Bitcoin Futures and Options Show Defensive Shift

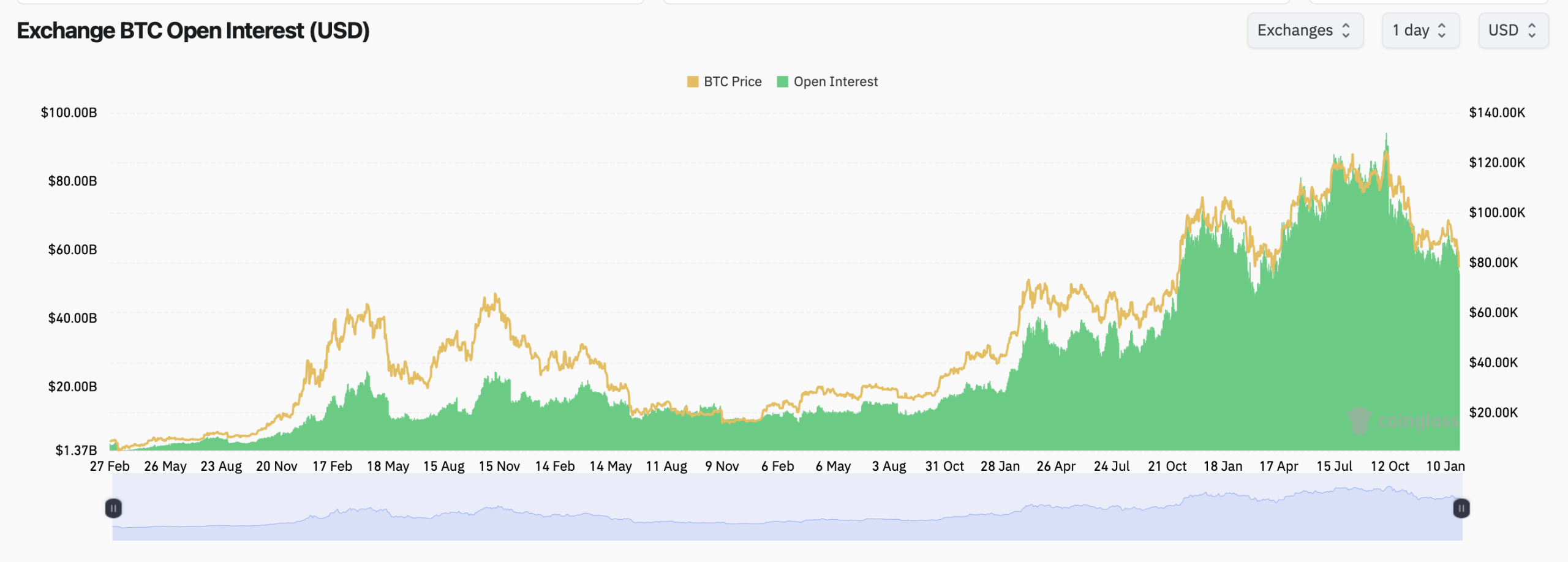

Across major derivatives exchanges this weekend, bitcoin futures open interest totals 677,730 BTC, or $52.98 billion, according to the latest exchange data. That figure marks a broad pullback, with aggregate open interest down 6.83% over the past 24 hours, signaling ongoing deleveraging after January’s volatility.

Futures positioning remains concentrated on a handful of venues. Binance and CME dominate, holding roughly 19.1% and 17.8% of total open interest, respectively. Binance leads with 129,580 BTC ($10.13 billion) in open contracts, while CME follows closely with 120,910 BTC ($9.45 billion), reinforcing the split between offshore and institutional futures activity.

Bitcoin futures open interest on Feb. 1, 2026.

Short-term flows show traders stepping back almost everywhere. One-hour and four-hour open interest changes are broadly negative across Binance, Bybit, Gate, and CME, while only OKX and Bitget post modest short-term increases, suggesting selective positioning rather than a broad directional push.

Zooming out, long-term data reveals how dramatically futures exposure has expanded since 2023 before rolling over. Total futures open interest surged alongside bitcoin’s climb toward six figures last year, then softened as bitcoin’s price retreated. The current contraction suggests traders are trimming leverage without fully abandoning directional exposure.

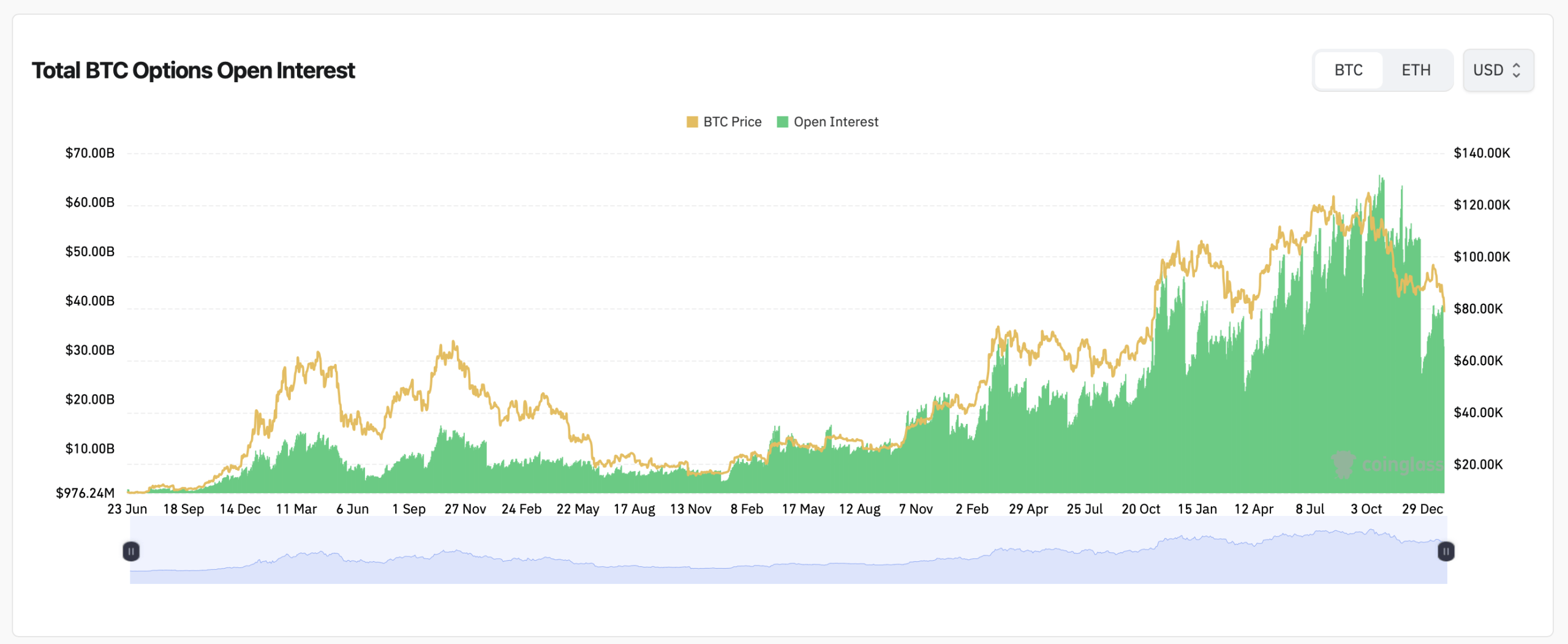

Options market data from coinglass.com tells a more nuanced story. Total bitcoin options open interest remains fairly elevated, with call contracts holding 55.99% of total open interest, versus 44.01% for puts. That tilt implies traders still see upside potential, even as they hedge more carefully.

Bitcoin options open interest on Feb. 1, 2026.

Volume paints a slightly different picture. Over the past 24 hours, puts edge out calls, accounting for 51% of traded options volume, while calls capture 49%. The imbalance hints at short-term caution, with traders actively paying for downside protection near current price levels.

Strike concentration offers another clue. On Deribit, the largest open interest clusters sit at $100,000 and $105,000 calls, alongside heavy positioning in $75,000 and $85,000 puts, reflecting a market bracing for volatility without committing to a clean directional thesis.

Max pain levels reinforce that tension. On Deribit, max pain hovers near $90,000, while OKX centers closer to the mid-$80,000 range. Binance’s max pain skews higher, pushing toward the low $90,000s, suggesting option writers benefit most if price remains pinned below recent highs but above panic levels.

Also read: Resistance Everywhere, Relief Nowhere: Bitcoin’s Rollercoaster Ride Continues

CME options add an institutional twist. Stacked-by-expiration data shows growing exposure in near- and mid-term maturities, with contracts expiring within six months dominating open interest. Stacked-by-position charts confirm calls still outweigh puts over time, though recent growth favors downside hedges rather than outright bearish bets.

Taken together, bitcoin’s derivatives markets are not flashing euphoria or fear. Futures traders are reducing leverage, options traders are clustering around key strikes, and max pain levels suggest price gravity zones are tightening. For now, derivatives traders appear content to let spot price do the heavy lifting—while they wait.

FAQ ⏱️

- What is bitcoin futures open interest?

It measures the total value of open futures contracts that have not been settled or closed. - Why is falling open interest important?

Declining open interest often signals deleveraging, reduced speculation, or traders exiting positions. - What does max pain mean in options markets?

Max pain is the price level where most options expire worthless, benefiting option sellers. - Are traders bullish or bearish right now?

Options data shows a mild bullish tilt in positioning, but short-term trading favors caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。