Today's homework is harder to write. Gold and silver have seen a significant decline, and unlike yesterday, where there was a quick rebound after the drop, today's rebound is much weaker. Additionally, a strange phenomenon has occurred today: the price difference between gold and silver in the U.S. and China has widened under the same unit of measurement, based on data before the closing of exchanges in both countries.

This may indicate that gold and silver in the U.S. are primarily traded through futures and paper contracts, while in Shanghai, there is a greater emphasis on physical delivery and actual demand. Therefore, in the face of the same decline, the prices of gold and silver on the Shanghai exchange appear to be more resilient. Currently, when converted, the prices of gold and silver in China should be higher than the current prices in the U.S.

Today, U.S. stocks continued to decline, but the U.S. dollar index is rising. Although this does not completely prove that institutions are reducing their stock holdings and increasing cash, the trend suggests a significant possibility, especially after Trump announced Kevin Walsh as the new Federal Reserve Chairman nominee, leading to a short-term increase in U.S. Treasury purchases, while long-term Treasuries saw new sell-offs. The market is not very optimistic about Walsh.

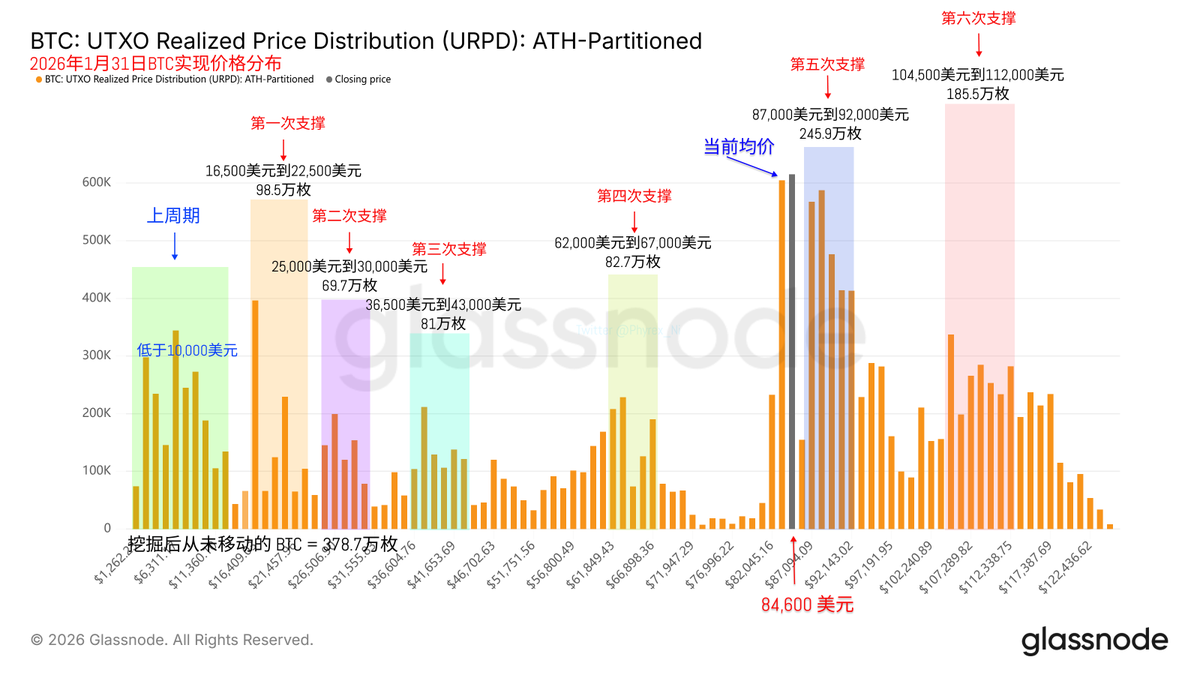

Looking back at Bitcoin data, the turnover rate has increased significantly. Yesterday was relatively stable, but today the level of panic has clearly risen. However, the main providers of turnover are still short-term investors. Due to the uncertainty of the specific reasons for the decline, market sentiment is quite tense, especially during the weekend when liquidity is poor. Let's observe the reaction of the Asian market.

From the perspective of chip structure, it remains stable, with the support at $83,000 being quite strong. More $BTC has returned to this range; let's see if a new bottom can be formed. However, it is evident that early investors who are at a loss have not seen much change.

Be cautious over the weekend.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。