The crypto exchange-traded fund (ETF) market offered a study in contrasts on Wednesday, Jan. 28. Capital remained cautious around bitcoin, but ether found its footing again, while XRP and solana continued to attract steady interest beneath the surface.

Bitcoin spot ETFs posted a $19.64 million net outflow, extending their recent run of red sessions. Blackrock’s IBIT led the exits with $14.18 million, followed by $12.61 million from Bitwise’s BITB and $12.30 million from Ark & 21Shares’ ARKB.

Fidelity’s FBTC attempted to steady the ship with a $19.45 million inflow, but it wasn’t enough to offset broader selling pressure. Total value traded came in at $3.27 billion, while net assets held relatively steady at $115.35 billion.

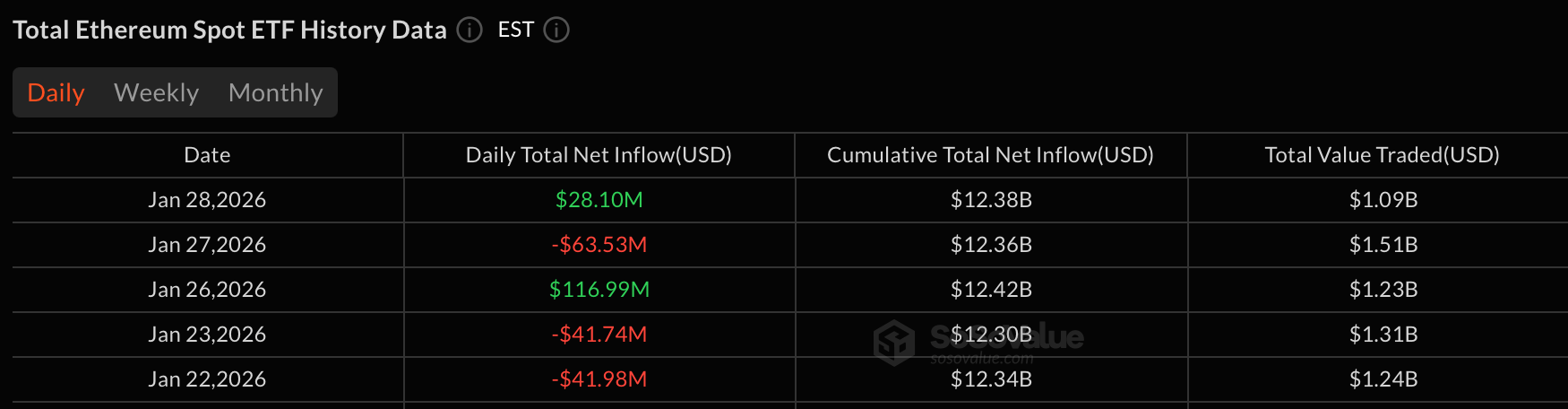

Ether spot ETFs flipped back into positive territory, recording a $28.10 million inflow. Blackrock’s ETHA did most of the heavy lifting with $27.34 million in fresh capital, while Fidelity’s FETH added a smaller $752,000. Trading activity remained subdued at $1.09 billion, and total net assets edged up to $18.22 billion.

Mixed trading days for ether ETFs over the past five days.

XRP ETFs extended their green streak with a $6.95 million inflow. Franklin’s XRPZ led demand with $3.13 million, followed by $2.60 million into Grayscale’s GXRP and $1.23 million into Canary’s XRPC. Total value traded reached $20.77 million, with net assets holding firm at $1.39 billion.

Solana ETFs delivered another solid session, posting a $6.69 million net inflow. Bitwise’s BSOL attracted $5.01 million, while Fidelity’s FSOL, Franklin’s SOEZ, and Vaneck’s VSOL added $1.11 million, $1.08 million, and $411,110, respectively. A $923,140 outflow from Grayscale’s GSOL had little impact on the broader positive trend. Total value traded stood at $35.07 million, with net assets closing at $1.08 billion.

Read more: Crypto ETFs Falter as Bitcoin, Ether See Combined Exit of $211 Million

Overall, the day highlighted ongoing rotation rather than retreat. Bitcoin continued to face pressure, ether showed signs of stabilization, and consistent inflows into XRP and solana suggested investors remain willing to selectively deploy capital across the crypto ETF market.

- Why did bitcoin ETFs stay in the red?

Investors remain cautious on BTC, extending outflows despite selective inflows into FBTC. - What fueled ether ETFs’ rebound?

Fresh inflows into Blackrock’s ETHA helped Ether ETFs flip back to positive territory. - Why are XRP ETFs seeing steady demand?

Consistent inflows suggest investors favor selective exposure beyond bitcoin and ether. - How did solana ETFs outperform again?

Broad-based inflows across multiple solana funds reinforced its ongoing momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。