On Thursday, it was reported that Citgo Petroleum acquired Venezuelan crude oil for the first time in seven years, according to two “sources familiar with the matter” who spoke to Reuters this week. The development follows the recent $500 million oil sale, which was also reported by Reuters and CNN, citing unnamed sources.

The U.S. has steadily advanced on this front since Nicolás Maduro was captured by U.S. forces at the direction of President Trump on Jan. 3, 2026. Maduro was transported to the United States, held at the Metropolitan Detention Center in Brooklyn, and charged with offenses that include narco-terrorism conspiracy and conspiracy to import cocaine. Maduro entered a not-guilty plea on Jan. 5–6, 2026.

Nicolás Maduro

His next scheduled court date is March 17, 2026, likely for a pretrial hearing or status conference. Following his removal, Vice President Delcy Rodríguez was sworn in as interim president on Jan. 5, 2026, by Venezuela’s parliament and Supreme Tribunal of Justice, which maintains that Maduro remains the de jure president. Moreover, immediately following Maduro’s capture, Trump moved swiftly to snap up U.S. oil interests in Venezuela.

Venezuelan crude, particularly from the Orinoco Belt—the world’s largest known oil reserves—is highly viscous (does not flow easily) and often “sour” (high sulfur content), which demands specialized handling. Reuters reports that Citgo has drawn on other Latin American heavy grades in recent years and, according to anonymous sources citing “confidential details,” has acquired a cargo of roughly 500,000 barrels of dense Venezuelan crude.

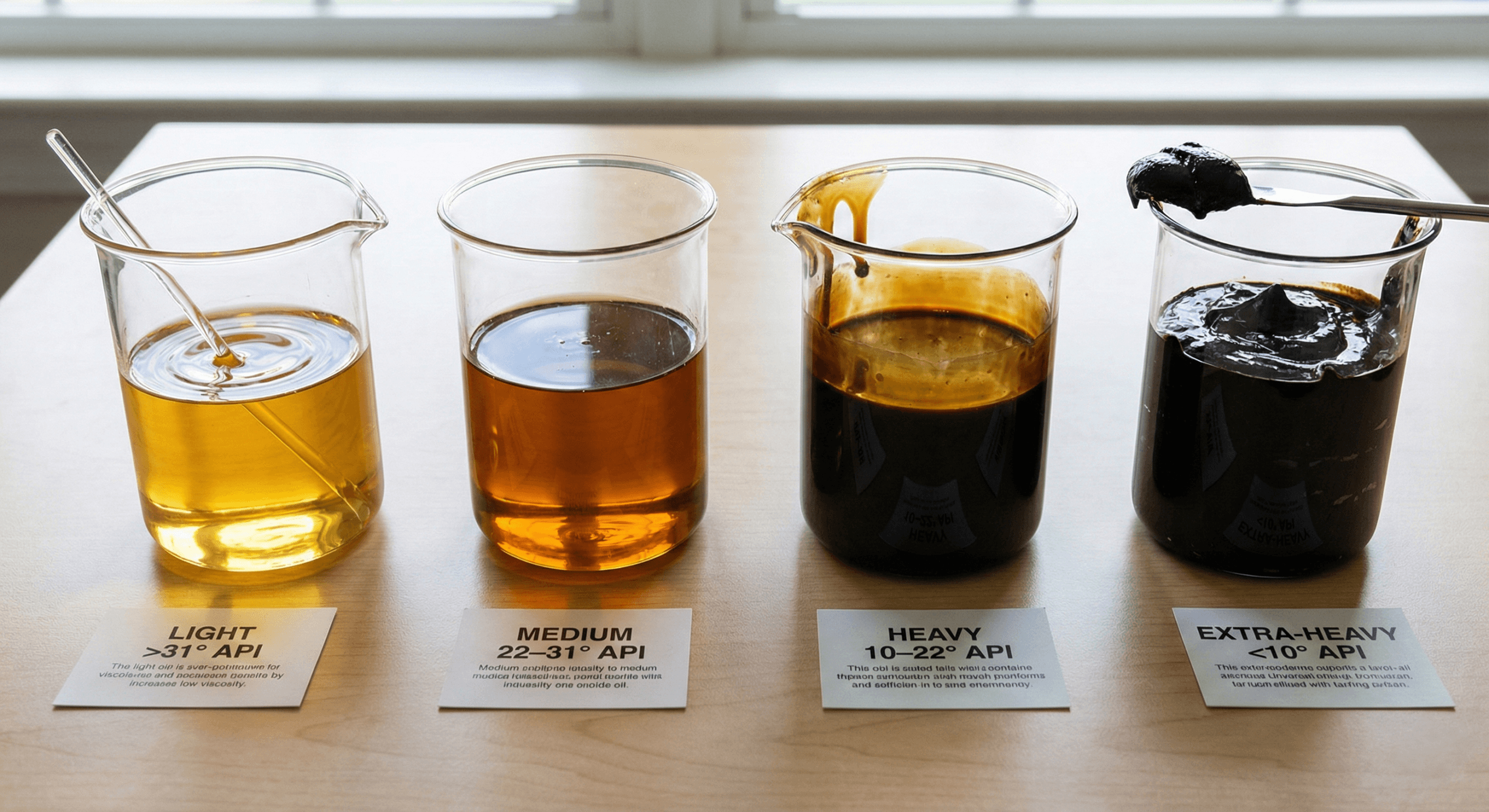

Crude oil grades by density: Light, medium, heavy, and extra-heavy oils shown side by side, illustrating why Venezuelan Orinoco crude requires blending with lighter U.S. diluent to make it transportable and refinable.

A central factor in the U.S. calculus is that American crude oil is generally not thick, with most production consisting of light grades that are easy to refine—a stark contrast to Venezuela’s largely heavy and extra-heavy blends from the Orinoco Belt. This abundance of light U.S. crude is exactly why the Trump administration can provide diluent—such as light hydrocarbons or naphtha—to blend with Venezuela’s dense oil, rendering it pumpable and suitable for refining.

Year to date, oil has performed solidly against the U.S. dollar, with spot prices for U.S. crude climbing roughly 13.96%. A barrel is currently changing hands near $64.74, far below the late-May 2022 advance above $120 and the mid-June 2025 run toward $75. Oil ranks as the world’s second-largest asset class, carrying an estimated $117 trillion market capitalization, trailing only real estate at about $671 trillion.

Also read: Trump Presses US Oil Expansion Into Venezuela, Signals Exxon Exclusion

If additional Venezuelan heavy crude enters the market efficiently—using light U.S. diluent for blending—oil prices could encounter downward pressure later in the year, absent a change in demand or unexpected disruptions. The reported Venezuelan crude sale and Citgo’s purchase of a Venezuelan cargo signal a notable turn in U.S.–Venezuela energy relations following years of sanctions.

Moreover, given the legal posture—U.S. federal custody, serious charges, and no public indication of a negotiated arrangement—Maduro does not appear positioned to return to power. At the national level, Venezuela could collect more revenue than it did under earlier sanctions, as the crude is now being sold at prices well above the steep discounts seen in prior periods.

- Why did Citgo purchase Venezuelan crude now?

Citgo’s acquisition follows a shift in U.S. policy after Nicolás Maduro’s capture, enabling limited Venezuelan crude sales under U.S. oversight. - Why does Venezuelan oil require U.S. involvement to move efficiently?

Venezuelan heavy crude from the Orinoco Belt must be blended with light U.S. diluent to make it transportable and refinable. - Could Venezuelan oil flows affect global prices?

An increase in efficiently blended Venezuelan supply could place downward pressure on oil prices later in the year if demand remains steady. - Does Venezuela benefit financially from renewed oil sales?

Yes, Venezuela may earn more revenue than under past sanctions because crude is now selling at higher prices than during heavily discounted periods.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。