Written by: Ethan (@ethanzhang_web3)

On January 29, the U.S. Securities and Exchange Commission (SEC) released a latest guidance document regarding tokenized securities. This document was released just as the SEC and CFTC were rescheduling their originally planned “SEC and CFTC Joint Regulatory” public event — the inter-agency coordination dialogue, originally set for January 27, has been adjusted to take place on January 29 from 2 PM to 3 PM EST.

Now that this inter-agency coordination dialogue has concluded, the SEC has proactively sent a clear signal through this guidance document: In constructing the regulatory framework for crypto assets, the SEC chooses to first clarify the structure, delineating the “identity” of tokenized practices in the market.

Odaily Planet Daily will break down how this document redefines the regulatory logic of “tokenized securities” and which popular projects will face critical tests as a result.

Core Objective: Re-labeling “Tokenized Practices”

Opening the original text of the “Statement on Tokenized Securities,” the document's goal is almost self-evident: The SEC is not trying to establish a new framework for tokenized securities but is attempting to answer a more fundamental question — under the existing federal securities laws, what category of financial instruments should the various tokenized operations in the market fall into?

Why is such “labeling” necessary? Because the current market's tokenized practices are extremely chaotic: some are securities issuers using blockchain to register equity, while others are third parties casually issuing tokens claiming to be “linked to certain stocks”; some on-chain assets can indeed trigger official changes in equity, while others are from issuers that are not even recognized. These differences blur regulatory boundaries, and investors can easily be misled by the term “tokenized stocks.” What the SEC aims to do is to first “organize these chaotic phenomena at a structural level.”

According to the document, tokenized securities are categorized into two main types: issuer-led tokenized securities (led by the securities issuer or its agents) and third-party-led tokenized securities (initiated by third parties unrelated to the issuer).

Issuer-led: Technological Upgrade, Not Changing the Essence of Rights

In the issuer-led model, blockchain is directly integrated into the securities holder registration system. Whether using the on-chain ledger as the main registration system or in parallel with off-chain databases, the core logic remains the same — the transfer of on-chain assets will simultaneously trigger changes in the official holder registry of the securities. The SEC emphasizes that the distinction of this structure from traditional securities lies only in the registration technology, without involving changes in the nature, rights, obligations, or regulatory requirements of the securities. The same type of securities can exist in both traditional and tokenized forms, and issuance and trading must still fully comply with the Securities Act and the Securities Exchange Act.

The document also mentions that issuers can theoretically issue tokenized securities that are “different categories” from traditional securities, but the SEC adds a crucial limitation: if the tokenized securities are “substantially the same” in rights and obligations as traditional securities, they may still be considered the same category under specific legal circumstances. This statement does not encourage structural complexity but rather reaffirms that the judgment standard is always based on “rights and economic substance.”

Third-party-led: Prudent Regulation, Risks and Rights Need Reevaluation

In contrast, the third-party-led tokenization structure is placed under a more prudent regulatory perspective. According to the document, when a third party tokenizes existing securities without the issuer's involvement, the on-chain assets may not necessarily represent ownership of the underlying securities, nor do they inherently constitute a claim against the issuer. More critically, token holders must additionally bear the risks associated with the third party (such as custody risk and bankruptcy risk), which do not exist when directly holding the original securities.

Based on this difference, the document further divides third-party tokenization into two typical models:

- Custodial tokenized securities: Essentially “securities equity certificates,” where a third party proves the holder's indirect rights to its custodial securities through tokenized forms (such as tokenized equity certificates issued by custodial institutions);

- Synthetic tokenized securities: Closer to structured notes or securities swaps, these are financial instruments issued by third parties to track the price performance of underlying securities, without granting any shareholder rights (such as tokenized derivatives linked to stock prices).

Despite the numerous risks associated with third-party-led tokenization structures, there remains a certain demand in the market. For some investors, these products offer a relatively convenient and low-cost investment avenue. For instance, some small investors may not be able to directly participate in trading stocks of large companies, but through custodial or synthetic tokenized securities issued by third parties, they can access similar investment opportunities at a lower threshold. Additionally, some investors are attracted to the innovative forms and potential high returns of tokenized securities, and although they may understand the associated risks, they are still willing to take on certain risks for possible returns.

Core Principle: Form Does Not Change Responsibility and Attributes

Throughout the document, the SEC repeatedly emphasizes that it is not the compliance of the technical path that matters, but an unchanging regulatory logic: As long as the economic substance of the financial instrument meets the definition of securities or derivatives, the applicability of federal securities laws will not change due to “tokenization.” The name, packaging method, or even whether blockchain is used are not decisive factors.

From this perspective, this new guidance resembles a “structural clarification statement.” It does not make a value judgment about the future of tokenized securities but clarifies a premise: In the U.S. legal system, tokenization can only change form, not responsibility and attributes. Subsequent market changes will unfold under this premise.

Returning to the Real Context: Which “Tokenized Stocks” Are Being Redefined?

If interpreted solely from the textual level, this new guidance seems to merely clarify the classification structure; however, looking at the real market, its direction is quite clear — it responds to a batch of “tokenized stock” practices that have already come to the forefront.

The most typical distinction first appears in whether the issuer is involved. In paths where the issuer is directly involved, tokenization is more viewed as a technological upgrade to the registration and settlement system. Just before and after the release of this guidance, asset management firm F/m Investments submitted an application to the SEC, hoping to maintain the records of its treasury bond ETF holders on a permissioned blockchain. The common characteristic of such attempts is that blockchain is merely integrated into the existing securities infrastructure, and the legal relationship between the issuer and investors has not changed. For this reason, although the pace of this path is slow, it remains within a framework that the SEC can understand and engage with.

In stark contrast is another category of practices that entered the market earlier and are more controversial. Taking Robinhood's “tokenized U.S. stocks” product launched in Europe as an example, its trading experience and price linkage are highly similar to real stocks, but the related tokens have not received authorization from the issuer. Similar market chaos is also reflected in the rumors of “OpenAI tokenized equity” — previously, a third-party platform claimed to provide “OpenAI on-chain equity certificates,” attracting investor attention. Subsequently, OpenAI publicly denied any association with any “tokenized equity,” which actually exposed the core issue of such structures — on-chain assets do not represent a direct claim to equity from the issuer. In the SEC's context, such products are closer to synthetic exposures constructed by third parties rather than true stocks.

Similar situations also appear in some crypto-native platforms that have launched “tokenized stocks” products. Whether providing securities equity certificates through custodial means or tracking stock price performance through contractual structures, these products functionally “resemble stocks,” but in terms of legal relationships, the entities investors face have shifted from the issuing company to the platform or intermediary itself. This is precisely the reality behind the SEC's repeated emphasis on third-party risks in the new guidance.

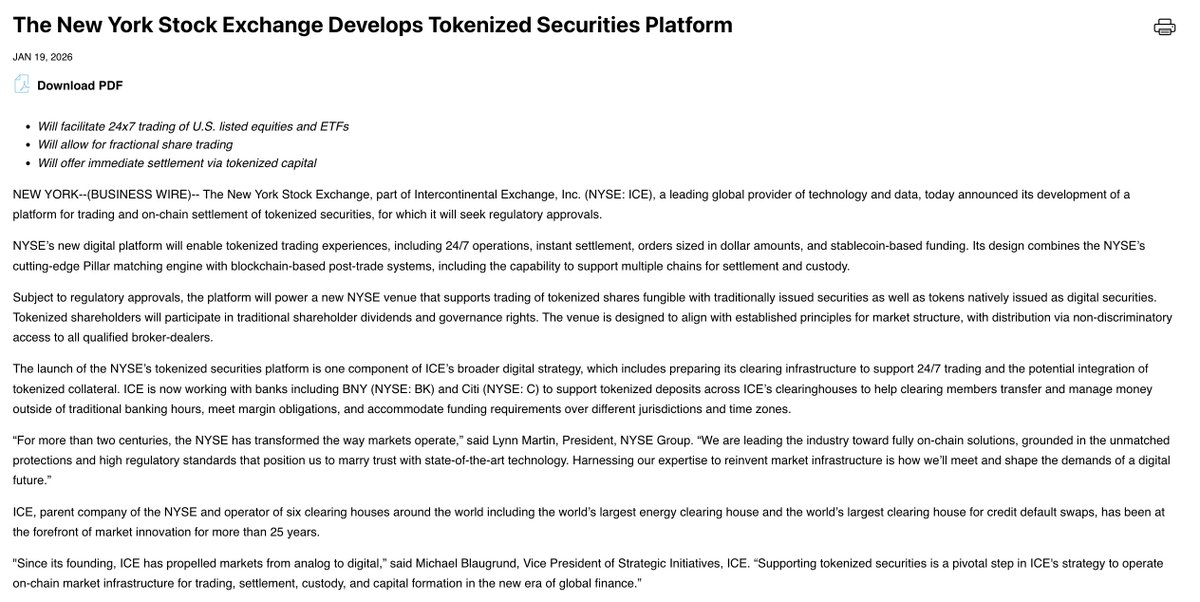

Conversely, those frequently mentioned attempts that always emphasize “compliance prerequisites” — such as Kraken's xStocks plan and the internal explorations of the NYSE and DTCC regarding tokenized stocks and ETFs — share a commonality not in how advanced the technology is, but in whether they fully incorporate the issuer, custody, clearing, and regulatory responsibilities into the existing system. The slow progress of these projects precisely indicates that the U.S. market does not have a shortcut for tokenization that allows for “getting on board first and paying later.”

Conclusion: Tokenization is Not a Shortcut, but a “Mirror” of Responsibility

The essence of the SEC's guidance is a “identity calibration” — before tokenization is grounded in concept, it first clarifies “what equity is and who bears the responsibility.”

In the U.S. regulatory logic, blockchain has never been a tool to bypass securities laws. Whether tokenization can be established depends on whether the issuer is involved, whether rights and obligations are clear, and whether risks are correctly assumed: meeting these three criteria makes it a technological upgrade within the existing financial system; lacking any one of them, the so-called “tokenized stocks” are viewed as another category of financial products in the eyes of regulators.

Therefore, the boundaries drawn by this document are not about “allowing and prohibiting,” but rather a “responsibility screening question” — it is reclassifying the tokenized practices in the market: some are evolving towards securities infrastructure, while others must confront their essence of “non-equity.”

For the market, this may not be a bad thing. At least from now on, tokenization is no longer a vague and enticing label, but a path that must be taken seriously and cannot be speculated upon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。