Written by: seed.eth

On the last trading day of January 2026, the global financial markets witnessed a historic "moment of terror."

On January 30 (Friday) Eastern Time, the previously soaring precious metals market suddenly faced a "cold wave."

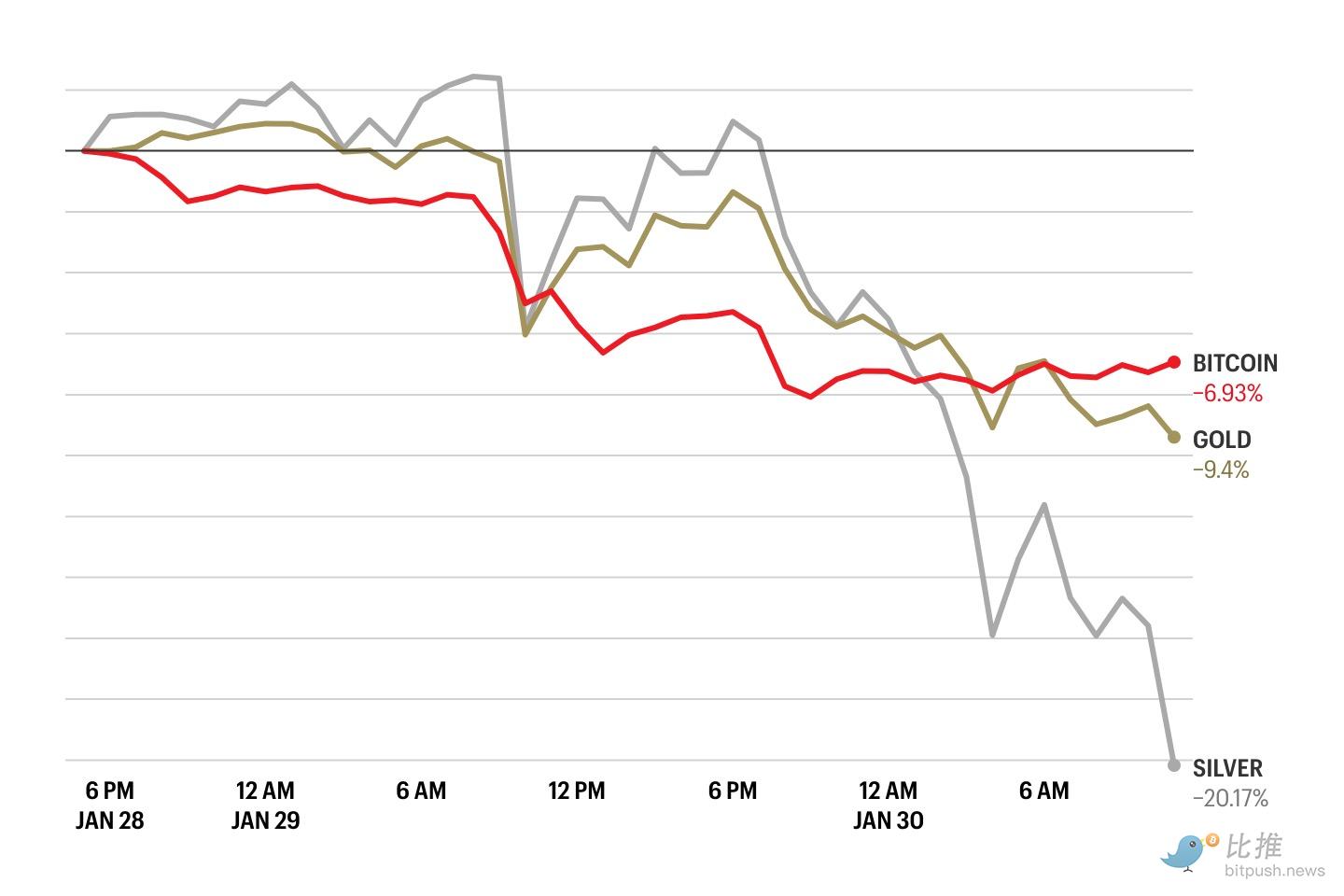

Spot silver recorded the largest single-day drop in history, plummeting over 30% at one point during the trading session; spot gold also suffered, with a single-day drop exceeding 9%, marking the worst loss since the early 1980s. Meanwhile, the previously weak U.S. dollar index (DXY) surged, recording the largest single-day increase since last July, rebounding approximately 0.9%.

In the U.S. stock market, the S&P 500 index fell 0.4%, the Dow Jones Industrial Average dropped 0.4%, while the tech-heavy Nasdaq index plummeted 0.9%.

The cryptocurrency market was also not spared. Bitcoin (BTC) briefly plunged 4% to $81,045, hitting a two-month low since last November. Although it rebounded afterward, it remained weak under the pressure of continuous ETF outflows.

This global asset restructuring not only wiped out trillions of dollars in market value from the precious metals market but also marked the first significant correction of the "weak dollar, strong gold and silver" trading logic since Trump returned to the White House.

Policy "Hurricane": Warsh's Nomination Ignites Dollar Counterattack

The direct trigger for the sharp decline in gold and silver was a significant personnel appointment by the Trump administration. On Friday, it was reported that Trump had chosen Kevin Warsh to be the next Federal Reserve chairman.

This decision caused multiple shocks to the market:

Defending the independence of the Federal Reserve: Previously, the market was highly concerned that Trump would choose a completely compliant "agent" inclined towards aggressive rate cuts, which had directly driven the dollar lower throughout January. Warsh, a former Federal Reserve governor known for his academic rigor and vigilance against inflation, greatly alleviated Wall Street's fears of the Federal Reserve becoming "politicized," restoring confidence in the Fed's independence.

Reshaping interest rate expectations: Warsh has historically shown a clear "hawkish" stance, with almost zero tolerance for inflation. Compared to the significant deep rate cuts that previous popular candidates might have brought, the market quickly adjusted its expectations to a "more moderate and cautious" monetary policy. As a non-interest-bearing asset, gold and silver lost their appeal under the expectation that "interest rates may remain high."

Short covering in the dollar: The dollar index fell about 1.4% in January, with short positions extremely crowded. The news of Warsh's nomination prompted a large number of dollar shorts to cover their positions, quickly pushing the dollar index above 96.74, which heavily impacted precious metals priced in dollars.

Evercore ISI Vice Chairman Krishna Guha stated that the market is trading on "hawkish Warsh," noting that "Warsh's nomination helps stabilize the dollar and reduces the one-sided risk of a continued dollar decline, thereby challenging the logic of 'currency depreciation trading'—which is also the reason for the significant drop in gold and silver."

Liquidity Crisis in Overbought Territory

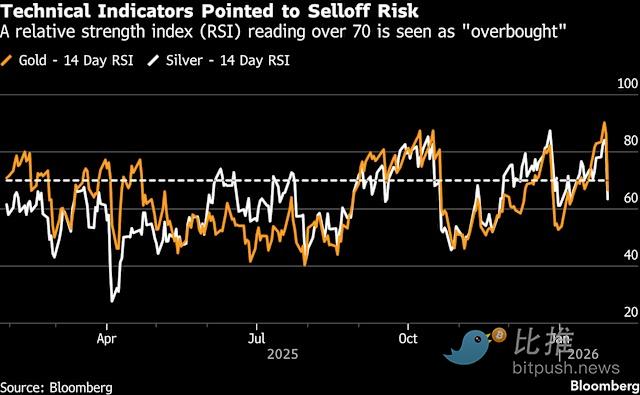

If Warsh's nomination is the "spark," then the extremely overbought state of the gold and silver markets is the "dry tinder."

Before the crash on January 30, spot gold had approached the $5,600/ounce mark, while silver had peaked at $120/ounce. Since the beginning of the year, silver's increase had reached 63%, and gold's monthly increase was nearly 20%. A Wall Street quantitative strategist remarked, "This increase can no longer be explained by fundamentals; it is a typical speculative bubble driven by FOMO (fear of missing out)."

Multiple technical factors led to Friday's "liquidation-style" drop:

RSI Indicator Peaks: The relative strength index (RSI) for gold reached a 40-year peak (RSI close to 90) before the crash, indicating extreme overbought conditions.

Forced Liquidation: The silver market, due to its high leverage, triggered large-scale programmatic stop-losses after prices fell below key support levels. Estimates suggest that the market value of gold and silver shrank by as much as $7.4 trillion on Friday, and such a scale of selling has evolved into a "liquidity contraction," forcing investors to sell the most liquid gold and silver to replenish margins for other assets.

Profit Taking: Early investors had a strong desire to cash out in the face of signals of a policy shift.

The combination of a strong dollar and the plunge in gold and silver directly devastated commodity currencies among the G10 currencies.

Australian Dollar (AUD): At one point, it plummeted over 2%. As a leading resource exporter, the crash in gold and silver directly undermined its trade foundation, making it the "disaster zone" among G10 currencies that day.

Swiss Franc (CHF): Fell by about 1.5%. The sharp drop in gold prices completely severed the safe-haven premium of the franc, causing funds to panic and flow towards the dollar, which is supported by hawkish expectations.

Swedish Krona (SEK): Plummeted nearly 1.8% during the day.

Market Outlook: Is it a "Bull Market Correction" or a "Termination Signal"?

For the future market, a report from Citibank provides a calm perspective. Citi pointed out that half of the risk factors supporting gold (such as geopolitical tensions, U.S. debt concerns, and AI uncertainties) may dissipate later in 2026.

Middle East and Russia-Ukraine Variables: As the Trump administration aims for "American-style stability" before the midterm elections in 2026, if the Russia-Ukraine conflict and the situation in Iran tend to ease, the safe-haven premium of gold will further diminish.

American-style Gold Stability: The "American-style gold stability" mentioned by Citi implies that if Warsh successfully takes office and stabilizes the Federal Reserve's credibility, the dollar will regain favor with international capital, thereby exerting mid-term negative pressure on gold prices.

However, some analysts hold a different view.

Nanhua Futures pointed out that despite the short-term shock, demand for silver in the new energy and industrial sectors remains strong, and a supply gap exists in the long term. This plunge is more about "de-leveraging" and "popping bubbles" rather than a complete deterioration of fundamentals.

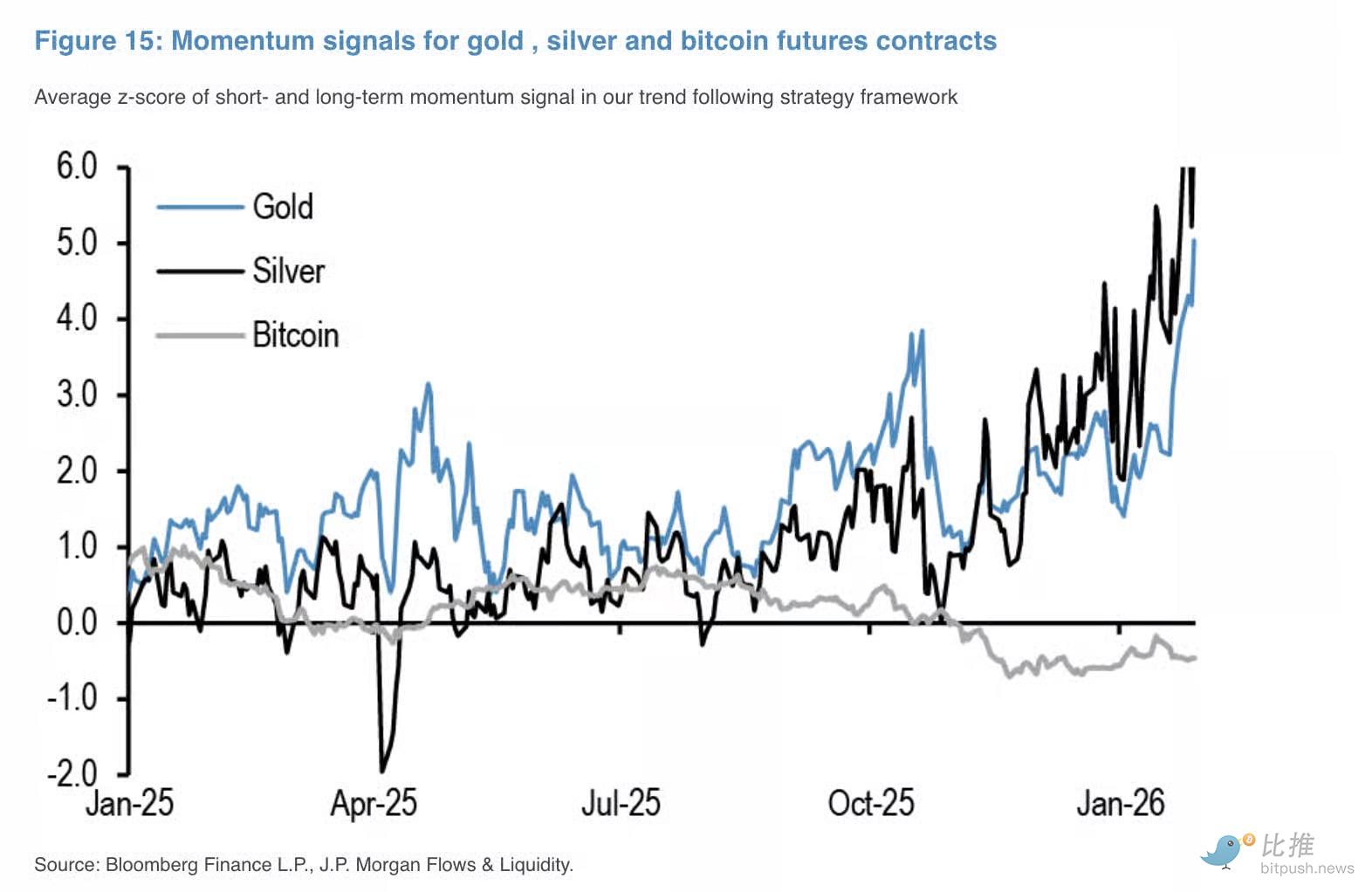

J.P. Morgan analysts are optimistic about gold's long-term prospects. In a recent report, they stated that both private investors and central banks are continuously increasing their allocation to gold.

Analysts emphasized the structural differences in liquidity among different assets using the Hui-Heubel ratio (an indicator measuring market breadth and liquidity). The chart shows that gold's Hui-Heubel ratio remains low, indicating stronger liquidity and higher market participation. In contrast, silver's ratio is higher, reflecting weaker liquidity. Assuming that people continue to use gold as a hedge against stocks instead of long-term bonds, the allocation ratio of private investors to gold may rise from the current slightly above 3% to about 4.6% in the coming years. In this scenario, analysts believe that the theoretical price range for gold could reach $8,000 to $8,500 per ounce.

For ordinary investors, the most critical observation point now is:

If Warsh's focus shifts the Federal Reserve's policy from "blindly supporting growth" to "returning to monetary discipline," then 2026 will become a turning point for the global financial environment.

This shift means: the dollar index is expected to completely bid farewell to a year-long downturn, regaining its dominance as the global reserve currency; while gold and silver, which were pushed to their peaks amid previous fervor, may be forced into a long and painful consolidation period to digest the premium bubbles accumulated over the past few years. The outlook for Bitcoin will become even more uncertain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。