Original Title: "Mass Producing Palantir, 58-Year-Old Peter Thiel Wants to Profit from War"

Original Author: Jack, Dongcha Beating

In January 2026, Minnesota was out of control.

The Trump administration announced the termination of Temporary Protected Status (TPS) for Somali nationals, meaning that tens of thousands of Somali refugees who had lived in the U.S. for years must leave by March 17. Minneapolis, which has the largest Somali community in the U.S., became the city most directly impacted by this policy.

Subsequently, "Operation Metro Surge" arrived as scheduled. Over 2,000 federal Immigration and Customs Enforcement (ICE) agents in tactical gear flooded the city, a number that even exceeded the total personnel of the Minneapolis Police Department. They drove black SUVs, conducting intensive raids and arrests in residential areas.

A large number of disturbing videos quickly surfaced on social media. Agents smashed car windows with breaching tools, dragged screaming drivers out of their vehicles in chokeholds, and pressed them onto the cold ground. Among the most shocking incidents was the death of 37-year-old American citizen Renee Good. This legal observer was shot in the head at close range by a federal agent through the windshield while documenting the enforcement actions. Officials claimed she attempted to run people over, but video evidence showed her car was merely turning slowly.

Behind this large-scale hunt lies a name: Palantir.

Multiple investigative reports revealed that ICE was extensively using a tool developed by Palantir called ELITE in Minneapolis. This system integrates vast amounts of data on surveillance targets, including Medicaid, tax records, and utility bills, and algorithmically marks them as target points on a map.

According to publicly available federal contract records, ICE awarded Palantir a $30 million contract modification on April 17, 2025, to develop a platform codenamed "ImmigrationOS." Public contract defense documents explicitly state that the system is designed to support the president's executive order to accelerate deportation actions. Many believe that this platform was specifically tailored for the "surge" large-scale operations that began in 2026.

In recent years, Palantir has been labeled a "data butcher" by public opinion. Its data support for the Israeli military during the Gaza War, combined with long-standing ethical controversies and over a decade of losses, has made Palantir an "unwelcome entity" in both Silicon Valley and Wall Street.

But everything changed in the past year.

From "Data Butcher" to "AI Belief Stock"

In 2025, Palantir exploded onto Wall Street. This company, which had lurked in controversy for twenty years, completed its transformation from "marginal contractor" to "backbone of the U.S. stock market." Being officially included in the S&P 500 in September 2024 was just the beginning; the company subsequently moved its listing from the NYSE to NASDAQ, with its stock price soaring 150% within a year, and its market value briefly surpassing $400 billion, rendering all traditional valuation models ineffective.

Behind this was a dramatic turnaround in its financial data. After experiencing 19 consecutive years of losses, Palantir achieved GAAP profitability for the first time at the end of 2022 and entered a hyper-growth mode in the second half of 2024. By 2025, its quarterly revenue surpassed the $1 billion mark for the first time, reaching $1.181 billion, with year-on-year growth skyrocketing from about 20.8% in early 2024 to 62.7% in the third quarter of 2025.

The core engine of this growth came from the explosion of its commercial business. In the third quarter of 2025, Palantir's U.S. commercial business revenue surged 121% year-on-year. This astonishing figure completely shattered the market's traditional perception of its "government dependency." On Reddit, retail investors hailed it as an "AI belief stock," praising Palantir for building the underlying digital operating system for modern civilization. In 2025, retail investors net purchased nearly $8 billion worth of Palantir stock, making it the fifth most purchased security that year, directly pushing its price-to-sales ratio above 100 times.

However, beneath the intoxicating prosperity lies the dark history of Palantir being ostracized by the entire Western financial system.

In September 2020, in retaliation against investment banks for suppressing its valuation, Palantir CEO Alex Karp and co-founder Peter Thiel chose a highly provocative direct listing model. They bypassed the traditional bank underwriting process, avoiding hefty underwriting fees. This meant a full-scale declaration of war against the entire Wall Street system.

Palantir's "original sin" is rooted in its founding DNA; it was one of the first startups funded by the CIA's investment fund, In-Q-Tel, in 2005. Although it only received $2 million in seed funding at the time, this intelligence agency background deeply bound Palantir's business to the government and military, particularly in its collaboration with ICE.

Since 2014, Palantir has developed the ICM investigation case management system and FALCON mobile application for ICE through a $41 million contract, allowing federal agents to track the geographical trajectories of targets in real-time using mobile phone tower data for identifying and tracking illegal immigrants.

Long-term collaboration with ICE has led to Palantir being classified as a company with "potential human rights violations" and "surveillance society risks" within the ESG framework. Palantir's scores in major ESG rating agencies have long been at the bottom. Ethos ESG once gave Palantir an F rating, with a total score of only 18.1 points (out of 100), ranking it in the bottom 1% of the software industry. In social dimensions such as "accountability" and "LGBTQ+ equality," Palantir's scores were all 0.

This directly led to Palantir being excluded from many ESG funds and banking institutions. In the modern financial system, ESG evaluations are no longer marginal moral references but core valves for banks to assess credit risk, allocate capital, and determine business access. For mainstream banks, supporting a company with a bottom-tier ESG rating not only means regulatory compliance pressure but could also provoke collective protests from their own employees and shareholders.

Amid ongoing social hostility, ESG standards became the most effective financial shackles to strangle Palantir.

JPMorgan Chase was once Palantir's first large corporate client, investing $120 million in 2009 to use its software to monitor internal fraud. However, as this project was labeled "employee surveillance" by public opinion, JPMorgan quickly terminated its collaboration with Palantir and rapidly severed financial ties. Morgan Stanley, as Palantir's long-term financing advisor, slashed its valuation from $20 billion to $4.4 billion in 2018.

Palantir also faced financing difficulties in Western financial markets. Due to its extremely low ESG metrics, Norway's largest asset management company, Storebrand Asset Management, and the Norwegian Government Pension Fund KLP implemented strategies to divest and refuse investment in Palantir, while major European banks began to impose invisible financial exclusion on Palantir.

To survive, Palantir had to turn to non-Western traditional financial powers like Malaysia's sovereign wealth fund Khazanah Nasional for support. This left CEO Karp thoroughly disillusioned with Western traditional finance. He has repeatedly criticized "woke culture" and the hypocrisy of Silicon Valley and Wall Street in public, denouncing them for enjoying the dividends of democratic order while refusing to support the technologies that maintain order.

From its founding in 2003 until the end of 2022, Palantir never achieved GAAP profitability in any year. The gears of fate only began to turn in 2022, thanks to two "explosions" from different dimensions: one erupted from the war in Eastern Europe, and the other was the revolution of large language models hidden within computing power centers.

The Russia-Ukraine war became Palantir's best commercial advertisement. Due to its technology being extensively used on the Ukrainian battlefield for target acquisition, refugee resettlement, and damage assessment, Zelensky personally praised Palantir on social media. European politicians suddenly realized that, in the face of a brutal survival crisis, the moral purity of ESG seemed pale and ineffective.

On the other hand, the large language model revolution ignited by ChatGPT directly provided nuclear fuel for the launch of Palantir's AIP artificial intelligence platform. Palantir's core team recognized that a once-in-a-lifetime "whitewashing" opportunity had arrived. CEO Alex Karp admitted in a 2023 interview, "We have been waiting for this moment for twenty years."

Launched in 2023, AIP is the strategic core of Palantir's response to the wave of large language models. It connects the chaotic internal data of enterprises with categorized labels to the large models, providing them with a "logical exoskeleton." At the same time, its highly aggressive Bootcamp sales model shortened the original sales cycle from a year to just a few weeks. In the first half of 2025 alone, Palantir held over 500 training camps, driving a 65% year-on-year surge in its commercial customer base, with adjusted operating profit margins climbing to an astonishing 51%.

In September 2024, Palantir was officially included in the S&P 500 index, meaning that passive funds tracking the index, regardless of whether they included ESG screening, must purchase its stock. Once critical of Palantir and holding reservations about it, major Wall Street firms have now become key partners or research supporters in promoting AIP.

The victory in the public market allowed Palantir to escape the suffocating fate of being "debanked," but this brutal game revealed a profound institutional fracture. Palantir's breakthrough is a heroic exception; in Silicon Valley, many startups deeply engaged in hard technology are still desperately struggling in the "valley of death" due to the tightening shackles of ESG standards and the politically correct tendencies of traditional banks.

They need a brand new financial infrastructure, a capital force that dares to ignore "woke culture" and can deeply understand its own value.

The Rise of Lonely Mountain: From "Palantir Gang" to New Financial Sovereignty

In July 2020, just before Palantir was preparing for its direct listing, a name that had disappeared for a decade reappeared on the company's board: Alexander Moore.

In the internal epic of Palantir, Moore is a totemic figure, the company's "employee number one." In 2005, when Peter Thiel was still scrambling for the CIA's meager $2 million investment, it was Moore, under the title of Chief Operating Officer, who built the initial framework of Palantir in a modest office in Silicon Valley. In 2010, he chose to leave Palantir on the eve of its stunning debut on the Afghan battlefield, diving into the venture capital circle and eventually becoming a partner at 8VC.

Moore's return in 2020 felt more like a convergence of power. Behind him, 8VC is led by Palantir co-founder Joe Lonsdale, the most industrially ambitious member of the "PayPal Mafia." This return seemed to convey a strong signal: the young people who once reshaped the intelligence community with code were now coming back to reshape America's industrial base.

In the public market's unstoppable momentum of 2025, the "Palantir Gang" joined forces again. Lonsdale, along with Anduril founder Palmer Luckey and their godfather Peter Thiel, pushed through a more audacious plan in the power gaps between Washington and Silicon Valley—establishing Lonely Mountain Bank. This is not a traditional commercial bank; its very birth is a public rebellion against the existing financial order. In the wake of the collapse of Silicon Valley Bank, Lonely Mountain Bank received approvals and endorsements from the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) at an almost "privileged" speed, within just four months.

Behind this "special treatment" is a dramatic shift in the power landscape of Washington and Silicon Valley. In the face of change, bureaucracy had to make way for the "Thiel Network."

Lonsdale proposed a grand vision for Lonely Mountain Bank: to become America's "comprehensive trading company." This concept is rooted in the practical lessons he learned after leaving Palantir to found 8VC. During his tenure at 8VC, Lonsdale anchored its focus on hard technology sectors such as defense, government, and industrial infrastructure, incubating and investing in numerous hard tech companies, including Anduril and Epirus. However, this experience left him in a profound state of "structural despair," which he summarized as a mismatch in the "geometric structure of capital."

In the traditional venture capital context of Silicon Valley, software companies are light on assets and offer quick returns, while defense hard tech companies like Anduril require massive upfront capital investments, often burning through billions of dollars from inception to IPO. Hard tech startups must face the "trinity" of execution pressure: simultaneously operating hardware manufacturing, software integration, and complex Washington political-business relationships. Even more brutally, they confront the insurmountable "valley of death," where the U.S. Department of Defense's budget cycle lasts 2 to 3 years, causing many startups to die in the black hole of the budget process before securing their first formal procurement contract due to cash flow breakage.

Lonely Mountain Bank abandoned the traditional financial credit mindset, significantly absorbing former Navy SEALs and senior engineers from SpaceX involved in the 8VC "Artist Colony" program, examining the underlying data of hard tech companies from unprecedented dimensions. This gave it asset pricing capabilities that traditional banks could not possess. When Anduril presented a test data set for a hypersonic missile, JPMorgan saw high-risk R&D expenditures, while Lonely Mountain Bank saw future defense contracts for the next five years.

This model directly opened up the bottlenecks and credit vacuums in the flow of financial capital to the real industrial sector. Based on this deep hard tech background and its unique government receivables financing model, Lonely Mountain Bank can accurately assess the default risk of a pending contract and provide asset-backed loans accordingly. This means Anduril can use future missile orders and its factory equipment as collateral to obtain current operating funds, no longer needing to give up equity for cash.

However, the most secretive core moat of Lonely Mountain Bank lies in its being a deeply "relationship-based bank." Over the past decade, Peter Thiel and Palantir's network have quietly infiltrated the U.S. federal government and military. Now, this network has transformed from a behind-the-scenes advisory list into a decision-making hub, providing Lonely Mountain Bank's clients with a highway to government contracts.

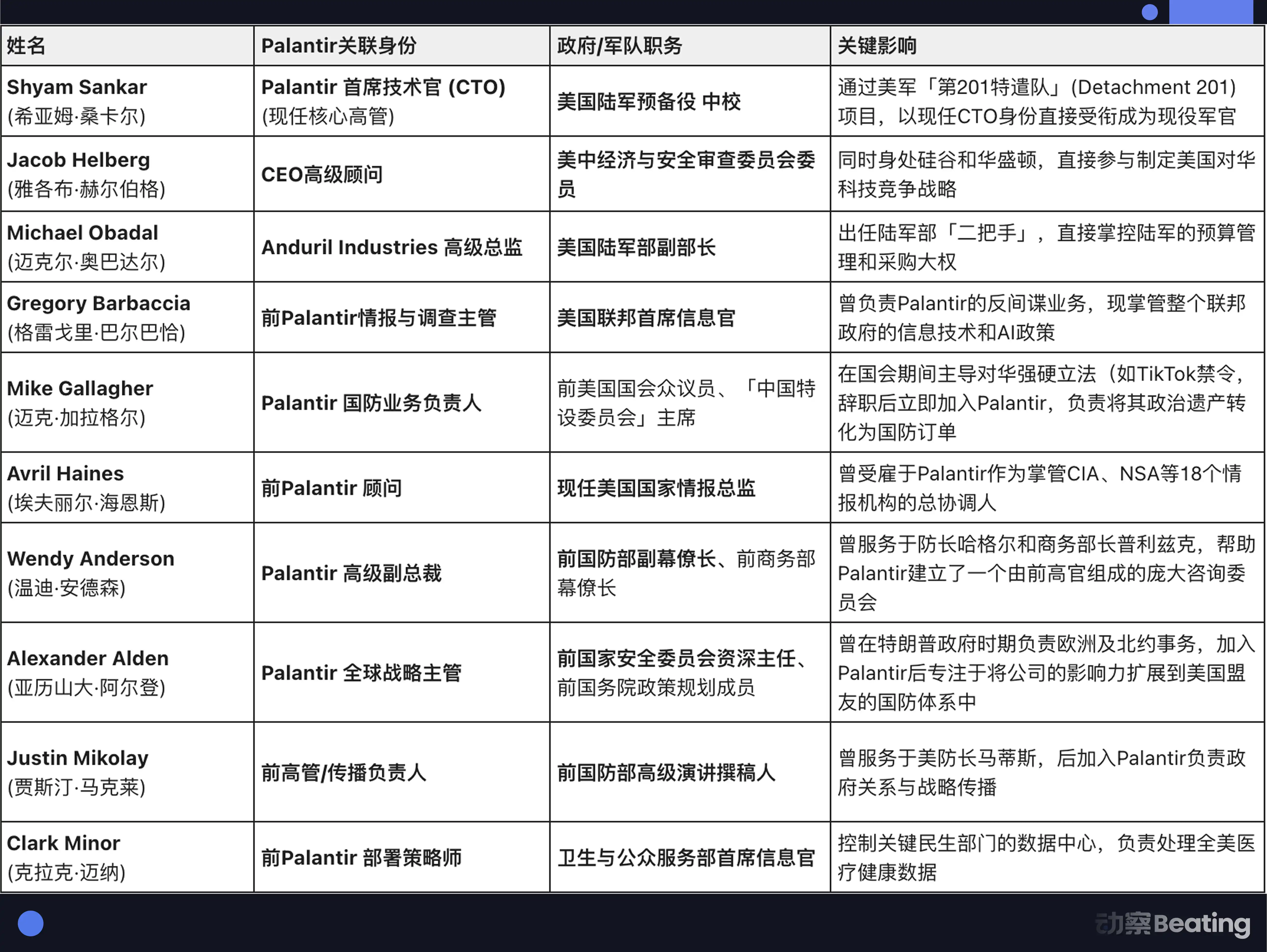

At the Pentagon, Deputy Secretary of the Army Michael O'Briant controls the Army's budget and procurement strategy. Although he has signed a recusal agreement, as a former senior director at Anduril, the "rapid procurement" reforms he promotes directly benefit the non-traditional defense contractors served by Lonely Mountain Bank. The newly established Army "201st Task Force" has directly granted Palantir CTO Shyam Sankar the rank of Army Reserve Colonel. Jacob Helberg, a former senior advisor to Palantir's CEO, is now the Deputy Secretary of State responsible for economic growth. His "Pax Silica" Silicon Valley peace initiative is forcibly reshaping global supply chains, clearing geopolitical obstacles for the mineral and chip companies invested in by Lonely Mountain Bank.

In the future, clients of Lonely Mountain Bank will no longer face the black box of bureaucratic systems but rather "insiders" sitting across the decision-making table.

Under the protection of a vast power network, Lonely Mountain Bank's internal structure presents an extreme contrast of calm. To establish a foothold in the ruins of financial regulation, Lonely Mountain Bank has adopted an extremely conservative strategy known as the "fortress model," maintaining a Tier 1 leverage ratio of no less than 12%, a risk control standard nearly double that of traditional commercial banks. The massive deposits it absorbs are strictly prohibited from being used for high-risk lending and are instead forcibly locked in safes containing highly liquid assets like U.S. Treasury bonds.

At the same time, Lonely Mountain Bank has also built an extremely aggressive payment engine. With the compliance endorsement of former top Department of Justice prosecutor Katie Haun and her crypto venture capital firm Haun Ventures, Lonely Mountain Bank merged with the stablecoin company Atticus, positioning itself as "the most regulated stablecoin trading hub." For defense tech companies operating globally, war does not adhere to a bank's 9-to-5 schedule. Using stablecoins as a settlement layer enables the bank to provide 24/7 funding clearing services during legal holidays, ensuring that supply chains located on the Polish border or at Pacific bases can achieve second-level payments.

Thus, the puzzle of Lonsdale's "American comprehensive trading company" has finally closed the loop. This structure, which played a core role in the post-war rise of Japan, embodies the essence of the integration of financial capital and industrial capital. Now, the "Palantir Gang" is playing an infinite game far beyond the logic of venture capital. In this game, finance is restructured into the "financial fuel" of hard tech, used to drive the long-stagnant heavy industry of America.

However, the geographical center of this transformation is no longer the Silicon Valley Bay Area but points to a heavier and more real coordinate. There, the once "Rust Belt" is being reshaped by this new financial power into America's "new defense industrial corridor."

American Power, Silicon Valley's "Reindustrialization" Dream

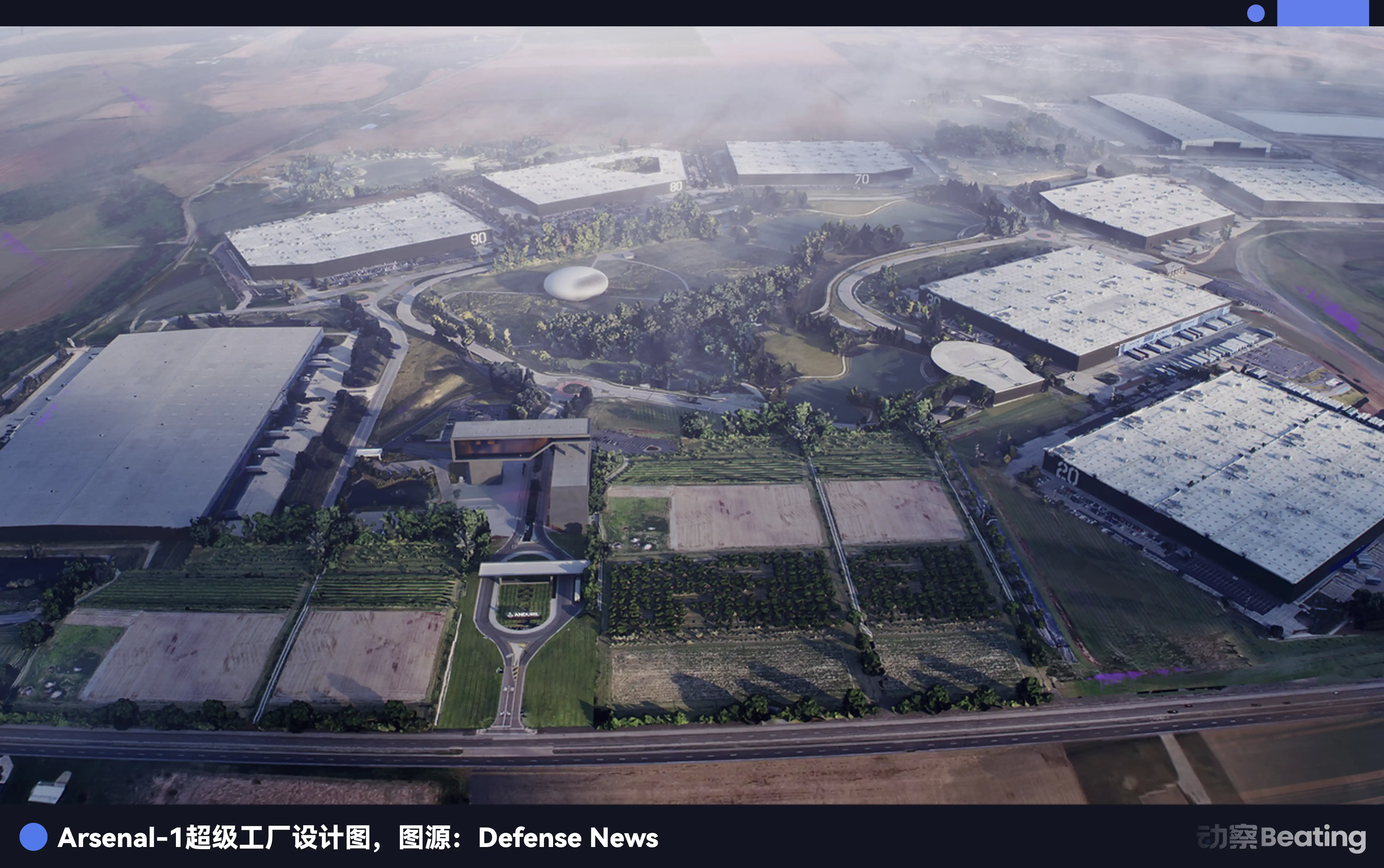

If you drive through the southern suburbs of Columbus in the winter of 2026, you will see a scene with a strong cyberpunk vibe: next to Rickenbacker International Airport, a super factory codenamed "Arsenal-1" is breathing like a giant beast.

This factory, with a planned area of 5 million square feet, is the crown jewel of Anduril and the largest single defense manufacturing project in Ohio's history. Its exterior walls flash cold signal lights, and thousands of engineers and technicians are producing autonomous jet fighters named "Fury," all of which are scheduled in real-time by an operating system called "Arsenal OS." There is no noise of traditional assembly lines, only the quiet flow of data and deadly efficiency.

This land was once the heart of American industry, where Cleveland's steel, Akron's rubber, and Dayton's aerospace components forged the foundation of the "democratic arsenal" during World War II. However, with the advance of globalization and deindustrialization, it became the infamous "Rust Belt," with factory closures leaving behind vast ruins and towns corroded by opioids, becoming scars of America's decline.

But around 2024, the winds shifted dramatically. Peter Thiel and core Silicon Valley capital like A16Z began to shift their focus from software companies in the San Francisco Bay Area to hard tech sectors in the American Midwest. This was a philosophical reckoning initiated by Peter Thiel against the development logic of Silicon Valley over the past twenty years.

The source of this reckoning can be traced back to Thiel's deafening curse: "We wanted flying cars, but instead we got 140 characters." In Thiel's view, the so-called "tech boom" since the 1970s is a massive lie. The elites of Silicon Valley are addicted to the false prosperity of the digital world, optimizing advertising algorithms and social media to make people addicted to clicking on screens, while falling into a fifty-year stagnation in the atomic world.

Thiel believes that this escape from the physical world has not only hollowed out economic growth but also made Western civilization extremely vulnerable in the face of geopolitical challenges. Therefore, he established an investment creed within Founders Fund that carries an apocalyptic tone: if technology cannot solve "hard problems" like nuclear fusion, space transport, and hypersonic defense, then all unicorn companies will ultimately be meaningless.

To realize the philosophical vision of returning to the atomic world, Silicon Valley elites have shown unprecedented political aggressiveness. A16Z has packaged it as the "American Dynamism" movement, with the core aim of using Silicon Valley venture capital to reconstruct those rigid national-level infrastructures.

To this end, A16Z broke the tradition of venture capital firms not directly engaging in politics, establishing a high-profile office in Washington, D.C., and forming a lobbying team composed of former high-ranking officials from the Department of Defense and seasoned lobbyists. According to public records, A16Z's federal lobbying expenditures exceeded $1.8 million in 2025, surpassing the total of the National Venture Capital Association. Their core mission is singular: to help hard tech companies like Anduril and Hadrian cross the "valley of death."

Within the walls of the Arsenal-1 factory, this philosophical movement is transforming into a productivity that disrupts the traditional military-industrial complex.

Traditional military giants like Lockheed Martin are accustomed to cost-plus contracts, meaning that regardless of how long R&D is delayed or how much costs overrun, the government will foot the bill, essentially rewarding inefficiency. In contrast, the Anduril model is a typical "Thiel-style" approach—using venture capital to self-develop products, rapidly iterating until the product matures, and then selling it to the military.

At the same time, the "American Dynamism" camp emphasizes absolute supply chain sovereignty, with SpaceX being the best example. Unlike traditional defense contractors that outsource components to a global supply chain, Anduril builds its own solid rocket engine factory to ensure that American missiles can still launch from their warehouses even if global shipping is cut off during war. Here, the production line itself is part of the software; through "Arsenal OS," the factory can seamlessly switch from producing reconnaissance drones to producing cruise missiles within weeks, a flexibility unimaginable in traditional rigid production lines.

This "reindustrialization" movement has a political ultimate umbrella—Vice President J.D. Vance from Ohio. As a former disciple of Peter Thiel, Vance is the perfect link between Silicon Valley capital and Rust Belt workers. After taking office as Vice President, he became the highest spokesperson for "American Dynamism" in the White House, vigorously promoting an upgraded version of "Buy American" provisions and providing substantial tax credits for tech companies building factories in the Rust Belt.

Data seems to validate the madness and success of this strategy. By early 2026, Ohio's manufacturing output had achieved double-digit growth for four consecutive quarters, with over 15,000 new high-end manufacturing jobs created. Not only Anduril, but Intel's wafer fabrication plant in Licking County and the fusion startup Helion Energy supported by Lonely Mountain Bank have also established roots in this land.

With the alliance of Silicon Valley elites and Washington power, this is no longer just Thiel's philosophical utopia; America's "reindustrialization" seems to be transforming from a hollow slogan into a reality interwoven with steel and code.

Achilles' Heel of Leviathan

As we pull our gaze away from the bustling munitions factories in Ohio and back to the global supply chain map, the revival fervor of Silicon Valley elites will soon be doused by cold facts. This American reindustrialization machine, attempting to reverse the historical gravity, is speeding toward invisible reefs formed by physical limits and economic laws. This is the fundamental logical deadlock of geopolitics and macroeconomics.

The most fatal soft spot is the buried curse of elements. While the Arsenal-1 factory can assemble drones day and night, the key raw materials that constitute the nerves and bones of these machines are not under its control. This is a deeply ironic closed loop. According to data from the U.S. Geological Survey (USGS), China controls about 90% of the global rare earth refining capacity. The Mountain Pass mine in California is the only rare earth mining site in the U.S., but the ore extracted here still needs to be shipped to China for refining due to a lack of domestic separation technology, and then bought back at a high price. This means that the new factories in Ohio are essentially using materials from China to manufacture weapons intended to contain China.

Alongside the supply chain crisis is the "kilowatt war" occurring on the U.S. power grid. While promoting "American Dynamism," Silicon Valley elites deliberately avoid an awkward physical fact. The high-energy-consuming AI data centers and new manufacturing industries they rely on are engaged in a life-and-death struggle on an increasingly aging power grid.

The computational power required for Palantir to train the next generation of large models is growing exponentially, with the energy consumption of its single data center nearing that of a medium-sized city. According to predictions from Boston Consulting Group, by 2030, the electricity consumption of U.S. data centers will account for 7.5% of total electricity consumption, while the recovery of manufacturing will further squeeze the remaining space. Before the fusion technology invested in by Lonely Mountain Bank becomes commercially viable, the U.S. faces a zero-sum game: when the digital brain and the industrial body compete for limited energy resources, the movements of this giant are bound to become fatally rigid due to insufficient blood supply.

The deepest and most difficult knot to untie lies in the genetic paradox of dollar hegemony. Historically, no country has ever simultaneously served as "the world's largest industrial exporter" and "the global financial hegemon," as this requires two diametrically opposed monetary policies. To revive manufacturing and capture markets through the export of weapons and industrial goods, the U.S. needs a weak dollar to lower production costs. However, to maintain Wall Street's financial hegemony and attract global capital back to support financial prosperity, it must also maintain a strong dollar.

This is the modern version of the famous "Triffin Dilemma."

Vance and Thiel are attempting to forcibly reverse this flow through administrative means, transforming the dollar from a public good serving global financial circulation into a national tool serving domestic industry. This means that the U.S. may need to tolerate long-term inflation, even forcing Wall Street to relinquish profits through administrative intervention to subsidize the assembly lines in Ohio. This is a political gamble that touches the very foundation of the nation. Are the financial capitalists of Manhattan really willing to sacrifice their global financial scepter for the workers of the Rust Belt?

From the cold hunting grounds of Minneapolis to the secret convergence in the corridors of Washington power, a group of "hackers" who once reshaped the intelligence community with code are trying to rewrite the physical world with the same logic. They are betting money, reputation, and even the fate of America, attempting to prove that the "Silicon Valley model" can save an empire's twilight. The answer may not lie in those polished pitch deck presentations but in the next winter storm, whether that fragile supply chain can still turn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。