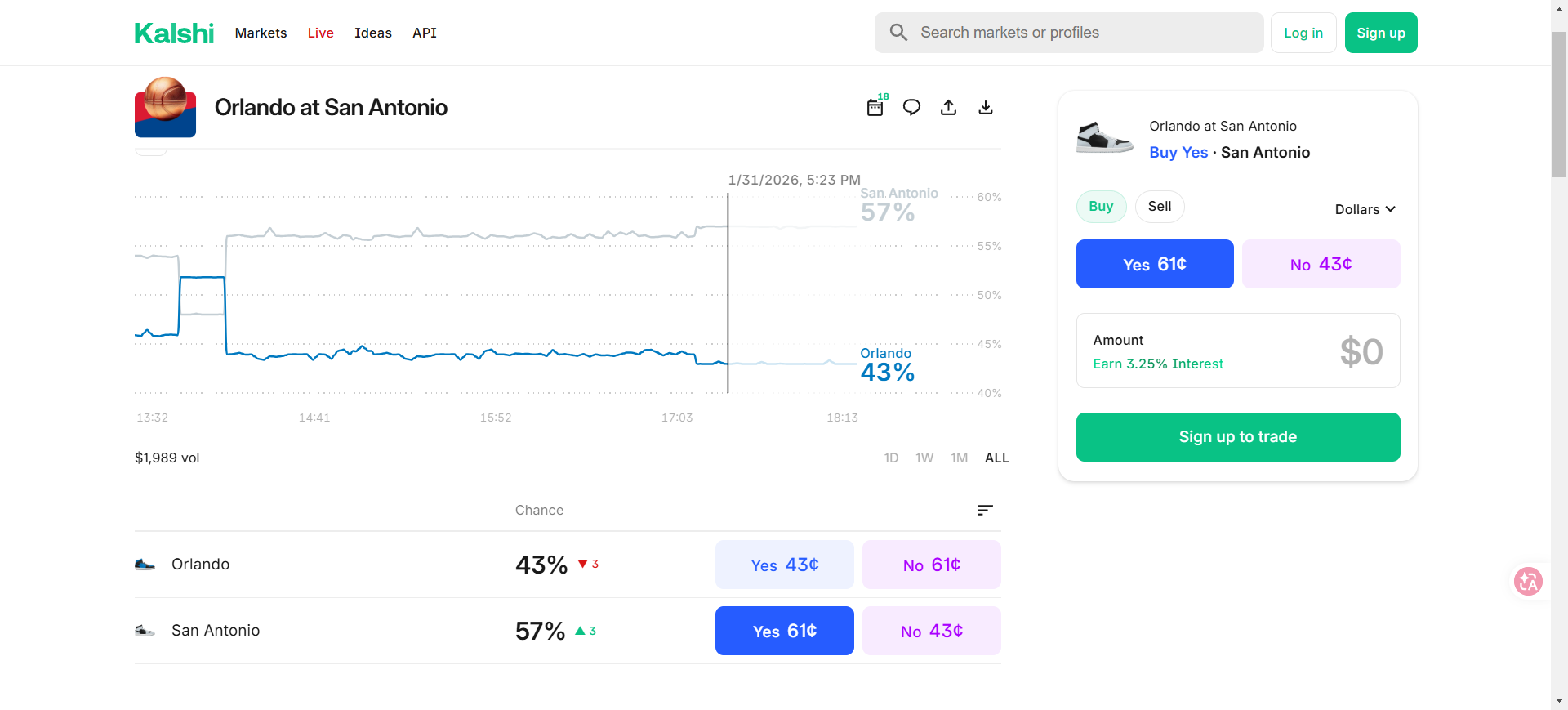

The same event may have different odds on different platforms (e.g., Polymarket and Kalshi). Suppose platform A has high odds for "event occurring" (market bullish), and platform B has high odds for "not occurring" (market bearish). If both platforms describe the same event, one can bet on both sides simultaneously.

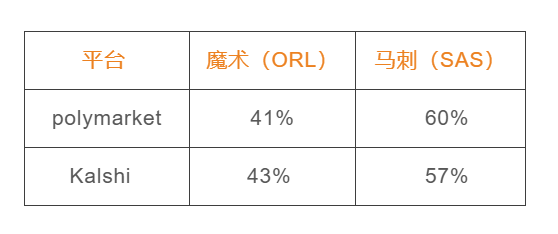

By comparing the real odds between Polymarket and Kalshi, we can create a table.

If you buy the magic team to win on platform B (41¢) and buy the Spurs to win on platform A (57¢), the total cost = 41¢ + 57¢ = 98¢.

- Regardless of which team wins, you will receive $1 (100¢) upon settlement.

- Net profit = 100¢ - 98¢ = 2¢, with a return of approximately 2%.

Cautions: Fees, transfer costs, and settlement differences between platforms may erode profits. Ensure that the event definitions are consistent.

4. Summary and Actionable Arbitrage

Prediction markets are filled with numerous automated bots and professional market makers who capture the majority of profits through efficient algorithms and professional techniques. As ordinary participants, we need to reflect: what is our competitive advantage in the face of these streamlined mechanisms? It is difficult for us to monitor all arbitrage opportunities through high-frequency scanning, so we should integrate subjective judgment.

AI-assisted tools combined with personal insights into specific event domains will become the key path to standing out. This collaborative approach can effectively fill the blind spots of algorithms and achieve differentiated profits.

Actionable suggestions:

- Record and review: Each time you place a bet, meticulously record the position size, hedging details, and outcome. Then analyze: Did the Yes/No contract prices significantly deviate from 1? Are there mismatches in price ranges? Use the review to optimize future decisions.

- Semi-automated monitoring: Use market tools or develop scripts or bots to monitor odds deviations in real-time and issue alerts, improving efficiency rather than relying on manual operations.

- Small-scale real-world validation: Run the complete process with a very small capital, including betting in prediction markets and perpetual hedging, to validate the feasibility of the strategy and accumulate practical experience.

Always remember: the market is unpredictable, and arbitrage must be combined with rigorous risk management and continuous learning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。