Written by: Wu Says Blockchain

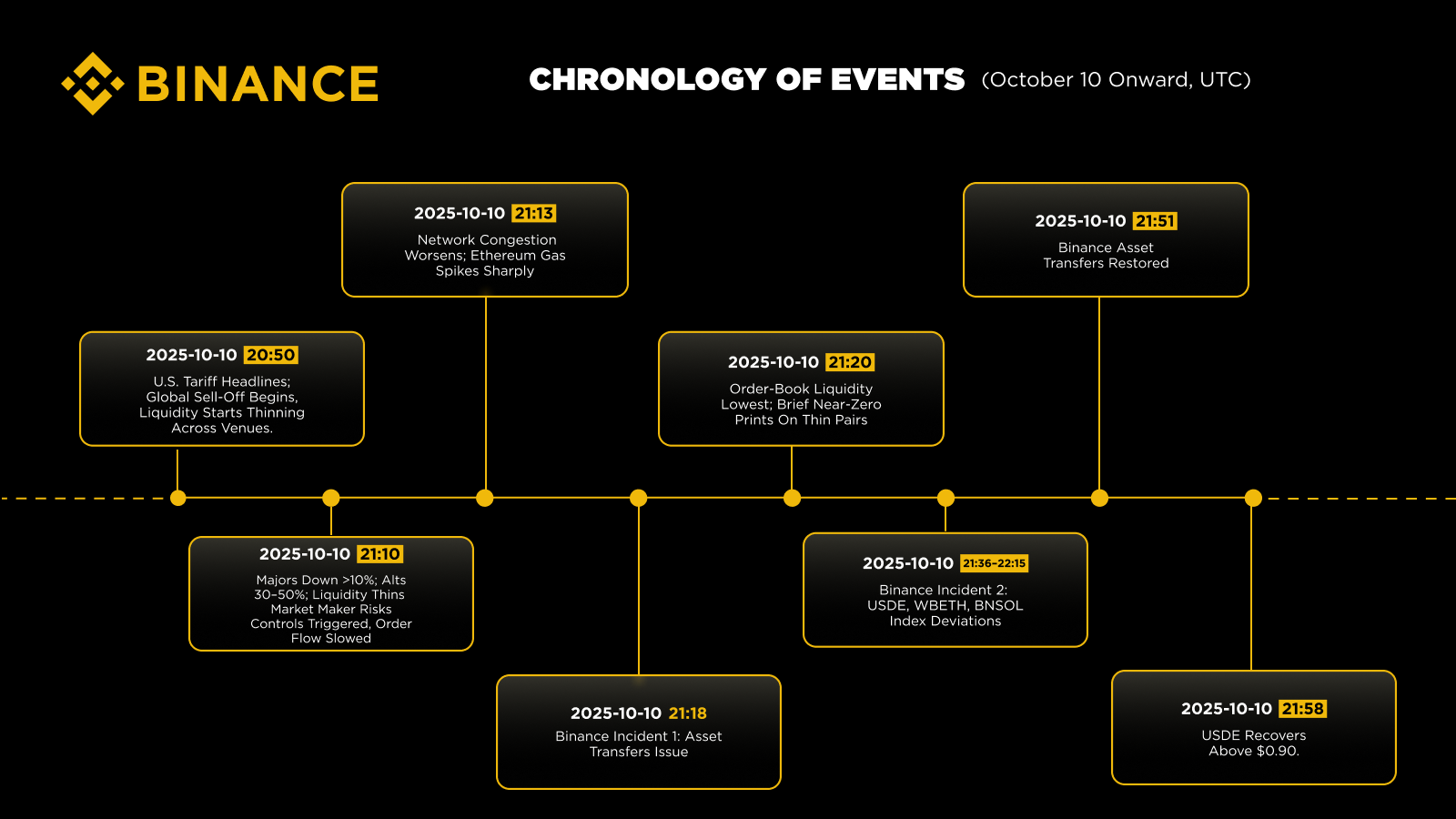

Under recent community pressure, Binance released a detailed report on January 31 at around 4 AM Beijing time, acknowledging two technical failures that occurred that day: First, during the market sell-off from 21:18 to 21:51 UTC, the asset transfer subsystem of Binance experienced a performance degradation of about 33 minutes, affecting some users' ability to transfer funds between spot, wealth management, and contract accounts. The matching, risk control, and clearing systems continued to operate normally; individual users seeing their balances displayed as "0" was a front-end display issue, not an asset loss. Second, from 21:36 to 22:15 UTC, during a period of declining market order book depth, on-chain congestion, and slowed cross-platform rebalancing, the USDe, WBETH, and BNSOL indices exhibited abnormal deviations. The report stated that during times of thin liquidity and slowed cross-platform capital flow, price fluctuations within the platform accounted for an excessively high proportion of the index calculation.

Previously, Wu Says published an exclusive interview with witnesses of the 1011 incident, which can be found here: “Witnesses Review the Details of the 1011 Incident: Sudden Liquidity Loss Triggered ADL Liquidation, Aggressive Market Makers Lost 50% or Even Went Bankrupt”

Note: The reason the "10/11 incident" is sometimes written as "10/10" is mainly due to different time references used by different people: many data/English narratives are recorded in UTC or Eastern Time, while the Chinese community usually uses UTC+8 (Beijing time); when key fluctuations occur late at night in UTC, converting to UTC+8 crosses into the next morning, so the same market movement can be referred to as both "10/10" and "10/11."

The following content is the main part of the report, slightly abridged

On October 10, 2025, the crypto market faced a macro shock. Although some attributed the blame to Binance's failures, the fact is that the chain reaction of liquidations was driven by macro risks from high-leverage positions, liquidity constraints due to market makers' risk control, and transfer delays caused by congestion on the Ethereum network. In this article, we will fully disclose the facts and acknowledge that the platform faced pressure at certain points.

Macro Background

Affected by trade war-related headlines, global financial markets plummeted, impacting nearly all asset classes. The previously rising crypto market, which had seen several months of gains, faced particularly high risks due to elevated leverage levels. In the derivatives market, positions were nearing historical highs, with the total open interest in Bitcoin futures and options exceeding $100 billion. On-chain data showed that most Bitcoin holders were in profit—under such circumstances, once a shock occurred, it was easy to trigger rapid profit-taking and forced deleveraging.

The shock was not limited to the crypto market: the U.S. stock market evaporated about $1.5 trillion in market value that day, with the S&P 500 and Nasdaq recording their largest single-day declines in six months, and the scale of systemic liquidations reached $150 billion.

Extreme Market Volatility Triggers Market Maker Risk Control Mechanisms

As the sell-off intensified, extreme market volatility triggered the algorithmic risk control systems and circuit breaker mechanisms of market makers, automatically managing inventory and reducing exposure. While this behavior was expected during extreme volatility, it temporarily withdrew liquidity from the order book.

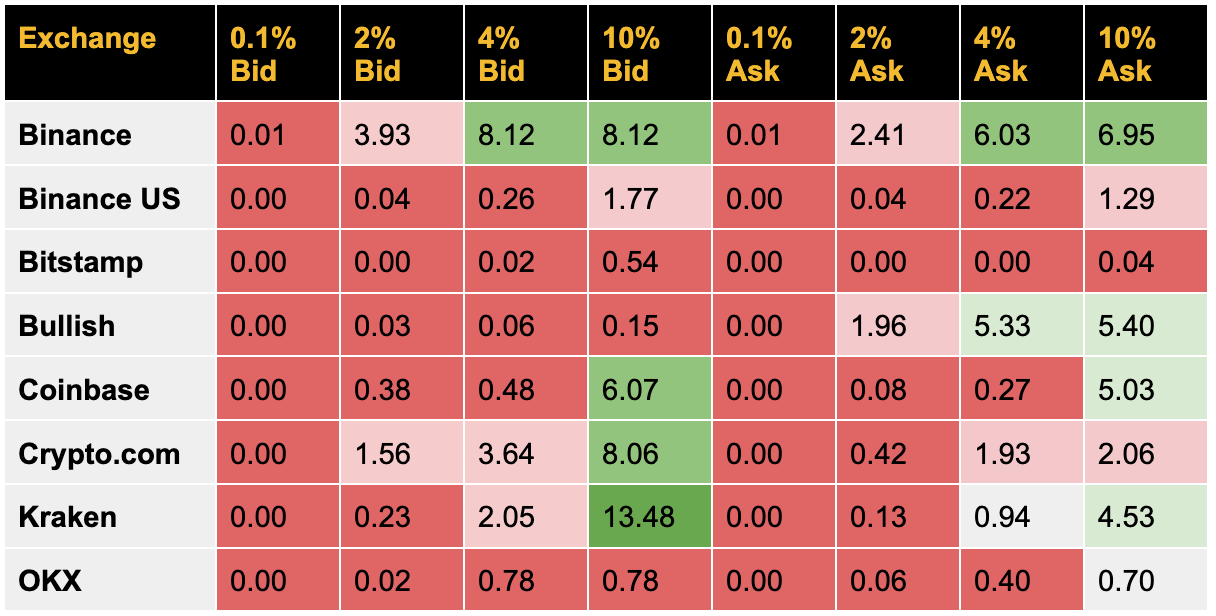

According to data from Kaiko (Figure 1), the order book depth showed that "Bitcoin liquidity was nearly zero at various price levels"—except for major exchanges like Binance, Crypto.com, and Kraken, other exchanges had almost no buy orders within a 4% price spread. This thin liquidity meant that each forced sell-off had a greater impact on prices. Additionally, cross-platform risk management and arbitrage functions also encountered obstacles.

Figure 1: During the crash on October 10, BTC's minimum depth was exhausted, and the price spread significantly widened. Source: Kaiko, Binance Research (Trading pairs: BTC-USDT, BTC-USDC, BTC-USD—based on minute averages from October 10)

Network Congestion

One compounding factor in the flash crash on October 10 was the congestion of the Ethereum blockchain, which caused Gas fees to spike from single digits to over 100 gwei, leading to block confirmation delays and slowing down arbitrage and cross-platform capital flow. In an already thinly liquid market, this further widened the price spread, making position rebalancing more difficult and creating a temporary liquidity vacuum that amplified price volatility. Before the sell-off pressure eased and the market stabilized, rebalancing and liquidity scheduling between exchanges were extremely challenging.

Market Impact

In the markets with the worst liquidity, even small orders could impact the order book, causing sharp "spike" price fluctuations on the charts. Programmatic selling and forced liquidations exacerbated price movements, while the slowdown in arbitrage and cross-platform transfers widened temporary price discrepancies. Some pegged tokens or derivative tokens briefly decoupled, reflecting the same pressures: thin liquidity, rapid capital flow, and restricted capital movement.

Like all exchanges, Binance also faced pressure when handling high trading volumes in extreme market conditions.

The market dislocation on October 10 was a systemic, macro-driven risk aversion behavior. That said, we acknowledge that certain aspects of the Binance platform experienced brief pressure under extreme market conditions and have compensated affected users while strengthening security measures.

It is important to emphasize that specific issues on the Binance platform did not cause the market flash crash. During the high volatility period from 21:10 to 21:20 UTC, about 75% of liquidations for the day had already been completed, while the widely reported decoupling events of the three tokens (USDe, BNSOL, WBETH) occurred only at 21:36. This timing indicates that most of the deleveraging process occurred during the initial macro shock phase—starting at 20:50, forced liquidations accelerated the price drop amid the exhaustion of order book liquidity.

This confirms that the main driving factors were the overall market's risk reduction and the reflexivity of liquidations, rather than platform-specific anomalies. Binance's core matching engine, risk checks, and clearing systems remained stable and uninterrupted throughout the process.

The following are our detailed explanations of the two events:

Event One: Performance Degradation of the Asset Transfer Subsystem (21:18–21:51 UTC)

During the peak of the sell-off, our internal asset transfer subsystem experienced a performance degradation of about 33 minutes. This affected some users' ability to transfer funds between spot, wealth management, and contract accounts. The core matching, risk checks, and clearing systems continued to operate normally; the impact was limited to the asset transfer path and its related functions. A small number of users saw their balances displayed as "0" on the interface due to backend call failures; this was a display issue, not an asset loss.

Root Cause: Under sudden high load, a high-frequency read path in the asset database experienced performance degradation. A certain high-frequency API call lacked effective caching and directly read from the database. With traffic 5-10 times higher than usual, database connections became saturated, thread pools were blocked, and timeout chains occurred. A previous version upgrade by the cloud service provider also removed the built-in query caching mechanism, reducing the fault tolerance of this query under high pressure.

Remedial Measures: Based on system logs and user operation records, we have completed full compensation for all eligible users affected during the period from 21:18 to 21:51. To address this issue, we have increased caching, expanded the database and its replicas, optimized connection management, separated key functions, and improved the UI display fallback mechanism.

Event Two: Index Price Deviations of USDe, WBETH, and BNSOL (21:36–22:15 UTC)

After the order book depth generally thinned, and on-chain congestion slowed cross-platform rebalancing speed, the price indices of USDe, WBETH, and BNSOL exhibited abnormal deviations. Due to local liquidity being thin, accelerated liquidations, and slowed cross-platform capital flow, the short-term prices on the Binance platform had an excessively high weight in the index calculation under pressure conditions.

Root Cause: The index inputs for these three tokens overly relied on Binance's own order book, failing to adequately anchor to the underlying reference prices (especially for wrapped/staked tokens), while the protective mechanisms used to identify outliers and deviations were not strict enough in a rapidly changing, thinly liquid market environment.

Remedial Measures: We have tightened parameters during stable periods and immediately initiated updates to the index methodology for these three tokens. All affected users have been fully compensated.

K-Line Chart Adjustment Explanation

On October 12 (UTC), we announced and implemented a front-end display update to optimize the price data display on K-line charts. This was in consideration of the fact that during periods of extremely low liquidity, ATOM/USDT and IOTX/USDT had shown "$0 lower shadows," due to excessive selling pressure, the system matched legacy buy orders from 2019, resulting in a one-time candle reflecting artificially low prices on the K-line chart. This was a UI-level adjustment and did not affect any actual trading data or API information. Some users misunderstood this as data manipulation; after receiving community feedback, we quickly rolled back the update. Binance has never, and will never, manipulate any actual trading data or historical data.

Other Perspectives

On January 26, ARK Invest CEO Cathie Wood pointed out in a Fox Business program that Bitcoin's recent high-level retreat was influenced by the $28 billion deleveraging event triggered by Binance's software failure on October 10. She analyzed that the current market selling pressure has basically ended, and as institutional investors focus on the "four-year cycle" turning point, Bitcoin is expected to end its downward trend and regain upward momentum after consolidating in the $80,000 to $90,000 range.

OKX CEO Star Xu stated on the 31st that the core reason for the 1011 incident was that Binance promoted high-yield products through aggressive marketing, which were treated as quasi-stablecoins. This included encouraging users to convert USDT and USDC into USDe, which has hedge fund risk characteristics, without sufficient risk warnings and restrictions, and allowing it to be used as collateral for repeated leverage, creating a high-risk cycle.

Wintermute founder Evgeny Gaevoy believes that the incident was clearly not a "software failure," but rather a flash crash driven by macro news in a highly leveraged, illiquid market environment on a Friday night. He stated that simply attributing the market decline to a single exchange is not rigorous. In a bear market context, while other assets rise and the crypto market is under pressure, seeking a "scapegoat" may be emotionally more acceptable, but logically blaming the issue entirely on one platform does not hold.

Solana co-founder Toly stated that if we are lucky enough, the 1011 market crash may open a bear market lasting 18 months, using this time to build something new for the crypto space. Subsequently, CZ unfollowed him.

Dragonfly partner Haseeb rebutted Star Xu's claim that the 10/10 crash was due to Binance and Ethena, arguing that the causality does not hold: BTC bottomed first, and USDe only deviated on Binance and did not propagate across platforms, failing to explain the simultaneous liquidation across the entire market. He believes a more reasonable explanation is that the macro shock combined with exchange API failures led to market maker dysfunction, liquidity vacuums, and amplified liquidations/ADL chains; such events lack a single "culprit" and resemble systemic failures of microstructure at the worst points.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。