Written by: Prathik Desai

Translated by: Block unicorn

Money has a captivating narrative. It reveals its perspective on the world through its flow in global markets.

In confident markets, money acts like a talent scout. It dares to take risks, trying various schemes, whether they are business plans, product prototypes, or what may seem like fanciful future visions today. It ultimately expresses its confidence by signing investment checks.

However, in turbulent markets, money behaves more like a cautious auditor, tending towards things that have been validated by the market. Think of companies with healthy cash flows, large user bases, established distribution channels, or strong teams.

Secondly, there is a third scenario, somewhere in between. In this case, money begins to recycle existing resources and flows between different owners. We see this happen when corporate ownership changes due to mergers, acquisitions, business unit reorganizations, and so on. All these situations indicate that funds are flowing, but this does not create new liquidity.

This is why anyone interpreting capital flows and financing numbers should approach them with caution. Huge financing may signal new risk-taking, but it could also simply mean the movement of funds between existing companies.

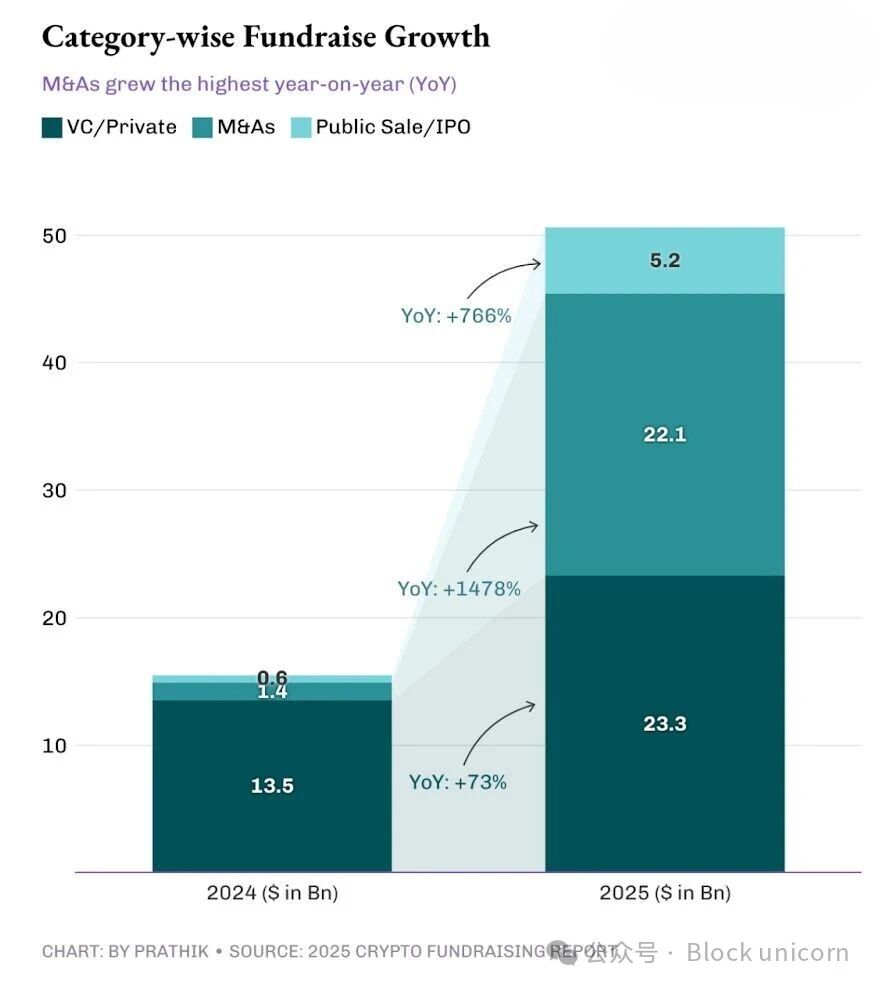

The "2025 Cryptocurrency Financing Report" reveals a figure: $50.6 billion raised through 1,409 rounds of financing in 2025, more than 200% higher than the $15.5 billion in 2024. This sounds like a feast, but only by analyzing this number can the truth be revealed.

In today's analysis, I will delve into these data and explain how last year's capital flow reflects the trends in the cryptocurrency market.

Let's get to the point.

A significant portion of the "raised funds" does not necessarily represent new money flowing into the cryptocurrency market. The financing report categorizes the total amount raised into the following categories: venture capital (VC)/private equity, mergers and acquisitions, and public sales/IPOs.

Over 40% of the funds raised last year came from mergers and acquisitions, while this proportion was only 9% in 2024. Although the total amount raised more than doubled compared to the previous year, 2025 appears to be more of a consolidation year for cryptocurrency.

The report interprets this data as "moderate growth" in venture capital activity and "explosive growth" in mergers and acquisitions. However, I believe there are deeper implications behind these numbers.

In relatively new industries like cryptocurrency, corporate consolidation can signify maturity and progress. But if it is accompanied by capital outflows from other channels, the situation could be entirely different.

In 2025, funds did not merely shift from investing in new projects to acquiring existing ones. While the total financing amount increased by $35 billion year-on-year, mergers and acquisitions and public sales/IPOs contributed $27 billion to this growth.

Despite a decline in the share of venture capital activity within the overall financing categories, venture capital activity still grew by over 70% year-on-year last year.

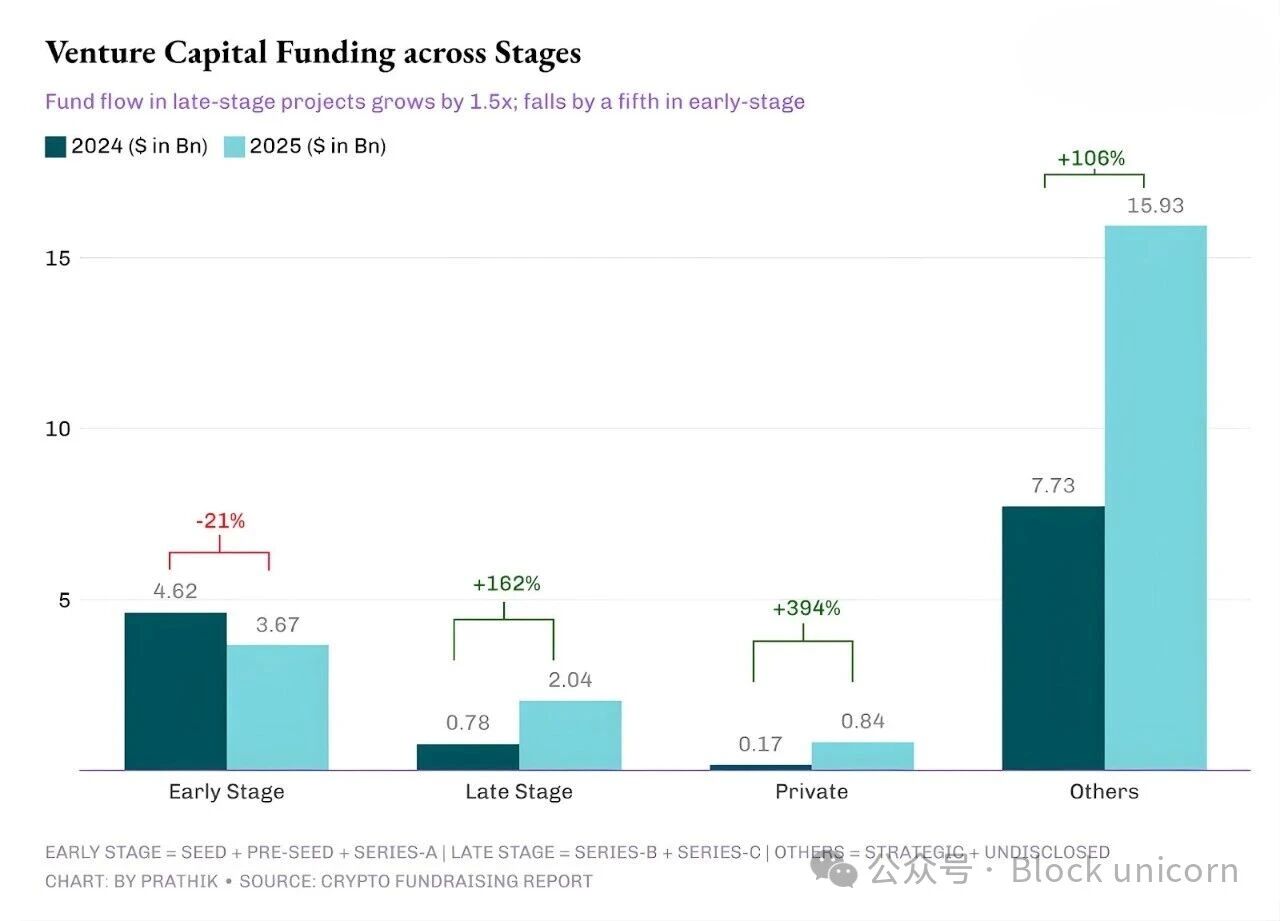

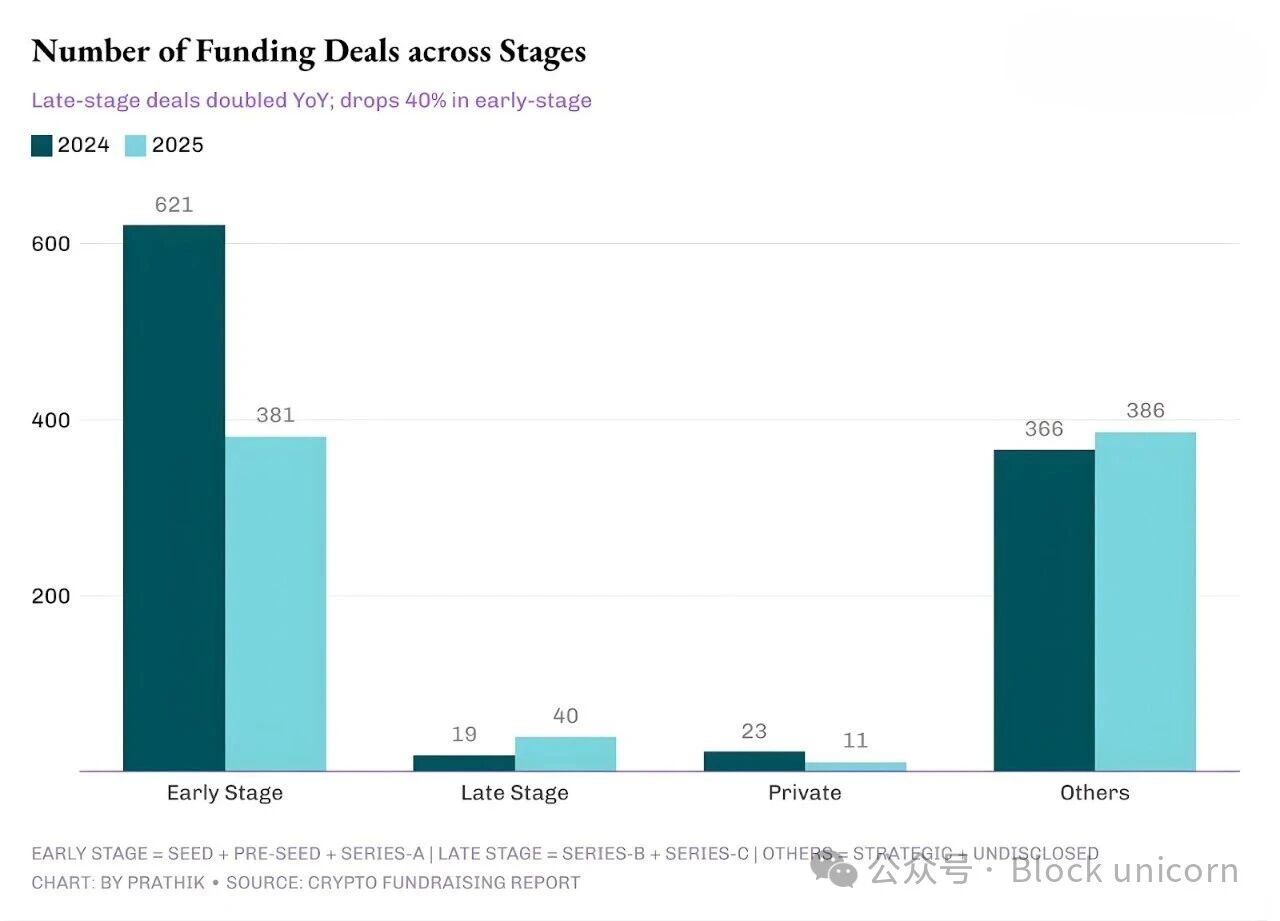

In 2024, the financing amount from venture capital firms accounted for over 85% of the total financing for cryptocurrency projects, but this proportion dropped to 46% in 2025. This phenomenon, along with the way venture capital firms allocated funds across different stages of cryptocurrency projects last year, has raised concerns among emerging cryptocurrency developers and founders. In 2025, the number of checks written by venture capital firms was far fewer than in the past, but the amounts were larger, primarily funding existing projects that had reached later stages rather than supporting emerging early-stage projects.

Segmented data shows that pre-seed, seed, and Series A financing stages saw year-on-year declines, while Series B and C financing doubled in 2025.

Even looking at the number of checks signed across all financing stages reflects this behavior.

The two charts above together tell us: "Yes, capital has increased. But it has increased in areas with lower uncertainty, and founders' pitches are more about 'the future of money' rather than 'here are some validated metrics to invest in.'"

According to the "Venture Economic Conditions Report" published by Equal Ventures, while this indicates that early entrepreneurs will face fierce competition, it may also signal a value investment opportunity for investors looking to inject funds into Series A and B projects.

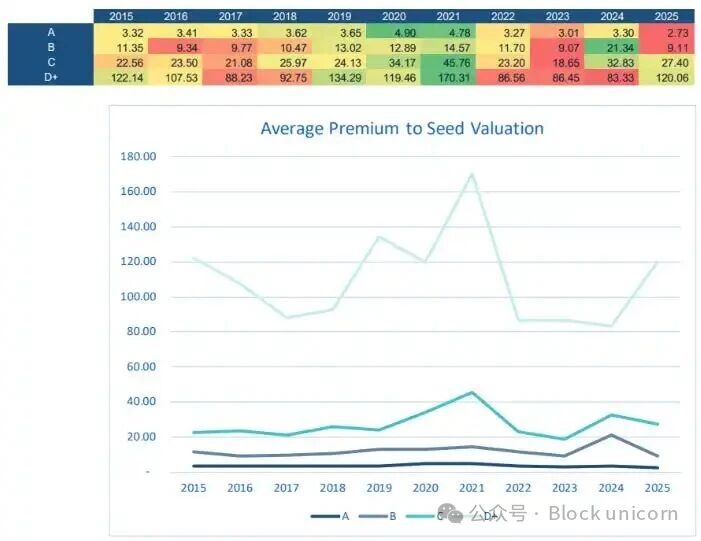

This is because the intense competition in seed and pre-seed financing stages has driven up valuation premiums.

Higher valuation premiums may mean paying the valuation multiples of growth-stage projects for the risk profile of seed-stage projects.

This shift prompts rational capital allocators to reallocate funds to lower-risk opportunities, such as Series A and B projects, which require lower valuation premiums than seed, pre-seed, Series C, and D rounds and beyond.

This, along with the surge in merger and acquisition activity, indicates that risk preferences at different stages are changing. On one hand, merger financing accounts for over 40% of all "financing amounts," but this is different from new funds injected through venture capital and does not represent true "new funds." On the other hand, the preference for later-stage financing is due to its seemingly lower underwriting risk, providing higher certainty and potential investment returns.

When capital concentrates in certain specific areas, two things happen.

First, the decision-making process becomes more centralized. Founders begin preparing to pitch to a smaller audience that focuses on similar metrics and shares notes.

Second, the concept of "quality" gradually standardizes. In the cryptocurrency space, this may mean broad distribution capabilities, sound regulation, enterprise-level applications, and business models that do not rely on the cyclical fluctuations of bull and bear markets.

This is why I am skeptical about the data in the 2025 cryptocurrency financing report, believing it to be entirely bullish. While financing amounts have increased, it is crucial to understand the driving factors behind the surge in mergers and acquisitions. Although the cryptocurrency market is relatively new, its tech stack has become crowded, making it difficult to scale distribution.

In such times, it is far wiser for existing companies to acquire and expand upon existing successful models than to persuade users to adopt new models. The transactions we saw last year fully demonstrate this.

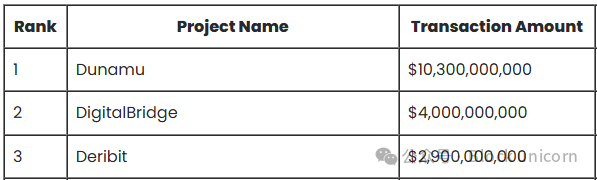

Let’s take a look at the top three merger and acquisition deals listed in the report: Dunamu, DigitalBridge, and Deribit. Their total amount is $17.2 billion, accounting for about 81% of the total merger and acquisition amount in the report.

Coinbase's acquisition of Deribit was not a bet on innovation or an attempt, but rather to leverage the well-established virtuous cycle of Deribit. Deribit offers a trading platform with ample liquidity, mature customer habits, and a comprehensive range of options and derivatives products, which could become an ideal choice for mature traders once the market matures.

Coinbase read the signals and prepared in advance.

South Korean internet giant Naver also adopted a similar strategy, deciding to acquire Dunamu, the operator of South Korea's largest cryptocurrency exchange Upbit, through an all-stock transaction valued at $10.3 billion.

This deal combines a massive consumer distribution platform (an internet fintech giant) with a regulated high-frequency financial product (an exchange).

What does all this mean for 2026?

I expect the concentration of capital to continue until we find a clear exit path. The only reservation I have about the consolidation plans proposed in the report is that maturity does not mean the end of innovation. If too much capital is funneled into ownership restructuring or increased investment in existing ideas, it could lead to stagnation and a reduction in breakthrough innovations.

If we do not see successful IPOs and large liquidity listings reopening, late-stage investors are expected to continue acting like strict underwriters, while early founders will face the issue of attention scarcity.

But I do not believe that the seed stage in the cryptocurrency space has vanished.

2025 offers early entrepreneurs valuable experiences and clear insights. By 2026, they will need to optimize their pitch materials, focusing on critical metrics for the market, such as how to build distribution channels, how to deliver products quickly while complying with regulations, and why their products can survive without relying on bull markets.

This concludes the analysis; see you in the next article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。