Written by: Shaw, Golden Finance

In the early hours of January 29, 2026, the Federal Reserve concluded its first FOMC meeting of the year, announcing that it would maintain the federal funds rate target range at 3.5% to 3.75%, in line with market expectations. Prior to this, the Federal Reserve had cut rates by 25 basis points in three consecutive meetings (September, October, and December of last year). The statement from this FOMC meeting upgraded the assessment of economic activity, stating it is expanding at a "robust" pace, with the unemployment rate showing some signs of stability, while job growth remains sluggish and inflation is still slightly high. The Federal Reserve also removed the language regarding increased risks to employment that appeared in the previous three statements. This rate decision had two dissenting votes, one less than the last meeting, with Waller casting his first dissenting vote, aligning with the rate cut proposal of Trump-appointed Governor Miran. Subsequently, Federal Reserve Chairman Powell did not provide substantial responses to the politically sensitive issues during the press conference.

After the Federal Reserve's decision was announced, there was little change in U.S. stocks and bonds. U.S. stock indices showed mixed results, with technology stocks pushing the S&P 500 to briefly surpass 7000 points in early trading. U.S. Treasury Secretary Basant stated that a "strong dollar policy" is being pursued, leading to a rebound in the dollar index. Bitcoin initially surged but then turned down, facing resistance near $90,000. The strong rebound of the dollar did not prevent precious metals from soaring. Spot gold surged by 4%, breaking through Goldman Sachs' expected target price of $5400. Spot silver rose by over 4%.

The Federal Reserve's decision to hold steady was in line with market expectations and brought little novelty. The internal disagreements among FOMC members have significantly decreased, with most supporting the pause, which suggests what? Why did Powell not respond to several political issues during the press conference, and what considerations are behind this? Will there be another rate cut before he steps down? How will the market interpret this decision, and where will it head next?

1. The Federal Reserve Holds Steady at the Start of the Year, Uncertainty Remains on When to Resume Rate Cuts

In the early hours today, the Federal Reserve concluded its first FOMC meeting of the year, announcing that it would maintain the federal funds rate target range at 3.5% to 3.75%, in line with market expectations. Prior to this, the Federal Reserve had cut rates by 25 basis points in three consecutive meetings (September, October, and December of last year). The statement from this FOMC meeting upgraded the assessment of economic activity, stating it is expanding at a "robust" pace, with the unemployment rate showing some signs of stability, while job growth remains sluggish and inflation is still slightly high. The Federal Reserve also removed the language regarding increased risks to employment that appeared in the previous three statements.

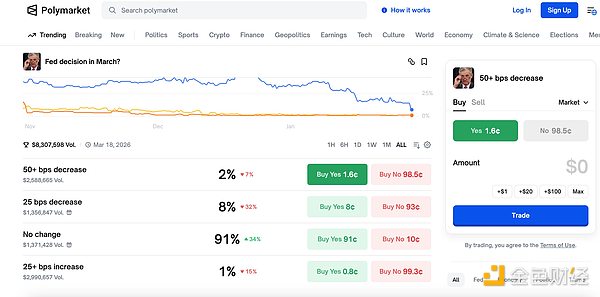

After the announcement, interest rate futures contracts indicated that the probability of a rate cut in April (the last meeting during Powell's tenure as chairman) is 28%, slightly down from before; while the probability of a rate cut in June rose to 64%, an increase from before, and a second rate cut within this year is quite likely. The latest CME "FedWatch" data shows that the probability of a 25 basis point rate cut by March is 13.5%, while the probability of maintaining the current rate is 86.5%. The probability of a cumulative 25 basis point rate cut by April is 24.1%, with a 74% chance of maintaining the current rate, and a 2.0% chance of a cumulative 50 basis point cut. Prediction market Polymarket data shows that after the announcement, the market's expectation of maintaining the rate in March has risen to 91%, while the probability of betting on a 25 basis point cut has dropped to 8%.

After the announcement, there was little change in U.S. stocks and bonds. U.S. stock indices showed mixed results, with technology stocks pushing the S&P 500 to briefly surpass 7000 points. U.S. Treasury Secretary Basant stated that a "strong dollar policy" is being pursued, leading to a rebound in the dollar index. Bitcoin initially surged but then turned down, facing resistance near $90,000, down 1.7% from its daily high. The strong rebound of the dollar did not prevent precious metals from soaring. Spot gold surged by 4%, with a single-day increase of over $200, breaking through Goldman Sachs' expected target price of $5400. Spot silver rose by over 4%, approaching the historical high of $117.7 set on Monday.

The Federal Reserve's pause in action was entirely in line with expectations and had little impact on major asset markets. With only two meetings left before Powell's term ends, in March and April, the market expects that it will be difficult for Powell to resume rate cuts during his remaining term.

2. FOMC Internal Opinions Are Relatively Unified, Only Two Dissenting Votes

Compared to the last FOMC meeting statement, this decision statement made slight adjustments in commenting on the economic situation. Overall, the Federal Reserve's assessment of the economy is better than last time. This statement upgraded the assessment of economic activity, stating it is expanding at a "robust" pace, with the unemployment rate showing some signs of stability, while job growth remains sluggish and inflation is still slightly high. The Federal Reserve also removed the language regarding increased risks to employment that appeared in the previous three statements. Additionally, the last meeting announced the initiation of so-called reserve management, and this statement removed the phrase that the FOMC believes it needs to start buying short-term government bonds, indicating that the New York Fed's reserve management purchases (RMP) are proceeding as planned without change.

In this meeting, out of the 12 FOMC voting members, two cast dissenting votes, one less than the last meeting. Ten FOMC members, including Federal Reserve Chairman Powell and Governor Cook, who was publicly threatened with dismissal by Trump last year, supported keeping rates unchanged. The two dissenters, who support another 25 basis point cut, are Federal Reserve Governor Miran (Stephen Miran) and another governor Waller (Christopher Waller). Miran has consistently voted against rate decisions since he became a governor in July last year, while Waller cast his first dissenting vote since the last decision statement revealed divisions within the Federal Reserve's decision-making body. Some analysts suggest that Waller's action, as one of the final candidates for the next Federal Reserve chair, may be to cater to President Trump's preference for low rates.

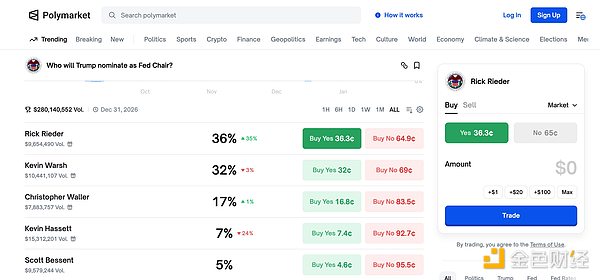

After the announcement of this statement, prediction market Polymarket showed that the odds of betting on Waller receiving the Federal Reserve chair nomination slightly increased to around 17%, while the nomination odds for two popular candidates—BlackRock executive Rieder (Rick Rieder) and former Federal Reserve Governor Warsh (Kevin Warsh)—are 36% and about 32%, respectively.

3. Powell Did Not Respond to Hot Topics, Did Not Indicate a Recent Resumption of Rate Cuts

Federal Reserve Chairman Powell subsequently explained the pause in action and the economic situation during the press conference and answered reporters' questions. Powell stated that the U.S. unemployment rate has shown some signs of stabilization, and the labor market may be stabilizing after gradually softening, with hiring, job vacancies, and wage growth showing little change. Consumer spending remains resilient, and business investment continues to grow. Powell stated, long-term inflation expectations are in line with targets, and the trend of slowing service sector inflation seems to be continuing, with overall core PCE inflation possibly rising by 3% in December. Powell indicated that there is no predetermined path for monetary policy, and decisions will be made sequentially at each meeting. He also mentioned that the impact of the government shutdown should be reversed in this quarter. Powell stated that the Federal Reserve is in a favorable position to face the risks of its dual mandate; it is difficult to conclude that policy has clearly become restrictive based on the latest data, and the Federal Reserve will focus on key target indicators, allowing data to guide the direction.

In response to reporters' questions, Powell stated that the impact of numerous tariffs has already been transmitted throughout the U.S. economy. Tariffs may lead to a one-time price increase. Most of the inflation exceeding expectations comes from tariffs, rather than demand. The core PCE, excluding the impact of tariffs on goods, is slightly above 2%. It is expected that the impact of tariffs on goods will peak and then decline this year. If this situation is observed, it would indicate that the Federal Reserve could ease policy. If the downside risks in the labor market re-emerge, they must also be monitored.

When asked whether the Federal Reserve has responded to the subpoena from the U.S. Department of Justice, Powell stated, "No comment." Powell also indicated that he has not yet decided on plans after his term as Federal Reserve chair ends. Additionally, Powell declined to comment on Republican Senator Thom Tillis's promise to block nominees. Powell stated that he does not believe the Federal Reserve will lose its independence. If the Federal Reserve loses its independence, its credibility will be difficult to restore. Powell also advised the next Federal Reserve chair not to get involved in political affairs. Powell said at the press conference: "Don't get involved in elected politics, don't get caught up in elected politics."

With only two meetings left before Powell's term ends, in March and April, if rate cuts are to be initiated during Powell's tenure, it will require not only clear turning signals in the data in the short term but also consensus and policy communication within a limited meeting window. Powell did not provide substantial responses to the politically sensitive issues, nor did he lack intentions to stabilize and "cool down" during his remaining term.

4. How to Interpret the Federal Reserve's Pause in Action

Regarding the Federal Reserve's first rate decision of the year, "Fed mouthpiece" Wall Street Journal reporter Nick Timiraos wrote that the Federal Reserve maintained rates as expected and did not clearly indicate when it might resume rate cuts. In December's forecast, out of 19 officials, 12 expected at least one more rate cut this year to be appropriate. The answer depends on which scenario occurs first: a collapse in the job market or inflation confidently returning to the 2% target. Since December, neither has occurred. Job growth has significantly slowed, but the unemployment rate remains stable. Due to the statistical interruptions caused by the government shutdown, inflation data has become murky. If the labor market does not weaken further, the next rate cut may have to wait until after Powell's term as Federal Reserve chair ends in May.

Jeffrey Gundlach, CEO of DoubleLine Capital and known as the "new bond king," stated that he expects the Federal Reserve to maintain rates during the remainder of Powell's chairmanship, as the economic outlook is becoming more balanced. Gundlach, in an interview on CNBC's "Closing Bell," stated that Powell is emphasizing that while inflation is slightly higher, it is not as bad as feared a few months ago, and the unemployment rate is no longer rising in any meaningful way.

Goldman Sachs analyst Kay Hais stated that given the strong economic data and signs of stability in the labor market, the Federal Reserve is likely to keep policy unchanged for the time being. However, we expect that rate cuts will be restarted later this year, as the slowdown in inflation allows the Federal Reserve to implement two more "normalization" rate cuts, bringing rates back to what FOMC members consider neutral levels.

Chief Market Strategist Ryan Detrick of Carson Group stated that the Federal Reserve did not stir up any waves, and the market generally expected them to hit the pause button. We may not see any rate cuts before Powell leaves the Federal Reserve in May. The potential good news is that they mentioned some positive factors in the labor market, but inflation is clearly still a concern. We know that Miran joined the Federal Reserve to stir things up, but Waller's choice is somewhat intriguing. His name is still on the potential next chair candidate list, so I’m sure he is also trying to catch Trump’s attention to show that he remains firmly in the dovish camp. The independence of the Federal Reserve is indeed a real issue, and the next chair will face significant pressure to cut rates.

Chief Market Strategist Chris Grisanti of New York MAI Capital Management stated that today’s Federal Reserve statement and press conference were clearly hawkish. The description of economic activity was upgraded from "moderate" to "robust," while the language regarding employment downside risks was removed. During the press conference, Powell stated that the job market has "stabilized" after experiencing a period of weakness last year. Although inflation is stabilizing, it is still "slightly high." Overall, the Federal Reserve's current focus has shifted from unemployment to inflation. I believe there will be no rate cuts in the short term. Additionally, given the strong market performance and ongoing economic strength, I think there may not be any rate cuts in 2026, which is a more hawkish stance compared to current market expectations.

Analyst Matthias Scheiber of Allspring stated that the stabilization of the labor market and the stickiness of inflation have led the Federal Reserve to choose to wait and assess the support effects of previous rate cuts on U.S. economic growth. The current interest rate level seems to be close to the neutral rate, which can stabilize employment while helping to control inflation. Nevertheless, the investment and capital expenditure boom driven by artificial intelligence, along with significant increases in commodity prices, including industrial metals, may lead to a more persistent inflation path this year. The market has gradually digested one of the two expected rate cuts from the end of last year. The biggest focus will still be the announcement of the new Federal Reserve chair, with the competitive landscape remaining open, but there is a general expectation that the successor to Powell will be more dovish. The pressure from the government for the Federal Reserve to cut rates will continue to be a persistent theme this year.

Wealth Management Analyst Sid Vaidya of TD Securities stated that the statement acknowledged strong GDP growth and a stable unemployment rate, raising the question of how much attention the Federal Reserve will pay to still high inflation. A series of recent rate cuts have supported employment. Therefore, Sid Vaidya suspects that the latest statement may signal that the Federal Reserve will refocus on inflation.

Chief Market Strategist Karl Schamotta of CORPAY stated that the Federal Reserve did nothing and is very firm. With a 10 to 2 voting result, the decision and the slight upward assessment of the labor market conditions clearly convey the Federal Reserve's intention to remain on hold. The market's expectations for a loosening of policy in the short term may be disappointed.

5. How Will the Market Develop in the Future

After the Federal Reserve's pause in action, how will the major asset markets, including cryptocurrencies, move in the future? Let's take a look at the main analytical interpretations.

1. Juan Perez, Trading Director at Monex USA stated that in the context of market uncertainty, it is reasonable for the Federal Reserve, as a key financial authority, to remain cautious and not adjust interest rates. There is still a lack of consensus among committee members, so this decision helps to alleviate some of the pressure the dollar has faced since January 20. We believe that the Federal Reserve's policy path will remain quite unpredictable.

2. Wintermute stated that BTC's current price range has shown signs of fatigue, but the market structure is not bearish; rather, it is in a stalemate. The $85,000 support level has been tested multiple times, either as a solid bottom or as a trap waiting to explode. Despite net outflows of funds from the U.S. and continued compression of volatility, this support level has held, indicating that there is buying interest below (albeit moderate). Gold is playing the role that Bitcoin should be playing. The stock market is waiting for earnings reports to validate valuation rationality. Bitcoin is stuck in a "no man's land"—not weak enough to break support, nor strong enough to regain upward momentum. The macro environment has built momentum for a trending market, but the crypto market has yet to follow suit. This situation could change due to a reversal in ETF fund flows or changes in the dollar's trajectory. If the Federal Reserve intervenes in the yen exchange rate and the dollar continues to weaken, it will become a clear catalyst for risk assets. If the earnings reports from the "Tech Seven" exceed expectations and the AI narrative continues to gain traction, it will drive the Nasdaq index upward, thereby boosting the crypto market. Conversely, if Powell sends hawkish signals or tariff conflicts escalate, the $85,000 support level will face severe tests. A 60-day consolidation period combined with such dense event risks will ultimately lead the market to choose a direction.

3. Ki Young Ju, Founder of CryptoQuant stated that gold, silver, and Bitcoin are safe-haven assets. If the market still views Bitcoin as a "risk asset," then it is undervalued.

4. Analyst Ali Charts stated that FOMC meeting weeks are usually accompanied by high volatility and downside risks for Bitcoin, even if the market remains optimistic before the meeting due to expected rate cuts, the reaction after the announcement is mostly bearish. Investors need to manage their positions cautiously.

5. IG Group stated that the continuous rise in gold prices and the high valuations in the stock market may prompt portfolio rebalancing, leading to fund flows into cryptocurrencies, thus driving a new round of upward momentum.

6. Tom Lee, Chairman of BitMine stated that major financial institutions are rushing to launch their financial tokenization products on Ethereum, the latest being Fidelity's stablecoin FIDD, as Ethereum is the future of finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。