Written by: ChandlerZ, Foresight News

On January 30, global risk asset sentiment significantly cooled, with U.S. stocks fluctuating lower under the dual pressures of tech stock divergence and rising geopolitical risks. The Nasdaq fell by 0.72%, with the biggest impact coming from Microsoft: the market raised concentrated doubts about the intensity and return cycle of its AI and data center-related capital expenditures, causing the stock price to drop nearly 12% at one point during the day, ultimately closing down 10%, marking one of the largest single-day declines since 2020, with its market value evaporating to the second largest scale in U.S. stock history, directly dragging down overall market sentiment.

Meanwhile, Bitcoin briefly fell below $82,000, reaching a two-month low. Ethereum dropped below $2,800, currently reported at $2,744. According to CoinAnk data, in the past 24 hours, the entire network saw liquidations of $1.451 billion, with long positions liquidating $1.361 billion and short positions liquidating $90.23 million. Among these, Bitcoin liquidations amounted to approximately $683 million, while Ethereum liquidations were about $335 million.

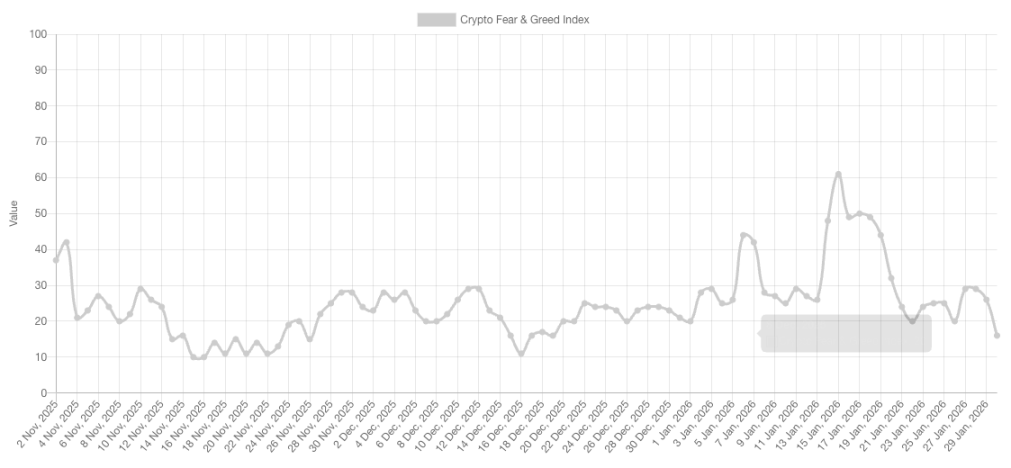

According to Alternative.me data, today the cryptocurrency fear and greed index dropped to 16 (down from 26 yesterday, indicating "fear"), suggesting that the market has shifted from a "fear" state to an "extreme fear" state.

Foresight News would like to know your judgment on the future market in 2026. Feel free to take 30 seconds to fill out the questionnaire, and we will reference the results in future reports.

Geopolitical Games Heat Up, Precious Metals Amplify Volatility Passively

Geopolitical disturbances have shifted market focus to the rising marginal risks in the Middle East. U.S. officials have been in intensive discussions with Saudi and Israeli counterparts in Washington regarding Iran, interpreted by outsiders as both military options and diplomatic paths being put on the table. Coupled with news of Iranian military exercises in the Strait of Hormuz, typical tail risks related to energy supply and shipping security have re-entered the pricing framework. International oil prices surged by 3%, reaching a five-month high, with Brent crude closing at its highest point since July 31, and WTI crude at its highest since September 26.

At the same time, another political clue is reinforcing risks. According to reports from the Financial Times and the U.S. Beast Daily, against the backdrop of deepening rifts between the U.S. and Canada, a "very, very high-level" U.S. government official secretly met with an extreme right separatist group attempting to undermine Canada's national foundation. The Financial Times cited sources saying that since April of last year, leaders of the extreme right separatist group "Alberta Prosperity Project," advocating for the independence of Alberta, Canada, have met three times with U.S. State Department officials in Washington. The organization is seeking to meet again next month with officials from the U.S. State Department and Treasury, planning to request the establishment of a $500 billion credit line to help the province operate after a yet-to-be-held so-called "independence referendum" is passed.

The precious metals market also experienced severe fluctuations, with gold and silver both plummeting significantly after reaching historical highs. On the night of January 29, spot gold prices briefly dropped over $400, falling from around $5,530/ounce to $5,105.83/ounce, before recovering nearly half of the decline, ultimately closing down 0.69% at $5,377.4/ounce. Spot silver prices also fell from a historical high of $121.67/ounce to $106.80/ounce, with a maximum intraday drop of 8.5%, before quickly rebounding, ultimately closing down 0.64% at $115.87/ounce.

Currently, the funding rate for Binance's U.S. dollar-denominated gold XAU USDT perpetual contract is 0.01982%, and for silver XAG USDT perpetual contracts, it is 0.0191%.

Microsoft Experiences Largest Single-Day Drop in Nearly Six Years, Igniting AI Bubble Concerns

Microsoft's earnings report has led the market to once again question the AI narrative. By the close, its market value had dropped to $3.22 trillion, with the stock price's significant decline resulting in a loss of $357 billion in market value for the tech giant.

The earnings report showed that Microsoft’s revenue for the second quarter of fiscal year 2026 was $81.27 billion, a 17% year-over-year increase, with adjusted earnings per share of $4.14, both exceeding expectations of $80.27 billion and $3.97. Benefiting from a change in accounting treatment for its investment in OpenAI, which brought in $7.6 billion in gains, GAAP net profit was $38.46 billion, a 60% year-over-year increase.

However, the core growth engine appears slightly fatigued. Although cloud business revenue surpassed $50 billion for the first time, reaching $51.5 billion with a 26% year-over-year increase, the growth rate of key services like Azure and other cloud services was only 38%, slowing by 1 percentage point from the previous quarter. Capital expenditures surged 66% year-over-year to $37.5 billion, with two-thirds allocated to AI chips and data center construction. Additionally, revenue from the more personal computing segment was $14.25 billion, a 3% year-over-year decline, and Xbox content service revenue fell by 5%, becoming the only business segment to decline year-over-year.

From an earnings report perspective, profits and revenues indeed continued to show strength, and the scale of the cloud business continued to expand, sufficient to prove that enterprise demand remains. However, in a high-valuation environment, Wall Street is more concerned with whether marginal trends continue to rise. Even a slight decline in Azure's growth rate could be seen as an early signal of a flattening growth curve, as this would mean that to maintain the same valuation multiples in the coming quarters, stronger acceleration evidence must be presented.

More direct pressure comes from the speed of capital expenditure expansion. Microsoft has significantly increased its investment in AI and data centers, and with constraints on computing power and capacity in the short term, Microsoft must tilt resources between immediate revenue from external cloud customers and its own AI product experience. This allocation of capacity will affect Azure's short-term profitability as a pure cloud platform and make it more difficult for investors to extrapolate future performance using traditional cloud business profit margin logic.

U.S. stocks may experience a temporary rebound supported by earnings reports, buybacks, and funds entering at lower prices, while gold and silver may also recover some of their declines after oscillating between safe-haven demand and liquidity rebalancing. However, the cryptocurrency market, due to currently tight marginal liquidity, lacks sustained spot support and stable incremental funding sources, with shallow market depth making it easy for concentrated selling pressure to breach key price levels, triggering a chain of stop-losses and forced liquidations, amplifying declines. Once key support levels are breached, it is even easier for the market to evolve into a trend downward.

Looking from the starting point of 2026, macro interest rates, geopolitical risks, and regulatory rhythms are still changing rapidly, and the direction of the cryptocurrency market throughout the year remains uncertain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。