After a bruising stretch of red, crypto exchange-traded fund (ETF) flows finally found their footing. Monday, Jan. 26’s session brought a cautious but welcome reversal, with inflows returning across all major digital asset ETFs and easing pressure after last week’s heavy selling.

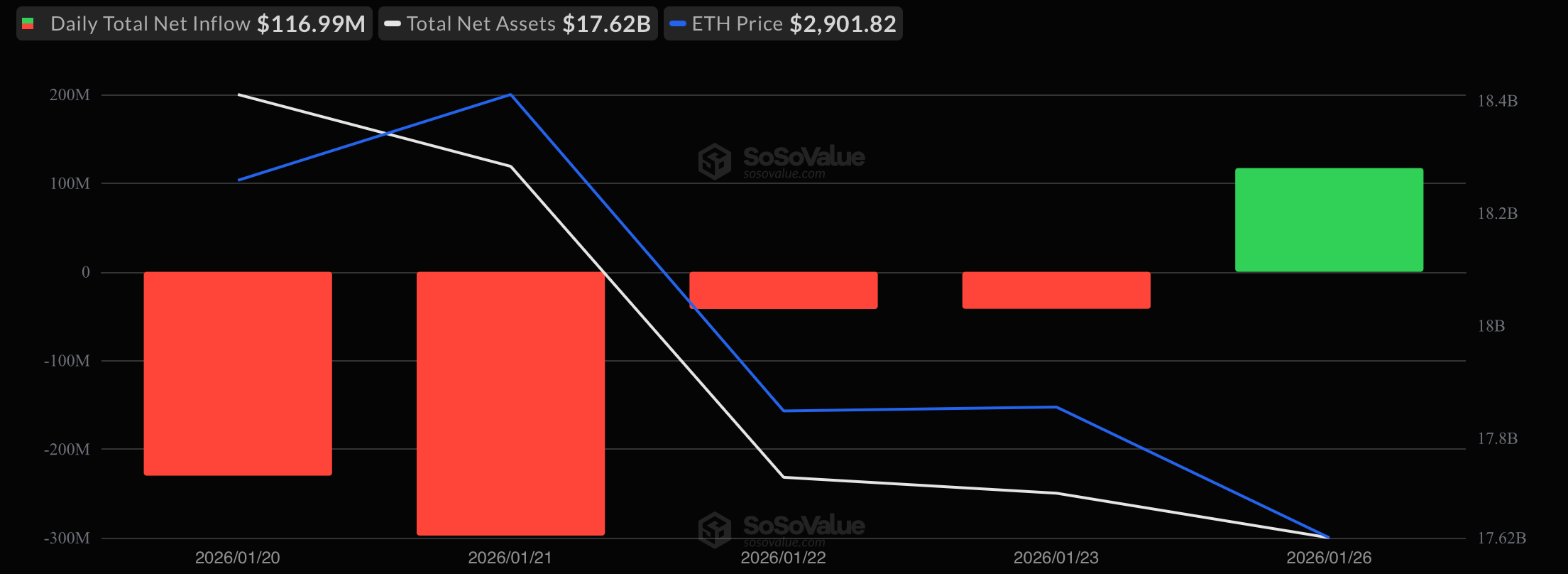

Ether spot ETFs led the recovery with a $116.99 million net inflow, decisively ending a four-day outflow streak. Fidelity’s FETH did the heavy lifting, pulling in a robust $137.24 million, a sign that investors were willing to re-engage at lower levels. Blackrock’s ETHA moved in the opposite direction with a $20.25 million outflow, but it wasn’t enough to derail the day. Total value traded reached $1.23 billion, while net assets settled at $17.62 billion.

Ether ETFs end four-day outflow streak with $117 million inflow

Bitcoin spot ETFs posted a modest but symbolically important $6.86 million net inflow, snapping a five-day run of red. Blackrock’s IBIT led inflows with $15.93 million, joined by $7.75 million into Grayscale’s Bitcoin Mini Trust and $2.79 million into WisdomTree’s BTCW.

Outflows nearly erased the gains, however. Bitwise’s BITB shed $10.97 million, Fidelity’s FBTC lost $5.73 million, and Ark & 21Shares’ ARKB saw $2.91 million exit. Still, the balance tipped green. Total value traded stood at $3.19 billion, with net assets closing at $113.54 billion.

XRP ETFs continued to show resilience, recording a $7.76 million inflow. Bitwise’s XRP attracted $5.31 million, while Canary’s XRPC and Franklin’s XRPZ added $1.41 million and $1.03 million, respectively. Trading activity reached $22.22 million, with net assets steady at $1.36 billion.

Read more: ETF Recap: Redemptions Surge as Bitcoin, Ether See Historic Weekly Exits

Solana ETFs also finished higher, logging a $2.46 million inflow, entirely driven by demand for Bitwise’s BSOL. Total value traded was $35.85 million, and net assets closed at $1.05 billion.

Overall, the session marked a shift in tone rather than a full reversal. Ether’s strong inflow set the pace, bitcoin stabilized, and smaller assets held their ground, suggesting investors are cautiously testing the waters after last week’s sharp pullback.

• What changed in crypto ETF flows?

Crypto ETFs rebounded as ether and bitcoin returned to net inflows after days of heavy selling.

• Which ETF led the recovery?

Ether ETFs led with nearly $117 million in inflows, snapping a four-day outflow streak.

• Did bitcoin ETFs turn positive too?

Yes, bitcoin ETFs posted a small inflow, ending a five-day run of net outflows.

• How did XRP and solana perform?

XRP and solana ETFs also closed green, signaling cautious risk appetite returning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。