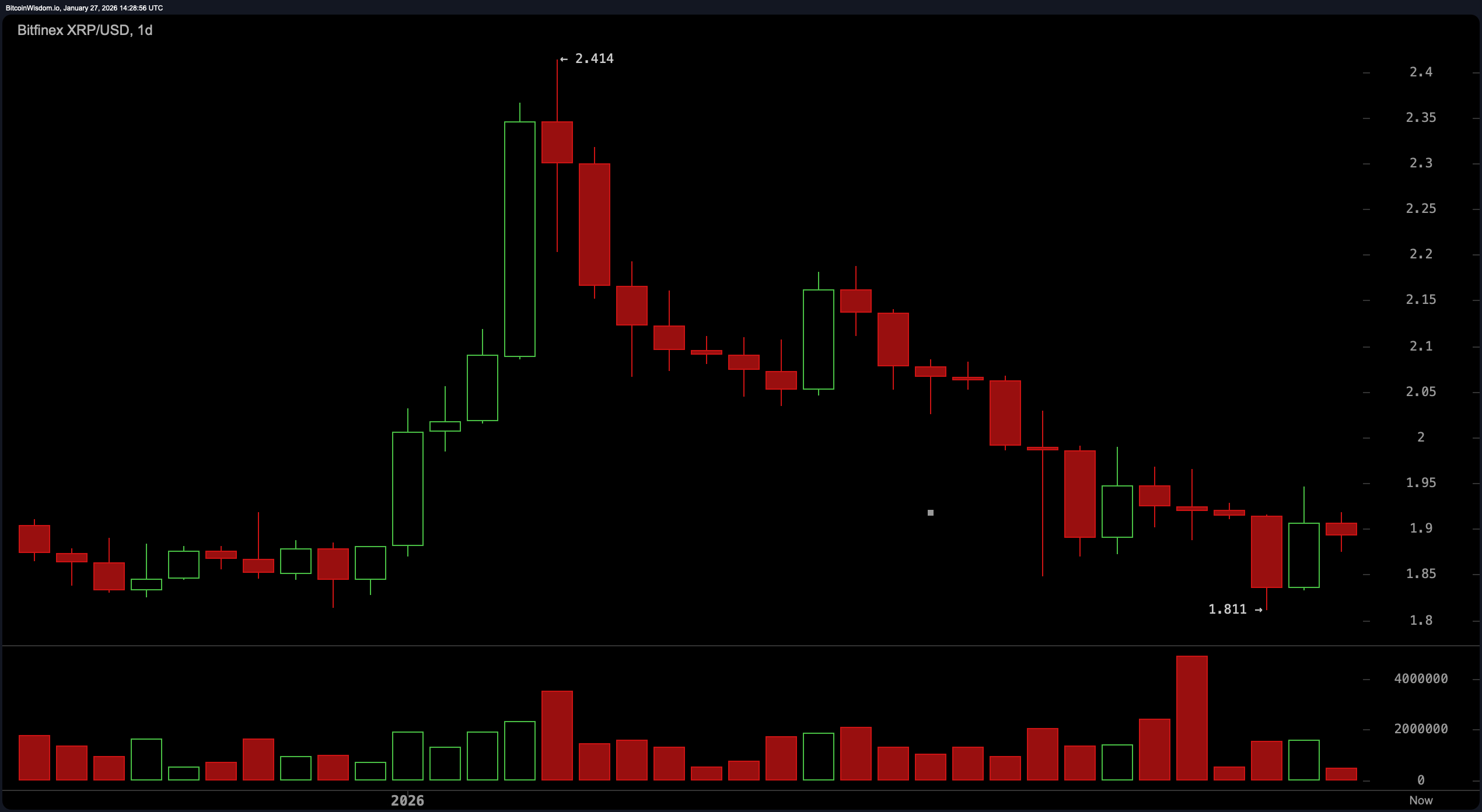

Zooming out to the daily chart, XRP looks like it partied a little too hard near its $2.41 peak and is now nursing a hangover around the $1.85 to $1.95 range. The recent low of $1.811 may be whispering sweet support, but with volume waning during the fall, it’s less of a triumphant bounce and more of a graceful collapse.

Oscillators, including the relative strength index ( RSI) at 42.17, Stochastic at 17.49, and the commodity channel index (CCI) at -88.23 are all waving neutral flags, seemingly just as unsure about the future as retail traders. The momentum indicator is dragging at -0.1704, while the moving average convergence divergence ( MACD) reads -0.0403—both suggesting the bulls may have misplaced their energy drinks.

XRP/USD 1-day chart via Bitfinex on Jan. 27, 2026.

On the four-hour chart, XRP staged a cute V-shaped recovery from the $1.811 dip, topping out at $1.94 before facing resistance and backing off like a shy prom date. The volume spiked during the bounce—encouraging—but tapered off on the pullback, which leans bullish if you squint hard enough. Lower highs are stacking up, so while it’s not a full-on reversal, the retracement appears more like a breather than a breakdown. And with most short-term exponential and simple moving averages (EMA/SMA) like the 10, 20, and 30 periods all firmly above current price levels, the trend isn’t handing out participation trophies just yet.

XRP/USD 4-hour chart via Bitfinex on Jan. 27, 2026.

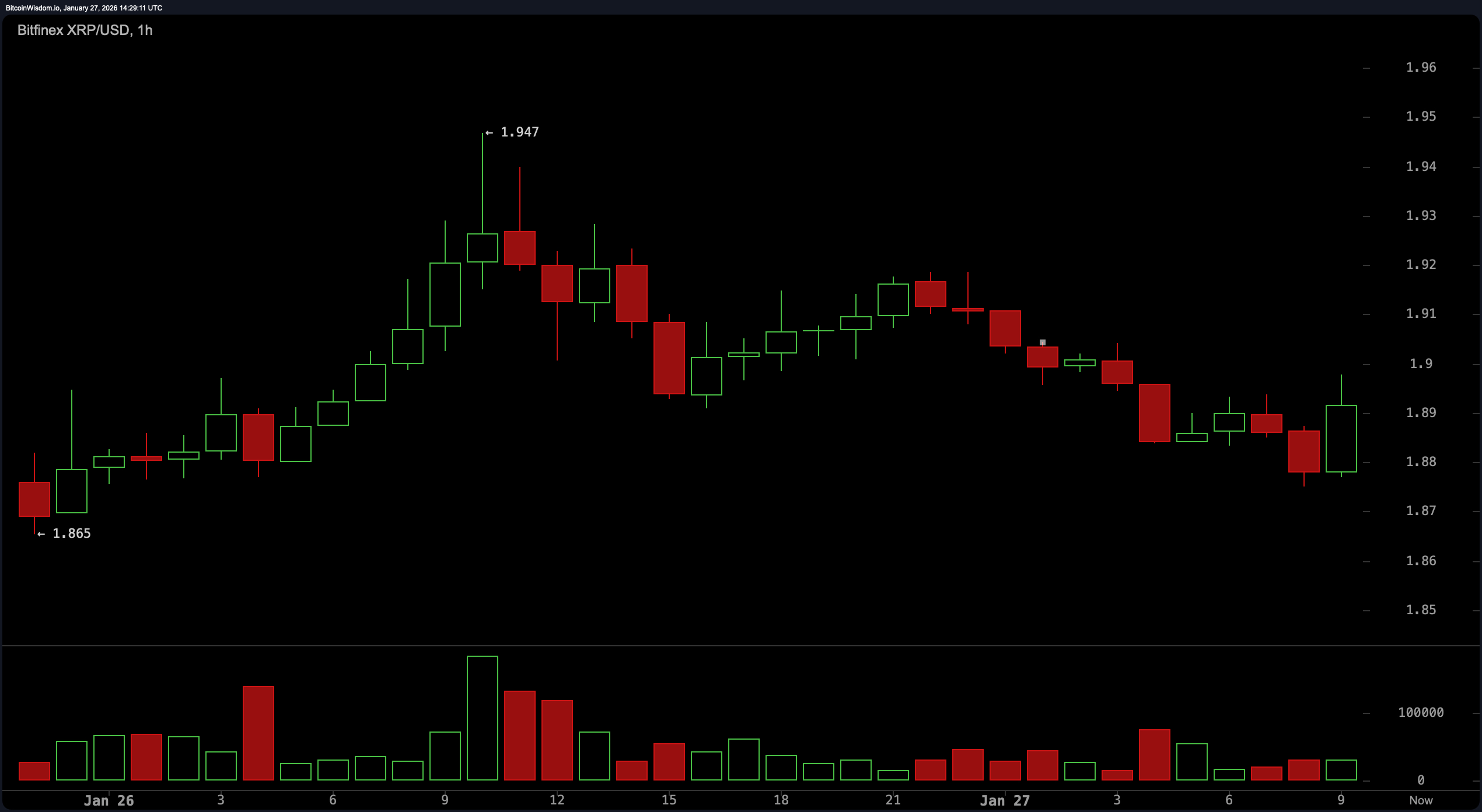

Over on the 1-hour chart, XRP’s price action resembles a toddler learning to walk—tentative, wobbly, but showing effort. It bounced off $1.865 and teased $1.947 before settling into a rhythm near $1.88, where buyers seem to be testing the waters. The support band between $1.875 and $1.885 is attracting attention, and while that sounds mildly optimistic, it’s far from a red carpet for a reversal. Intraday, the 1-hour moving averages are doing XRP no favors, with the 10-period exponential moving average (EMA) at $1.927 and the 10-period simple moving average (SMA) at $1.918 continuing to shadow the price from above.

XRP/USD 1-hour chart via Bitfinex on Jan. 27, 2026.

Looking at the bigger technical picture, the moving averages are staging a unanimous intervention. From the 10-period to the hefty 200-period, both exponential and simple moving averages are pointing to a consistent story— XRP’s price is skating below all of them. The 200-period EMA stands way up at $2.28 while its SMA counterpart towers at $2.54, showing just how far XRP has sunk since its last sugar high. If that’s not a technical cold shower, I don’t know what is.

To wrap it up, XRP is offering a masterclass in cautious consolidation across all timeframes. While there’s tentative evidence of accumulation near the $1.85 level, a genuine momentum shift would need volume to wake up and moving averages to loosen their chokehold.

Bull Verdict:

If accumulation holds and volume wakes up from its nap, XRP could claw its way back above resistance and flirt with the $2.05–$2.25 zone. The groundwork is there—now it’s just a matter of whether the bulls remember where they left their momentum.

Bear Verdict:

With every major moving average towering overhead and momentum indicators dragging their feet, XRP looks more likely to test support than to stage a breakout. Until volume and trend confirmation arrive, the bears are enjoying a slow, steady strut through this consolidation zone.

- What is XRP’s current price? XRP is trading at $1.89 with a daily drop of 1.2%.

- Where does XRP rank in the crypto market? XRP holds the fifth spot by market capitalization at $114 billion.

- What is XRP’s trading volume today? XRP saw a thin 24-hour trading volume of $2.36 billion.

- What price range did XRP trade in today? XRP moved between $1.87 and $1.93 during today’s session.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。