Original Title: The Crypto CEO Who's Become Enemy No. 1 on Wall Street

Original Authors: Amrith Ramkumar, Dylan Tokar, Gina Heeb, The Wall Street Journal

Translated by: Peggy, BlockBeats

Editor’s Note: When the crypto industry truly touches the core financial areas of bank deposits and payments, the conflict is no longer an ideological dispute but a battle of interests. This article uses the confrontation between Brian Armstrong and Wall Street as a thread to reveal the essence of the game between banks and crypto platforms behind the "CLARITY Act." This is not only about the legality of stablecoin yields but also about who will dominate the rule-making power of the next generation of financial systems.

The following is the original text:

Last week, during the World Economic Forum in Davos, Brian Armstrong, CEO of the largest cryptocurrency company in the U.S., was having coffee with former British Prime Minister Tony Blair when Jamie Dimon suddenly interjected.

"You’re talking nonsense," said Jamie Dimon, who has long been skeptical of cryptocurrencies and once called Bitcoin a "scam," while pointing his finger directly at Armstrong's face.

According to insiders, Dimon's core message was simple: Armstrong should stop lying on television. Just a week prior, Armstrong had accused banks on multiple business television programs of trying to undermine legislation aimed at establishing a new regulatory framework for digital assets.

This confrontation clearly did not align with the Davos annual meeting's purpose of "promoting global leader cooperation."

As the crypto industry rapidly enters the mainstream financial system in the U.S., some heavyweight figures on Wall Street are beginning to realize that a threat is looming. Although banks have somewhat embraced crypto assets—such as assisting clients in investing in Bitcoin or using digital assets to enhance cross-border transfer efficiency—when crypto business touches their core territory, banks have chosen to draw a line: consumer deposits.

The positions of banks and Coinbase are in direct conflict over a key issue: should crypto trading platforms be allowed to offer users "holding yields"? This so-called "reward" typically refers to paying a certain percentage of returns to stablecoin holders regularly, such as an annualized 3.5%. Stablecoins are a type of digital asset pegged to real-world currencies like the U.S. dollar.

Bank of America CEO Brian Moynihan and JPMorgan CEO Jamie Dimon.

Banks believe that such payments to users are essentially no different from bank account interest. Since the yields offered by banks are much lower—savings account rates are typically below 0.1%—they are concerned that the result will be a significant outflow of consumer funds into crypto assets. This outflow, banks claim, will undermine the viability of community banks and affect lending to businesses.

Brian Armstrong and other crypto industry figures argue that the free market should be allowed to operate: banks can compete with stablecoins by raising deposit rates or simply enter the stablecoin business themselves.

The legislation known as the "Clarity Act" could reshape the future of everyday financial services, including bank deposits and electronic payments.

According to insiders, in the latest round of compromise efforts, the White House plans to convene a meeting on Monday with banking and crypto industry groups, with David Sacks, the Trump administration's head of AI and crypto affairs, expected to attend. Kara Calvert, Coinbase's head of U.S. policy, is also on the guest list.

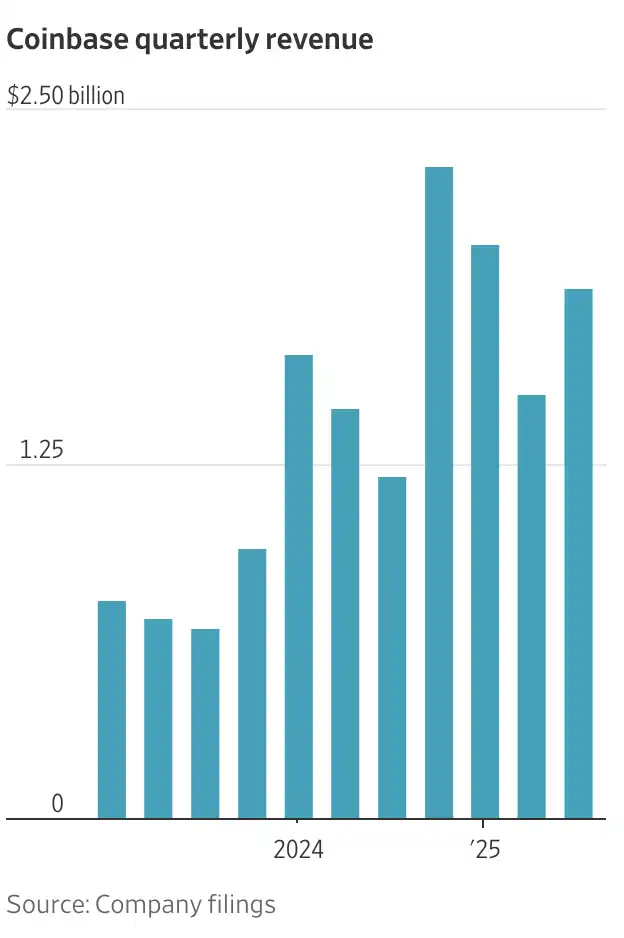

43-year-old Armstrong co-founded Coinbase in 2012 and has played a significant role in pushing the crypto industry toward legitimacy and mainstream acceptance. As the leader of a company valued at about $55 billion, Armstrong holds significant sway in industry debates, especially in this ongoing game in Washington.

Just a day before a Senate committee was set to vote on a version of the bill that could effectively prohibit companies like Coinbase from offering yields to customers, potentially resulting in losses of billions of dollars, Armstrong posted on X: "We would rather have no bill than a bad bill."

Hours later, the vote was unexpectedly postponed, surprising the financial community.

Ron Hammond, head of policy and initiatives at digital asset trading firm Wintermute, stated, "Now it feels more like Coinbase versus the banks, rather than the crypto industry versus the banks."

Armstrong's counterattack did not stop with the January 14 post on X. He later reiterated his views on television, stating in an interview with Bloomberg that bank lobbyists "are trying to kill the competition" and accused banks of "essentially taking their customers' deposits to lend out without permission."

According to insiders, these remarks directly led to a series of uncomfortable confrontations with several bank CEOs in Davos.

"If you want to be a bank, then just go be a bank," Brian Moynihan said during a 30-minute meeting with Armstrong at the main venue in Davos last week. The atmosphere of the meeting was superficially friendly but somewhat stiff.

Citigroup CEO Jane Fraser gave Armstrong less than a minute of her time. (Coinbase is also a client of Citigroup and JPMorgan and has business collaborations with several banks.)

That "minute" was even more than the time Wells Fargo CEO Charlie Scharf allotted. When Armstrong approached him, Scharf bluntly stated that there was "nothing to talk about." This scene unfolded while Scharf's former boss, Dimon, was not far away.

"Bank Alternative"

Armstrong attended Rice University in Houston, where he studied economics and computer science, and was an early proponent of digital currency and blockchain ideas. He read the Bitcoin white paper published in 2008 under the pseudonym Satoshi Nakamoto; in 2011, while working at Airbnb, he was troubled by the difficulties of sending money to South America.

These experiences paved the way for the birth of Coinbase. The company initially sought to solve a core problem that plagued crypto investors: there was no safe place to store digital assets. Later, as some users wanted to do more than just "store" Bitcoin, Coinbase naturally evolved into an exchange.

Coinbase quickly grew from a small apartment in San Francisco (the company's first office). By 2017, when another co-founder left, Armstrong had become the undisputed leader of the company.

Former colleagues have previously told The Wall Street Journal that Armstrong is introverted, sometimes struggles to communicate with employees, and is not very good at giving face-to-face criticism to subordinates. Some former employees feel that his style resembles that of the "Vulcans" from "Star Trek," known for their calmness and restraint.

Brian Armstrong in 2014, CEO of Coinbase.

However, Armstrong has never hidden his ambitions for Coinbase. He positions Coinbase as the American company that will bring cryptocurrency into the mainstream. Today, Coinbase's business scope covers various fields, from electronic payments and stock trading to commodities and prediction markets.

"Fundamentally, we want to be a bank alternative," he stated last year on Fox Business, "We want to build a super app that provides various financial services."

As the business expanded, Armstrong invested tens of millions of dollars to build the largest lobbying machine in the industry. After experiencing multiple cycles of boom and bust in the crypto market, Coinbase went public in April 2021, reaching a peak market value of $100 billion, and Armstrong's personal stock value briefly rose to about $13 billion.

After surviving the industry's collapse in 2022 and the regulatory crackdown during the Biden administration in 2023, Armstrong began to push back strongly and gradually found his voice. The founder, who once preferred to wear headphones, write code in the office, and was somewhat reluctant to speak publicly, has now become the most active spokesperson for the crypto industry in Washington—while the U.S. political landscape's attitude toward cryptocurrencies is also undergoing a dramatic shift.

Coinbase has invested about $75 million through a network of super political action committees (Super PACs) in the 2024 election cycle, aiming to counter skeptical candidates and build grassroots organizations to garner public support for crypto-related legislation. The super PAC group announced on Wednesday that it currently has a funding size of $193 million.

Trump's victory in 2024 opened a policy window for Armstrong that he has pursued for a decade. He praised Trump for ushering in the "dawn of a new era for crypto" and attended a "Crypto Ball" featuring a performance by Snoop Dogg before and after Trump's inauguration. Now, this executive changes out of his signature T-shirt and black jacket into a suit to visit lawmakers on Capitol Hill at least every two months.

"In all matters related to crypto in the U.S., Coinbase is at the forefront," said Anthony Scaramucci, founder of SkyBridge Capital and a long-time crypto investor.

Last summer, Trump signed the "Genius Act" into law, clearing the way for multiple companies to issue stablecoins. This law has driven rapid growth in stablecoin activities. The bill prohibits issuers from directly paying interest to users but does not cover trading platforms or third parties like Coinbase. This "omission" is viewed by banking groups as a regulatory loophole and is the current flashpoint in the conflict surrounding the "Clarity Act."

A Long Legislative Journey

The House of Representatives passed its version of the "Clarity Act" last year, but advancing it in the Senate is generally considered more challenging, partly due to significant disagreements over what rules crypto companies should follow. The Senate Agriculture Committee, responsible for overseeing provisions related to the Commodity Futures Trading Commission, advanced its own version on Thursday. Legislators will ultimately need to pass a version of the text in a full Senate vote and reconcile it with the House version.

According to insiders, Brian Moynihan's core point to Armstrong is that if crypto companies like Coinbase want to offer services similar to deposits, then, in the eyes of many banks, they should accept the same regulatory burdens as banks. Regulatory agencies, including the Federal Reserve and the Office of the Comptroller of the Currency, review banks' risk profiles, conduct regular examinations of their operations, and impose strict capital requirements for loans and investments.

"The controversy surrounding the 'reward mechanism' is actually an exception in our overall relationship with banks," said Coinbase Chief Policy Officer Faryar Shirzad. "We maintain close cooperation with banks and have announced several partnerships."

Coinbase has established a lucrative partnership with stablecoin issuer Circle, allowing it to earn a substantial revenue share from the mainstream stablecoin USDC. Through this unique arrangement, Coinbase can offer some USDC holders a yield of 3.5%, which is uncommon in the industry. The company states that such incentives help attract users and provide consumers with more options in an environment of extremely low savings account rates.

"There is no reason to prohibit paying interest to consumers," Armstrong said in an interview with The Wall Street Journal last year.

On January 15, 2026, Brian Armstrong appeared on Capitol Hill.

As the "Clarity Act" gradually moves toward a vote in Congress, banks have begun intense lobbying behind the scenes. According to a government estimate cited by banks, if the relevant restrictions are lifted, approximately $6.6 trillion in deposits could be "pulled out" of the traditional financial system. This lobbying quickly bore fruit: a nearly 300-page draft of the bill included a series of provisions and potential amendments that, in Armstrong's view, amounted to a failure for the crypto industry. He promptly withdrew his support, and Senate Banking Committee Chairman Tim Scott (Republican, South Carolina) canceled the scheduled vote just hours later.

According to insiders, Armstrong has ideas on how to break the deadlock. He has suggested to Brian Moynihan the establishment of a new category of stablecoin issuers: those that meet stricter regulatory standards would be allowed to pay yields to users. This way, banks could theoretically compete under the same regulatory framework as Coinbase.

Other proposals advocate for broadly prohibiting yield payments but reserving a small number of exceptions for institutions like Coinbase.

Regardless of the final proposal, legislative progress will almost certainly require Armstrong's endorsement.

"The current situation is that everyone believes whether this legislation passes ultimately depends on whether Coinbase gives a nod," said Hilary Allen, a professor at American University Washington College of Law, a securities law expert, and a crypto skeptic. "This is a truly shocking reality."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。