I. Market Overview for This Week

This week, the cryptocurrency market experienced overall fluctuations under pressure, with Bitcoin trading sideways in the $85,000–$94,000 range for over 60 days. The record net outflow of BTC and ETH spot ETFs has become a major selling pressure in the short term. During the Asian trading session, the market weakened, with leveraged long positions liquidated exceeding $550 million. After briefly testing the $86,000 support, BTC stabilized, while Ethereum dropped to the $2,785 region, with both market participation and implied volatility remaining low. However, Bitcoin has completed the excessive leverage cleanup, and institutional risk aversion has increased, shifting towards options hedging, showing initial resilience in the market in the medium to long term.

Core driving clues present a multi-dimensional interweaving characteristic. On the macro front, uncertainties such as Trump's tariff remarks, the risk of a U.S. government shutdown, and fluctuations in the yen and Japanese bonds continue to disturb market sentiment. On the regulatory front, multiple countries are synchronously advancing compliance construction and risk control. The U.S. SEC and CFTC will jointly coordinate cryptocurrency regulation, Binance has submitted a MiCA license application in Greece, and South Korea plans to allow local institutions to issue virtual assets. Globally, there is a continued crackdown on cryptocurrency fraud, money laundering, and other illegal activities. On the institutional and industry front, actions are intensive, with UBS planning to open cryptocurrency trading to private banking clients, Tether launching the USA₮ stablecoin compliant with U.S. regulatory frameworks, and the global layout and real-world applications of stablecoins accelerating. On the technical front, Ethereum has clarified FOCIL as the core function of the Hegota upgrade, and Vitalik has reiterated the value of ZK technology and the importance of independent blockchain verification, with industry technology iteration steadily advancing.

II. Core Market Trends and Capital Dynamics

This week, the cryptocurrency market continued to exhibit a cautious and weak recovery trend. Although market sentiment slightly improved, it remains deeply entrenched in the fear zone, with the total market capitalization hovering around the $3 trillion mark. The mainstream coins are collectively oversold, creating expectations for a technical rebound, but the rebound strength is questionable due to insufficient trading volume and capital differentiation. Institutional capital layouts show divergence, with the derivatives market continuing to deleverage, and the overall market's long-short game remains conservative, with the bottoming process yet to be completed.

From the perspective of market sentiment, the Crypto Fear & Greed Index rose slightly from last week's 34 to 37, still within the fear zone, reflecting only a slight recovery in market sentiment, with the overall cautious atmosphere unchanged. Currently, mainstream coins are in a narrow fluctuation pattern, with market trading volume remaining sluggish. Coupled with uncertainties in macro policies and tariffs, the outflow of funds has not yet reversed. Although the market has moved away from the previous extreme fear state, the lack of effective support from increased volume and capital inflow means that sentiment stabilization will still require time.

In terms of core market capitalization, the total cryptocurrency market capitalization is reported at $2.99 trillion, with a slight 0.76% decline over 24 hours, consistently fluctuating around the $3 trillion mark without forming an effective upward breakout, and the market's recovery pace continues to slow. After the previous market capitalization decline, there has been a persistent lack of sufficient buying support to drive market capitalization upward, and the overall short-term state remains under pressure. The process of market capitalization bottoming has not yet been completed.

Specifically regarding the two major cryptocurrencies, BTC and ETH both exhibit characteristics of being oversold and awaiting a rebound, with trends still weak. BTC is currently priced at $88,673.59, down 0.89% over 24 hours and down 1.62% over 7 days, with a market capitalization of $1.772 trillion and a market share slightly decreasing to 58.92%. Short-term indicators are collectively oversold, creating expectations for a technical rebound, but indicators like MACD still show weakness, and downward pressure has not completely dissipated. ETH is currently priced at $2,992.38, down 0.66% over 24 hours and down 1.24% over 7 days, with a market capitalization of $362.378 billion and a market share slightly increasing to 12.03%. Short-term multiple indicators have also entered the oversold range, indicating a slight rebound possibility. However, both are constrained by market pessimism, and the rebound strength is likely limited, with medium to long-term indicators leaning bearish, and the downward trend has not been reversed. In terms of operations, positions need to be strictly controlled, and attention should be paid to the stabilization of support levels; if broken, timely stop-loss measures are necessary.

On the capital flow side, the ETF market shows significant differentiation, breaking the previous state of synchronized capital outflows from BTC and ETH. Bitcoin ETF funds continued the outflow trend from last week, with a net outflow of $19.64 million on the day, although the outflow intensity has significantly narrowed compared to last week's overall level of $644 million. Institutional cautious attitudes have slightly eased but have not turned optimistic. In contrast, the Ethereum ETF ended its previous outflow trend, recording a net inflow of $28.1 million on the day, indicating a marginal improvement in institutional attitudes towards it. Future attention should focus on the sustainability of Ethereum's capital inflow and whether Bitcoin's capital outflow further narrows, which will be a key signal for assessing capital market recovery.

The derivatives market continues to show a weakening trend with ongoing deleveraging, aligning with the overall cautious and fluctuating sentiment in the market. The scale of open futures contracts is $3.7 billion, with a slight increase of 0.43% over 24 hours, reflecting a small demand for hedging and short-term positioning; the scale of open perpetual contracts is $63.367 billion, down 1.42% over 24 hours, with capital continuing to deleverage. Over the past week, the open interest in perpetual contracts has continued to decline. The overall market's leverage structure is further contracting, and the long-short game remains conservative. Short-term market fluctuations may be influenced by leveraged capital adjustments, and future attention should focus on changes in volume to confirm the true direction of capital.

Overall, the current cryptocurrency market is in a phase of weak sentiment recovery, capital differentiation, and insufficient volume, with the technical rebound of mainstream coins lacking effective support from fundamentals and capital. In the short term, the market is likely to remain under pressure and fluctuating, waiting for signals of increased volume, capital inflow, or the realization of macro negative impacts to confirm the completion of the bottoming process.

III. Selected Trading Strategy Rankings

1. High-Yield Strategy Selection

Core Highlights:

1. Strong Drawdown Control: Maximum drawdown is only 1.08%, demonstrating outstanding stability in a high-volatility environment for small coins, with very low risk.

2. Clear Profit-Loss Ratio Advantage: A profit-loss ratio of 2.87 can effectively cover a low win rate of 32.5%, allowing single profits to offset multiple losses, providing high tolerance.

3. Ample Yield Elasticity: Nearly 400% actual return rate and over 300% AI predicted return, aggressively adapting to small coin pulse markets.

4. Risk-Reward Ratio Meets Standards: Sharpe ratio of 1.01 achieves a basic balance between returns and risks under high volatility.

Applicable Scenarios:

Suitable for traders with medium to high risk tolerance seeking high returns with low drawdown in small coin trading, adaptable to low market cap coins like XLM that have phase-driven hotspots, especially fitting for concept speculation and capital rotation pulse markets. This can serve as an elastic strategy for small coin allocation, not suitable for long-term stable funds or extreme one-sided markets.

2. High-Frequency Trading Strategy Selection

Core Highlights:

- Excellent Risk-Reward Ratio: Sharpe ratio as high as 89, with attractive returns corresponding to unit risk, perfectly aligning with the core logic of high-frequency trading "controlling risk, accumulating small profits."

- Outstanding Drawdown Control: Maximum drawdown is only 11%, with very low volatility, capable of stably supporting hourly high-frequency operations, avoiding significant drawdowns that affect compound interest accumulation.

- Stable Return Expectations: AI predicts an annualized return rate exceeding 66%, with the high-frequency model "accumulating small wins for big wins," showing significant long-term compound interest effects.

Applicable Scenarios:

Suitable for traders with medium to high risk tolerance seeking stable compound interest in high-frequency trading, specifically designed for high liquidity mainstream trading pairs like ETH, adaptable to fluctuating or mild trend markets. This can serve as a high-frequency bottoming strategy and is also suitable for funds preferring low volatility and continuous returns, not suitable for small coins or extreme one-sided markets.

3. High Stability Strategy Selection

Core Highlights:

- Extreme Win Rate: A historical win rate of 100% indicates extremely high accuracy of strategy signals, with no losses in historical trades, providing strong tolerance.

- Outstanding Stability: Maximum drawdown of less than 5%, performing steadily among high-volatility mainstream coins like ETH.

- Reasonable Risk-Reward Ratio: Sharpe ratio of 21 achieves growth in returns while controlling risks, with attractive returns per unit risk.

- Solid Return Performance: Over 65% actual return rate, achieving considerable yield elasticity within a stable framework, balancing safety and aggressiveness.

Applicable Scenarios:

Suitable for investors with medium risk tolerance seeking steady progress, specifically designed for high liquidity mainstream coins like ETH, adaptable to fluctuating or mild trend markets. This can serve as a core strategy for medium to long-term allocation and is also suitable for traders preferring low drawdown and high win rates, not suitable for extreme one-sided markets or small coin speculation.

IV. Top 24h Cryptocurrency Price Changes

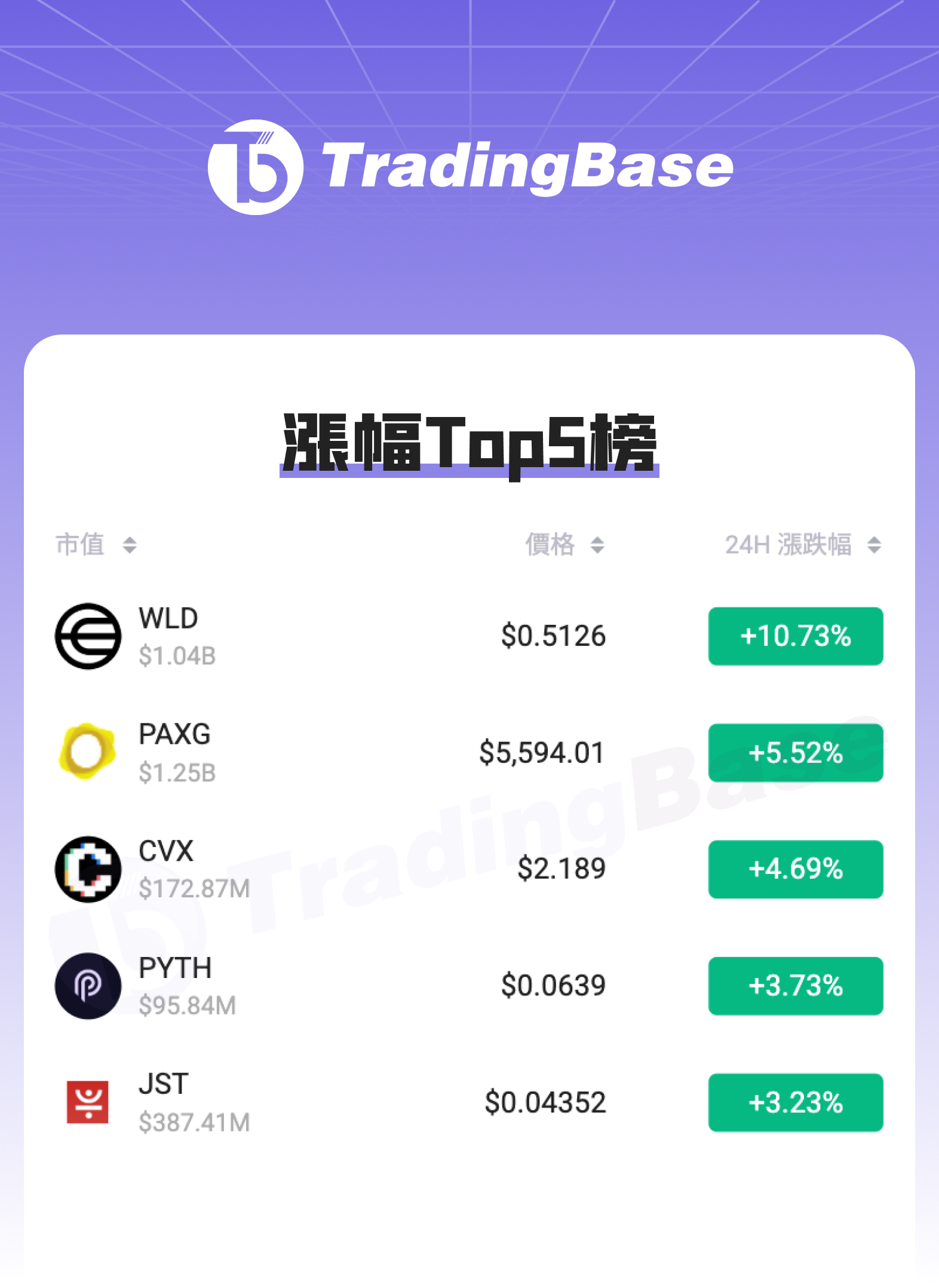

Top 5 Gainers:

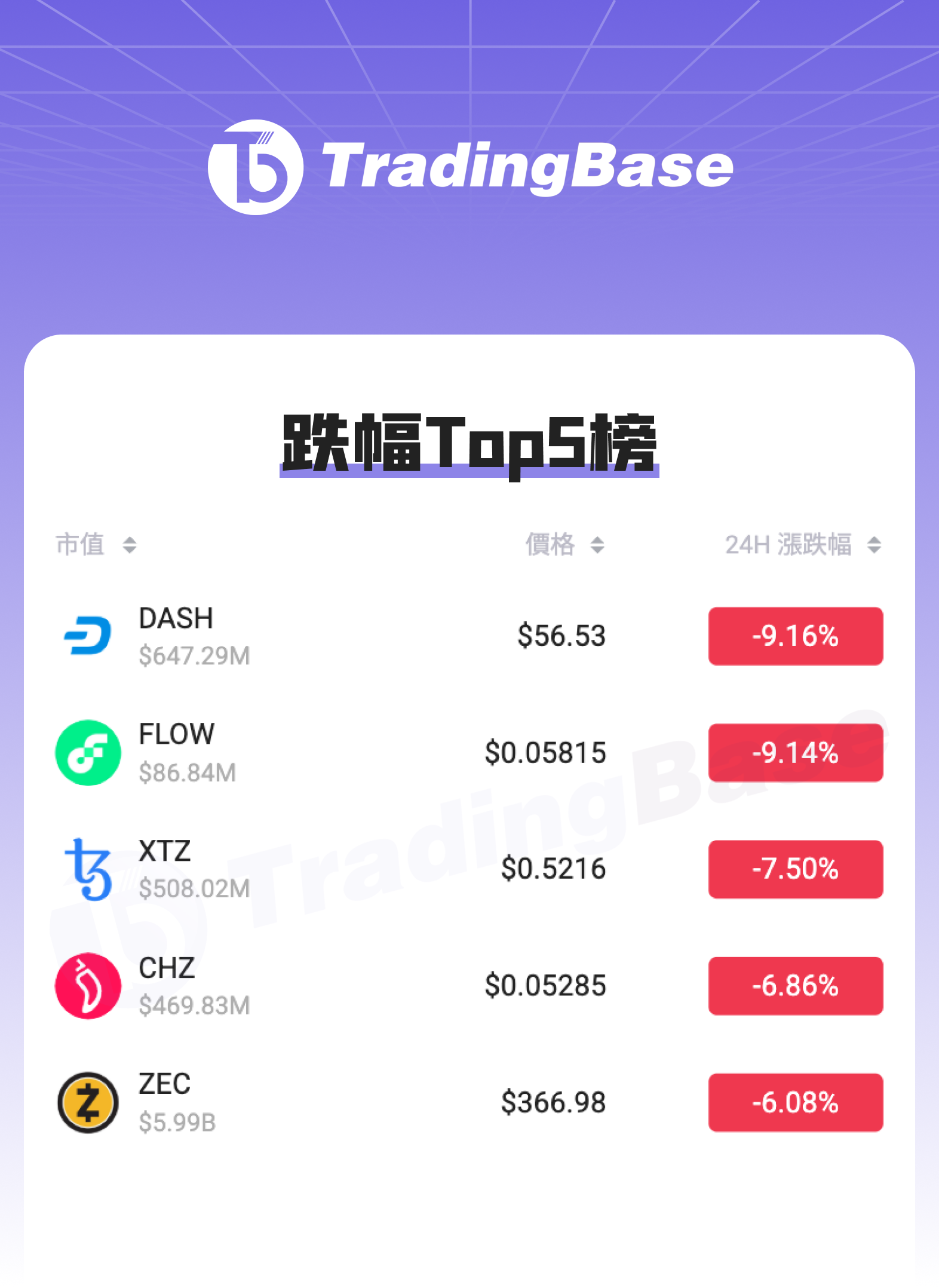

Top 5 Losers:

V. Conclusion

This week, the cryptocurrency market is temporarily suppressed by capital outflows and macro uncertainties, showing significant fluctuation characteristics. However, the excessive leverage cleanup has been completed, the regulatory framework is gradually clarifying, and institutional and technical layouts are continuously deepening, laying a solid foundation for the medium to long-term development of the industry. Future attention should focus on defending the key support level of BTC at $85,000, signals of ETF capital inflow, and the liquidity trends of the Federal Reserve. In the medium to long term, focus can be placed on compliant cryptocurrency products, the stablecoin sector, and structural opportunities brought by Ethereum's technological upgrades, while rationally responding to short-term market fluctuations. Please continue to follow this column for the latest market interpretations and strategy analyses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。