The Bitcoin market is undergoing a "stress test" targeting institutional holdings. After falling below the $80,000 threshold, Bitcoin's price further declined, reaching and breaking through the market-recognized key institutional holding cost line—the average holding cost of MicroStrategy (approximately $76,037) by the end of January 2026.

This event not only triggered a leveraged liquidation that led to over $2.3 billion in liquidations across the network but also pushed the market's long-reliance on the "institutional narrative" to a crossroads of doubt. Market sentiment shifted from euphoria to extreme caution, with the Fear and Greed Index briefly dropping into the "extreme fear" range.

1. Market Status: Key Defense Line Breached and Leverage Bubble Burst

The recent sharp decline in the market is the result of a resonance of multiple factors including fundamentals, liquidity, and sentiment.

1. Key Price Defense Lines Breached

Since the peak in November 2025, Bitcoin's price has fallen over 30%. During this decline, several key psychological and technical support levels have been breached one after another:

● $80,000: An important psychological threshold and a previous area of dense trading.

● $76,037: Considered the "institutional faith benchmark," the average holding cost line of MicroStrategy. Falling below this level means that the company's Bitcoin holdings have first entered a state of paper loss, shaking market expectations of "institutional steadfast holding."

● Lower Support Levels: According to KOL analysis, the next support levels to watch are at $74,000, $70,000, and even $58,000 and $50,000. Some opinions warn that if the $50,000 level is breached, the market may see a resurgence of the extreme pessimism narrative of "Bitcoin is dead."

2. High Leverage Concentrated Liquidation Triggers a Cascade

● The price breaking through key levels triggered a chain liquidation in the high-leverage derivatives market. Within 12 hours on February 1, 2026, the total liquidation amount across the network reached $2.367 billion, with over $2.2 billion from long positions being forcibly closed.

● This "downward-liquidation-further decline" death spiral quickly drained order book liquidity, exacerbating price declines. A single account of a whale agent lost over $700 million in this liquidation, highlighting the degree of leverage and risk accumulation in the market.

3. Continued Pressure on Liquidity

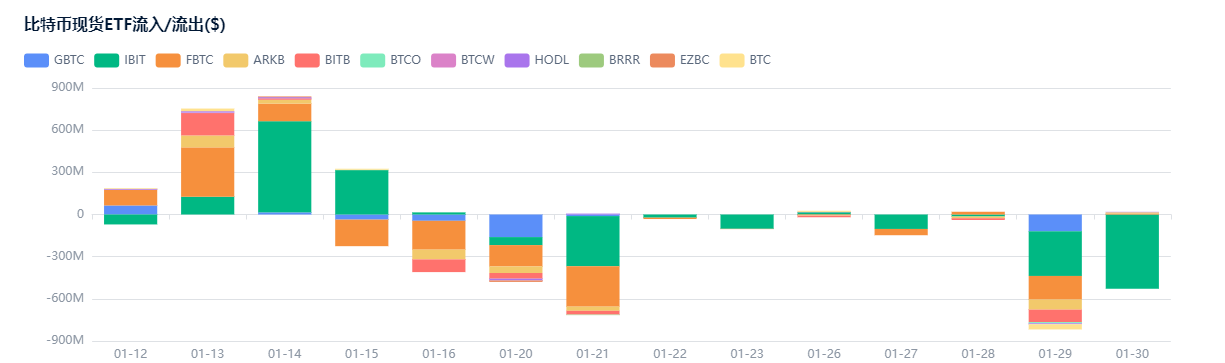

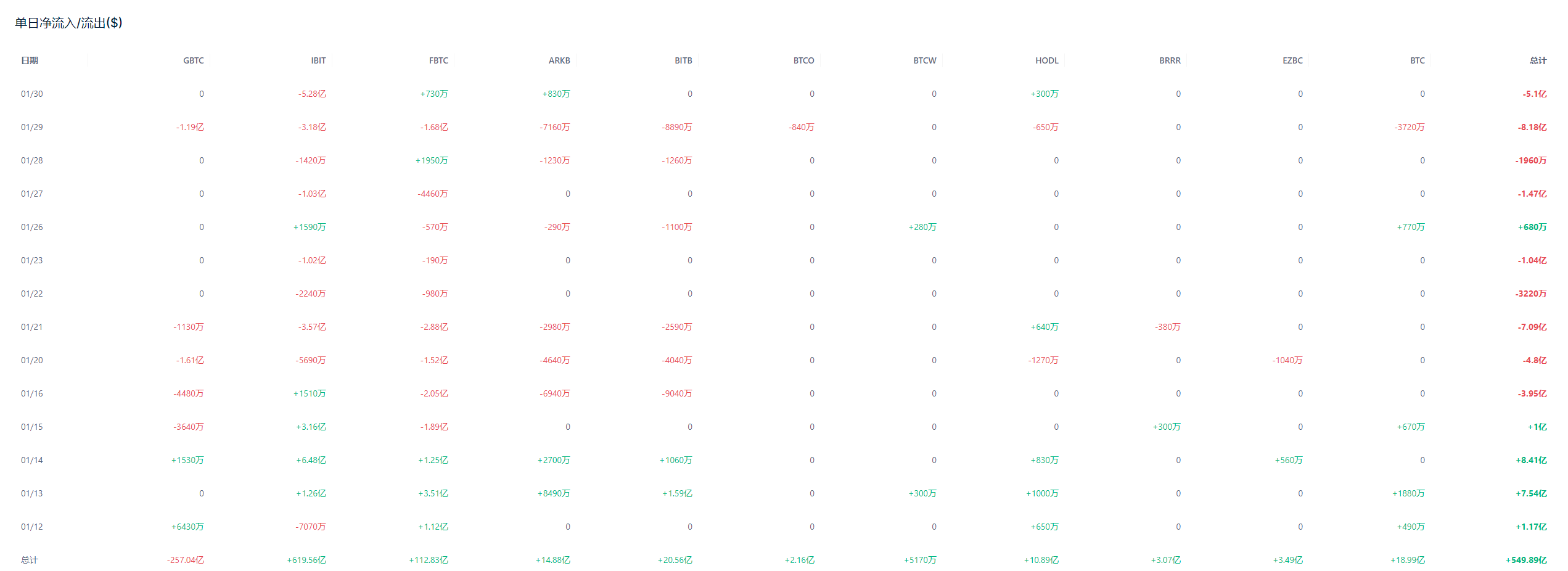

As one of the core narratives of the 2025 bull market, the spot Bitcoin ETF has recently seen a reversal in capital flow. Data shows that the U.S. spot Bitcoin ETF has experienced net capital outflows for several consecutive trading days, with the total outflow over the past five days amounting to approximately 1.7 trillion Korean won. This reflects a simultaneous shrinkage in sentiment among institutional and individual investors, with the "buying engine" that once drove prices up now reversing into a "selling pressure source."

2. Core Focus: Institutional Holding Costs and the Ineffectiveness of the "Old Narrative"

The current core contradiction in the market revolves around the "institutionalization" that has been the central narrative over the past year.

1. Strategy: From Benchmark to Risk Focus

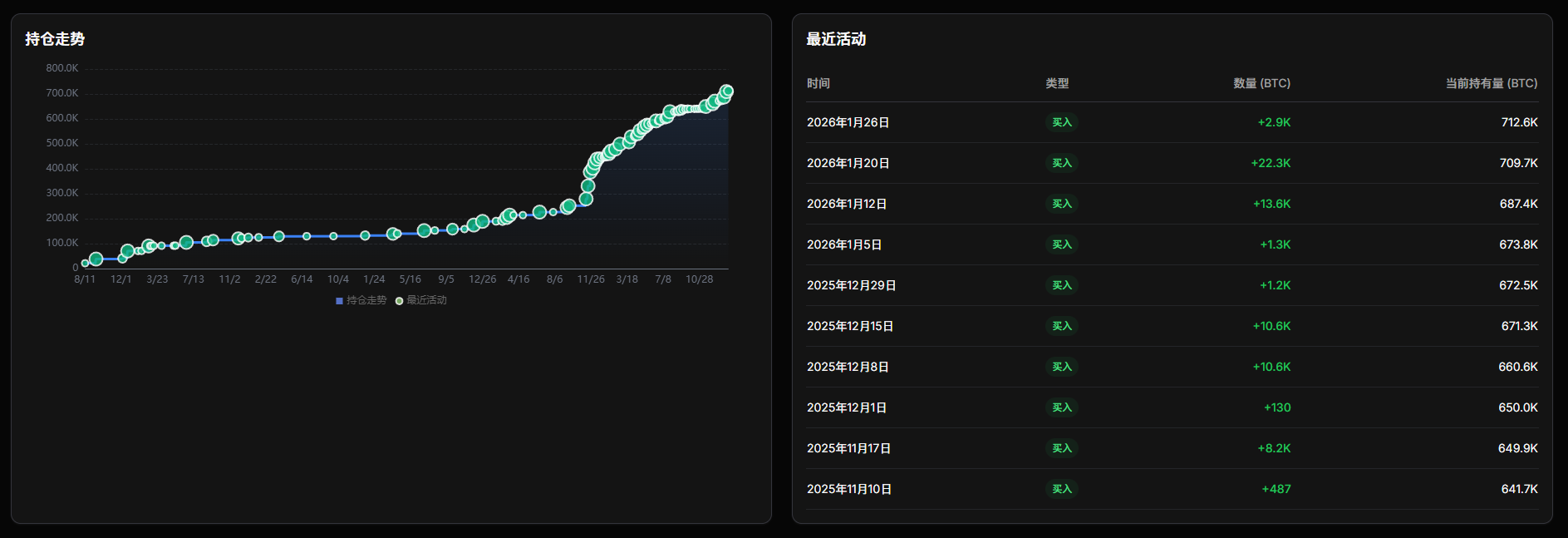

As the publicly traded company holding the most Bitcoin globally, MicroStrategy's every move is closely watched.

● Holding Status: As of early February 2026, the company holds approximately 712,647 Bitcoins, with an average cost of $76,037. As the price fell below this line, its holdings shifted from paper profit to paper loss, completely eliminating its safety cushion.

● Aggressive Financial Strategy: To continue purchasing Bitcoin, MicroStrategy has financed itself by issuing high-yield preferred shares (STRC) and raised the dividend rate to 11.25%. This high-cost financing method is feasible when prices rise but will severely squeeze the company's cash flow and increase financial risk when prices fall. Analysts point out that if prices remain below the cost line for an extended period, the sustainability of its aggressive strategy will face severe challenges.

2. Spot Bitcoin ETF: High-Level Trapped Positions Formed

Represented by Grayscale, BlackRock, and others, 11 major spot Bitcoin ETFs currently hold about 1.29 million Bitcoins, accounting for 6.5% of the total circulating supply.

● High Average Cost: The average purchase cost for these ETF investors is approximately $90,200. At current prices, the overall paper loss is severe.

● Pro-Cyclical Effect Emerges: In contrast to the earlier pro-cyclical effect of "buying driving up prices," there is now a counter-cyclical effect of "redemptions exacerbating declines." Investors who bought at high levels are choosing to cut losses and redeem, leading to continued net outflows from ETFs, amplifying the downward pressure on the market.

3. The "Old Money Entry" Narrative Faces Testing

● Macro strategist Jim Bianco from Bianco Research points out that the market is facing a crisis of "narrative exhaustion." The once-hopeful "old money entry" (Boomer Adoption) story, in light of the overall paper losses of ETFs and MicroStrategy, has not only been fully priced in but is even beginning to be falsified.

● The market suddenly realizes that a highly institutionalized holding structure is like a double-edged sword: it acts as a booster when prices rise but may transform into concentrated and massive potential selling pressure when prices fall. The key question is, at the current price level, where will the next batch of large-scale buyers come from?

3. Market Perspectives Summary: Diverse Views from KOLs and Institutions

In the face of a complex market situation, analysts and institutions have provided differing insights ranging from short-term technical analysis to long-term trend judgments.

1. Key Price Analysis from On-Chain Analysts and KOLs

Several analysts have made predictions about potential bottoms based on on-chain data and historical cycles.

● Cautiously Optimistic: On-chain data analyst Murphy believes that even if 2026 continues to be bearish, Bitcoin is likely to bottom within the strong support ranges of $70,000-$80,000 or $60,000-$70,000. His reasoning is that there is a significant accumulation of chips and support from a "double anchor structure" in these ranges. He believes that once the price enters the $70,000 range, it will attract off-market funds to actively enter.

● Risk Warning: CryptoQuant analysts point out that since October 2025, Bitcoin's demand growth has consistently been below the long-term trend, which is a clear bear market signal. They warn of downside risks in the second half of 2026, with key levels at $70,000, and it may even further decline to $56,000.

● Scenario Prediction: Some KOLs have provided more detailed probabilistic predictions (as of January 27, 2026), suggesting that the most likely bear market low (60%-70% probability) is in the range of $58,000-$65,000, corresponding to the miner's breakeven line and significant supply cost support. A more pessimistic scenario would require conditions such as continued ETF outflows and macro deterioration to trigger.

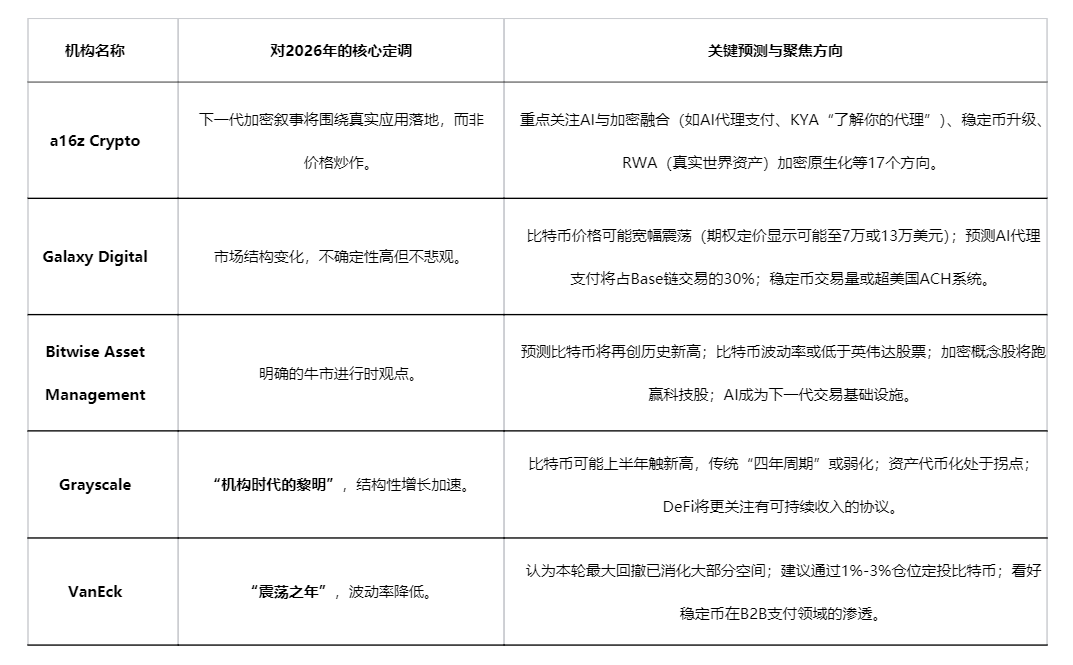

2. Top Investment Institutions' 2026 Outlook

Despite the short-term market slump, several top venture capital and asset management institutions have outlined a picture in their 2026 outlook reports released at the end of 2025 that focuses more on long-term structural changes. Their consensus is that the crypto market is transitioning from an emotion-driven retail cycle to an "institutional era" centered on compliance, value, and long-term capital.

Here are some representative viewpoints from leading institutions:

4. Future Outlook: New Momentum Emerging from Silence

The current market is filled with a unique atmosphere of "silence": enthusiasm for discussing new narratives has waned, investors feel a psychological gap when comparing the crypto market with other standout traditional assets (like gold and U.S. stocks), and even some KOLs have reduced their voices. This silence is precisely the necessary stage for the market to transition from speculative frenzy to deep value cultivation.

1. Short-Term: Focus on Key Support and Macro Turnaround

● In the short term, the market will revolve around the key support levels of $70,000-$74,000. Macroeconomic policies, especially the Federal Reserve's interest rate path, will become key variables affecting the liquidity of global risk assets (including cryptocurrencies). If a monetary easing cycle begins, it may provide a breathing window for the market.

2. Mid to Long-Term: Value Reconstruction Driven by New Narratives

● In the mid to long term, the healthy development of the industry needs to be driven by new narratives and real applications that go beyond "price speculation." The frequent mentions in institutional reports of the integration of AI and Crypto, tokenization of RWA (real-world assets), and the large-scale application of stablecoins in cross-border payments are recognized potential new growth engines.

● These directions represent a deeper penetration of blockchain technology into the real economy, and their success or failure will determine the quality and height of the next cycle.

3. Insights for Participants

This market adjustment serves as a profound risk education. It reveals the dangers of over-reliance on high leverage and a single narrative. For long-term believers, the market's "silence period" may be an opportunity to exchange time for space and make strategic layouts. As one analyst put it, if you believe in Bitcoin's long-term future, then every significant pullback is accumulating fuel for future surges. However, the premise of all this is that the market must endure the current liquidity test and find a real path to the next spring on the foundation of value.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。