Most people are well aware of the winter storm ripping through multiple U.S. states, causing several mining operations to temporarily power down to ease strain on local grids. As of press time this weekend, the hashrate is idling around 850 exahash per second (EH/s). It hasn’t dipped this low since late June 2025.

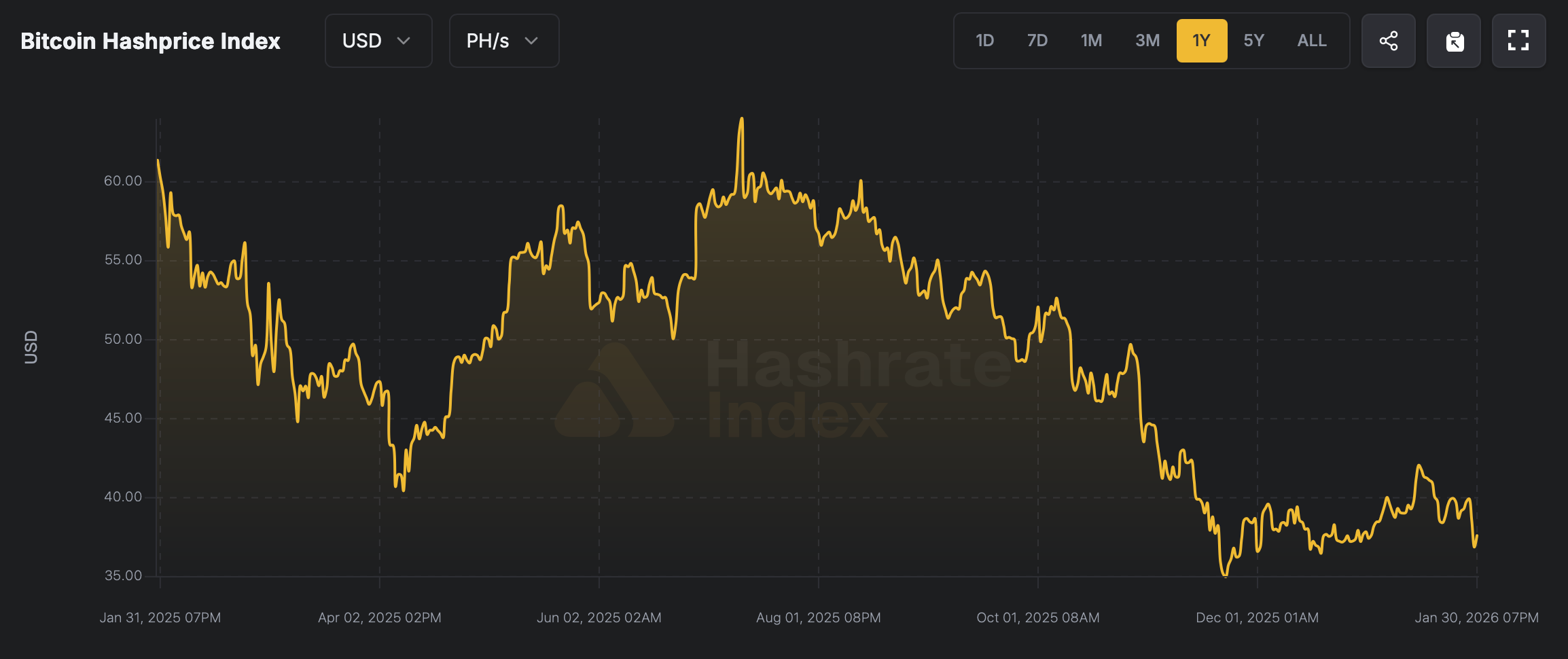

On top of that, bitcoin mining outfits are grappling with prices slipping to territory not seen since April 2025. That drop has dragged hashprice—a gauge of the estimated value of one petahash per second (PH/s) of hashpower—down to painfully low levels. While the $35.22 hashprice hasn’t quite matched the $34.99 print from Nov. 22, it’s uncomfortably close for comfort.

Bitcoin’s hashprice on Feb. 1, 2026.

It marks the second-lowest revenue reading of the past 12 months for bitcoin miners, with the figure sitting roughly 45% below the 12-month high of $64.03 per PH/s set on July 11, 2025. Adding insult to injury, the top 13 publicly traded bitcoin miners by market cap all finished Friday deep in the red.

Applied Digital (APLD) took the hardest hit, tumbling 11%, followed by IREN Limited (IREN) down 10.19% and Cipher Mining (CIFR) sliding 9.83%—a tidy sweep of losses across the leaderboard. Taken together, it all piles serious pressure on miners, and only a short list of factors stands a chance of easing the squeeze.

Read more: Latam Insights: Venezuelan Oil Flows to the US Again, El Salvador Buys the Gold Dip

Those include bitcoin climbing back from recent lows, as at current prices BTC remains 37.4% below its October all-time high north of $126,000. Onchain fees could offer some relief too, but they’ve been stuck below 1% of the average block reward for quite a while now. The largest—and more reliable—source of relief is likely to come from the next difficulty epoch, which is shaping up to be quite a meaningful adjustment.

For now, miners are stuck grinding through a cold, unforgiving stretch where margins are thin, machines are quieter, and patience is wearing thinner by the block. Until prices rebound or difficulty resets deliver breathing room, survival comes down to efficiency, balance-sheet discipline, and waiting out the storm—both meteorological and market-driven—with fewer comforts than usual.

- Why are bitcoin miners seeing lower revenue right now?

Mining revenue has fallen as bitcoin prices dropped and hashprice slid to one of its lowest levels in the past year. - What is hashprice and why does it matter to bitcoin miners?

Hashprice measures the estimated daily revenue earned per petahash per second (PH/s) and directly reflects miner profitability. - How far is bitcoin from its recent all-time high?

Bitcoin is currently about 37% below its October all-time high above $126,000. - What could improve bitcoin miner revenue going forward?

A recovery in bitcoin’s price or a downward adjustment in mining difficulty could help ease pressure on miner margins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。