After the plunge in gold and silver, the U.S. stock market is also facing pressure. On February 2, Nasdaq index futures fell nearly 1% before the market opened, indicating another weak trading day. The S&P 500 index has retreated 0.43% from its peak, and the fear index VIX has surged to 17.44. Market sentiment is clearly turning cautious.

From a technical perspective, the Nasdaq index has been oscillating at high levels for three months, forming an ascending wedge structure. Now, this key upward trend line has been effectively broken for the second time, significantly undermining market confidence. If tonight's daily closing price is below the previous low, forming a "Lower Low," a larger downward trend may begin.

What further unsettles the market is the "Epstein Files," which have been brewing since last weekend. This batch of over 3 million pages of documents involves Kevin Warsh, the next Federal Reserve chair candidate nominated by Trump's new administration. His name appeared on the guest list for the 2010 "St. Barts Christmas Party." This has turned distant political gossip into a real risk hanging over the market.

Political Risk Escalation

The market's panic primarily stems from a reassessment of the policy uncertainties of the "Trump 2.0" era. Warsh is a hawkish figure, and his nomination almost signals the end of the low-interest-rate era.

Warsh has long been a vocal critic of the Federal Reserve, arguing that authorities need to undergo a "systemic change." He has publicly criticized the Fed for cutting interest rates by a full percentage point when inflation exceeds targets in 2024, and then hesitating afterward, damaging its credibility.

Kevin Warsh, the next Federal Reserve chair candidate nominated by Trump's new administration

Warsh's core argument is that the Fed's massive balance sheet distorts the healthy functioning of the economy and fuels asset bubbles. He advocates for reducing the balance sheet, even if it means implementing tightening policies. This combination of "hawkish rate cuts" has left the market worried about a sharp tightening of future monetary policy.

The release of the Epstein Files has exposed enormous, unpredictable political risks to the market. Although there is currently no evidence that Warsh participated in illegal activities, his name being associated with this century's scandal constitutes a significant political liability, making an already controversial nomination even more difficult.

Additionally, the uncertainty surrounding the Trump administration's signature tariff policies has raised market concerns. If a new round of tariffs expands, it could not only undermine consumer confidence and corporate profits but also lead to an even larger fiscal deficit.

It is predicted that in just the first three months of 2026, the U.S. fiscal deficit will reach $601 billion. This fiscal outlook, combined with the political trust crisis exposed by the Epstein Files, creates an extremely fragile market environment.

Global Market and Commodity "Bloodbath"

The commodity market was the first to ignite a "long squeeze." Traditional safe-haven assets like gold and silver experienced an epic crash, with gold prices dropping by as much as 12% and silver plummeting 36%, recording the largest single-day drop since 1980 after a trading volume of $30 billion in ETFs. Highly leveraged long positions were concentratedly liquidated in a short time.

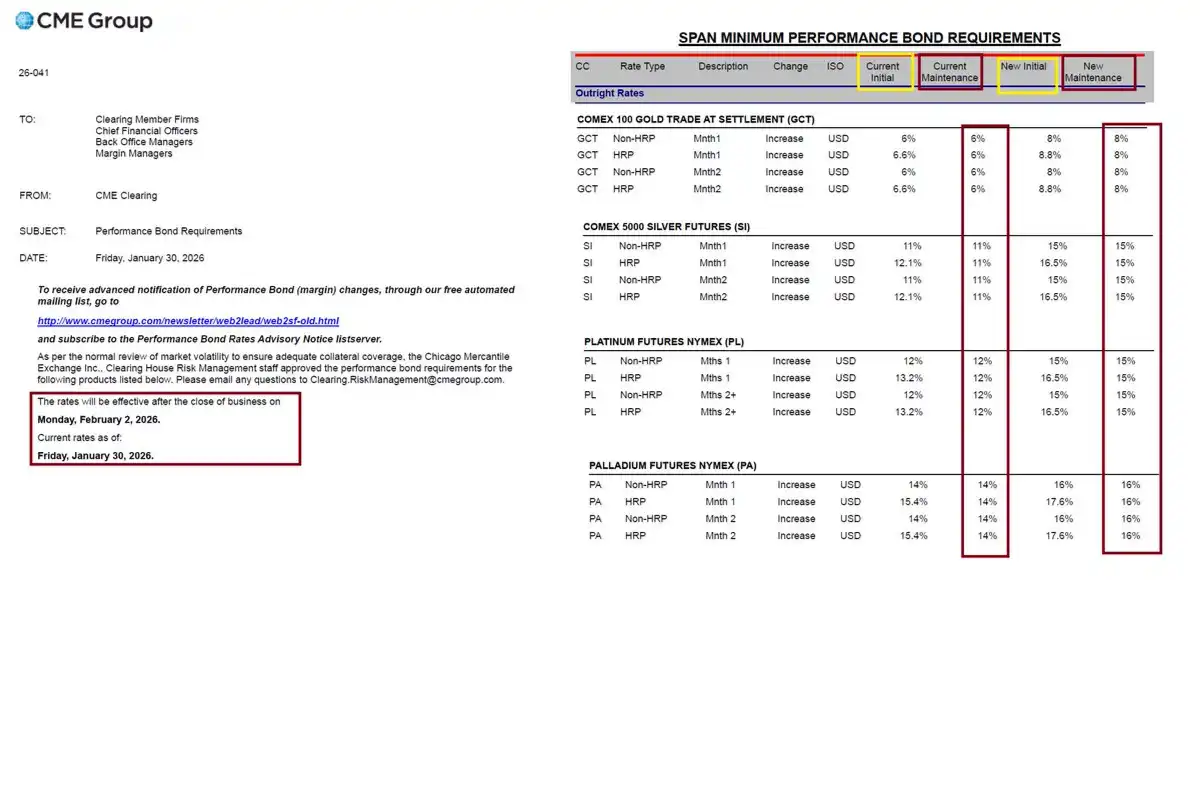

As prices fell, the Chicago Mercantile Exchange (CME) quickly raised margin requirements for gold and silver futures. For example, the margin ratio for silver futures for non-high-risk accounts was raised from 11% to 15%. This forced many undercapitalized long traders to be liquidated, with sell orders flooding the market, further crushing prices and creating a vicious cycle. According to statistics, the liquidation amount for tokenized futures alone reached $140 million within 24 hours.

The Chicago Mercantile Exchange announced that the margin ratio was raised from 11% to 15%

This storm also affected the domestic market, with several gold shops in Shenzhen's Shuibei facing "explosions" due to participation in unqualified gold futures betting transactions, with the amount involved possibly reaching billions, affecting thousands of investors.

Crude oil prices also did not escape, falling 5.51% to $61.62 per barrel. The weakness in Asian stock markets had already issued a warning, with the Nikkei index down 1.11% and the Hang Seng index plunging 3.15%. Bitcoin, as a barometer of risk assets, also fell below the psychological threshold of $75,000. Behind this series of chain reactions, a global deleveraging event may be occurring.

When investors are forced to liquidate in one market (such as commodity futures) due to high leverage, they must sell assets in other markets (such as Asian stocks and Bitcoin) to raise margin, triggering cross-market risk contagion. If this liquidity drought continues, the next asset to be sold off may be the U.S. stock market, which is currently overvalued.

Economic Data and AI Bubble

Cracks in the economic landscape are becoming increasingly clear. The upcoming employment report has become the focus of market attention. If the data shows an unexpected cooling in the labor market, concerns about an economic recession will quickly escalate. The Federal Reserve is currently maintaining interest rates, but with inflation remaining high, its policy space is extremely limited. If inflation does not fall as expected, future rate hikes will be inevitable.

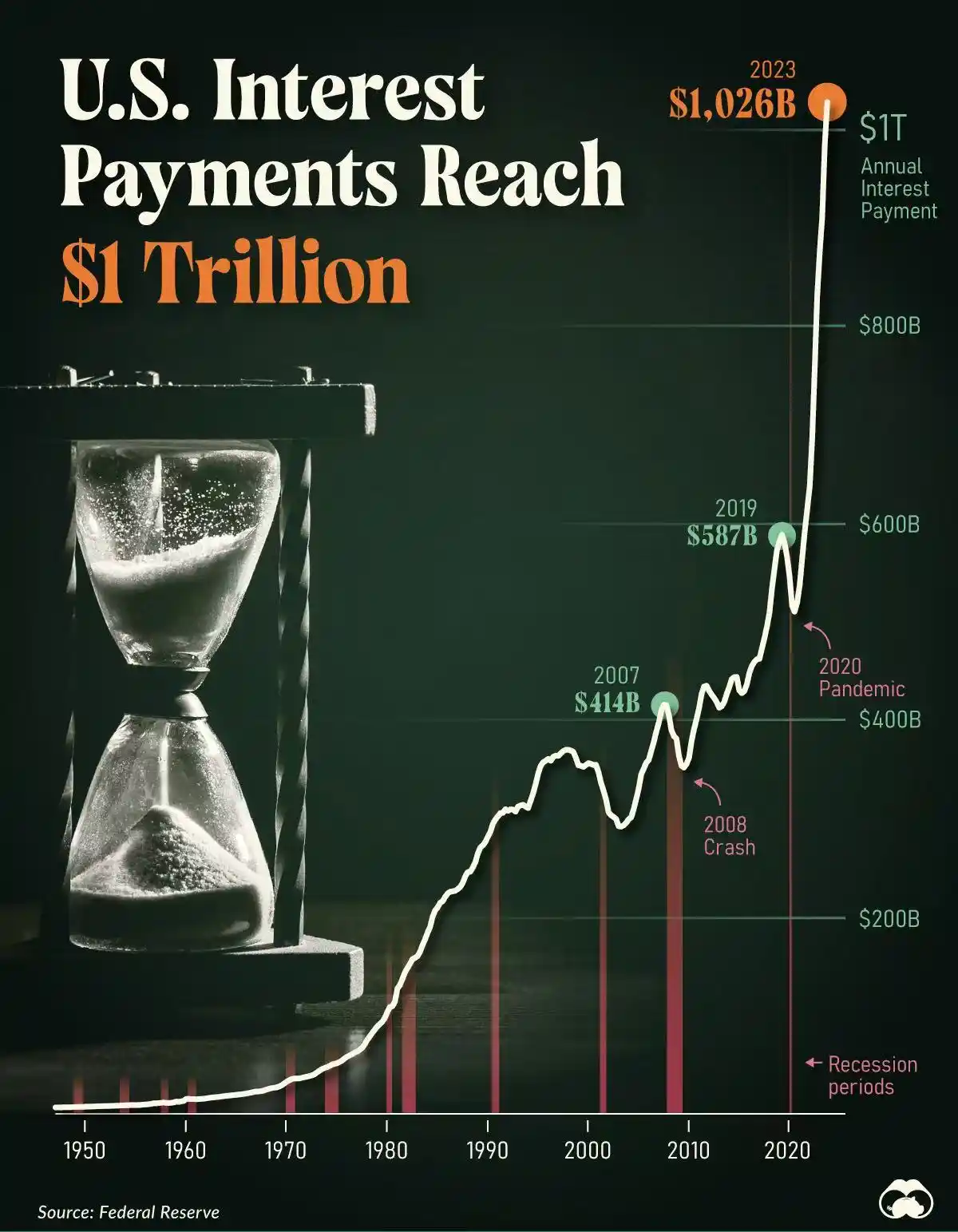

The yield on the 10-year U.S. Treasury has climbed to 4.218%, and the massive interest payments on U.S. government debt each year are exacerbating the fiscal situation. Historically, an inverted yield curve has often been a reliable leading indicator of economic recession, and the market is once again approaching this dangerous edge.

Historical trend of total U.S. Treasury interest payments, which has now exceeded $1 trillion

Meanwhile, the AI narrative that supported the market boom in 2025 is also showing signs of cracks. The recent weakness in the Nasdaq index, especially with software stocks becoming the most oversold sector in the S&P 500, indicates that the market's enthusiasm for AI is cooling.

Investors are beginning to realize that the commercialization and profitability of AI will be much longer and more challenging than anticipated. The upcoming earnings season, particularly the financial reports of tech giants like Amazon and Alphabet, will serve as a "litmus test" for the viability of AI. If the earnings reports fall short of expectations, a massive sell-off may be unavoidable.

The Ghost of 1979

The current geopolitical and macroeconomic environment bears a striking resemblance to 1979, which makes many seasoned investors uneasy.

1979 marked the end of the détente period of the Cold War. In December of that year, the Soviet Union invaded Afghanistan, leading to a sharp deterioration in U.S.-Soviet relations and a peak in global geopolitical tensions.

Almost simultaneously, the Iranian Revolution triggered the second oil crisis, causing oil prices to soar and plunging the global economy into "stagflation" (a combination of economic stagnation and high inflation). At that time, the Federal Reserve failed to take decisive action under political pressure, leading to uncontrollable inflation, which ultimately had to be curbed by the newly appointed chairman Paul Volcker through drastic interest rate hikes, but at the cost of a deep economic recession.

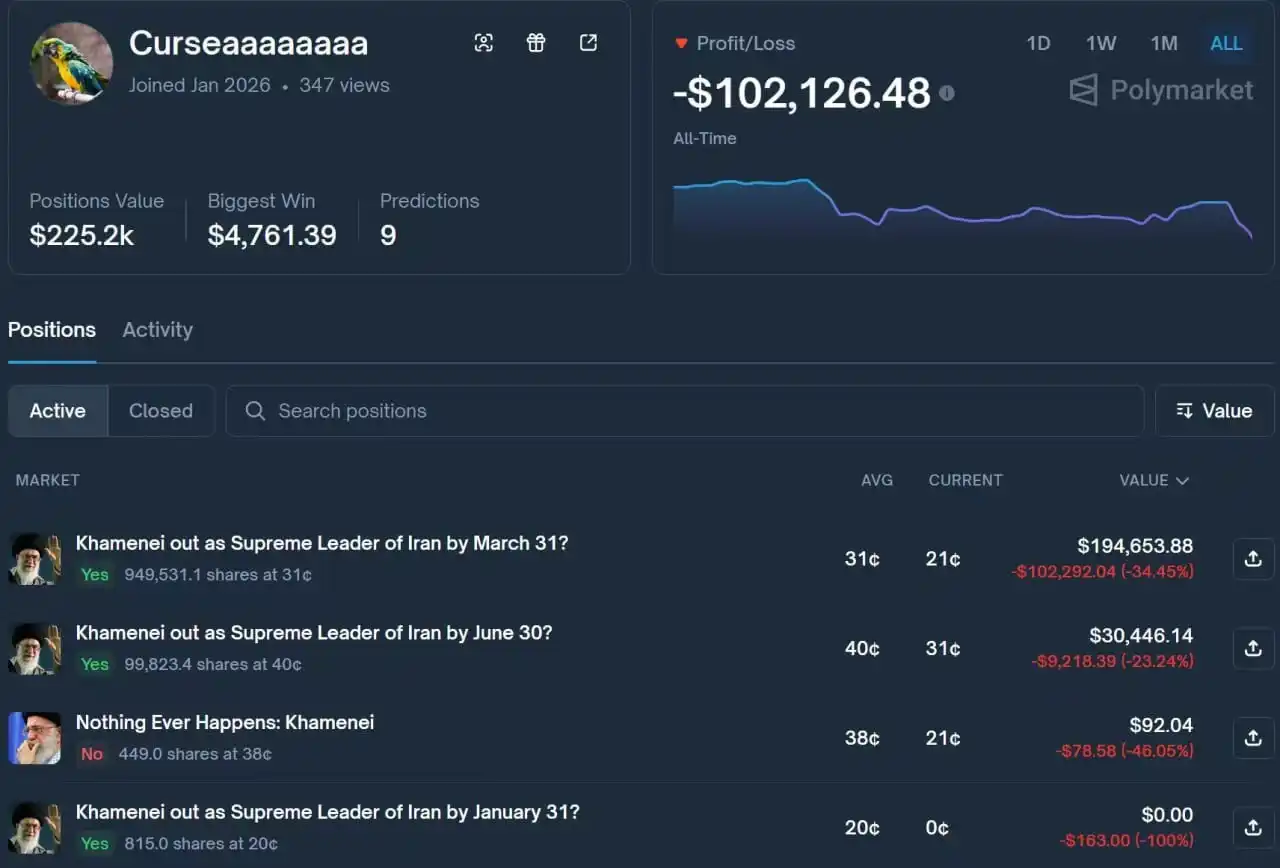

Today, we face a similar situation: geopolitical tensions in the Middle East, with market predictions from Polymarket indicating that as of February 2, the probability of the U.S. striking Iran by the end of the month has risen to 31%, with insider whales betting heavily on Khamenei's ousting.

Insider whales on Polymarket are betting heavily on Khamenei's ousting, with total bets of $336.7k | Source: Polybeats

Meanwhile, energy prices are highly volatile, and global inflationary pressures remain high. The potential intervention of the Trump administration in the Federal Reserve's independence, along with the nomination of the hawkish Warsh, evokes memories of the policy missteps under political pressure from back then. If history repeats itself, the aggressive tightening policies taken to control inflation could end this artificially sustained bull market, leading to a crisis of confidence in the dollar and a significant correction in the U.S. stock market similar to the late 1970s to early 1980s.

For investors who have been riding high during the 2025 boom, it may be time to reassess risks and prepare for potential market volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。