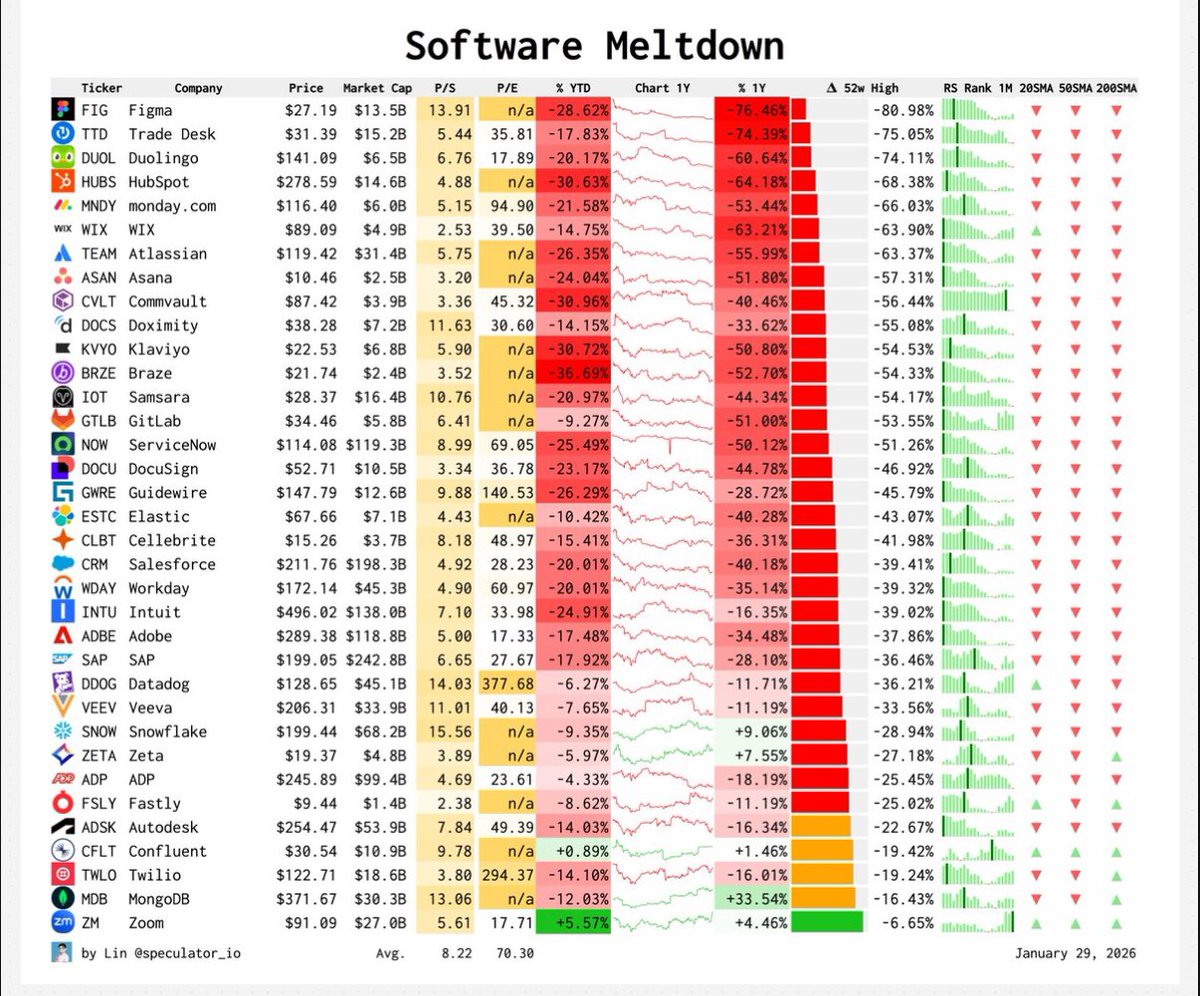

⚠️ It's not just gold and silver; American software stocks have also crashed, facing the worst annual start in years!

As the Nasdaq approaches historical highs, several traditional SaaS companies' stocks have recorded their largest weekly declines;

It can be said that the release of Claude Cowork AI has showcased unprecedented capabilities and speed of change, completely accelerating the performance divergence of software stocks and other sectors in technology!

Over the past decade, the U.S. stock market's software sector has benefited from a triple dividend:

1) Low interest rates → Extremely low discount rates → Maximization of future cash flows

2) SaaS model → High gross margins + High renewal rates → The ability to tell a lifetime value story

3) Cloud transformation → The market is willing to give a premium for certain growth

The result is a typical phenomenon:

As long as you are SaaS + high growth + attractive ARR — even if you are not profitable, you can expect a valuation of 15–30 times.

However, with the emergence of AI, the marginal costs of some software functions have approached zero, leading to a noticeable shift in capital —

From application layer SaaS → Flowing into AI infrastructure + Computing power + Chips + Platform-level models

Following this trend, regardless of how cheap the stock price is or how large the decline is, it seems that there are currently no reasons to hold software stocks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。