Original Title: 《What prediction markets reveal about ICOs》

Author: LEGION (@legiondotcc)

Translation and Compilation: BitpushNews

Prediction Markets in the World of Tokens 预测市场

The token issuance prediction market of Polymarket has processed nearly $2.5 billion in trading volume, with the platform claiming an astonishing prediction accuracy—100% for fundraising scale predictions and over 90% for valuation predictions. However, in-depth analysis shows that these figures are severely misleading: the true market signal lies not in "what was predicted correctly," but in "how often predictions were wrong."

By analyzing data from 231 prediction markets across 29 token issuance events, combined with actual token performance from CoinGecko, we found that these markets are not reliable prediction tools but rather contrarian indicators reflecting market sentiment.

Key Findings:

One week before the prediction market closed, the actual prediction accuracy was only 66.7%. At critical moments, the crowd was wrong one out of every three times, and erroneous predictions systematically exhibited excessive optimism.

24-hour volatility issue: Using hourly data from CoinGecko, we found that the PM market betting on "FDV exceeding X on the first day of listing" was subject to extreme volatility.

Average 24-hour change: ±23% | Best case: Monad +54.8% | Worst case: Trove -38%.

75% of tokens saw their prices drop within the first 24 hours of listing. PM's 24-hour FDV prediction accuracy: only 62.5%.

The Fallacy of Accuracy

When we track the changes in market probabilities over time rather than just looking at the final results, a different picture emerges. The commitment market appears "100% accurate" because, as sales progress, final data leaks out. Insiders and observers update prices based on this, which is merely price discovery after the facts have occurred.

Key Findings:

Both the commitment market and FDV market approach ~100% accuracy at closing because they settle after the results are known. The commitment market closes after the sale ends; the FDV market closes after the 24-hour period post-listing. The only meaningful predictive metric is the accuracy one week before closing, when true uncertainty exists. A 66.7% commitment accuracy indicates that the market is wrong one-third of the time at critical moments.

Where Users Misjudge

We examined every market where users had over 60% confidence in unrealized outcomes. In every case, the erroneous direction was consistent: excessive optimism. The crowd consistently believed that the fundraising scale would be larger and the valuation would be higher than reality.

This systematic bias indicates that participants in these markets are optimistic speculators, drawn in by their positive outlook on token sales.

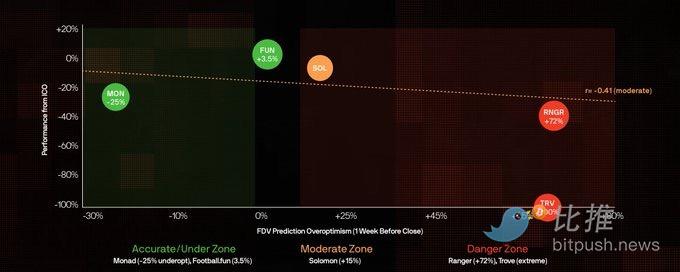

Excessive Optimism vs Token Performance (Since ICO)

Methodology: This analysis only selected markets that conducted public ICOs and issued tokens, using PM odds from one week before closing. Excessive optimism = (PM predicted FDV – actual 24-hour FDV) / actual 24-hour FDV. The Y-axis shows the return performance since the ICO.

Data shows a moderate negative correlation between excessive optimism and ICO returns (r=-0.41). Monad was underestimated (-25%) but has still dropped -24% since the ICO. Ranger was the most excessively optimistic (+72%) but has dropped -32% since the ICO. Only Football.fun remains above its ICO price (+1%).

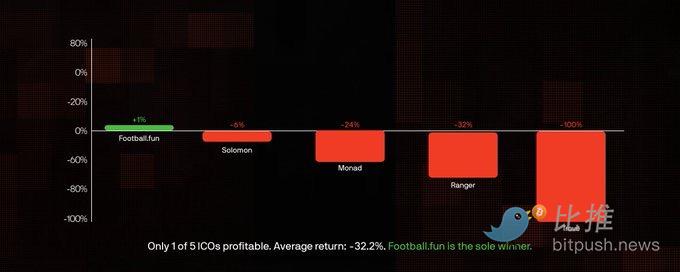

Token Performance Ranking

The table below uses historical PM odds from one week before closing, revealing the true predictive accuracy.

The pattern is clear: extreme excessive optimism predicts disaster, while high PM trading volume is a contrarian indicator even when its predictions are accurate.

ICO FDV vs Listing Performance

Key Findings: Among tokens with ICO data, 40% listed below their ICO valuation. Average return since the ICO: -32.2%. Only Football.fun's trading price is above its ICO price.

The pattern is very clear: even those tokens that listed above their ICO valuation (Monad, Solomon) ultimately fell below the ICO price. Among the five ICO tokens in this dataset, only Football.fun currently trades above its ICO price (+1%), making it the sole winner.

Key Conclusions

After analyzing 231 markets, $241.5 million in trading volume, and 8 listed tokens with verified 24-hour FDV data, several conclusions emerge clearly:

"100% accuracy" is meaningless. Markets close after the results are known (commitment markets after sales, FDV markets after 24 hours), so later accuracy is irrelevant and approaches ~100%. One week before closing, the true prediction accuracy of commitment markets was only 66.7%. At critical moments, the crowd is wrong one-third of the time.

Systematic excessive optimism. Among the top 15 markets, five had over 60% confidence in unmet thresholds. Average FDV overestimation: +35%.

High PM trading volume is a contrarian indicator. Monad ($89 million) and MegaETH ($67 million) exhibited the highest levels of excessive optimism. The more money the crowd invests, the more confident they become, and they often err more drastically.

Conservative predictions = better outcomes. Tokens with accurate PM predictions (Monad, Football.fun) experienced smaller declines. Low hype and accurate predictions seem to be bullish signals.

Trading Signals

Based on the analysis, we can extract actionable signals for evaluating future token sales. These are not absolute but represent patterns that recur in our dataset.

Bearish Signals

PM trading volume > $50 million

FDV excessive optimism > 50%

All FDV thresholds may be unmet

Commitment amount excessive optimism > 30%

Bullish Signals (relatively)

PM trading volume > $5 million

FDV prediction error within 20%

Multiple FDV thresholds will be met

Crowd expectations are conservative

This asymmetry is crucial. Bearish signals are strong indicators of poor outcomes, while bullish signals are relatively weak—merely suggesting that a token may "not drop as badly" as those that are heavily hyped. In a market where token prices are generally retreating from historical highs, "not dropping much" is already the most ideal scenario.

Ultimately: Polymarket's token sales market is essentially a hype measuring device. The real signal lies not in the predictions themselves but in the degree of deviation between predicted outcomes and actual performance. When public funds flood in, betting that valuations will continue to rise, it is wise to remain vigilant.

History has repeatedly shown: when market consensus peaks, it is often when investors experience the greatest pain.

Data sources in the article: Polymarket CLOB API, CoinGecko, CMC (cross-validated), price data as of January 27, 2026.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。