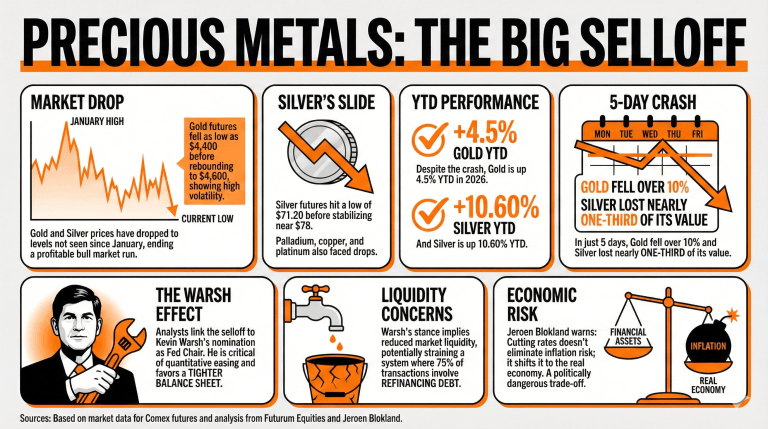

Gold and silver continued their selloff, dropping to prices not seen since January, closing a very profitable bull market for precious metals’ investors.

Comex gold futures saw a significant retrace, falling as low as $4,400 during Monday morning and later rising to $4,600, exhibiting high levels of volatility that gold, an asset considered a traditional safe haven, is not expected to experience.

In the same way, silver futures fell, reaching a session low of $71.20 at the time of writing. Futures later rose and stabilized toward the $78 mark. Palladium, copper, and platinum also faced similar dips.

With this fall, gold is still in the green this year, rising 4.5% year-to-date (YTD). Silver also maintains a winning performance in 2026, with prices up 10.60%.

Even so, gold futures have fallen by close to 10% during the last 5 days, and silver lost almost a third of its value in the same period, a testament to the intensity of the precious metals sell-off.

Analysts are linking this commodity sell-off to the nomination of Kevin Warsh to become the next Chairman of the Federal Reserve. Shay Boloor, chief market strategist at Futurum Equities, stated that Warsh was openly critical of quantitative easing, favoring a tighter Fed balance sheet. This means that liquidity in financial markets will be affected.

Others are unsure about the feasibility of making these changes without a spillover to Main Street. Jeroen Blokland, author of The Great Rebalancing, stated that shrinking the Fed’s balance would “immediately strain a financial system in which roughly 75 percent of all transactions revolve around refinancing existing debt.”

“Cutting rates to support economic growth does not eliminate inflation risk. It merely shifts inflation from financial assets into the real economy. Politically, that is a dangerous trade-off,” he concluded.

What recent trend has impacted gold and silver prices?

Gold and silver have experienced significant selloffs, dropping to levels not seen since January, ending a profitable bull market for investors.What were the recent price fluctuations for gold and silver futures?

Gold futures dipped to $4,400 before stabilizing at around $4,600, while silver futures fell to a low of $71.20, eventually rising to near $78.How does the selloff affect the year-to-date performance of gold and silver?

Despite the recent drops, gold remains up 4.5% year-to-date, and silver has increased by 10.60% in 2026.What factors are analysts linking to the selloff in precious metals?

Analysts connect the selloff to Kevin Warsh’s nomination as Fed Chairman, as he has criticized quantitative easing and favors a tighter Fed balance sheet, affecting market liquidity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。