The price of silver plummeted by 26% in less than 20 hours, marking the largest single-day drop in history, with the global precious metals market evaporating over $5 trillion in market value in a single day, while the price of Bitcoin remains stagnant around $87,000.

Last Friday, global traders witnessed a historic moment in the precious metals market. Silver prices fell by 26%, and gold dropped by 9%. The rapid evaporation of trillions of dollars in market value has prompted global investors to reassess the flow of funds.

However, amidst this violent fluctuation in precious metals, the cryptocurrency, once referred to as "digital gold," appeared unusually quiet, with Bitcoin prices stagnating around $87,000.

1. Event Review

● Last Friday, the precious metals market experienced the most severe single-day volatility since the 1980s. Silver prices plummeted by 26%, and gold fell by 9%, marking the worst single-day performance in over a decade.

● In just a few hours, over $5 trillion in market value evaporated from the precious metals market. The speed and scale of this crash shocked global traders, with market volatility described by MKS PAMP's head of metal strategy as "frenzied and untradeable."

2. Multiple Reasons

● This historic plunge was not caused by a single factor but was the result of multiple pressures. The immediate trigger was the nomination of the Federal Reserve Chair, as news emerged that Trump planned to nominate Kevin Warsh for the position, sharply raising market expectations for a hawkish shift in monetary policy.

● Warsh is known for his tough stance on inflation; he has repeatedly warned about inflation risks and called for the Fed to reduce its balance sheet. The continuous increase in margin requirements exacerbated market fragility, with the Chicago Mercantile Exchange raising margin requirements for gold and silver futures five times in just nine days.

● The margin for silver futures increased from 6% to 8%, and from 11% to 15% for gold futures. These measures squeezed the funding space for leveraged traders, forcing some positions to be liquidated.

● The market's technical indicators were severely overbought, laying the groundwork for the plunge. The relative strength index for gold reached as high as 90, the highest level in decades, indicating that the open interest in bullish options for silver reached record levels.

3. Fund Flow

In this violent fluctuation of precious metals, a noteworthy phenomenon is the reallocation of funds. Cryptocurrencies, traditionally considered to have similar properties, did not move in sync with precious metals.

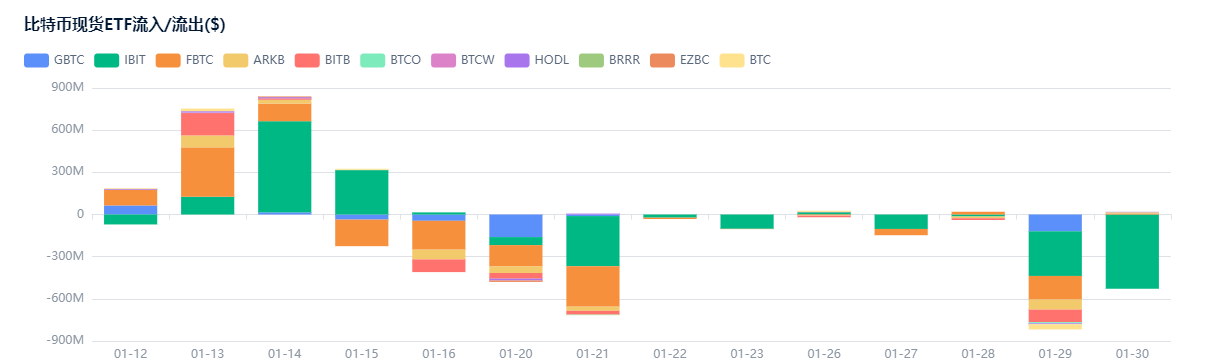

● Since October 2025, Bitcoin has dropped about 25% from its peak, with a 6% decline in just the past week. Investors are withdrawing funds from Bitcoin-related funds, continuing the trend of outflows from cryptocurrency ETFs.

● Market observers point out that cryptocurrencies currently face competition from two directions. In terms of safe-haven properties, they are inferior to gold, and in terms of growth attributes, they lag behind AI-related stocks.

● Fund flow data shows that broad-based stock ETFs are experiencing the largest inflow of funds on record, while the cryptocurrency market is experiencing outflows. On-chain data from CryptoQuant indicates that Bitcoin holders have entered a net realized loss phase, the first time since 2023.

4. Market Divergence

The performance difference between gold and Bitcoin has sparked discussions about whether Bitcoin truly possesses the attributes of "digital gold." The two often diverge in their performance during significant economic events.

● At the beginning of the pandemic in early 2020, gold and silver surged due to safe-haven sentiment, while Bitcoin plummeted by over 30%. In the 2017 bull market, Bitcoin skyrocketed by 1359%, while gold only rose by 7%. In the 2018 bear market, Bitcoin fell by 63%, while gold only dropped by 5%.

● This divergence in trends indicates that the price correlation between Bitcoin and gold is not stable. Bitcoin resembles an asset at the intersection of traditional finance and new finance, possessing both technology growth attributes and being influenced by liquidity conditions.

● There is a divergence in the market's positioning of Bitcoin, which may explain why the cryptocurrency market remains relatively calm during the violent fluctuations of traditional safe-haven assets.

5. Correlation Impact

Although Bitcoin has remained calm during this precious metals crash, there are still noteworthy correlations between the two. Institutional investors may be rotating funds between the two asset classes.

● After severe fluctuations in the precious metals market, some funds may flow back into the cryptocurrency market. Fundstrat's Tom Lee predicts that once the recent surge in gold and silver ends, the cryptocurrency market is likely to catch up.

● Historical data shows that Bitcoin often reacts with a delay following major movements in gold. During fund rotation periods, cryptocurrency prices tend to consolidate rather than exhibit strong trends. The current precious metals market has added trillions of dollars in market value; even a small portion of that capital flowing into cryptocurrencies could significantly impact the smaller crypto market.

The 26% single-day drop in the silver market set a historical record, while the 9% drop in gold is also unprecedented in over a decade. The precious metals market has evaporated over $5 trillion in market value.

Market participants are now focusing on China's opening on Monday, observing whether this market, which previously drove prices up, can absorb this shock. Meanwhile, Bitcoin prices continue to hover around $87,000, with investors continuing to withdraw from cryptocurrency funds.

Wall Street traders have readjusted the data monitoring parameters on multiple screens, knowing that the aftershocks of this market earthquake, triggered by multiple factors, are not yet over, and when cryptocurrencies will see the "next stop" of fund rotation may depend on when the precious metals market truly stabilizes.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。